SBI Cards IPO Review, Dates, Allotment, Size, Live Bid Details, GMP & RHP

Last Updated Date: Nov 24, 2022Let’s have a detailed review of the company and analytics of the SBI Cards IPO release date, IPO offer price, subscription, SBI Cards IPO allotment, grey market price and other details like the SBI Cards and Payment Services Private Limited – company background, its financial positions, its promoters and other related information.

- Issue Price of this IPO is Rs 750 – Rs 755 . Check the Live Share Price here SBI Cards Share Price

- To track the performance of this IPO, click on this link – IPO Performance

| Face Value | Rs 10 |

| Price Band | Rs 750 – Rs 755 |

| Listing At | BSE, NSE |

| Min. Order Quantity | 19 |

| Listing Date | Mar 16, 2020 |

| Offer for Sale | 130,526,798 |

| Fresh Issue | Rs 500 Crores |

SBI Cards IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 8.9/10 |

| Industry Ranking | 8.2/10 |

| Company Background | 8.3/10 |

| Company Reputation | 8.2/10 |

| Competitive Edge | 8.2/10 |

| Financial Statements | 7.8/10 |

| Popularity Index | 7.9/10 |

| Promoters Reputation | 8.2/10 |

| Retail Appetite | 8.8/10 |

| Top Brokers Review | 8.9/10 |

| Overall Ratings | 8.4/10 |

| Star Ratings | ★★★★☆ |

Summary of SBI Cards IPO

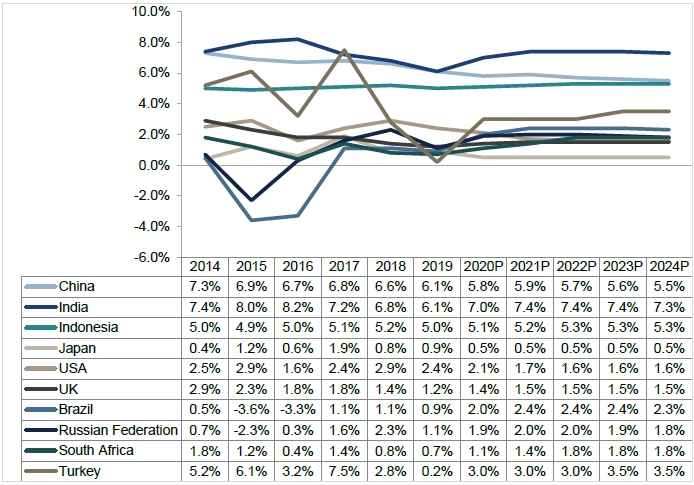

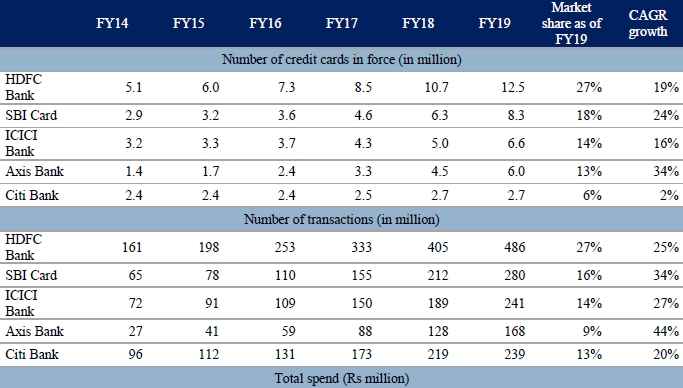

They are the second-largest credit card issuer in India, with a 17.6% and 18.0% market share of the Indian credit card market in terms of the number of credit cards outstanding as of March 31, 2019 and September 30, 2019, respectively.

They are the second-largest credit card issuer in India, with a 17.6% and 18.0% market share of the Indian credit card market in terms of the number of credit cards outstanding as of March 31, 2019 and September 30, 2019, respectively.

And a 17.1% and 17.9% market share of the Indian credit card market in terms of total credit card spends in fiscal 2019 and in the six months ended September 30, 2019, respectively, according to the RBI.

The company has raised Rs 2,769 crore from 74 anchor investors.

From FY 2015-16 to FY 2018-2019, as per the Restated Financial Statements

They have established a proven track record of consistently generating profits over the past three fiscal years. The total income increased from Rs.34,710.38 million in fiscal 2017 to Rs.72,868.34 million in fiscal 2019 at a CAGR of 44.9% and their revenues from operations have increased from Rs.33,462.03 million in fiscal 2017 to Rs.69,991.11 million in fiscal 2019 at a CAGR of 44.6%.

Their net profit increased from Rs.3,728.59 million in fiscal 2017 to Rs.8,627.19 million in fiscal 2019 at a CAGR of 52.1%. The ROAE has remained stable at 28.5% in fiscal 2017 and 28.4% in fiscal 2019, while their ROAA increased from 4.0% in fiscal 2017 to 4.8% in fiscal 2019.

The Promoters of this company are STATE BANK OF INDIA. The lead manager to the issue are Kotak Mahindra Capital Company Limited, Axis Capital Limited, DSP Merrill Lynch Limited, HSBC Securities and Capital Markets (India) Private Limited, SBI Capital Markets Limited*, Nomura Financial Advisory and Securities (India) Private Limited and the Registrar to this issue is Link Intime India Private Limited.

SBI Cards IPO Dates / Launch Date

The opening and the closing date of SBI Cards IPO is Mar 02, 2020 and Mar 05, 2020.

The Bid/ Offer closes (QIB Bidders) on – Mar 04, 2020.

SBI Cards IPO Subscription / Bid Details (BSE+NSE)

CLICK ON THE BELOW LINKS TO CHECK THE REAL TIME BID DETAILS:

| Day / Date | QIB | NII | RII | Employee | Others | Total Subscription |

| 1st Day – Mar 02 | 0.00x | 0.12x | 0.62x | 0.80x | 0.69x | 0.39x |

| 2nd Day – Mar 03 | 0.21x | 0.47x | 1.21x | 1.84x | 1.41x | 0.87x |

| 3rd Day – Mar 04 | 57.18x | 2.19x | 1.77x | 3.29x | 3.54x | 15.49x |

| 4th Day – Mar 05 | 57.18x | 45.23x | 2.50x | 4.74x | 25.36x | 26.54x |

| Shares Offered or Net Issue | 24,224,003 | 18,341,418 | 42,796,641 | 1,864,669 | 13,052,680 | 100,279,411 |

The shares subscribed by the public will be updated herein.

SBI Cards IPO Allotment Status

Here, you can find the Allotment Status of this IPO.

Allotment of Equity Shares pursuant to the Fresh Issue and transfer of the Offered Shares of the Promoter Selling Shareholders pursuant to the Offer for Sale to the successful Bidders. However, the Allotment status is not yet disclosed.

SBI Cards IPO Listing Date

Find the dates below on basis of allotment, refund, listing and more:

| Basis of Allotment Finalization | Mar 11, 2020 |

| Refunds Initiation | Mar 12, 2020 |

| Credit of Shares to Demat Account | Mar 13, 2020 |

| Share Listing Date | Mar 16, 2020 |

SBI Cards IPO Price Band / Cash Price

The face value of each share is Rs.10,and the Price Band of the IPO is Rs 750 – Rs 755.

SBI Cards IPO Size / Share Offering

Fresh Issue – Rs 500 Crores

Offer for sale – Upto 130,526,798 Equity Share

Employee reservation portion – 1,864,669 Equity Share (Rs 125.87 Crore – 126.80 Crores)

SBI shareholders reservation portion – 13,052,680 Equity Share (Rs 978.95 Crore – 985.48 Crores)

Total issue size – Rs 10,275.52 Crore – 10,340.79 Crores

The share offering ratio:

QIB – 50% (Rs 4585.35 Crore – Rs 4616.26 Crore)

NII – 15% (Rs 1375.61 Crore – Rs 1384.28 Crore)

RII – 35% (Rs 3209.75 Crore – Rs 3229.98 Crore)

SBI Cards and Payment Services Private Limited – Company Overview

SBI Cards & Payments Services Ltd. which was previously known as SBI Cards and Payment Services Private Limited. The company is coming up with his initial public offering soon. SBI Cards and Payment Services Limited is one of the largest credit card issuer in India. It is not starting SBI card pay a payment feature based on HCE Technology (Host Card Emulation).

SBI Cards Technology and Database

Their business is technology-driven and underpinned by their data analytics capabilities, which cut across all aspects of their operations. Their core technology systems are scalable, modern and sophisticated, with considerable capacity to support their future growth.

They possess a large database of cardholder demographic and socio-economic data (such as their cardholders’ purchase patterns, behaviors and payment histories) derived from the numerous transactions carried out by millions of cardholders each year, which they analyze to generate underwriting scorecards, proactively mitigate risks, and reduce losses and delinquencies.

SBI Cards Revenue Model

They have a diversified revenue model whereby they generate both non-interest income (primarily comprised of feebased income such as interchange fees, late fees and annual fees, among others) as well as interest income on their credit card receivables. The share of their revenue from operations that they derive from non-interest income has steadily increased over the past three fiscal years, from 43.6% in fiscal 2017 to 48.9% in fiscal 2019.

SBI Cards Networking & Multiple Channels

They deploy a sales force of 33,086 outsourced sales personnel as of September 30, 2019 operating out of 133 Indian cities and which engages prospective customers through multiple channels, including physical points of sale in bank branches, retail stores, malls, fuel stations, railway stations, airports, corporate parks and offices, as well as through tele-sales, online channels, email, SMS marketing and mobile applications.

In addition, their partnership with SBI provides them with access to SBI’s extensive network of 22,007 branches across India, which enables them to market their credit cards to SBI’s vast customer base of 436.4 million customers as of March 31, 2019.

Business strategies of SBI Cards:

-

Continued expansion of portfolio

-

Enhance productivity and operational efficiencies

-

Optimizing the value of their asset portfolio through an efficient capital structure

SBI Cards Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

SBI Cards IPO Financial Summary

On the basis of Standalone statement:

| Amount (in INR & million) | |||||

| September 30, 2019 |

September 30, 2018 |

March 31, 2019 |

March 31, 2018 |

March 31, 2017 |

|

| Total Assets | 244,591.43 | 176,035.04 | 202,396.34 | 156,860.02 | 107,649.85 |

| Total Revenue | 46,772.08 | 33,422.74 | 72,868.34 | 53,701.92 | 34,710.38 |

| Total Expense | 36,426.23 | 27,623.98 | 59,552.35 | 44,508.47 | 28,994.15 |

| Profit After Tax | 7,258.82 | 3,766.10 | 8,627.19 | 6,011.43 | 3,728.59 |

| EBITDA | 1 7,037.82 | 1 0,826.19 | 2 4,299.10 | 16,553.49 | 11,048.47 |

Earnings per Equity Share (in Rs.million)

| September 30, 2019 |

September 30, 2018 |

March 31, 2019 |

March 31, 2018 |

March 31, 2017 |

|

| Basic & Diluted | 7.79 | 4.20 | 9.43 | 7.40 | 4.75 |

From the above statements, one could find that the SBI Cards and Payment Services Limited may perform well.

SBI Cards IPO – Promoters

The Promoters of this IPO are:

- State Bank of India

List of Related Parties (Key Managerial Personnel)

- Mr. Hardayal Prasad, MD and CEO

- Mr. Vijay Jasuja, CEO

SBI CARDS IPO – Details of shareholding:

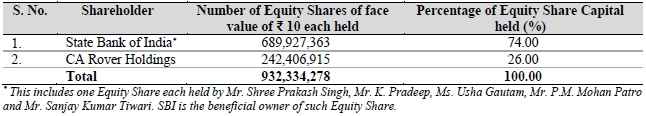

The State Bank of India holds around 74% of equity shares and CA Rover Holdings holds around 26% equity share.

Interest in promotion of the Company

Their Directors have no interest in the promotion or formation of their Company as on the date of this Draft Red Herring Prospectus. However, their Promoter, SBI has nominated four nominee Directors on their Board, pursuant to the terms of the SHA.

Property Interest

Their Directors have no interest in any property acquired or proposed to be acquired by their Company.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

SBI Cards IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered |

Up to [●] Equity Share aggregating up to Rs.million

|

| Of which: | |

| Fresh Issue | Up to [●]Equity Share aggregating up to Rs.5,000 million |

| Offer for Sale | Up to 130,526,798 Equity Shares aggregating up to Rs.million by the Promoter Selling Shareholder |

| QIB Portion | Upto Equity Share of face value of Rs.10/- |

| Of which | |

|

Anchor Investor Portion

|

Up to [●] Equity Shares

|

| Balance available for allocation to QIBs other than Anchor Investors (assuming Anchor Investor Portion is fully subscribed | [●] Equity Share |

| Of which | |

| Available for allocation to Mutual Funds only (5%of the QIB Portion (excluding the Anchor Investor Portion) |

[●] Equity Shares

|

|

Balance of QIB Portion for all QIBs including Mutual Fund

|

|

|

Non- Institutional Portion

|

Not more than [●] Equity Shares |

|

Retail Portion

|

Not more than [●] Equity Share |

| Equity Shares outstanding prior to the Issue | 932,334,278 Equity Shares |

| Equity Shares outstanding after the Issue | [●] Equity Shares |

SBI Cards IPO Issue Object

These are the IPO Issue Objects of the company:

- The object of the Offer for Sale is to allow the Selling Shareholders to sell an aggregate of up to 130,526,798 Equity Shares held by them. Their Company will not receive any proceeds from the Offer for Sale.

SBI Cards IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Second largest credit card issuer in India with deep industry expertise and a demonstrated track record of

growth and profitability - Diversified customer acquisition capabilities

- Supported by a strong brand and pre-eminent promoter

- Diversified portfolio of credit card offerings

- Advanced risk management and data analytics capabilities

- Modern and scalable technology infrastructure

- Highly experienced and professional management team

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW in % | NAV (Rs.) | |

| 31-Mar-17 | 4.75 | 26.00 | – |

| 31-Mar-18 | 7.40 | 25.00 | – |

| 31-Mar-19 | 9.43 | 24.00 | 46.99 |

- Price to Earnings (P/E) ratio in relation to Price band of Rs.[●] to Rs.[●] per Equity Share

| Particulars | P/E ratio |

| Highest | 152.50 |

| Average | 35.14 |

| Lowest | (8.87) |

Competitive Peers of SBI Cards and Payment Services Limited

Below are listed companies in India that engage in a business similar to that of their Company.

SBI Cards IPO Lead Managers to the Issue

| Lead Managers |

|

Kotak Mahindra Capital Company Limited,

Axis Capital Limited,

DSP Merrill Lynch Limited,

HSBC Securities and Capital Markets (India) Private Limited,

SBI Capital Markets Limited*,

Nomura Financial Advisory and Securities (India) Private Limited

|

SBI Cards IPO Registrar to offer

| Registrar to the Offer |

|

Link Intime India Private Limited

C-101, 1st Floor, 247 Park Lal Bahadur Shastri Marg, Vikhroli (West) Mumbai – 400 083 Maharashtra, India Telephone: +91 22 4918 6200 Email: sbicard.ipo@linkintime.co.in Website: www.linkintime.co.in Contact Person: Shanti Goplakrishnan SEBI Registration No: INR000004058 |

SBI Cards IPO – Other Details:

- Statutory Auditor – S. Ramanand Aiyar & Co,

- Legal Counsel to the Company – Shardul Amarchand Mangaldas & Co

- Bankers to the Company ;

| Syndicate Members | Kotak Securities Limited and SBICAP Securities Limited |

| Sponsor Bank | HDFC Bank Limited |

| Categories | FI, IC, MF, FII, OTH, CO, IND NOH, EMP and SHA |

SBI Cards IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 8.5/10 | 8.1/10 | 8.5/10 | 7.3/10 | 7.5/10 |

| Sharekhan | 8.6/10 | 8.3/10 | 8.6/10 | 8.5/10 | 8.1/10 |

| Kotak Securities | 7.3/10 | 7.5/10 | 7.5/10 | 8.1/10 | 7.3/10 |

| ICICI Direct | 8.5/10 | 8.1/10 | 8.1/10 | 8.0/10 | 7.1/10 |

| IIFL | 8.6/10 | 8.1/10 | 7.3/10 | 7.5/10 | 7.1/10 |

| Edelweiss | 7.5/10 | 7.4/10 | 8.5/10 | 8.1/10 | 7.2/10 |

| Zerodha | 7.4/10 | 7.1/10 | 7.1/10 | 8.1/10 | 7.0/10 |

| 5Paisa | 8.5/10 | 8.1/10 | 8.4/10 | 7.3/10 | 7.5/10 |

| Karvy | 8.6/10 | 8.1/10 | 7.2/10 | 8.5/10 | 8.1/10 |

| Motilal Oswal | 7.1/10 | 7.1/10 | 8.6/10 | 8.3/10 | 7.2/10 |

SBI Cards IPO Grey Market Premium

The SBI Cards IPO Grey Market Premium price is Rs. 290-295 (Only buyers, No Sellers), and the Subject to Sauda is Rs. 5000. Application for Rs. 3500/3700.

Subscribe to SBI Cards IPO

SBI Cards IPO News

News 1 – SBI Cards IPO [DRHP Prospectus]

News 2 – SBI Cards IPO [Download RHP Prospectus]

Market Guide

Featured Topics