Bear Call Spread – An Option Trading Strategy for Bearish Market

Last Updated Date: Nov 16, 2022Bear Call Spread is an option trading strategy used in bear market condition. It is an advanced trading strategy used by traders.

Know everything about this strategy here.

About Bear Call Spread

Even though Bear Call Spread strategy involves the use of only two transactions, it is still considered fairly advanced for beginners. Due to the nature of the transactions, it requires a high level of trading from the investor.

An investor can use this strategy when they expect the price of an underlying security to fall. However, it works well for a stock which might fall only by a moderate rate.

This is why an investor must not make use of this strategy for a stock which might fall by a large gap from its current price.

Open a Demat Account Now! – Apply this Options Strategy

Why should an investor use the Bear Call Spread option trading strategy?

Ideally, this strategy has a design which makes it suitable for a situation where the price of a security may fall but not by a huge margin.

If the investor finds himself ready to undertake the risk associated with the strategy, they can take a position in it.

This strategy is a viable alternative to a short call strategy because it will cap the maximum loss that the investor might incur.

Even if the underlying security does not move from its price, the investor will still stand to make a profit.

Thus, even if an investor does not have complete confidence in the outcome of this strategy, it will still reward them one way or another.

An investor will need to enter into two transactions to execute this strategy. Ideally, both transactions must take place at the same time.

The investor will take the following positions to plan and implement the strategy:

- Open an order to sell the security

- Open an order to buy the security

Both the transactions will take place for an equal number of options and the same date of expiry. Since there is a difference between the strike prices of the options purchased by the investor, the amount paid by them will be less than the amount received by them upfront.

Thus, at the inception of this strategy, the investor will create a net credit spread. If the difference between both strike prices is large, the potential for profits will also be large.

At the same time, the risk associated with the strategy will also be high, if the price of the security moves up instead of down.

What is the potential to make a profit or incur a loss under this strategy?

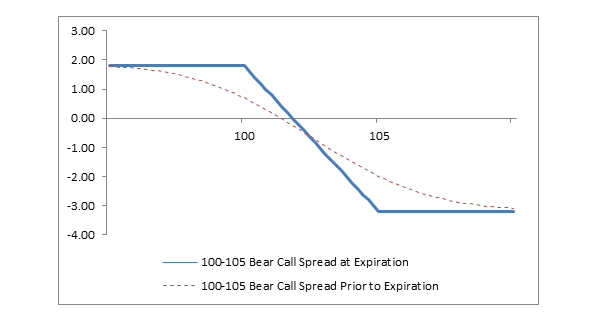

There is a capping on the amount of maximum profit which an investor can make from this strategy. So, an investor can at most earn the amount of net credit spread by implementing this strategy.

It is vital that the options chosen by the investor must expire either at the money or out of the money. This will make them worthless and let the investor retain the amount of profit, without incurring any liability.

This is why learned investors always recommend opting for options which are at the money. This is when the investor still manages to make a profit even when the price of the security does not fall down.

In contrast, the investor will not benefit quite easily if they opt for in the money options. Then, they will need the price of the security to fall below the strike prices to earn a return. In any situation where the investor makes a profit, there is a capping on the maximum amount of it.

On the other hand, if the price of the underlying security starts moving up, it may be time to look down at losses. This is because it will accrue a liability for the investor if the price of the security is in the money at expiry.

In this case, the investor will have to buy the options or else, assign them. However, there is still a capping on the maximum amount of loss that an investor could incur.

The difference between the strike prices of the two contracts and the number of options will be the amount of net loss.

Find out more relevant Bear Option Trading Strategy below

| Long Put | Bear Put Ladder Spread | Bear Butterfly Spread |

| Bear Ratio Spread | Short Bear Ratio Spread | Bear Put Spread |

| Short Call |

How to implement Bear Call Spread Options Strategy?

Let us take an example to understand how the strategy works.

Let us assume that the price of security is INR 50. As an investor, you expect the price of the security to fall in the days to come. To execute the Bear Call Spread trading strategy, you position yourself in the following trades:

- At the money calls for the stock is at a strike price of INR 50. These options are currently trading at INR 2 each. At a strike price of INR 52, the out of the money call options is trading at INR 1 each.

- You write 1 contract for call options at a strike price of INR 50. This creates a credit of INR 200 for 100 options.

- You buy one contract for call options at a strike price of INR 52. These 100 options come to you at a cost of INR 100.

As a result of these positions, the investor enters into a net credit spread of INR 100.

Now, on the day of expiry, the following situations can come up:

- The price of the security could come down to INR 48. The options in contract 1 above will expire and become worthless. Similarly, the options in contract 2 above will also expire and become worthless. The result will be a gain of INR 100 which the investor can keep.

- The stock price could continue to trade at INR 50. Both contracts above will expire since they are at the money and out of the money. The investor gets to keep INR 100 as the net gain from the trade.

- The stock price could increase to INR 52. The options in contract 1 above will now pose a liability of INR 2 each. The options in contract 2 above will expire and become worthless. The total liability of INR 200 will be offset by the INR 100 of credit received at the beginning of the strategy. The investor will bear the final loss of INR 100 on the trade.

It is possible that the stock price may fall even below INR 48. In this case, the profit accrued to the investor will go no higher than INR 100 since it has a capping on it.

On the other hand, it is possible that the price of the stock may go higher than INR 52. In this case, too, the maximum liability from the trade has a capping on it and thus, the amount of loss to the investor will not go beyond INR 100.

This is because the liability resulting from options in contract 1 above will rise at the same pace as the returns from contract 1.

Advantages and disadvantages of Bear Call Spread Option trading strategy

Investors can benefit from this strategy if it falls and even if it remains at the same price. The investor is at liberty to choose the relative strike prices, depending on the expected outcome of the movement in stock prices.

Depending on the difference between the actual price of the security and its strike price, the investor can make a bigger profit. The fact that there is a capping on the amount of maximum loss and profit makes this strategy flexible.

On the other hand, some investors may find the capping on maximum profit disadvantageous to their profit making motive.

Due to the nature of the contracts, the investor should enter this strategy only if they are experienced enough.

A beginner may fail to make sense of this strategy and may end up entering into losses. The number of transactions also poses an increase in the cost of commissions which the investor must pay to take a position in this strategy.

To Conclude Bear Call Spread

It is clear from the design of this strategy that the amount of maximum profit has a limit on it. It is the same for the amount of maximum loss.

If an investor can foresee a short but imminent fall in the price of a security, then this strategy is definitely ideal to use.

The biggest benefit associated with this strategy is the advantage of capping on the losses. While profits are limited, so are the losses.

Yet, due to the complex nature of this strategy, it is not good to use for a beginner.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading