Bear Put Spread – A Simple Options Trading Strategy for Beginners

Last Updated Date: Nov 16, 2022Bear Put Spread is a simple options trading strategy used by beginners. This trading strategy is mainly used in bear market conditions.

Know everything about Bear Put options Trading Strategy here.

About Bear Put Spread

As the name suggests, the Bear Put Spread trading strategy is an options strategy designed for use in bearish market conditions. An investor must have a typically bearish outlook to security to choose this strategy for investment.

Interestingly, even beginners can get their hands sunk in this strategy to bear profits. Since this strategy bears a simple design with only two underlying transactions, it is ideal for all types of investors.

Though there is a capping on the number of maximum profits which an investor can earn from the strategy. Thus, it is an excellent approach to limit the involved costs and still make a profit.

Open a Demat Account Now! – Apply this Options Strategy

When to use a Bear Put Spread option trading strategy?

The idea behind using the Bear Put Spread option trading strategy is to gain from a fall in the price of the underlying security.

Ideally, the right time to use this strategy is when an investor expects a small fall in the price of such security.

The highlighting feature of this strategy is its reduced outlay in terms of capital at the inception of the strategy.

At the same time, the strategy also keeps a check on the impact of time decay on the prices of options owned by the investor.

What is the right way to use the Bear Put Spread strategy?

To apply and execute this strategy amidst real market conditions, an investor will need to enter into two transactions. These transactions are as follows:

- Buy at the money put options

- Write out of the money put options at a lower strike price than above

The expiry date of both options must be the same and they should be based on the same underlying security. As a result of these transactions, the investor will create a net debit spread.

Since the cost of buying the options will be greater than the cost received on writing the options. The investor is at liberty to choose the strike prices at which they want to take the options.

However, it is ideal to opt for a strike price which is close to the price of the underlying security. It must be as close as possible as you expect it to be at the expiration of the options.

Using a lower strike price would mean the potential to make higher profits. But at the same time, the credit received to cancel the debit spread will be less.

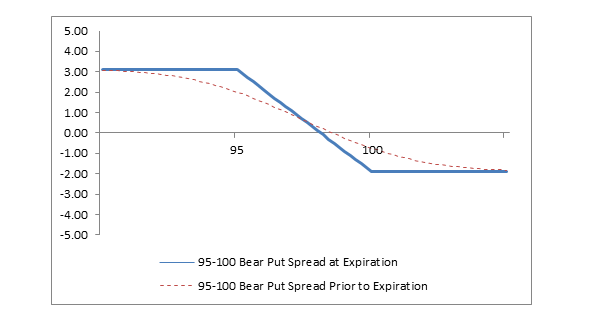

What is the potential to make a profit or incur a loss with this strategy?

The idea behind this strategy is to use it at a time when the investor expects the price of a security to fall.

Additionally, the strategy also yields a return for the investor with the flow of time. This will happen as long as the security does not move out too far away from its slated strike price.

The investor accrues the maximum profit on their investments when the price of the security falls down to match the strike price used to take a position in the options. The put options will raise the return that the investor receives.

While at the same time, the liabilities on the contract do not materialise due to expiration. Unfortunately, if the price of the security drops further, the investor will begin losing money on the options written by them.

However, since the put options will also increase in price, the overall effect will be negligible.

The ultimate stage where you lose your money will come only when the prices of security ultimately increase.

Also, if there is no change in the price of the security or if there not enough downfall in the price of the security, the investor will lose their initial investment.

Find out more relevant Neutral Option Trading Strategy below

| Long Put | Bear Call Spread | Bear Butterfly Spread |

| Bear Ratio Spread | Short Bear Ratio Spread | Bear Put Ladder Spread |

| Short Call |

How to execute a Bear Put Spread options trading strategy?

Let us take an example to understand how the strategy works and how an investor stands to make a profit out of it.

Let us assume that the current trading price of a stock is INR 50. As an investor, you expect this price to fall in the days to come but not below INR 47.

The present at the money put options for the stock at a strike price of INR 50 is trading for INR 2 per option. Also, the out of the money put options for the stock at a strike price of INR 47 are trading at INR 0.50 each.

You decide to enter the following transactions:

- Buy one contract for at the money put options for a total cost of INR 200 with 100 options.

- Write one out of the money put contract for a total credit of INR 50 for 100 options.

As a result of these transactions, the investor enters into a net debit spread of INR 150 at the inception of the strategy.

Now, at the date of expiry of the options, the following situations can come up.

- The price of the underlying security could decrease to INR 47. In this case, the options in contract 1 above will be around INR 3 each. The options in contract 2 above will expire and become worthless. After deducting the net debit spread of INR 150, the profit remaining with the investor will be for INR 150.

- The price of the underlying security could decrease to INR 48. The options in contract 1 above will be worth INR 2 each. The options in contract 2 above will expire and become worthless. After deducting the amount of net debit spread, the profit remaining with the investor will be worth INR 50.

- The price of the underlying security can remain at INR 50 or increase in price. In this case, the options in contract 1 and 2 above will expire and become worthless. The ultimate cost to the investor will be for INR 150, which is the amount of net debit spread spent to take these positions.

If the price of the security keeps increasing, the outlay for the investor will not be more than INR 150.

And if the stock price falls lower than INR 47, no more than INR 150 will accrue to the investor as profits.

This is simply because the options in contract 2 will begin to cost the investor just as much as the options in contract 1 above will bring in.

Thus, it is easy to deduce that there is a limit on the amount of maximum profit which an investor can make. At the same time, there is a limit on the amount of maximum loss as well.

What are the advantages and disadvantages of the Bear Put Spread options trading strategy?

The main advantage to the investor on using this strategy is its reduced cost. Without limiting the potential to make a profit, the strategy effectively reduces the overall cost involved in taking a position as per the strategy.

Since the upfront cost is limited, the investor always stands to make a big return on his investments.

Talking of the lowdown’s, there aren’t too many with this strategy. Due to the positions taken in two separate strategies, the investors end up giving more commission costs.

Some investors feel that the fact that there is a capping on the maximum amount of profit still poses a huge downside.

To Conclude Bear Put Spread

This strategy is quite effective when it comes to making desirable gains. On an overall scale, there are more benefits to this strategy than disadvantages.

It is right to implement it when the investor expects the price of a security to fall by a moderate level.

There is a capping on the amounts of maximum profit and loss. As compared to the costs, the profits which accrue to the investor are larger in quantum.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading