Protective Put & Protective Calls Options Trading Strategy

Last Updated Date: Nov 19, 2022Protective Puts & Protective Calls are option trading strategies used to protect profits which can be realized. These are advanced option trading strategies used by Traders.

Know everything about these strategies here.

About Protective Puts & Protective Calls

Both the protective put and protective call come under the category of option trading strategies. We use them to secure gain especially the one which has been carrying a long-term or short-term stock position.

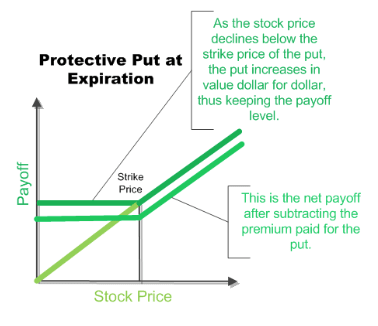

A protective put is largely a risk-control method that makes use of contract alternatives. Buyers use it to shield in opposition to the lack of proudly owning an inventory or asset.

The protective put in themselves is a falling method wherein the dealer believes that the fee of the asset will see a downfall in the future.

So here’s the potential put applied where the investor is not good enough on the stock. Investor’s might wish to barricade the potential losses and uncertainty.

Open a Demat Account Now! – Apply this Options Strategy

Application of Protective Puts Strategy

We apply protective puts in the case of stocks, currencies, commodities, and indexes. It helps in protecting them when they see a downfall. The protective put often acts as an insurance policy by providing downfall protection.

It provides privacy whenever the price of the asset declines. On the other hand, the protective call is the type of option strategy which we use for minimizing the risk.

We use the strategy of protective call when the trader is hopeless towards the market. He may also be expecting the price to decline.

The protective call is often what we know as synthetic long put. Its risk and reward profile is quite similar to that of the long put.

Gains from the maximum profit by the protective call is more whereas the maximum risk is less. The protective call is the most simple and we use it as a strategy while keeping the positions wide open.

Learn everything about Option Trading & start making big money in Options Market

Reason behind using Protective Puts & Protective Calls

As already mentioned above, protective puts and calls are the bounding strategies that stock traders mainly use. They don’t wind up in a successful position rather need their gains to be protected.

Let’s take an example – if a trader purchased commodities in ABC Company at the cost price of 20 INR. Then, it gradually grows to 25 INR and it is clearly visible that they gained 5 INR per share. Hence, it is obvious that the profit is not meaningful unless he sells the share.

Now, selling the sale means that there will not be any further profit.

Here we can use protective put when the trader thinks that the stock should keep on growing. However, they will focus on the gradual downfall in the price. Therefore, using the strategy of a “protective put” is the best idea.

The protective call is what we use for quite a similar cause but the strategy of protective call is for when the commands on a short-term stock position.

It is in a place basically the commodities have swathe downfall and the trader wants to protect in opposition to the stock to rise up again.

Find out some of the Best Options Trading Strategies here

Pros & Cons of Protective Puts & Protective Calls

There are various advantages and disadvantages of the policy’s protective put and protective call. One of the major advantages of these strategies is that they give access to the user to keep a profit-making space wide open so that there are high chances of making further profits.

On the other hand they also ensure that they don’t drop the profits which are already made at that position.

These strategies are basically bounding in the bright sense where the trader or the investors are bounding in the opposition of the risk of downfall of income or profit that they have already adequately made.

Another major benefit of these strategies is that they can easily transform into the synthetic straddle. It is so especially if they overlook the trader or the investor’s changes and later on they believe that the stock goes volatile.

Coming to the other part, the major disadvantage of using these strategies is that there is some cost price for applying it.

This price can later on shallow the profit margin that we make. It is quite confusing to understand whether the price is worthy of the protection that we apply.

Taking the pros and cons separately of both the strategies, the pros of protective put include minimizing potential losses and unlimited profit potential.

On the other hand, the cons of potential put include protection ends when the option expires and a small portion of profits sacrificed due to option premium.

The pros of protective calls include the potential for unlimited profits and the limited risk whereas the cons include the downfall of the profit by the amount of premium paid if the price decreases.

How Do We Use Protective Puts?

We use the strategy of a protective put more often as compared to the protective call. The reason behind using protective puts is that the traders or the investors hold positions. It is better than a short position.

The protective put is very essential. It is quite similar to “long-term put” because there is a single transaction and that is ordering puts.

The long-term put is applicable when the trader or the investor is hypothesizing on security whose graph is reducing in value.

On the other hand, we apply the protective put when the hedging purpose is there or when there is a disclosed long-term commodities position.

Hence, to create a protective put, the trader or the investor just has to go through and use the buy to open order so as to buy enough puts which will cover the price of the share that is being owned.

So, if the share owned is 100, which is 20 INR at trading, then there is a need to purchase one put with a crash price of 20 INR. It is a must to purchase options that have some months until it expires.

If the commodity which is being used continues to grow in cost then for sure that the put option would expire and this is totally worthless.

But there is also a high possibility that the buyer will gain more money from the commodity position and if in case the price went down, then the put option will get high in terms of value and covers the losses that are being made from the commodity position.

How to Use a Protective Calls?

We use the protective call rightly at times of uncertainty. The protective call comes into play when the trader or the investor is bearish towards the market and is expecting the market to go down. At the same time, the investor is uncertain that the prices may go up.

In such a situation, the trader has to purchase a protective call to safeguard the upward rise in prices and retain his profits. We use the Protective call largely whilst there’s an open quick inventory function this is in gain.

The Protective call is quite similar to protective put and this is also so simple. Also, in a protective call, there is a requirement of only one transaction.

The trader or the investor again needs to apply the buy to open order so as to buy enough call options which will help in covering the number of shares that the trader or the investor has short sold.

The call options ought to be sold with a strike rate identical to the modern buying and selling rate of the inventory that the trader or the investor is quick on (i.e. on the cash name options) and with some months till expiration.

They are then supposed to be at the safe zone or are secured. If the commodity on downfall starts to rise up in price again, the call options will also rise in cost.

If the stock fails to rise then the trader or the investor could switch to the option to buy it. He can, later on, use it to close their short-term commodity position.

He could also opt to sell their call options to gain and leave their stock positions open.

Protective Puts & Protective Calls – Conclusion

The productive put and the productive call are not actually the options trading strategies. It is because they are for speculation in the market but they are better tools. Also, they act as a good example of how better options strategies are.

Without options strategies, it is hard for the trader or the investor to protect their gains from an open place. As a result, they have to close or back out from that function.

They consequently pass over on extra earnings if the inventory persevered shifting within the proper direction.

However, by applying these protective put and protective call strategies correctly, it is possible to have the best profits. They can expect it along with the best and rising market within both worlds.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading

| Live Nifty Option Chain |

| Live NSE Option Chain |

| Open Interest Stock Options |

| Open Interest Index Options |

| Most Active Index Options |

| Most Active Stock Options |

| Put Call Ratio |