TCNS Clothing IPO – Review, Allotment Status, Subscription, Price, Date & more

Last Updated Date: Aug 30, 2023TCNS Clothing IPO consists of 15,714,038 equity shares, will be open from July 18, 2018 – July 20, 2018. It is one of the recent IPO filed by any textile company. In this Article, we will do a detailed TCNS Clothing IPO Review. Along with this Review we will also look into other important aspects like TCNS Clothing IPO Allotment Status, IPO Subscription, IPO issue details, Company background & financials, IPO issue date, IPO price band & more.

- Issue Price of this IPO is Rs 714 – Rs 716. Check the Live Share Price here TCNS Clothing Share Price

- To track the performance of this IPO, click on this link – IPO Performance

TCNS Clothing IPO Ratings & Review

| TCNS Clothing IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 7.5/10 |

| Industry Ranking | 7.2/10 |

| Company Background | 7.7/10 |

| Company Reputation | 7.3/10 |

| Competitive Edge | 7.9/10 |

| Financial Statements | 8.2/10 |

| Popularity Index | 8.1/10 |

| Promoters Reputation | 7.5/10 |

| Retail Appetite | 8.3/10 |

| Top Brokers Review | 8.1/10 |

| Overall Ratings | 7.8/10 |

| Star Ratings | ★★★★☆ |

Summary – TCNS Clothing IPO

TCNS Clothing Co. Limited IPO is one of latest IPO drafted with SEBI from Textile Sector.

TCNS Clothing is India’s leading women’s branded apparel company in terms of total number of exclusive brand outlets as of November 2017, according to Technopak. They design, manufacture, market and retail a wide portfolio of women’s branded apparel across multiple brands. The promoters are ONKAR SINGH PASRICHA AND ARVINDER SINGH PASRICHA .

TCNS Clothing is India’s leading women’s branded apparel company in terms of total number of exclusive brand outlets as of November 2017, according to Technopak. They design, manufacture, market and retail a wide portfolio of women’s branded apparel across multiple brands. The promoters are ONKAR SINGH PASRICHA AND ARVINDER SINGH PASRICHA .

TCNS Clothing has hired 2 Lead managers or Investment Bankers to take care of their IPO related engagements. Kotak Mahindra Capital Company Limited & Citigroup Global Markets India Private Limited are the two lead managers. They Registrar to the offer is Karvy Computershare Private Limited.

As per the Prospectus drafted wtih SEBI, the textile company plans to sell more than 1.57 crore shares through the offer-for-sell route. Out of this 47.18 lakh shares will be allocated to anchor investors.

Subscribe to TCNS Clothing IPO – Fill up the Form Below

TCNS Clothing IPO Date

The Opening and Closing date of this IPO is 18 July 2018 – 20 July 2018.

TCNS Clothing IPO Subscription

| Subscription | |

| Day 1 – July 18, 2018 | 0.10x (1075880 shares) |

| Day 2 – July 19, 2018 | 2.06x (22608740 shares) |

| Day 3 – July 20, 2018 | 5.22x (57438400shares) |

| Day 4 | – |

| Day 5 | – |

TCNS Clothing IPO Allotment Status

The allotment status of TCNS Clothing IPO will be out after 3-4 weeks of IPO issue.

Other Details:

- Basis of Allotment: 25-July-2018

- Refunds: 26-July-2018

- Credit to demat accounts: 27-July-2018

- Listing: 30-July-2018

TCNS Clothing Co. Limited IPO Price Band

The Face value is Rs 2 per Equity Share and the price band of the IPO is between Rs 714 – Rs 716 Per Equity Share.

TCNS Clothing IPO Issue Size

Size of the IPO is 15,714,038 Equity Shares.

TCNS Clothing IPO Equity Share Offerings

The Minimum Order Quantity is 20 Shares, so Rs.14,320 is the minimum size lot and up to 15,714,038 Equity Shares of Rs 2 face value, aggregating up to Rs 1,125.13 Cr. The shares are listed at both BSE and NSE.

TCNS Clothing Co. Limited – Company Overview

TCNS Clothing is one of the leading branded apparel company in the country. They sell their products across India and through multiple distribution channels. As of September 30, 2017, they sold products through 418 exclusive brand outlets, 1,305 large format store outlets and 1,361 multi-brand outlets, located in 29 states and two union territories in India.

TCNS Clothing is one of the leading branded apparel company in the country. They sell their products across India and through multiple distribution channels. As of September 30, 2017, they sold products through 418 exclusive brand outlets, 1,305 large format store outlets and 1,361 multi-brand outlets, located in 29 states and two union territories in India.

As of September 30, 2017, they also sold products through six exclusive brand outlets in Nepal, Mauritius and SriLanka. In addition, they sell products through their own website and online retailers.

The Companies product portfolio includes top-wear, bottom-wear, drapes, combination-sets and accessories that caters to a wide variety of the wardrobe requirements of the Indian woman, including every-day wear, casual wear, work wear and occasion wear.

Over the years, they have expanded their brand portfolio to three brands, each positioned to cater to well-defined needs of their respective target consumers:

W

It is a premium fusion wear brand, which merges Indian and western sensibilities with an emphasis on distinctive design and styling. This brand is targeted primarily at the modern Indian woman’s work and casual wear requirements.

Aurelia

It is a contemporary ethnic wear brand targeted at women looking for great design, fit and quality for their casual and work wear requirements.

Wishful

It is a premium occasion wear brand, with elegant designs catering to women’s apparel requirements for evening wear and occasions such as weddings, events and festivals.

Key Members of the Company

- Onkar Singh Pasricha (Chairman & Executive Director)

- Anand Kumar Daga (Managing Director)

- Naresh Patwari (Non-Executive Director)

TCNS Clothing Co. Limited – Financial Statements

Lets have a detailed look at the companies financials

Financial Statement (in INR & Millions):

| 31-Mar-18 | 31-Mar-17 | 31-Mar-16 (Proforma) | |

| Total Assets | 5,763.59 | 4,258.04 | 3,087.84 |

| Total Revenue | 8,491.57 | 7,129.73 | 4,881.35 |

| Profit After Tax | 980.97 | 157.97 | -414.96 |

Earning per Equity Share

| Earning per Equity Share (in INR) | |||||

| Mar’17 | Mar’16 | Mar’15 | Mar’14 | Mar’13 | |

| Basic | 15.04 | 9.57 | 5.13 | 1.71 | 0.93 |

| Diluted | 14.74 | 9.35 | 5.01 | 1.67 | 0.91 |

TCNS clothing has grown at an outstanding rate in last 5 years. According to their financials, their growth in 5 years 20x leap which is extraordinary. The IPO will be of a very good value as the sentiments will be very strong.

TCNS Clothing Co Limited Promoters

The Clothing giant is being promoted by 2 individuals.

- Onkar Singh Pasricha

- Arvinder Singh Pasricha

Interest of Promoters

Interests of our Promoters and Related Party Transactions

Promoters are interested in our Company to the extent that they have promoted our Company and to the extent

of their respective shareholdings in our Company and dividend or other distributions payable, if any, by the Company.

The Promoters do not have any interest in any property acquired by the Company during the two years preceding the date of filing of this Draft Red Herring Prospectus.

Promoters are not interested in any entity which holds any intellectual property rights that are used by the Company.

No sum has been paid or agreed to be paid to the Promoters and Promoters are not interested as members of any firm or any company and hence no sum has been paid or agreed to be paid to such firm or company in cash or shares or otherwise.

TCNS Clothing IPO Offer Details or Issue Details

| Offer | Up to 15,714,038 Equity Shares aggregating up to ₹ [●] million |

| Of which: | |

| A. QIB Category | Not more than 7,857,018 Equity Shares |

| Of which: | |

| Anchor Investor Portion | 4,714,210 Equity Shares |

| Balance available for allocation to QIBs other than Anchor Investors (assuming Anchor Investor Portion is fully subscribed) | 3,142,808 Equity Shares |

| Of which | |

| Available for allocation to Mutual Funds only (5% of the QIB Category (excluding the Anchor Investor Portion)) | 392,851 Equity Shares |

| Balance for all QIBs including Mutual Funds | 2,749,957 Equity Shares |

| B. Non-Institutional Category | Not less than 2,357,106 Equity Shares |

| C. Retail Category | Not less than 5,499,914 Equity Shares |

TCNS Clothing IPO will see more than 1.5 crore shares issue & out of which approx 55 lakh shares will be allotted to retail buyers.

TCNS Clothing Co Limited IPO Issue Object

Below is the objective of IPO issue:

- To ripe the benefits of listing equity shares in the stock exchange

- IPO issue will enhance the Brand image of the company further

- Listing will also provide a public market for the Equity Shares in India

Here are other Upcoming IPOs Drafted with SEBI

TCNS Clothing IPO – Basis of the Offer

The Offer Price of the IPO will be decided by Promoters of the Company along with consultation with Investment Bankers. The Offer price is determined by looking into Qualitative & Quantitative Factors. Lets check these factors now.

Qualitative Factors

- Strongly positioned to leverage growth in the women’s apparel industry in India

- Leading women’s apparel company in India with a portfolio of established brands

- Innovative and institutionalized product design process

- Widespread distribution network and presence across a variety of retail channels

- Longstanding relationships with suppliers and third party manufacturers

- Capital efficient and scalable business model

- Experienced, aligned and professional management team with strong organizational culture

Quantitative Factors

- Basic and Diluted Earnings per Share (“EPS”) is 11.57 & 11.32 respectively till Dec 2017.

- Price/Earning (“P/E”) ratio in relation to Price Band

- Return on Net Worth (“RoNW”) is 30.05% for last 3 consecutive years

- Minimum Return on Total Net Worth

- Net Asset Value per Equity Share as on 31st Sep 2017 is INR 61.05

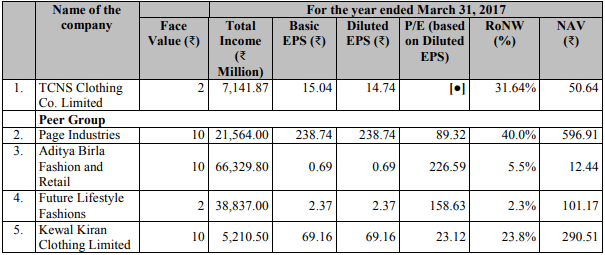

- Comparison with Listed Industry Peers, TCNS is one of the largest

TCNS Clothing IPO Lead Managers

| Lead Managers |

| Kotak Mahindra Capital Company Limited |

| Citigroup Global Markets India Private Limited |

TCNS Clothing IPO Registrar to the Offer

| Registrar of the Offer |

| Karvy Computershare Private Limited |

TCNS Clothing IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Repu-tation | Compe-titive Edge | Finan-cial State-ment | Popu-larity Index | Promo-ters Repu-tation |

| Angel Broking | 8.2/10 | 8.4/10 | 8.1/10 | 8.1/10 | 7.8/10 |

| Sharekhan | 8.2/10 | 8.1/10 | 8.2/10 | 8.1/10 | 7.9/10 |

| Kotak Securities | 8.3/10 | 8.5/10 | 8.0/10 | 8.1/10 | 8.3/10 |

| ICICI Direct | 8.3/10 | 8.3/10 | 8.2/10 | 8.1/10 | 7.9/10 |

| IIFL | 8.5/10 | 8.2/10 | 8.3/10 | 8.0/10 | 8.1/10 |

| Edelweiss | 8.5/10 | 8.4/10 | 8.1/10 | 8.3/10 | 8.2/10 |

| Zerodha | 8.4/10 | 8.1/10 | 8.1/10 | 8.1/10 | 8.0/10 |

| 5Paisa | 8.1/10 | 8.1/10 | 8.2/10 | 8.1/10 | 8.1/10 |

| Karvy | 8.4/10 | 8.3/10 | 8.1/10 | 8.1/10 | 8.1/10 |

| Motilal Oswal | 8.1/10 | 8.1/10 | 8.0/10 | 8.3/10 | 7.8/10 |

TCNS Clothing IPO Grey Market Premium

TCNS Clothing IPO grey market premium Rs 15-20 and the Kostak is Rs 250 and Subject to Sauda is Rs 450.

Subscribe to TCNS Clothing IPO – Fill up the Form Below

TCNS Clothing IPO News

News 1 – TCNS Clothing files draft papers for IPO

News 2 – Download Prospectus

Market Guide

Featured Topics