Bull Put Spread – An Advanced Options Trading Strategy for Bull Market

Last Updated Date: Nov 16, 2022Bull Put Spread is an option trading strategy used in Bull Market Condition. This strategy is used only by advanced traders as it is complex strategy.

Know everything about this strategy here.

About Bull Put Spread

A Bull Put Spread is a strategy used when the traders have a bullish outlook for the market. This strategy is used when the price of the underlying security is expected to rise, but not by a substantial margin.

If the price is expected to rise significantly, you should opt for other strategies that can offer you higher returns.

The execution of the strategy is not at all complex as it requires the trader to buy as well as sell puts for different strike prices.

Many traders use it as a cheaper alternative to a short put, the only difference being limited profits as well as limited losses. Though the execution is simple, the strategy itself is very complex and requires expertise.

The trader must be aware of the market conditions and should analyze the underlying security thoroughly.

It is because of this complex analysis that beginners should stay away from this strategy.

Open a Demat Account Now! – Apply this Options Strategy

When to use a Bull Put Spread?

The Bull Put Spread is an options trading strategy used when the traders have a bullish outlook for the market.

If your analysis suggests that the price of an underlying security will rise but not by a substantial margin, you should opt for a Bull Put Spread.

In such scenarios, when the market is bullish and not extremely bullish, people use short put as well. The only difference between the two is limited profits.

If you are confident that the price of a security will rise by a small margin but at the same time you want to cut your losses short, you should go for a Bull Put Spread.

This is because by using a Bull Put Spread; you put a limit on your profits as well as losses.

Find out other Bull Option Trading Strategy here

| Long Call | Bull Condor Spread | Bull Butterfly Spread |

| Bull Call Ladder Spread | Bull Ratio Spread | Short Put |

| Bull Call Spread | Short Bull Ratio Spread |

How a Bull Put Spread works?

In simple words, a Bull Put Spread is a less risky alternative you short put. In case of a Bull Put Spread, the trader buys a put and writes another with a different strike price but the same date of expiry.

Just like any other strategy, strike price and expiry are two major factors that the buyers must consider while implementing the strategy.

The strike price is the target price at which you feel the security will rise, and the date of expiry is the date at which the option contract will expire.

In the case of a Bull Put Spread, the traders usually consider two types of puts, namely, In the Money and Out of the Money.

To create a Bull Put Spread, you need to buy OTM put, which means the strike price you choose should be lower than that at which security is trading.

Simultaneously sell ITM put which has a strike price greater than that at which security is trading.

Let’s take an example to analyze various possible cases

Nifty 50 is trading at: 8800 Lot size= 75

- Buy OTM put with a strike price 8700 for a premium of 72. Therefore, the premium paid is 72 points

- Sell ITM put with a strike price of 8900 for a premium of 163. Therefore, the premium received is 163 points

Therefore, the net premium received is (163-72= 91), which creates a credit spread.

Case 1:

Nifty 50 is at 8600 at the time of expiry of the put contract.

In this case, the value of the put contract with a strike price of 8700 will rise, and so will the put with a strike price of 8900. This implies the following result:

Sell the put contract with a strike price of 8700 for a premium of 100. But the put with a strike price of 8900 will rise too, and you will have to buy it at a premium of 300.

This would lead to a net loss which can be calculated as:

Net position: 163(sold 8900PE) – 72(bought 8700PE) + 100(sold 8700PE) – 300(bought 8900PE) = -109 points loss

Case 2:

Nifty 50 is at 8800 at the time of expiry of the put contract.

In this case, the value of the put contract with a strike price of 8700 will become worthless, and so will the put with a strike price of 8900. This implies the following result:

Net Position: [163(sold 8900PE) – 72(bought 8700PE) =91 points profit

Case 3:

Nifty 50 is at 8900 at the time of expiry of the put contract.

In this case, the value of the put contract with a strike price of 8700 will become worthless, and so will the put with a strike price of 8900. This implies the following result:

Net Position: [163(sold 8900PE) – 72(bought 8700PE) = 91 points profit

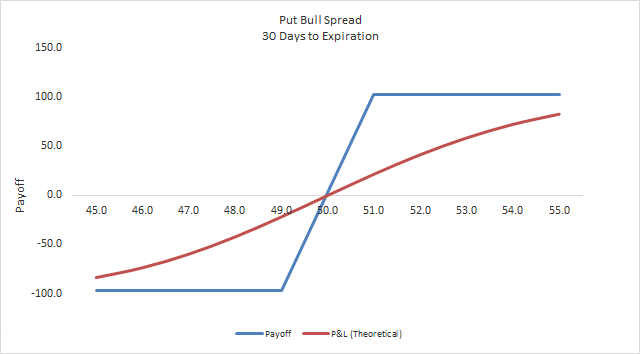

The above-mentioned cases were three scenarios, and either of these might occur when implementing this strategy. As seen in the cases above, the trader tends to lose money if the price of the underlying security falls.

But the chances of making money are higher as you book profits even if the security does not change or rises. However, there is an upper limit on the profits that you can earn.

Summarizing the above cases, we find that:

- The breakeven point for the strategy is at 8809, which is calculated by the difference of higher strike price and net credit.

- The trader will incur losses if the index expires at a level lower than the breakeven point. However, these losses would be limited to 109 points only.

- The trader will make profits if the index expires at a level greater than the breakeven point. But in that case, too, the profits would be limited to 91 points only.

| Closing price on expiry | The payoff from OTM put bought | The payoff from ITM put sold | Net position |

| 8600 | +28 | -137 | -109 |

| 8800 | -72 | +163 | +91 |

| 8900 | -72 | +163 | +91 |

Advantages of the strategy:

- The probability of making money is high as you can book profits even if the security does not go up in price. This happens because, at expiry, both put contracts become worthless, and thus, the entire upfront credit becomes your profit.

- Since you are buying out of the money puts as well, it helps in reducing the chances of potential losses.

- The factor of time decay, which people consider as a downside in most cases, helps you to earn profits in a Bull Put Spread. This happens because you are also selling the puts for a strike price.

Disadvantages of the strategy:

- A high level of trading experience and expertise is required for applying this strategy. Therefore, we do not recommend beginners to implement this while trading.

- Since you are buying as well as writing puts at the same time, your profits and losses are limited. This means that if the market rises beyond your strike price, in that case, too, you will earn a limited amount of profit.

Conclusion: Bull Put Spread

The Bull Put Spread is a strategy that can be used as an alternative to short put when you have a moderately bullish outlook for the market.

Although, if you feel that the market is extremely bullish, there are other alternative strategies available.

One must opt for a Bull Put Spread only if they have a moderately bullish outlook for the market, and they want to safeguard themselves against any unexpected fall in the market.

By using a Bull Put Spread, you are limiting your profits, but at the same time, you are limiting your potential losses too.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading