Short Bear Ratio Spread – An Advanced Bearish Options Trading Strategy

Last Updated Date: Nov 19, 2022Short Bear Ratio Spread is an advanced options trading strategy. This strategy is used in bearish market conditions only.

Know everything about this Options Strategy here.

About Short Bear Ratio Spread

Among the league of advanced trading strategies is the Short Bear Ratio Spread options strategy.

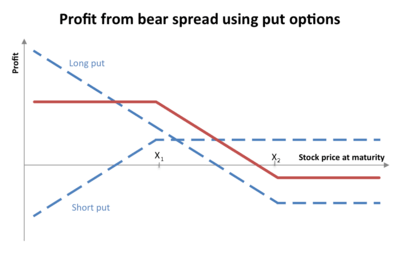

It devises making a profit from a fall in the price of the underlying security. On the face of it, the strategy is a clear extension of the long put.

However, by operation, it is certainly advanced in terms of the returns that it can yield for the investor.

The added advantage to the strategy comes from the fact that the investor need not pump as much capital into the strategy as the long put.

Again, the strategy is in contrast to long put in terms of the ratio of calls and puts. Here, the investor usually purchases call options in a different number as the put options.

Due to this, the strategy is hardly recommended for a beginner, who may fail to understand the design of the strategy.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use the Short Bear Ratio Spread options trading strategy?

If an investor expects the price of a security to fall in the days to come, they may choose to employ this strategy in the options market.

The takeaway of this particular strategy is that it offers the best returns when the investor wishes to limit the upfront costs which they need to spend to take a position in this strategy.

The maximum profit has a capping on its quantum but the cost of taking a position in this strategy comes down significantly.

This is because the investor not only buys put options but also writes a certain number of put options.

The right time to use this strategy is when the investor expects the price of a security to go down. But at the same time, they also have a speculation that the price may go up.

As the security keeps falling, the investor makes a return on each fall. But if it continues to fall beyond a certain point, losses can also manifest on the charts.

So, ideally, this is a strategy which is suited to the investor when they expect security to fall. But at the same time, they want to hedge their risk against a possible increase in the price of such security.

To take a position in this strategy,

An investor will have to enter into two separate transactions. It is possible to enter both these positions at the same time or separately if the investor so desires. The investor will need to buy and sell put options to trade with this strategy.

To make the strategy successful, it must pertain to the same underlying security. Also, the date of expiration of such contracts must be the same.

The only difference between this strategy and any other bearish trading strategy is that the investor will purchase a greater number of call options than the options they will sell. The investor shall decide the ratio in which they will trade with the call and write options.

Most investors prefer to buy 3 put options against writing 1 put option. If this ratio increases, the potential to make profits will also increase but so will the cost of taking the options. Similarly, the investor must also decide the strike prices for each contract.

Usually, the closer the strike prices, the more is the profit which will accrue to the investor.

What is the potential to make profits under the Short Bear Ratio Spread Strategy?

There is only one capping on the amount of profit which the investor can make under the strategy. It pertains to the quantum in the fall of the price of the underlying security.

The design of the strategy is such that an investor will need the value of the options owned to be more than the options are written.

Since this strategy design can turn out to be difficult to implement and plan, it is not suitable for a beginner.

For the sake of hedging, the maximum amount of risk that an investor may have to bear also has a capping on it.

If on the date of expiry, the price of the security continues to trade at the strike prices, then the investor will have to bear a loss on the strategy.

At this point, the options bought by the investor will expire. However, the options written by the investor will become a liability.

In the case of rising prices of a security, it will be hard for an investor to make a gain out of this strategy.

However, if the price rises by a small margin, there will be little to lose as compared to a situation where the price rises dramatically.

This is why the ratio of calls and puts should be such that the initial up front cost is as close as possible to zero.

Find out other Bear Option Trading Strategy here

| Bear Put Ladder Spread | Bear Call Spread | Bear Butterfly Spread |

| Bear Ratio Spread | Short Call | Bear Put Spread |

How to execute the Short Bear Ratio Spread options trading strategy?

Let us take an example to understand how the bear ratio spread strategy works.

Let us assume that the price of security is INR 50. As an investor, you expect that the price of the security will decrease drastically.

At present, the at the money put options for a strike price of INR 50 is trading at INR 2. Also, the in the money put options for a strike price of INR 55 are trading at INR 6.

You decide to enter into the following transactions:

- Buy 3 put options contract for a strike price of INR 50. Each contract contains 100 options. The total cost amounts to INR 600.

- Write 1 put options contract for a strike price of INR 55. Each contract contains 100 options. The total credit amounts to INR 600.

As a result of these trades, the net amount comes out to be zero and you have successfully formed a bear ratio spread strategy.

Now, on the day of expiry of the contracts, the following situations can emerge:

- The price of security may decrease to INR 47. The options in contract 1 above will be worth INR 3 each and the options in contract 2 above will be worth INR 8 each. After adjusting both legs of the transactions, your net profit will be INR 100.

- The price of the stock may come down to INR 45. The options in contract 1 above will be worth INR 5 each. And the options in contract 2 above will be worth INR 10 each. After adjusting both legs of the transactions, your net profit will be INR 500.

- The price of the security could continue to trade at INR 50. The options in contract 1 above will be worthless. The options in contract 2 above will be worth INR 5 each. As a result, you will incur a net loss of INR 500 on the entire trade.

- The price of the security can increase to INR 55. The options in contract 1 above will become worthless. The options in contract 2 above will also expire and become worthless. As a result, there will be no outlay or inlay of profit or loss.

If the price of security continued to rise above INR 55, the result will be the same. You will neither earn anything nor lose anything.

But, if the price of security continues to fall below INR 45, your profits will continue to rise.

What are the advantages and disadvantages of the Short Bear Ratio Spread Options trading strategy?

The biggest benefit of this strategy is that there is a huge potential to make profits. On the other hand, even if the price of the security were to increase, even indefinitely, the investor will only lose the amount spent to take the positions.

It is only when the security continues to trade at the same price, will the investor make a loss in terms of the cost spent to take the positions in the strategy.

Due to the low cost of entering this strategy, it is attractive to most investors. On the downside, the complexity of the strategy may make many beginners steer clear of the strategy.

It is only as long as the calculations of the strategy go right, that the investor will remain on the profitable side with this strategy.

To Conclude Short Bear Spread

This strategy is a classic alternative to the long put strategy. This is because the investor can easily employ it in specifically speculative situations.

Now, the strategy does not invite the risk element but it is quite low in comparison to most other bearish trading strategies.

The nature and design of the strategy will apparently appeal only to an experienced investor who will feel comfortable in taking positions as per the specified ratio.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading