Long Put – A Simple Bearish Market Options Trading Strategy

Last Updated Date: Nov 17, 2022Know everything about Long Put Options Trading Strategy here.

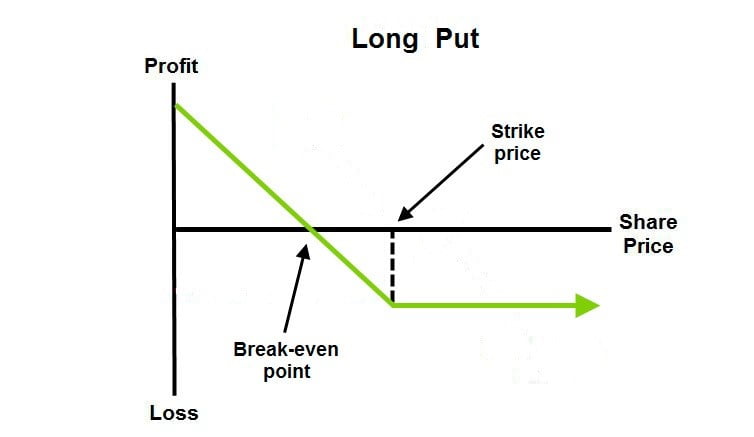

Counted among the basic strategies in the options trading segment, a Long Put trading strategy is one where the investor holds a bearish outlook towards the market sentiment.

Thus, if the investor believes that the price of a security may fall down below a defined strike price, they may opt to implement this strategy.

About Long Put Strategy

With this outlook, the investor will make a purchase of several put options in the market.

Consequently, if the actual price of the security indeed falls below the strike price placed by the investor on the date of expiry of the trading strategy, there is a huge potential to make a profit from the trade.

On the face of it, the strategy is quite simple to implement since it involves only one trade. So, it is easy for beginners to implement as well.

As long as the investor is confident of a price drop in the underlying security, a Long Put strategy can benefit the investor.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use a Long Put Strategy?

A Long Put strategy implies a bearish outlook towards the price movement of a security.

Thus, it is likely that an investor will choose to plan and execute a Long Put strategy when they have a definite assumption or reading in mind about the expected downfall of security.

The timeline of this drop is expected to be a short one. Although, the strategy allows room to accommodate a wider expectation for a longer duration of fall.

A notable feature at this point is the impact of time decay. The possibility of rust forming over the planned profits cannot diminish for a longer timeline.

Often, investors also make use of the Long Put strategy as an instrument of hedging.

Hence, if they already own security which may possibly reduce in the time to come, combining a Long Put strategy with it might prove to be profitable.

Is it worth using the Long Put Strategy?

As compared to short selling, an investor will always be in more benefit by using the Long Put strategy.

Due to the presence of leveraging element, there is a huge scope to make quality returns. There is no limit on the rate of the downfall of security.

Hence, it is possible to make an unlimited profit on this strategy. Furthermore, the profit is easy to calculate at the point of difference in the point of the strike price of the option and the amount of premium paid to obtain the options.

Since there is a limit on the quantum of maximum loss, the associated risk with the strategy is also quite low. At most, an investor can incur a loss equivalent to the amount of premium paid along with the commissions.

As the market falls, the profit will increase on the scale for the investor. However, with the passage of time, the value of the options may erode. So, the investor should make a wise decision regarding the strike prices.

This directional strategy is a simple one to implement and understand for beginners. It is easy for an investor to assume a position in this strategy and take it to its destination until the date of expiry.

Find out other Bear Option Trading Strategy here

| Bear Put Ladder Spread | Bear Call Spread | Bear Butterfly Spread |

| Bear Ratio Spread | Short Bear Ratio Spread | Bear Put Spread |

| Short Call |

How to take a position in the Long Put strategy?

There is no science involved in a classic Long Put strategy, except for deciding the strike prices.

These are the rates at which the investor seeks the security to fall down, on the date of expiry. Since there is only one transaction involved, even a beginner can plan and execute the strategy.

So basically, the investor needs only be clear about three essential factors of this strategy. One is the strike price at which they would like to enter into the strategy.

Another is the date of expiry up to which they want to stretch the strategy. And the third one is the realization of the profit and loss potential of the strategy.

Every investor can have a unique outlook on each of these factors. Thus, they base their decision on them to decide how to take the positions a certain way.

Since the success of the strategy rests on the strike price, it will determine the exact profits which you can reap.

It is completely up to the investor to choose the strike price. It can be equal to the current trading price of the security, or higher or lower than it as well.

There is ideally no problem in choosing a date of expiry for the contracts. This is because it depends on the estimate of the investor.

So, how soon they expect the stock price to fall down, determines the date which they will choose for the strategy.

If they expect a downfall soon, it will be better to choose a closing date of expiry. On the other hand, if they expect the downfall at a later date, they will choose a date which is farther away.

What is the potential to earn a profit or incur a loss?

Let us take an example to demonstrate the impact of the trading strategy.

Let us assume that the stock price of a security is trading at INR 50. As an investor, you expect that the price will come down in the days to come.

At present, at the money put options for the security are trading at INR 2 each at a strike price of INR 50. Thus, you purchase one contract which consists of 100 options for a total value of INR 200.

Now, on the date of expiry, the price of the underlying security could take the following turns:

- The stock could be trading at INR 48. Due to this fall, the call options will not trade at INR 2 each. Thus, you will be able to sell them for a value of INR 200. At this stage, you will incur no loss but also, you will be unable to earn any profit.

- The stock price could fall further down to INR 45. Thus, the options in the contract will trade at INR 5 each. You will be able to sell these contracts for a value of INR 500. After deducting the amount of INR 200 of debit spread, your final profit will be INR 300.

- The stock price could continue to trade at INR 50 or increase in price above that. In this case, the put options will become worthless and you will have to forgo your initial investment of INR 200.

Naturally, the investor is under no obligation to maintain his positions till the very end of the expiration of options.

If at any point, their expectation about the movement of prices of the security changes, they can take appropriate action.

So, they may either sell the options when they realise a certain profit on the strategy. Or else they can exit from it to cut down the losses when the price of the security continues to mount upwards.

Advantages and Disadvantages of a Long Put strategy

As with almost every options strategy, the Long Put does not come without its share of benefits or disadvantages.

The biggest benefit of the strategy accrues to the investor from the fact that there is an unlimited profit-earning potential to explore.

At the same time, since the extent of making a loss is limited, the investor is under motivation to undertake that risk and aim for better profits. Thus, in comparison to short selling, the strategy proves to be quite rewarding to the investor.

This is why the strategy appears to be fruitful for a beginner as well. However, there is no protection to the investor in the scenario where the price of the security takes an upward swing.

The only end to the losses at this stage will be to lose the complete amount of the debit spread.

Waiting out till the date of expiry for the options to materialize will further lead to an intensification of the impact of time decay on the options.

To conclude the Long Put Trading Strategy

The Long Put strategy is a viable approach to make desired profits in a state of falling prices of the underlying security. There are many reasons which can make the price of security fall down.

With a limited risk approach, the strategy opens a wide scope for the investor to make profits. This is why the strategy is a good bet for investors. They can seek to benefit from price movement in the market.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading