Long Call – A Simple Bull Market Options Trading Strategy

Last Updated Date: Nov 17, 2022Long Call is a option trading strategy used in bullish market condition. Beginners & Professionals both will be able to use this bull market strategy.

Know everything about Long Call Options Trading Strategy here.

About Long Call

A Long Call is one of the most basic and commonly used strategies in a bullish market. It does not matter if you are a beginner or a professional; you can always use the Long Call strategy. The only factor which you need to consider is the price of the underlying security.

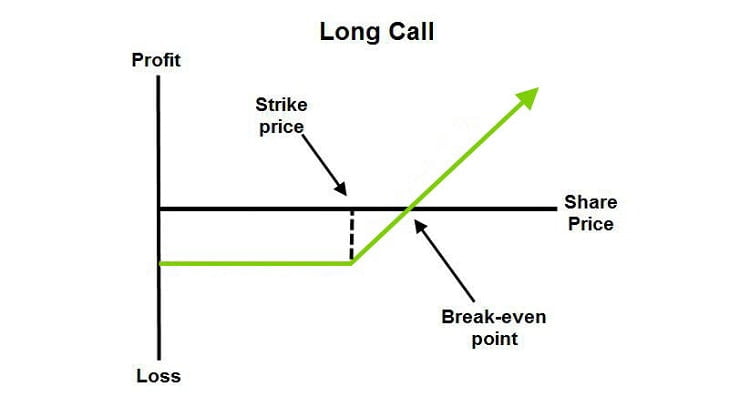

If you believe that the price of the underlying security is going to rise significantly above the strike price you choose, you must go for a Long Call.

In terms of complexity, this option strategy is the easiest way of options trading in a bullish market. It is because there is only one transaction involved i.e., buying a call option of the selected strike price.

As the price of underlying security reaches your strike price, the value of your call increases and vice versa.

Open a Demat Account Now! – Apply this Options Strategy

When to use a Long Call?

Since the Long Call is a basic strategy involving only one transaction, you must go for a Long Call only if you have a bullish outlook for that particular security.

If we put this in simple words, you must buy a Long Call if you are confident that the price of the underlying security will increase regardless of an factors.

This is because if the market goes against your analysis, you may incur a loss. If the price of underlying security does not change or falls significantly, you may lose a major portion of the invested amount.

You must also keep in mind the effects of time decay. Since options have a date of expiry, the price of your call might not change if the price of underlying security increases slightly over some time.

How a Long Call Strategy works?

As mentioned above, the procedure of buying a Long Call is the easiest among all other option trading strategies due to its simple execution.

In case of a Long Call, the buyer needs to consider two major factors that are the strike price and expiry date.

The strike price is the target price at which you feel the security will rise, and the date of expiry is the date at which the option contract will expire.

If you feel that the strike price of the security will rise significantly in a relatively shorter time span, you should buy contracts with the nearest expiry date as they will charge less premium.

On the other hand, if you feel that the price of the underlying security will increase but not rapidly, then you should go with contracts with a longer expiry date. But in both cases, you must consider the effect of time decay on the price of your call.

Let’s take a few examples for a better understanding of the strategy:

Long Call Options Strategy – Example 1

- Nifty 50 current spot price: 8100

- Buy OTM call of strike price 8200 for a premium of 100

- Lot size of nifty: 75

- (Nifty 50 rises to 8200)

- Sell call of strike price 8200 at 150

In this case, the nifty 50 index was at 8100 points, and you buy a call with a strike price of 8200 for which the premium paid was 100 per lot.

Since the lot is 75 quantities, the total amount invested is 75*100= 7500 rupees. If the trade turns favorable and Nifty 50 reaches a level of 8200, the price of the call rises to 150.

Therefore, the total sell value is 150*75= 11250

Buy Value=7500

Sell Value= 11250

Net Gain= 3750

Long Call Strategy – Example 2

- Nifty 50 current spot price: 8100

- Buy OTM call of strike price 8200 for a premium of 100

- Lot size of nifty: 75

- (At expiry Nifty 50 stays at 8100 levels)

- Sell call of strike price 8200 at 50

In this case, the nifty 50 index was at 8100 points, and you buy a call with a strike price of 8200 for which the premium paid was 100 per lot. Since the lot size is 75, the total amount invested is 7500.

If the price of the underlying security does not change until the time of the expiry of the contract, the price of your call will reduce significantly.

This happens because premium starts to decrease, and thus you will have to sell it at a loss. In this case, the price of security does not change, and the premium falls from 100 to 50.

Therefore, the total sell value is 50*75= 3750

Buy Value= 7500

Sell Value= 3750

Net Loss= -3750

Long Call Options Trading Strategy – Example 3

- Nifty 50 current spot price: 8100

- Buy OTM call of strike price 8200 for a premium of 100

- Lot size of nifty: 75

- (At expiry Nifty 50 fallsto 8000 levels)

- Sell call of strike price 8200 at 10

In this case, the nifty 50 index was at 8100 points, and you buy a call with a strike price of 8200 for which the premium paid was 100 per lot. Since the lot size is 75, the total amount invested is 7500.

If the price of the underlying security falls then, you might incur major losses because of time decay, and the strike price is significantly higher than the price at which the security is trading.

In this example, the nifty 50 index falls to 8000 by the date of expiry due to which the premium paid for the call falls from 100 to merely 10.

Therefore, the total sell value is 10*75= 750

Buy Value=7500

Sell Value=750

Net loss= -6750

The above-mentioned cases were three types of scenarios, and either of these three can happen while you are trading.

Thus, it is always advisable to go for a Long Call option only if you are confident that the price of the underlying security will rise significantly by the time of expiry.

Find out more relevant Bull Option Trading Strategy below

| Bull Put Spread | Bull Condor Spread | Bull Butterfly Spread |

| Bull Call Ladder Spread | Bull Ratio Spread | Short Put |

| Bull Call Spread | Short Bull Ratio Spread |

How to minimize risk while using a Long Call strategy?

Since a Long Call is a basic strategy involving only one transaction, it does not hedge you if your trade turns unfavorable.

One of the most basic ways to minimize the risk in case of the Long Call is to buy At/In the money call.

In this case, you might have to pay a higher premium, but there is a relatively less chance of incurring losses when compared to OTM.

Advantages of the Long Call:

- The Long Call is a basic strategy, and therefore the beginners can also opt for this, provided they have analyzed the underlying security.

- There is only one transaction involved; thus, a lower commission is charged.

- If the trade turns favorable, there can be unlimited profits.

Disadvantages of the Long Call:

- If the trader buys At/In the money call, a higher premium is charged. Thus, the margin requirement is higher.

- There is no scope for hedging, and thus the trader is exposed to risk to the extent of capital invested.

Long Call Strategy – Conclusion

The Long Call is undoubtedly the most fundamental and commonly used strategy by beginners as well as professionals. It has the potential to give you unlimited profits if you do the right analysis.

Although, it only involves transaction due to which there is no scope for hedging.

Therefore, it is advisable to go for a Long Call only when you are confident that the price of the underlying security will reach your strike price.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading