TradingBells Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Nov 16, 2022Tradingbells Brokerage is a discount broker which is mainly having a presence in the state of Madhya Pradesh and especially in Indore city. The broker has been famous for its innovative ideas and services and products which facilitates the trading experience of the investors.

The article below is a detailed Tradingbells Brokerage Review which can enlighten you about the different aspect of the company be it the brokerage plans it has or the trading platform it uses and lots more.

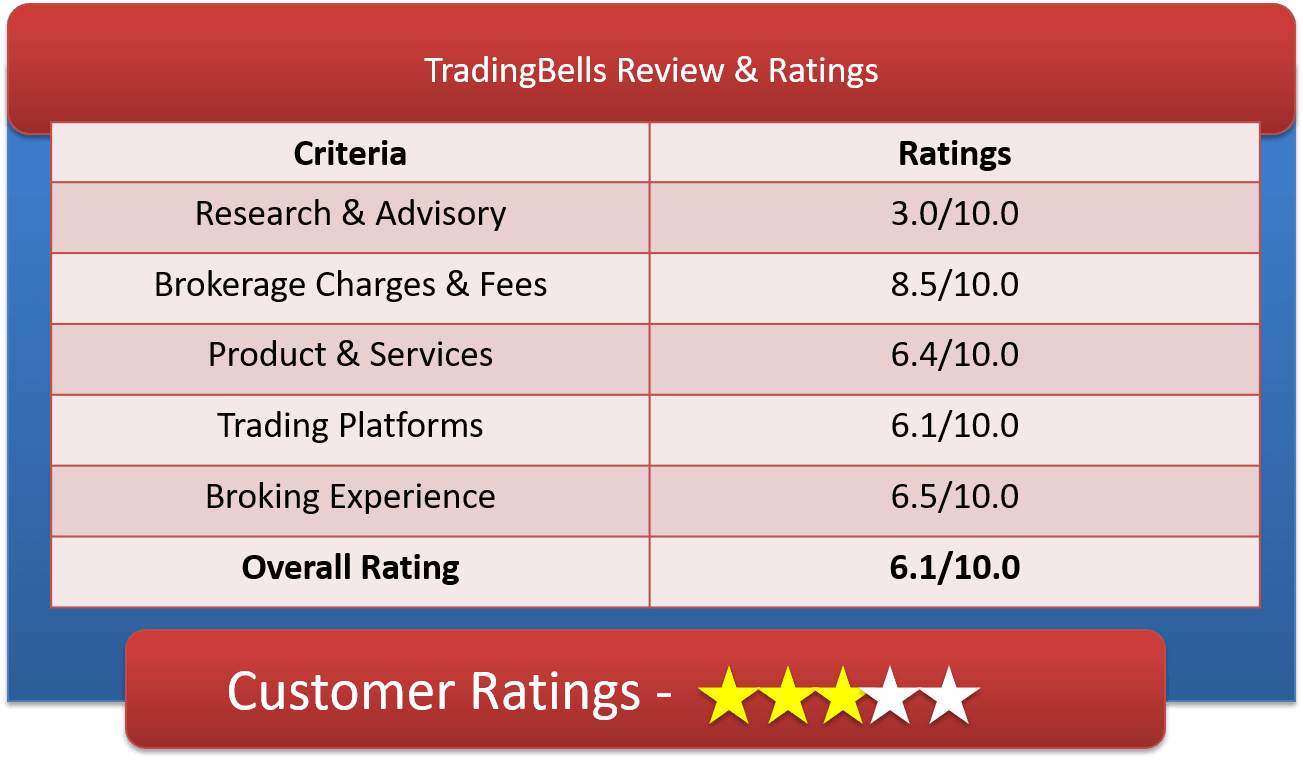

TradingBells Customer Ratings & Review

The customer rating of the brokerage house suggests that the company is at par with the market as its overall rating is 6.2 out of 10 which an average in the industry is.

It also suggests that the company is prudent enough in keeping enough care of the customers and its products and services are well accepted in the market.

About TradingBells

| Overview | |

| Company Type | Private |

| Broker Type | Discount Broker |

| Headquarters | Indore, Madhya Pradesh |

| Founder | Amit Gupta |

| Established Year | 1999 |

Tradingbells started its journey in the year 2016 as a discount broker and then it became a part of the Swastika Investmart Ltd. later in December month of the same year. This is based in the city of Indore, Madhya Pradesh.

Though the firm started in 2016 Swastika Investmart is a 25 years old company which is now running this firm established by Amit Gupta in the year 2016.

The experience of the traditional broker – the parent company – Swastika Investment helps Tradingbells to grow faster and acquire the market as fast as it can.

Get a Call Back from TradingBells. Fill up this Form.

TradingBells Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery Trading | Free |

| Equity Intraday Trading | 0.01% or Rs.20 per order |

| Commodity Options Trading | 0.01% or Rs.20 per order |

| Equity Futures Trading | 0.01% or Rs.20 per order |

| Equity Options Trading | 0.01% or Rs.20 per order |

| Currency Futures Trading | 0.01% or Rs.20 per order |

| Currency Options Trading | 0.01% or Rs.20 per order |

| Minimum Brokerage | 0.01% of total transaction |

| Demat AMC Charges | Free |

| Trading AMC Charges | Free |

| Margin Money | Zero Margin |

| Brokerage Calculator | Tradingbells Brokerage Calculator |

The Tradingbells brokerage charges are at par with most of the discount brokers in the country. They charge nothing for the transactions where equity delivery is involved.

For the rest of the segments, whether it is cash or currencies or any segment, they charge the lower of a flat fee of Rs. 20 or 0.01% on the transaction’s amount.

The minimum brokerage you have to pay to this broker is 0.01% of the transaction and the maximum is Rs. 20. So, for any volume of trade, you just need to pay Rs. 20 per order at the latest.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

TradingBells Charges

| Other Charges | |

| Transaction Charges | 0.00294% of Total Turnover |

| STT | 0.0111% of Total Turnover |

| SEBI Turnover Charges | 0.0007% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

The charges which are mandated by the government have to be paid with discount brokers as well. The transaction charges you have to pay for each transaction is 0.00294% while the STT charges are 0.0111% and the SEBI charges are 0.0007% and all these rates are charged on total turnover.

The GST is applicable at the rate of 18% on the cumulative amount of brokerage and transaction cost of an order. The stamp duty you have to pay according to the state you are living and trading from.

TradingBells Demat Account Opening Fees

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Rs.750 |

| Demat AMC Charges | Free |

| Trading AMC Charges | Free |

| Margin Money | Zero Margin |

| Offline to Online | No |

For an opening account with Tradingbells brokerage, you have to pay Rs. 750 as a one-time fee. If this fee seems to be little too high to open an account, then you must look at the other charges, and you will find that the company charges only the account opening fee and no recurring maintenance fee for years to use the account.

So, paying recurring yearly maintenance charges is always better than paying an account opening fee which is double the maintenance charges but for once. The firm also does not charge any margin amount from the clients and they can trade using their holdings in the trading account.

TradingBells Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | No |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | No |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | Yes |

| Zero Brokerage for Loss Making Trades | No |

- The firm provides various discounts on the amount of brokerage generated, from time to time.

- There is no annual maintenance fee on any of the accounts whether trading or the Demat and this helps the clients save the maintenance fee which is recurring in nature.

- The firm has referral offers for the investors and the clients as well.

Find Offers from other Broking Houses

| Zeroshulk | Steel City Securities | Trade Jini | Veracity Finance |

| Zuari Finserv | Stewart Mackertich WMS | Tradeplus Online | Vertex Securities |

| SKI Capital | Sumpoorna Portfolio | Trade Smart Online | VNS Finance |

How to open Demat Account with TradingBells?

To open Tradingbells Demat Account you have to visit their online website.

- In this website you will find that there is a tab called “Open Demat Account”, click on the tab. The pop-up will open with various options.

- On that pop-up, share your details like name mobile number & ciry.

- Once they call you, Tradingbells executives will take care of the rest of the process.

- You have to submit the KYC documents and other details of yours which they will verify and approve your application on successful verification.

- Then you will receive your login id for trading using your trading and Demat account.

Get a Call Back from TradingBells

Why Open TradingBells Trading Account?

- Cheap Brokerage: They have very nominal brokerage charges as you have read in the above section. They charge a flat fee brokerage of Rs. 20 as the maximum and the minimum is 0.01% of the transaction which is applicable if the amount is lower than Rs, 20. So, you get a gamut of services within this low brokerage.

- Variety of Products: Since, it is a part of Swastika Investmart, which is a traditional broker, the Tradingbells bring a discount broker offers many products which are rare to find with discount brokers.

- Free Delivery Trades: While the overall brokerage is Rs. 20 at max, you can take equity delivery for free. They charge no brokerage n delivery trades and this can be a great opportunity to save your money to be spent on the brokerage even when you are getting to trade all the products of your choice.

- Customer Support: Since the firm is under the surveillance of Swastika Investmart, they have proper customer support facility and also branches in a different location to facilitate the clients, unlike other discount brokers who hardly have any branches.

- Trading Platforms: The trading platforms are well integrated and developed as per the trading needs of the clients and investors of these days. They offer various technical analysis tools and other advanced options for better and smooth trading.

TradingBells Products & Services

List of products & services provided to its clients

TradingBells Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

The products which this brokerage house offers ranges from regular stockbroker products which discount brokers mostly offers like the equities, currencies or the commodities and the derivatives – Options and futures. However, this discount brokers stands out for its mutual funds and SIP offerings.

TradingBells Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 10X |

The services of the Tradingbells brokerage house are at par with any traditional brokerage house and the reason behind it is the parent company – Swastika Investmart.

They offer Demat services being a depository participant of both CDSL and NSDL. The other services include intraday services, IPO – Initial public offering services and also stock recommendations.

TradingBells Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | No |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Relationship Manager | No |

Tradingbells being a discount broker offers quite a good number of research services which is unique in its own.

They provide research reports, free stock tips for the investors so that it helps them identify better opportunities. There are IPO reports available to them. They also suggest top stocks for the day to invest in. They do not have any advisory services as of now.

TradingBells Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Upto 2X |

| Equity Intraday | Upto 10X |

| Equity Futures | Upto 4X |

| Equity Options | Upto 4X |

| Currency Futures | Upto 3X |

| Currency Options | Upto 3X |

| Commodities | Upto 3X |

| Margin Calculator | Tradingbells Margin Calculator |

Being a discount broker, Tradingbells offer exposure for the cash segment up to 10 times which is not only commendable but surprising to most of the investors, but it does.

For the segments like equity futures and equity options, the leverage is up to 4 times which is also higher than most of the discount brokers. For commodities, and currency segment the exposure is up to 3 times and for the delivery segment, it is two times.

Check Margin or Exposure of other stock brokers

| Skung Tradelink | Sunidhi Securities | Tradeswift | Vrise Securities |

| SPFL Securities | Sunlight Broking | Tradingbells | Wealth Discovery |

| Sri Shirdi Capital | Sunness Capital | Trustline Securities | Wellworth Share |

TradingBells Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

The trading platforms offered by Tradingbells are –

Tradingbells ODIN – Trading Terminal:

This is the software for the desktop or laptop with Windows or MAC Operating System. The features include –

- Trading across different exchanges, segment using one single screen

- Perfect for bulk trading

- Technical tools for analysis and making option strategies

- Charts and indicators

- Customizable market watch and easy to handle interface.

Tradingbells NSE NOW – Web-based Platform:

The features are simple and yet highly effective –

- Technical analysis tools

- The lightweight browser-based platform, no need for any installs or plugins.

- Good performance and fast trading experience

Tradingbells NETNETLITE – Browser-based Platform:

This is another browser-based platform which is offered to the clients of Tradingbells by the parent company Swastika Investmart. This application has more integrated options for trading with a lot more advanced technical tools.

Tradingbells Mobile-based Platform:

This platform offers –

- Charts – intraday, industry charts, etc.

- Various research reports on your mobile application

- Customizable market watch

Tradingbells NSE NOW Mobile App:

You can also use this application for trading using your mobile which is integrated with Tradingbells Demat and Trading account as well. They offer a gamut of features –

- Various indicators, charts, and other technical tools

- One of the fastest mobile trading application as of now – allows you to capture the price you want for trading

So, Tradingbells offers five different types of trading platforms which are rare to see with even the traditional brokerage house.

TradingBells Customer Support

| Customer Support | |

| Dedicated Dealer | No |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | Zero |

You can contact them via email at – helpdesk@tradingbells.com

Or you call to reach them at 9667658800 and WhatsApp them on 7440404400.

On their website, they also offer online support and they have online helpdesk available.

TradingBells Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 17 |

| Resolvd in BSE | 15 |

| Lodged in NSE | 28 |

| Resolved in NSE | 25 |

In the previous year, 28 complaints were registered against this firm on NSE and 17 on BSE. They resolved 25 and 15 respectively.

TradingBells Disadvantages

- Need to update their technology and other tools for trading

- Website is not properly developed with proper information

TradingBells Conclusion

With Tradingbells, you can trade smoothly as it seems from their offering. You can trade across various segments and verticals and that too with lower brokerage charges.

Get a Call Back from TradingBells

Find Reviews of other Stock Brokers

| SS Corporate | Suresh Rathi | Unlock Wealth | Wisdom Capital |

| SSJ Finance | Sykes & Ray | Vachana Investments | Zebu Wealth |

| Standard Chartered Securities | Systematix Shares | VCK Stock | Zenmoney |

Most Read Articles