Ushanti Colour Chem IPO – Review, Allotment, Subscription, Price, Date & more

Last Updated Date: Nov 16, 2022Ushanti Colour Chem Ltd is to issue upto 19,26,000 Equity Shares through its IPO, having face value of Rs. 10.00 each. Let’s have a detailed review of the company and analytics of the Ushanti Colour Chem IPO release date, IPO offer price, subscription, Ushanti Colour Chem IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

- Issue Price of this IPO is Rs 57 – Rs 60. Check the Live Share Price here Ushanti Colour Chem Share Price

- To track the performance of this IPO, click on this link – IPO Performance

Ushanti Colour Chem IPO Review & Ratings

| Ushanti Colour Chem IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.3/10 |

| Industry Ranking | 6.5/10 |

| Company Background | 6.4/10 |

| Company Reputation | 6.5/10 |

| Competitive Edge | 6.2/10 |

| Financial Statements | 6.1/10 |

| Popularity Index | 6.3/10 |

| Promoters Reputation | 6.3/10 |

| Retail Appetite | 6.4/10 |

| Top Brokers Review | 6.2/10 |

| Overall Ratings | 6.3/10 |

| Star Ratings | ★★★☆☆ |

Summary of Ushanti Colour Chem IPO

The Company manufactures Reactive and Direct Dyestuffs also known as Synthetic Organic Dyes with an integrated production process. The company also manufactures Copper Phthalocyanine, Blue Crude which are one of the major raw materials used for manufacturing of Dyestuffs. The company is promoted and managed by Mr. Maunal Gandhi and Mr. Minku Gandhi. With decades of experience in this industry, our promoters along with the team of management are actively involved in the day-to-day affairs of our company’s operations adding valuable knowledge and experience required for sustainable growth.

The Company manufactures Reactive and Direct Dyestuffs also known as Synthetic Organic Dyes with an integrated production process. The company also manufactures Copper Phthalocyanine, Blue Crude which are one of the major raw materials used for manufacturing of Dyestuffs. The company is promoted and managed by Mr. Maunal Gandhi and Mr. Minku Gandhi. With decades of experience in this industry, our promoters along with the team of management are actively involved in the day-to-day affairs of our company’s operations adding valuable knowledge and experience required for sustainable growth.

Review of Operation For the Period Ended December 31, 2017

- Net revenue from operations (i.e. net of excise duty and GST) for the period ended December 31, 2017 was Rs. 2,724.85 lakhs.

- Income was Rs. 17.76 lakhs for the period ended December 31, 2017.

- Total expenses, excluding tax amounted to Rs. 2,738.67 lakhs for the period ended December 31, 2017 which is 90.55% of total revenue.

- Depreciation and amortization expenses were Rs. 85.65 lakhs which was 3.12% of total revenue out of which depreciation on tangible fixed assets was Rs. 80.79 lakhs and amortization of intangible assets was Rs. 4.86 lakhs for the period ended December 31, 2017.

- Profit after tax for the period ended December 31, 2017 was Rs. 183.01 lakhs. Our Profit after Tax was 6.67% of our total revenue for the period ended December 31, 2017

The lead manager to the issue is PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED and the Registrar to this issue is BIGSHARE SERVICES PRIVATE LIMITED.

Open Free* Demat A/C Now! Fill the details below

Ushanti Colour Chem IPO Date

The opening and the closing date of IPO is from July 23, 2018 – July 25, 2018 .

Ushanti Colour Chem IPO Subscription

| Subscription | |

| Day 1 – July 23, 2018 | 0.38x (694000 shares) |

| Day 2 – July 24, 2018 | 1.21x (2206000 shares) |

| Day 3 – July 25, 2018 | 6.24x (11414000 shares) |

| Day 4 | – |

| Day 5 | – |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

Ushanti Colour Chem IPO Allotment Status

Bigshare Services Private Limited : http://www.bigshareonline.com/bssipoapplicationstatus.aspx

Ushanti Colour Chem IPO Price Band

The face value of each share is Rs 10 and the price band of the IPO is Rs 57 – Rs 60 Per Equity Share. So, the Primium price is Rs 47 – Rs 50.

Ushanti Colour Chem IPO Equity Share Offering

1,926,000 Equity Shares of Rs 10/- each but Issue Price is yet to be disclosed so it will be aggregated to Rs 11.56 Crores and the Minimum Order Quantity is 2000 Shares.

Ushanti Colour Chem Limited – Company Overview

Company was originally incorporated as ‘Ushanti Colour Chem Private Limited’ on May 12, 1993. Later on February 19, 2018 and the name of our Company was changed to ‘Ushanti Colour Chem Limited’. The Company manufactures Reactive and Direct Dyestuffs also known as Synthetic Organic Dyes with an integrated production process. The company also manufactures Copper Phthalocyanine, Blue Crude which are one of the major raw materials used for manufacturing of Dyestuffs. The pigment and dyestuffs manufactured by us caters to the raw material requirement of textile, garment, cotton, leather, nylon, paper, wool, ink, wood, plastic and paint industries. We concentrate in manufacturing “Turquoise Blue” Dyestuffs and Pigments.

The company has 3 manufacturing facilities situated together at Vatva GIDC in Gujarat. The facilities are spread over 2,739 sq. meters in total area.

The focus on “Turquoise Blue” Dyestuffs has assisted us to be become a niche player in the segment. The company generates most of its revenue from export operations and has received from Certificate of Recognition as Export House, products of the company are exported to countries like, Turkey, Egypt, Bangladesh, Pakistan, Indonesia, China etc. We have a dedicated Research & Development and Quality Control Team, which looks after the quality of the product we manufacture.

Competitive Strengths of Ushanti Colour Chem Limited:

- Focus on quality and innovation

- Experienced Promoters and Management

- Intermediates Production

- Locational Advantage leading to reduction of cost

- Established relationship with clients

Business strategies of Ushanti Colour Chem Limited:

- Business expansion

- Reduction of costs

- Vertical integration of production process

- Expanding customer base

- Capacity expansion

Ushanti Colour Chem Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | |||||

| 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | 31-Mar-13 | |

| Total Assets | 2,273.94 | 2,238.70 | 2,022.31 | 1,889.78 | 1315.76 |

| Total Revenue | 2,962.10 | 2,511.31 | 2,970.96 | 3,541.98 | 2,414.66 |

| Total Expense | 2755.05 | 2463.57 | 2924.49 | 3203.60 | 2336.57 |

| Profit After Tax | 127.73 | 26.22 | 28.36 | 222.00 | 51.01 |

Earnings per Equity Share (in Lakhs)

| 31-Dec-17 | 31-Mar-17 | 31-Mar-16 | |

| Basic | 3.40 | 2.38 | 0.49 |

| Diluted | 3.40 | 2.38 | 0.49 |

From the above statements, one could find that the Ushanti Colour Chem Limited may perform well.

Ushanti Colour Chem IPO – Promoters

The Promoter of this company are:

| Promoter |

| Maunal Shantilal Gandhi |

| Minku Shantilal Gandhi |

| Promoter Group |

| Shantilal Bhailal Gandhi |

| Mona M. Gandhi |

| Sheafali M. Gandhi |

| Maunal Shantilal Gandhi HUF |

| Shantilal Bhailal Gandhi HUF |

| Minku Shantilal Gandhi HUF |

| Aadit Gandhi |

INTEREST OF PROMOTERS

The individual Promoters who are also the Joint Managing Directors of the Company may be deemed to be interested to the extent of fees, if any payable to them for attending meetings of the Board or a committee thereof as well as to the extent of remuneration, commission and reimbursement of expenses payable to them as per the terms of the Articles of the Company and relevant provisions of Companies Act. The individual Promoters may also be deemed to be interested to the extent of Equity Shares held by them in The Company and also to the extent of any dividend payable to them and other distributions in respect of the said Equity Shares in the Company.

LITIGATION INVOLVING THE PROMOTERS

For details of legal and regulatory proceedings involving the Promoters, please refer “Outstanding Litigation and Material Developments” on page 199 of this Draft Red Herring Prospectus.

OTHER VENTURES OF THE PROMOTERS

Save and except as disclosed in the chapter titled “Our Promoter and Promoter Group” and “Our Group Companies” beginning on page 171 and 175, of this Draft Red Herring Prospectus, there are no ventures promoted by the Promoter in which they have any business interests / other interests.

DEFUNCT/ STRUCK OFF COMPANY

None of their group Company has struck off.

Ushanti Colour Chem IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | Upto 19,26,000* Equity Shares of face value of Rs.10/- each |

| Of which: | |

| Reserved for Market Makers | Upto [●] Equity Shares of face value of Rs. 10/- each |

| Net Issue to the Public | Upto [●] Equity Shares of face value of Rs.10/- each |

| Of which: | |

| QIB Portion | Not more than [●] Equity shares of face value of Rs. 10/- each fully paid of the Company for cash at a price of Rs. [●]/- per share aggregating Rs. [●] Lakhs; shall be available for allocation to QIB |

| Of which | |

| Available for allocation to Mutual Funds only (5% of the QIB portion) (Excluding the Anchor Investor Portion) | [●] Equity Shares of Face Value of Rs. 10/- each |

| Balance for all QIBs including Mutual Funds | [●] Equity Shares of Face Value of Rs. 10/- each |

| Retail Investors Portion | Upto [●] Equity Shares of face value of Rs. 10/- each (available for allotment to Retail Individual Investors of up to Rs. 2.00 Lacs) |

| Non-Retail Investors Portion | Upto [●] Equity Shares of face value of Rs. 10 /- each (available for allocation to investors up to Rs. 2.00 Lacs) |

| Equity Shares outstanding prior to the Issue | 53,75,700 Equity Shares |

| Equity Shares outstanding after the Issue | Upto 73,01,700 Equity Shares of face value of Rs. 10 each |

Ushanti Colour Chem IPO Issue Object

These are the IPO Issue Objects of the company:

1. To finance setting up of Vinyl Sulphone manufacturing facility at GIDC Saykha Industrial Estate, Bharuch;

2. Repayment/pre-payment of certain secured borrowings availed by our Company; and

3. General corporate purposes.

Ushanti Colour Chem IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Focus on quality and innovation

- Experienced Promoters and management

- Intermediates Production

- Wide range of products

- Locational Advantage

- Cost reduction initiatives

- Well established relationship with clients

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW (%) | NAV (Rs.) | |

| 31-Mar-17 | 2.38 | 19.54 | 12.16 |

| 31-Mar-16 | 0.49 | 4.99 | – |

| 31-Mar-15 | 0.53 | 5.68 | – |

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | 26.76 |

| Highest | 63.34 |

| Lowest | 8.52 |

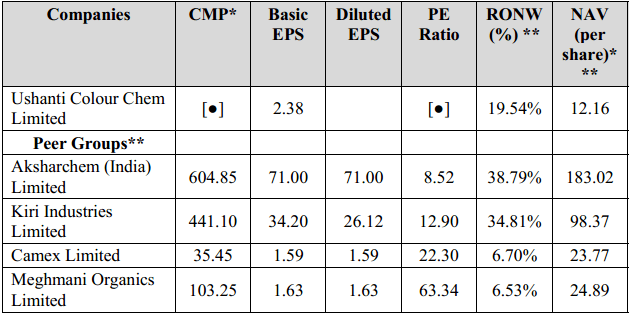

- Competitive Peers

Ushanti Colour Chem IPO Lead Managers

| Lead Managers |

| PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED 406-408, Keshava Premises, Behind Family Court, Bandra Kurla Complex, Bandra (East), Mumbai – 400051, Maharashtra, India. Tel: +91-22 61946700 Fax: +91-22 2659 8690 Website:www.pantomathgroup.com, Email: ipo@pantomathgroup.com Investor Grievance Id:ipo@pantomathgroup.com Contact Person: Hardik Bhuta/Unmesh Zagade SEBI Registration No:INM000012110 |

Ushanti Colour Chem IPO Registrar to offer

| Registrar to the Offer |

| BIGSHARE SERVICES PRIVATE LIMITED

1st Floor, Bharat Tin Works Building, Opp. Vasant Oasis, Makwana Tel: +91 22 6263 8200, Fax: +91 22 6263 8299 |

Other Details:

- Statutory Auditor – NA

- Peer Review Auditor – NA

- Bankers to the Company – NA

- Summary:

| Open Date | June 29 2018 |

| Close Date | July 04 2018 |

| Total Shares | 1,926,000 |

| Face Value | Rs 10 Per Equity Share |

| Issue Size | 11.56 Cr. |

| Lot Size | 2000 Shares |

| Issue Price | Rs 57-60 Per Equity Share |

| Listing At | NSE Emerge |

| Listing Date | July 12 2018 |

Ushanti Colour Chem IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

Ushanti Colour Chem IPO Grey Market Premium

The Ushanti Colour Chem IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Open Free* Demat A/C Now! Fill the details below

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics