Margin Calculator – Calculate Leverage / Exposure for All Asset Classes

Last Updated Date: Aug 29, 2023Margin Calculator helps in calculating the Exposure or Leverage of Individual Stock Brokers for all Asset Classes. Margin is the amount deposited by an individual in a Trading Account.

In order to transact more from the clients, all stock broking firms provides Limit or Exposure over an above of the Margin deposited by Clients. This extra amount provided by broking house is known as Limit or Leverage.

What is Margin Calculator?

Margin Calculator is a process by which a client can calculate the Exposure or Limit provided by various Broking House.

Each Broking House provides different weightage to different scrips based on their past performance. Margin Calculator keeps few things in picture before calculation –

- Broking House (Different Broking House provides different margin as per their risk taking capacity)

- Weightage of every Scrip (Large Cap companies have high weightage)

- Available Balance (Current Margin Available in Trading Account)

- Share Price (Stock price of Scrip)

Based on these 4 metrics Margin Calculator calculates the Margin or Exposure to be provided to Clients.

List of Top 50 most used Stock broker Margin Calculator

What is Margin Funding / Exposure / Leverage / Limit in Stock Broking?

Margin Funding or Exposure or Leverage or Limit, all four are same. Different Broking House calls them by different names.

Margin Funding is a process when a stock broker provides extra margin to its clients based on following –

- Company Scrip (Large Companies have high Exposure Limit)

- Type of Investment (Intraday, Delivery, Commodity, Currency or F&O)

- Clients Holdings (Client with Collaterals or High Volume Holdings get high Leverage)

- Clients History (Old Clients with high transaction history get more Limit)

These are the major reasons which affects exposure limit. Also, for delivery product, every broking house keeps cut-off period. Post this Cut-off period Auto Square off applies.

Margin Funding taken by clients are liable to pay 18% interest + GST.

Open 90% discount on Brokerage – Open Demat A/C Now!

List of Remaining Stock Brokers Margin Calculator

The below mentioned list will help you calculate exposure of all Stock Brokers for more 550 stocks listed in NSE & BSE.

How Margin Calculator Works?

The process of calculating margin is very simple. Find the Steps Below –

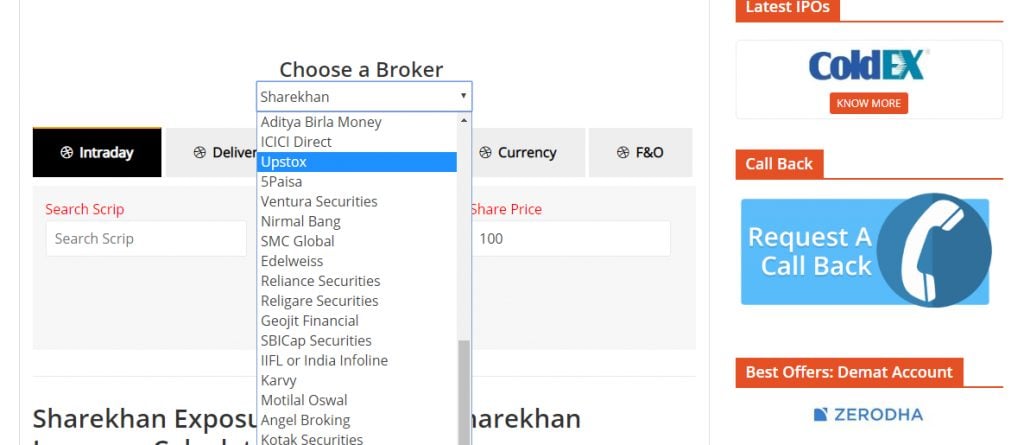

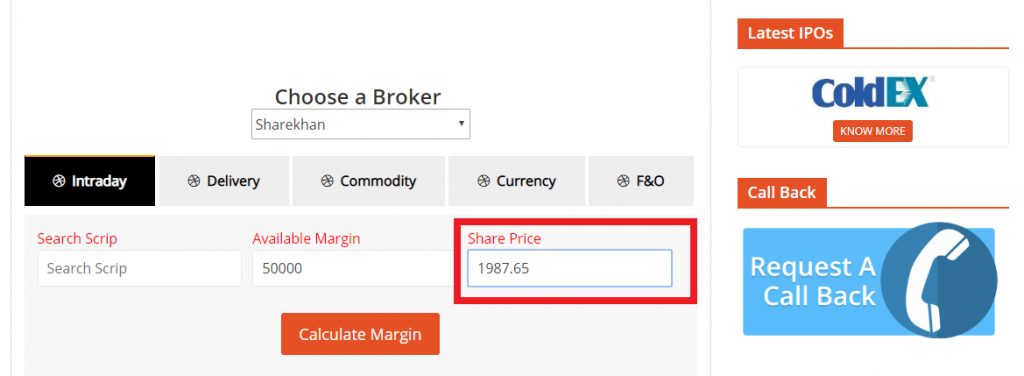

Step 1 – Choose a Stock Broker

Example – Sharekhan

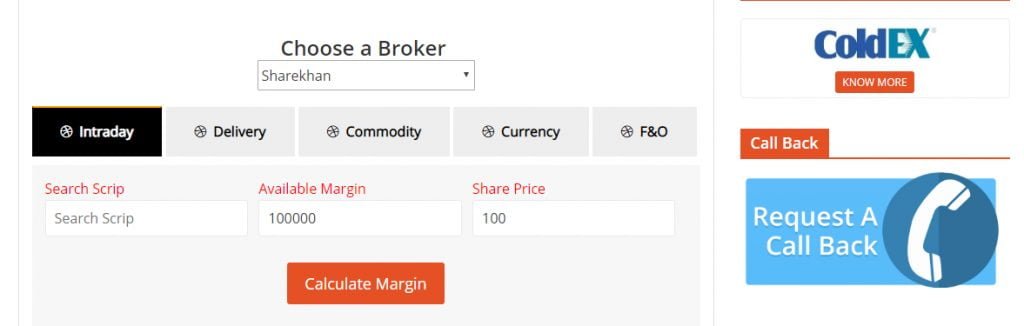

Step 2 – Select an Asset Class

Example – Intraday

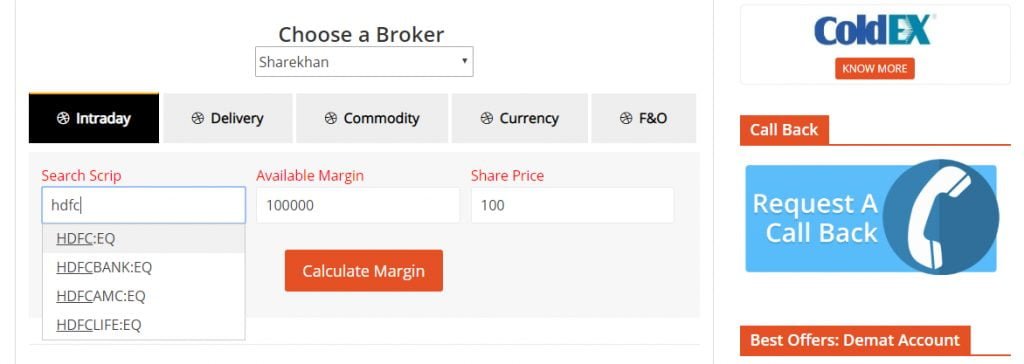

Step 3 – Search for a Scrip

Example – HDFC:EQ

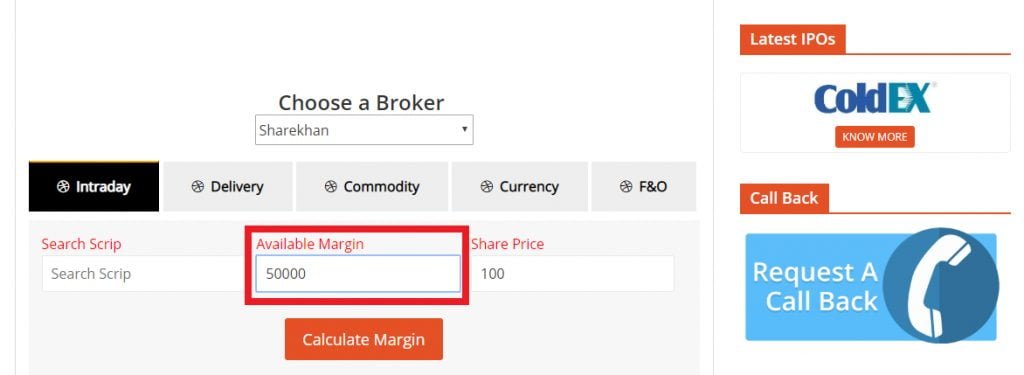

Step 4 – Enter Available Balance in Trading Account

For Example – Rs.50,000

Step 5 – Enter Share Price of HDFC – For this search on Google & then enter Share Price

Example – Rs.1987.65

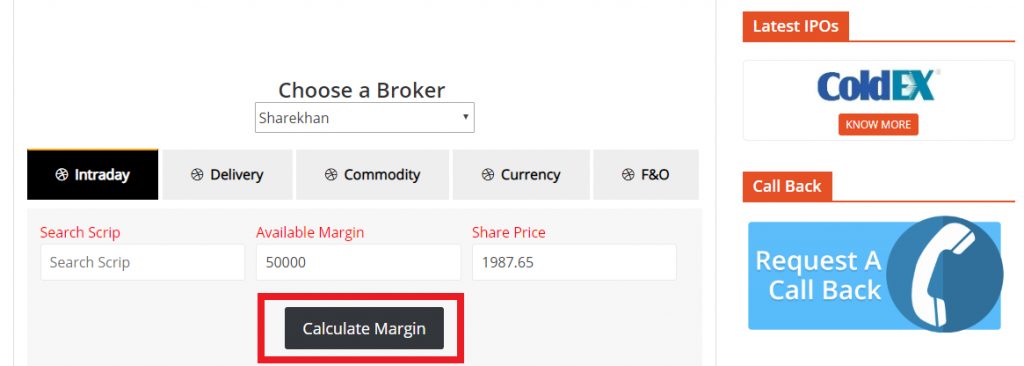

Step 6 – Hit Calculate Margin Button

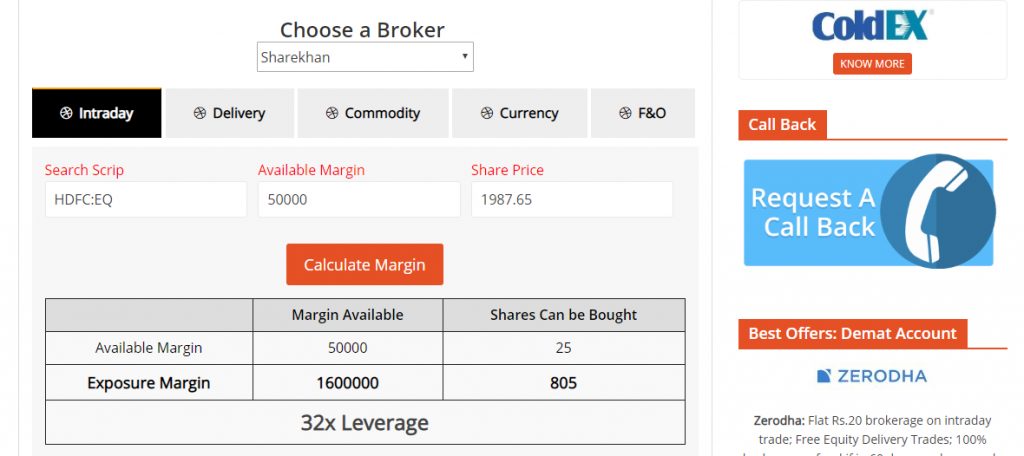

Step 7 – Your Margin is Calculated along with Leverage

As per the Calculation, For HDFC, Sharekhan provides 32x Leverage or Exposure to their clients. If you are a Sharekhan client & wants to invest in HDFC in Intraday, you will 32x exposure.

If you have Rs.50,000 in Trading Account, you can buy HDFC Shares worth Rs.16,00,000. That also means instead of buying 25 shares you can buy 805 shares. This can significantly increase your profits.

Open 90% discount on Brokerage – Open Demat A/C Now!

Most Read Articles