Bull Ratio Spread – An Advanced Options Trading Strategy for Bullish Market

Last Updated Date: Nov 16, 2022Bull Ratio Spread is an advanced options trading strategy. This strategy is used only by traders & it is used in bullish market conditions.

Know everything about this trading strategy here.

About Bull Ratio Spread

The Bull Ratio Spread is a bullish options trading strategy that the traders implement if they have a bullish outlook towards the market or underlying security. Some people call Bull Ratio Spread as an extension of a bull call spread.

However, it is slightly more complicated, but at the same time, it provides more flexibility to the trader.

Moreover, you can use it to reduce the upfront cost of buying calls. The major difference between a long call and a Bull Ratio Spread is the potential profits.

In case of a Bull Ratio Spread, the trader can book profits even if the security does not go up in price or falls.

Due to this complex implementation of the strategy, we do not recommend beginners to use it while trading. It requires a high level of expertise, which can only be gained through experience.

Open a Demat Account Now! – Apply this Options Strategy

When to use a Bull Ratio Spread?

As mentioned earlier, a Bull Ratio Spread is primarily used to earn profits if the trader has a bullish outlook towards the market or for an underlying security.

This simply means that if you expect the price of an underlying security to rise in the future, you can go for a bull call ratio spread.

But, due to its flexible nature, it can be implemented in multiple ways through which the trade can earn profits in all scenarios.

Therefore, if implemented rightly, you can earn profits through a Bull Ratio Spread even if the security falls in price. Also, if you do not have enough capital and the margin requirement for implementing a bull call spread is higher, you can use a bull call ratio.

Find out other Bull Option Trading Strategy here

| Long Call | Bull Condor Spread | Bull Butterfly Spread |

| Bull Call Ladder Spread | Bull Ratio Spread | Short Put |

| Bull Call Spread | Short Bull Ratio Spread | Bull Put Spread |

How a Bull Call Ratio Spread works?

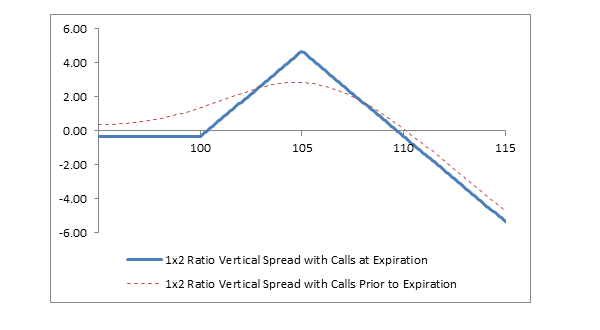

The Bull Ratio Spread is a two-transaction strategy that requires you to buy as well as write calls for different strike prices but the same expiry date. The condition here is that the calls you write should be more OTM than the calls you buy.

As the name suggests, the strategy requires the trader to follow a certain ratio. This means that there should be a fixed ratio between the calls you buy and the calls you write.

Ideally, you are supposed to write a higher number of calls than you buy to create a Bull Ratio Spread.

Although there is no defined ratio for this, you should follow a 2:1 ratio, which means for every lot you buy, you need to write two lots.

If you are writing more calls, you will get more premiums to buy the calls and vice versa.

Writing more calls gives you a net credit, but if the price of the security rises more than you expect it to, you may end up losing money.

Let’s take a few examples for a better understanding of the strategy:

ABC Stock is trading at 50INR Lot size: 100

The expected price is 54INR

You need to initiate the following transactions to implement a Bull Ratio Spread:

- Buy one lot ATM Call i.e., 50 CE for a premium of 2INR. Which implies a debit of 200INR

- Write two lots of OTM calls with 54 CE for .2 INR, which implies credit of 40 INR.

In this case, the net debit is 160 INR.

Case1: ABC stock is trading at 50INR or lesser by the time of expiry.

In this case, the calls you bought expire worthless, creating a liability of 200 INR. But since the calls written also expire worthless, there is a 40 INR premium received from them

Therefore, the net liability is of 160INR, which was the actual value of the debit spread created to implement the strategy initially.

Net Position: 160INR loss

Case2: ABC stock is trading at 54INR by the time of expiry.

In this case, the calls written will become ATM and expire worthless, but the ones we bought initially would become ITM, and therefore, the premium would increase.

Considering the calls rise from 2INR to 4INR. The premium received would be 4INR per lot, which is equal to 400 INR.

Net position=4*100 – 160(initial investment to implement the strategy

=400-160

=240 INR gain

Case3: ABC stock is trading at 58INR by the time of expiry.

In this case, both the calls i.e., 50CE and 54CE, would become ITM; therefore, the premium value will increase. If the calls written increase to a premium of 4INR, it will lead to a liability of 800INR as we sold two lots.

On the other hand, the calls we bought for 2INR will become 8INR, which will lead to an inflow of 800INR. This means that the net liability is 0.

Net position= 4*2*100(amount payable for writing calls) – 8*100(amount received from selling 50CE) – 160(initial investment for implementing the spread) = 160INR loss

The above-mentioned cases were three major scenarios, and you can face either of these while implementing the strategy.

It simply suggests that you need to choose the strike price carefully because if the security falls below your strike price, you may end up losing money in this Bull Ratio Spread.

You can benefit from a fall in price too, but for that, you need to create a different ratio spread.

How to minimize risk while using a Bull Ratio Spread?

The tendency to lose money in case of a Bull Ratio Spread depends entirely on the selection of strike prices.

This is because the strike prices can be adjusted in a manner to make money even if the security falls in price.

However, it becomes important to choose the right ratio and accurate strike prices. The kind of strike price you choose should depend on the type of move you expect in the market.

If you are choosing the strike prices according to the expected move, you can avoid losses.

Advantages of the strategy:

- The trader has the flexibility to choose the ratio and strike prices accordingly. By doing so, he can make money even if the security falls in price.

- The type of ratio the trader follows can also decide what kind of spread is created. The trader can write more calls if he wishes to receive a credit to reduce the upfront cost of the strategy.

Disadvantages of the strategy:

- The selection of ratio and strike price can sometimes be difficult as it requires a lot of analysis,

- The strategy is complex as multiple transactions are initiated. Due to this complex nature, we recommend beginners to stay away from this strategy.

Conclusion: Bull Ratio Spread

The Bull Ratio Spread is an options trading strategy that can help you make money, not only in case of a bullish market but even if the security falls.

The flexibility offered by the Bull Ratio Spread allows you to choose the ratio of calls and strike prices as per your analysis.

The ratio of calls and selection of strike prices helps you make money even if the security falls in price, provided you have applied the ratio correctly.

So, if you have a bullish outlook towards the market and expect the security to rise to a certain level, you can implement a Bull Ratio Spread.

Since you are also writing calls at the same time, you can increase the ratio to create a credit spread. A credit spread helps you in reducing the upfront cost of implementing the strategy.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading