Wisdom Capital Review & Brokerage Charges

Last Updated Date: Dec 01, 2022Wisdom Capital is one of the highly recognized Discount Broker in India. Lets look at Wisdom Capital Review, their other features like Demat Account & Brokerage Charges & Fees.

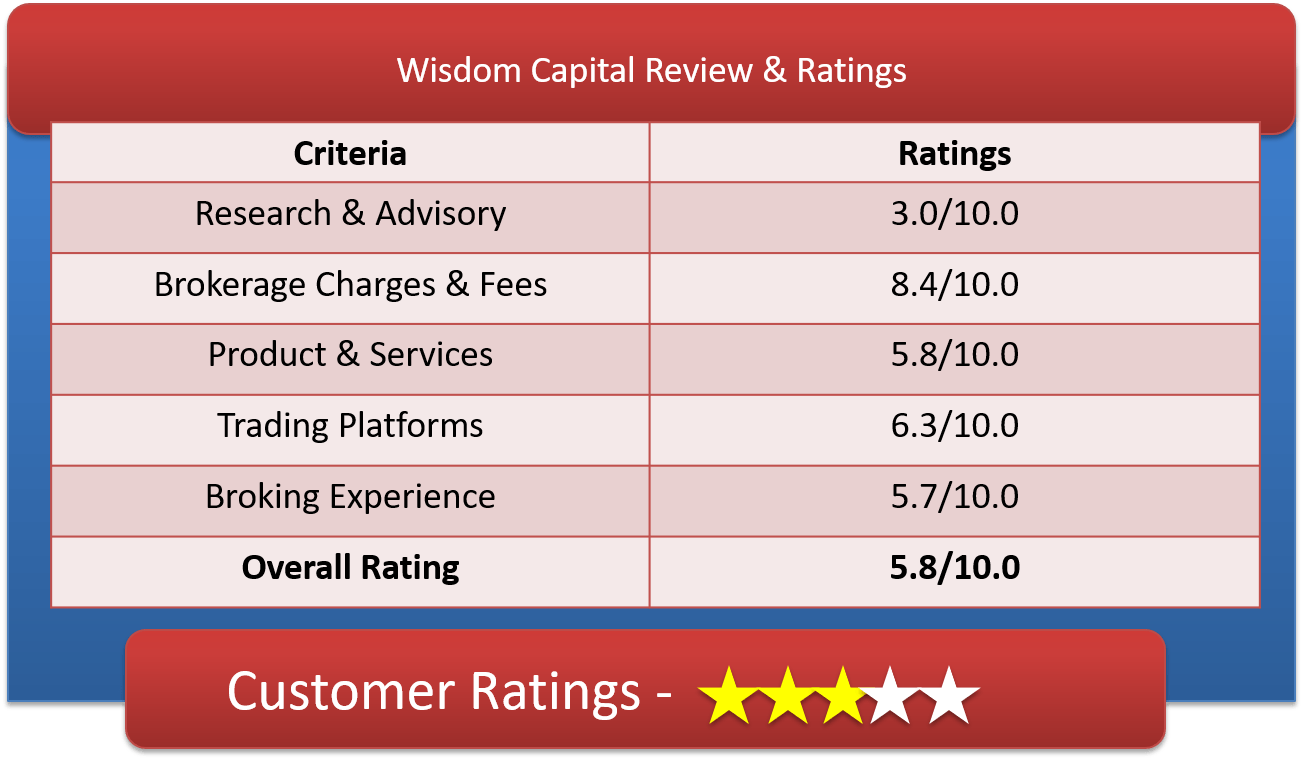

Wisdom Capital Ratings by Top10StockBroker

Wisdom Capital has a sprawling client base, as they have managed to acquire 25000+ clients by far, and manage 700+ cr daily turnover. They help execute around 75000+ orders per day and offer a lot of investment and financial services.

This stock broker is present rated 4.9 stars on an overall basis, while its powerful mobile app has a rating of 4.8 stars.

About Wisdom Capital

Wisdom Capital a discount brokerage firm, with its 250 franchisee network across 500+ cities, supports broker assisted trade as well as automated online trading in all the segments across BSE and NSE.

The broking house offers heavily discounted trades with Free Demat & Trading account without any hidden charges.

The discount broker has its client covered whether it is over toll free, phone, email or live chat. They provide three softwares (NOW,NEST & ODIN) for convenient and hassle free trading. Wisdom Capital also offers semi and fully automated algo trading facility. With them you can take high leverage upto 20 times in NSE & MCX Derivatives and 40x in cash. The Broker also offers precious metal futures trading and trade in almost all metals, agri and non-agri commodities too.

They also offers depository services to enjoy smooth trading experience. They provide advance order type ( MIS, CO, SL, SL(M), BRACKET Order) which apart from allowing margin also aids in capital protection while trading .Client has to maintain only a Single Ledger for all segments i.e. Equities, Currencies & Commodities. They also offer courses through Trading School to train beginners to invest in financial market.

Open Demat Account with Wisdom Capital

Wisdom Capital Brokerage Charges & Fees

| Brokerage Plan | Pro Plan |

| Equity Delivery | 0.01% |

| Equity Intraday | 0.01% |

| Equity Futures | Rs 9 Per Order |

| Equity Options | Rs 9 Per Order |

| Currency Futures | Rs 9 Per Order |

| Currency Options | Rs 9 Per Order |

| Commodity | Rs 9 Per Order |

Wisdom Capital Pro Plan

This plan is for the advanced traders, who are in need of high exposure and certain set of tools which go along with the process of trading. Aside availing for advanced trading tools, there is also an obligation of paying brokerage charge, which are meager.

Herein the Pro Plan, especially designed for experts, there is a brokerage charge of 0.01% for the equity segments, i.e. both delivery and intraday.

As for the other segments, i.e. derivatives and also for the commodity segment, there is a flat rate of brokerage. Investors or the demat account holders need to pay Rs 9 per order, for each of the segment.

Wisdom Capital Other Brokerage Plans

| Brokerage Plan | Freedom Plan | Ultimate Plan |

| Equity Delivery | Zero | 0.02% |

| Equity Intraday | Zero | 0.02% |

| Equity Futures | Zero | 0.005% |

| Equity Options | Zero | Rs.15 per lot |

| Currency Futures | Zero | 0.005% |

| Currency Options | Zero | Rs.15 per lot |

| Commodity | Zero | NA |

Wisdom Capital Freedom Plan

In this plan you can trade free for Futures & Options and equity segment in NSE,BSE. Commodity trading at MCX and NCDEX all segment is also free. This is zero brokerage plan. This is the most competitive plan out there, which is exclusively free of any charges such as per executed order,advance payment, monthly or yearly fees.

There are absolutely no hidden charges whatsoever, and you get an account which free of any brokerage for lifetime.

Wisdon Capital Ultimate Plan

This plan is designed for traders who need higher intraday exposure and have certain requirements relating to trading. Herein, the plan offers trading in the cash equity segment at just a tiny brokerage rate of 0.02%.

Trading in future contracts, you shall be deemed to pay a brokerage at the rate of 0.005%, pretty less than Equity segment. Contrarily on the options trading front, you have to pay on the basis of per lot. So, herein, the charge is a small amount of Rs.15 per lot. These charges are pretty low on an industry average basis.

Open Demat Account with Wisdom Capital

Wisdom Capital Charges

| Other Charges | |

| Transaction Charges | 0.00300% |

| STT | 0.0126% of Total Turnover |

| SEBI Turnover Charges | 0.0002% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

When you place any kind of order, there are a set of charges that you need to pay alongside brokerage and they are provided in the table above. Each and every charge is mandatory and may slightly vary as per the segment and the stock exchange you trade in.

Wisdom Capital Other Charges

- Pledge – Choice of service including pledge creation, closure and invocation, you will be charged @Rs 25 per Instruction.

- Dematerialisation – There is a separate charge for the demat service, and it is Rs 3 per certificate + Courier charges.

- Rematerialisation – As for the service of rematerialization, you shall be obligated to pay Rs 15 per request + Rs 30 Courier charges.

- Call and Trade Charges – Irrespective of the brokerage plan you choose, call and trade service is chargeable. Fee levied on this service is commonly Rs 20/Executed Order.

Wisom Capital Demat Account Charges

| Depository Source | NSDL |

| Account Opening Charges | Zero |

| Demat AMC Charges | lifetime Rs 999 + taxes |

| Trading AMC Charges | Free |

| Margin Money | Zero |

| Offline to Online | Yes |

Wisdom Capital is one of the top discount broker in plan offering. The flexible plans offered here covers each and every level of investor. Freedom plan is good for active investors where pro plan is good for professional investors.

- Trading account opening fee: Free

- Demat Account opening fee: Free

- Trading Account Maintenance Charges: Nil

- Demat Account Maintenance Charges: Rs 999 lifetime +taxes

Wisdom Capital Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | Yes |

| Referral Offers | Yes |

| Zero Brokerage for Loss Making Trades | No |

- Zero Account opening charges

- Free Trading account

- Flexible brokerage plan

- Lowest brokerage charges

Why Wisdom Capital?

- 100 day challenge to get brokerage refunded if you come out profitable at the end of 100 trading days.

- Lowest Transaction Charges, no minimum brokerage, no trading and demat account opening fee.

- Unlimited Leverage in all exchanges (upto 20X NSE & MCX Derivatives & 40x in cash)

- Low Brokerage plans, single ledger for all segments, option to choose trading terminal of your like.

How to Open Wisdom Capital Demat Account

For online trading, investor has to open 2-in-1 account (Trading and Demat). Following are the ways to open demat account with Wisdom Capital:

- Fill an online application form. Fill the contact form.

- Website: wisdomcapital.in/

- Contact Phone Number/helpline:1800-3000-5048

- Contact email: helpdesk@wisdomcapital.in

- Registered Office: A-38, Sector-67, Noida: 201301 Delhi & NCR

Wisdom Capital Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Up to 2x |

| Equity Intraday | Up to 20x MIS, BO & CO |

| Equity Future | Up to 4x MIS, BO & CO | Trade Nifty & Bank Nifty @ 40000 approx |

| Equity Option | Up to 4x MIS, BO & CO |

| Currency Future | Up to 4x |

| Currency Option | Up to 4x |

| Commodity Future | Up to 4x MIS, BO & CO |

| Margin Calculator | Wisdom Capital Margin Calculator |

You can check the extent of exposure you can avail for under each of the segment in the table provided above. Maximum leverage is provided in the Intraday segment and it is 20x for MIS, BO & CO. Post which, 4x is the general level of exposure provided for other segments such as Futures and Options.

Precisely for the equity Delivery segment, the leverage you can avail for is up to 2x. You can use the calculator we provide to commute the exposure for any transaction.

Wisdom Capital Trading Platforms Review

The broking company offers a huge variety of trading platforms to its clients. It has trading platform for all formats i.e. Desktop Terminal, Web Platform & Mobile Platform.

Fox Trader: Wisdom Capital Trading Terminal

Most advanced trading platform with variety of features like redefined charts, automated strategies, easy strategy testing, real time market scanners and others are available in this Trading Terminal. These are the futuristic tools and services you can expect from the broker.

Wisdom Trade: Web Based Platform

This comes with a lot many features as well like real time support, hassle free trade, advanced charts, works with different web browsers, auto update facility is available. You can get a complete data analysis of FII and DII, alongside an order book, which is crafted to give you ease in browsing through your trade orders.

Wisdom Pro: Wisdom Capital Mobile App

Trade eye is a mobile app platform provided to their clients. It comes all the features available in trading terminal & Wisdom Trade. This is a extremely advanced & gives grand performance. As for the trending features it possess, they are watchlist of 30 stocks at a glance, multiple charts and scanners. This makes technical and fundamental analysis easy.

Wisdom Power: Online Trading Terminal

Traders get direct connectivity to NSE via this trading terminal. Investors can view live data feed from this leading stock exchange, and easy execute trade orders in a stance.

NEST: Wisdom Capital Online Trading Terminal

PC users who want a full fledged professional trading experience can avail for this trading terminal. This terminal comes jam packed with the best of trading tolls, charts and scanners which ought to make the trading experience great and complete.

Wisdom Capital Products & Services

List of Products & Service this broking company provides

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | Yes |

Wisdom Capital Products

You can avail for a lot of financial products with Wisdom Capital. Though they are a discount broker, you can invest in all kind of segments with them. They also offer you services of insurance and mutual Funds.

There are precisely 5 domains of insurance they cover for, and it includes Life insurance, Term insurance, Car insurance, Health Insurance and Travel Insurance.

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Acount | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 4X |

Wisdom Capital Services

So the table briefly describes the set of services you can expect with Wisdom Capital. With an exposure of up to 4x in majority of segments, you can experience investment in the best way possible. This company is presently not into the 3 in 1 account, which includes a saving account, PMS and Robo Advisory.

Wisdom Capital Research

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | Yes |

| Monthly Reports | Yes |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

Investment is basically driven by a full fledged research activity, and the above mentioned table describes all the research services provided by Wisdom. You can rely upon this discount broker in many aspects, to fulfill your research needs.

Wisdom Capital Customer Care

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | Yes |

| Branches | Zero |

This stock broking house’s customer care services are on point. They provide prompt service for any kind of query raised. The kind of assistance you can opt for is provided in the table, there are email support, toll free number and also call and trade services provided from the broker’s end.

Wisdom Capital Advantage / Disadvantages

Wisdom Capital is trader’s paradise indeed. They have something to offers for all type of traders/Investors. With its highly competitive brokerage charges, support for every type of trader, up to date tools and technology, It has quite the offering for investors who fit into its target mold.

Advantages

- Lowest transaction fee in the industry

- Fastest in account opening time

- First ones to introduce lifetime plan

- No minimum brokerage.

- There are no account opening charges for both demat and trading accounts.

- They provide the maximum exposure, if compared as per the present industry standards and SEBI rules.

- The KYC and compliance service provided by the company are fast and quick.

- DP services are as well fast and prompt.

Disadvantages

- No support to invest in IPOs.

- Charges for using semi-automated algo trading.

- Offline assistance is not provided.

Wisdom Capital – Conclusion

If you are in a look out for an easy to go discount broker, you will must definitely opt for Wisdom Capital. It offer 3 brokerage plans which are all suitable for beginners as well as experts.

They have powerful trading platforms and provide a bunch of financial tools as well. All in all, they are a great gateway or source for investment, you can definitely stick with.

Know in detailed about other Stock Brokers

| Religare Securities | Shri Parasram Holdings | Sushil Finance | Ventura Securities |

| SAMCO | Shriram Insight | Swastika Investmart | Way2Wealth |

| 5Paisa | SMC Global | Tradebulls | Yes Securities |

Open Demat Account with Wisdom Capital

Most Read Articles