Short Call – An Option Trading Strategy for Bear Market

Last Updated Date: Nov 19, 2022Short Call is a simple options trading strategy suitable for beginners. This startey is used in bear market conditions only.

Know everything about this strategy here.

About Short Call

When an investor expects the price of a security to go down in the days to come, they may use the Short Call option trading strategy.

The name of the strategy comes from the fact that it involves selling calls to take a position with the strategy.

At times, some investors also give it the name of an uncovered call write. This is because the strategy involves selling an asset that the investor is not truly entitled to or owns in their name. The instance of making a profit arises when the price of a security falls down.

The strategy involves taking a position with only one transaction. Even then, this is not a strategy that will appeal to a beginner. The nature of the strategy gives it a high trading level and thus, it carries a significant amount of risk.

On the downside, there is no capping on the scope of making a loss. This mere fact makes the strategy quite complicated and risky for an investor.

However, in the instance, when an investor makes an informed use of the strategy, there is a good potential to make attractive returns out of it.

Moreover, unlike some other bearish trading strategies, even a small fall in the price of a security can lend a likely return to the investor.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use a Short Call options trading strategy?

As the name suggests, this strategy is likely a good option for an investor at a time when they expect the price of an underlying security to fall.

However, more specifically, this strategy is ideal for a situation when you expect only a small drop in the price of a security.

This is because there is a capping on the amount of maximum profit that an investor can make from such a strategy. And due to this, no matter how far security falls, the profit that accrues to the investor will not increase.

In case the investor expects a major downfall in the price of a security, they can go with other bearish trading strategies such as long put.

As such, there is no protection to the investor in the incident where the price of the security may begin rising.

As the quantum of rise keeps increasing, the investor will continue to suffer a rising loss.

This is the reason why it is essential to invest in this strategy only when the investor expects a fall in the price of a security.

How to implement the Short Call option trading strategy?

There is not much difficulty for the investor to plan and execute this strategy. First, the investor will write call options for an underlying security. This security should be one which they expect to fall in the days to come.

This will give the investor a short position on such a strategy. At this stage, the investor will have to decide the strike price at which they will be taking a position in the strategy.

Also, a vital decision included in this process is deciding upon the date of expiry of the options.

As long as the investor is able to put enough thought into these two factors of an option, they will be able to benefit from the position taken on this strategy.

It is common for investors to take a position for an at the money call option. This is done because the investor usually expects the downfall to occur in a short span of time.

So, there is no need for the expiry date to be longer or extended. It is less likely that anything drastic may happen during this span. It is thus, the perfect ingredient for an investor to cook the desired profits.

Find out other Bear Option Trading Strategy here

| Bear Put Ladder Spread | Bear Call Spread | Bear Butterfly Spread |

| Bear Ratio Spread | Short Bear Ratio Spread | Bear Put Spread |

What is the potential to make a profit or incur a loss?

Using a Short Call implies entering a credit position so, at the beginning of the strategy, a credit spread forms. If at the end of the strategy, the calls expire, the investor gets to keep the amount of credit spread.

To make a profit out of this strategy, the price of the underlying security needs to move by a small margin at the least.

Profit accrues to the investor for the payment that they receive at the time of planning and executing the strategy, as long as the security falls by enough margin.

To make the maximum amount of profit, the contracts must expire out of the money. At any point, if the investor desires, they may exit from the strategy by purchasing a closing order.

This may happen in a case where the price of the security falls by a small margin but there is an expectation that it may increase again.

Due to the nature of this strategy, the existence of risk factors cannot be ruled out. This is why, if the estimates flip out, the investor may incur huge losses.

This is the sole reason why this strategy is not a good bet for beginners.

What are the advantages and disadvantages of the strategy?

Before entering this risky strategy, it is important to determine the scope of benefits it offers and the losses that it can amount to. This will help the trader decide if they must enter this strategy or not.

The fact that a small drop in the price of a security can benefit the investor, feels motivating at first.

However, along with this comes the risk that the price of a security may not move as expected. Thus, its disadvantages cannot be ruled out.

Since the strategy includes writing calls at the beginning, the investor receives an amount upfront. However, this also entails undertaking a liability in exchange for this return.

Often, investors consider this strategy quite easy and simple to implement. Since there is a single transaction involved, the level of commissions is also quite low. However, using such a strategy requires a high trading level, which may not be permitted by every broker.

The underlying risk associated with the strategy is vast since the price of the security can go up any moment. Then it will expose the investor to huge losses.

In a case such as this one, it is best to buy back the options at the earliest since there is always a huge downside that the investor remains exposed to.

Understanding the extent of the Short Call options trading strategy

Let us take an example to understand how this strategy works and how it can reap the desired returns for the investor.

Let us assume that the stock price of a security is INR 50. As an investor, you expect the price of the security to come down in the days to come. At present, the at the money calls for the stock are trading at INR 2 for a strike price of INR 50.

Thus, you write one contract with 100 options in it. The result is an amount of INR 200 which you receive at this point.

Now, at the date of expiry, the following circumstances can crop up.

- The price of the stock could fall down below INR 50. In this case, the calls will become worthless and your liability will diminish. You will retain the value of INR 200 which you received at the beginning of the strategy.

- The price of the security could hover at INR 50 only, The calls will become worthless and the profit of INR 200 will remain with you as a profit.

- The price of the security could increase beyond INR 50, let’s say, to INR 52. The liability, in this case, will be INR 2 per option. This will get cancelled by the amount of INR 200 which you received at the starting of the strategy.

Anything greater than INR 52; in this case, will yield a loss for you. If such is the expectation, the investor must exit the strategy at the right time to cut down further losses.

It is no assurance that the investor may remain clear of losses with this act. But the extent of losses will be minimal.

There are a few elements of this strategy which are easy to deduce from the above example.

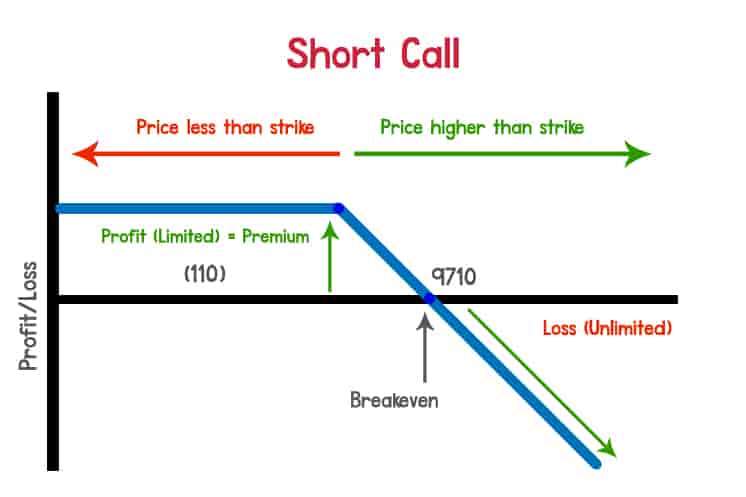

- The scope of the maximum profit is limited. Price per option is the basic level of profit which the investor stands to make.

- The maximum profit is achieved when the price of the underlying security is less than or equal to the strike price of the security.

- There is no capping on the quantum of maximum loss

To Conclude the Short Cal Strategy

Under the right circumstances, this strategy is quite useful and effective. However, the level of risks associated with it makes it quite dangerous.

Unless the investor is absolutely sure that the price of the security will fall, this strategy continues to pose a risk to the investor.

This is why the strategy is not the best fit for beginners, however simple it may appear. To limit the losses, the investor must exit the strategy at the right time.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading