Sandhya Marines IPO – Review, Allotment Status, Subscription, Price, Date & more

Last Updated Date: Aug 28, 2023In this article, we will discuss in detail about Sandhya Marines IPO review along with in-depth analysis on offerings, company’s financial, Sandhya Marines IPO reputation, allotment status, grey market pricing, Sandhya Marines IPO release and close dates, price and many more.

Sandhya Marines Ltd IPO Review & Ratings

| Criteria | Ratings |

| Industry Sentiments | 6.0/10 |

| Industry Ranking | 6.3/10 |

| Company Background | 6.5/10 |

| Company Reputation | 6.0/10 |

| Competitive Edge | 6.5/10 |

| Financial Statement | 6.0/10 |

| Popularity Index | 6.3/10 |

| Promoters Reputation | 6.5/10 |

| Retail Appetite | 6.6/10 |

| Top Brokers Review | 6.5/10 |

| Overall Ratings | 6.3/10 |

| Star Ratings | ★★★☆☆ |

Summary of Sandhya Marines IPO

The seafood exporter, Sandhya Marines IPO offers the issue of Rs 300 crore and offer Rs 1.26 Crore sale of equity share by the following shareholders – Dr K. V. Prasad, Ms K. Suryanarayanamma, K. Anand Kumar and K. Arun Kumar.

The seafood exporter, Sandhya Marines IPO offers the issue of Rs 300 crore and offer Rs 1.26 Crore sale of equity share by the following shareholders – Dr K. V. Prasad, Ms K. Suryanarayanamma, K. Anand Kumar and K. Arun Kumar.

The proceedings from the Sandhya Marines IPO is for the set-up of a new Processing Unit for shrimps, new corporate office, mill-facility for fish food and Debt repayment.

Karvy Investment Banking (Karvy Investor Services Limited) and SBI Capital Markets Ltd will be lead managers of the company’s Initial Public Offer (IPO). Karvy Computershare Private Limited is the registrar to this offer.

The main objective of this company is associated with fish farming & culture and business of processing, packing, export & import and other similar business in marine products.

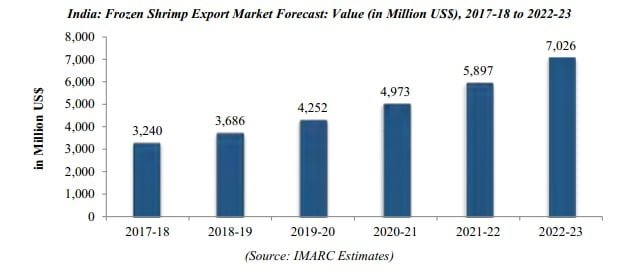

It is expected that by 2022, the shrimp production in India can reach a volume of more than 1 million tons and the growth rate at CAGR of 11%.

The Government of India has given the approval under fisheries policy for the following categories:

The Government of India has given the approval under fisheries policy for the following categories:

(a) Processing Units

(b) Aquaculture Pond/ Farm

(c ) Feed Manufacturing Units or related Equipment Manufacturing

(d) Aqua Labs/ Disease Diagnostic Labs Promotion.

Open Free* Demat A/C Now! Fill the details below

Sandhya Marines IPO Date – Start & End Date

The opening date and closing date of this IPO is not yet finalized and these dates will be disclosed here one week before the actual release.

|

Issue |

|

| Opens On | Closes On |

| – | – |

Sandhya Marines IPO Subscription

| Subscription | |

| Day 1 | X |

| Day 2 | X |

| Day 3 | X |

| Day 4 | X |

| Day 5 | X |

The IPO will be up in the stock exchange for subscription probably in the 2nd week of May 2018. We will update the data of Subscription once it is declared.

Sandhya Marines IPO Allotment Status

The Allotment status will be out within 2-3 weeks of IPO issue. Please check the IPO allotment status post issue of IPO.

|

Amount Payable |

|

| Application Price | Allotment Price |

| Rs. | Rs. |

Sandhya Marines IPO Price Band

The price band is yet to be disclosed, this will be revealed before 1 week of the issue.

Sandhya Marines Issue Size

The issue size of the IPO is around INR 300 crore and the secondary market sale of 12.6 million shares by the promoters.

Sandhya Marines IPO Equity Shares Offerings

Not yet disclosed. This will be released post approval from SEBI.

Sandhya Marines Ltd – Company Overview

Sandhya Marines Ltd was incorporated in the year 1987. This company is based out of Hyderabad, Andhra Pradesh. Sandhya Marines Ltd is seafood product exporter and has filed its DRHP (Draft Red Herring Prospectus) under SEBI for IPO permission. In year 2017, Sandhya Marines generated a total revenue of around Rs. 528.84 crores jobs, which is 47% up (from the previous year), perhaps the company profit increases by 48% to Rs 32.74 crore.

Registered and Corporate Office:

D.No-7-5-108/1, Plot No.62 & 67, IInd Floor, Pandurangapuram, Visakhapatnam – 530 003, Andhra Pradesh, India

Contact Person: Mr. M.S.Sivanand, Company Secretary and

Compliance Officer: +91 891 256 6357;

Fax: +91 891 256 7226 Email-ID: cs@sandhyamarines.com;

Website: www.sandhyamarines.com

Corporate Identity Number: U05004AP1987PLC007578

Sandhya marines is an exporter of frozen seafood products that are ready to cook and ready to eat. These products are made from white shrimp. These products are exported across North America, Europe and various parts of Asia.

Sandhya Marines Ltd Company – Financial Statement

Check out the details below for their financial stability:

Assets of the Company

| Non-Current Asset | Current Asset | Total Asset | ||

| Assets (in millions) | Mar’17 | 977.85 | 2,001.92 | 2,979.77 |

| Mar’16 | 921.95 | 1,379.52 | 2,301.47 | |

| Mar’15 | 647.93 | 1,010.37 | 1,658.30 | |

| Mar’14 | 511.9 | 791.68 | 1,303.58 | |

| Mar’13 | 399.6 | 301.46 | 701.06 |

Revenue & PAT of the Company

| Total Revenue | Profit after Tax (PAT) | ||

| Revenue & Profits (in millions) | Mar’17 | 8402 | 555 |

| Mar’16 | 7798 | 297 | |

| Mar’15 | 6941 | 476 | |

| Mar’14 | 5871 | 329 | |

| Mar’13 | 3001 | 119 |

There seems to be a potential growth in the last five years, which is almost 5 times. So, the profit in the future seems equally in the bright side.

Company Promoters

| Promoted By |

| K V Prasad |

| K Suryanarayanamma |

| K Anand Kumar |

| K. ARUN KUMAR |

Sandhya Marines IPO Offer Details

Check the details below for detailed understanding:

| Offer of Equity Shares | [●] Equity Shares aggregating up to ₹[●] million |

| Of which: | |

| Fresh Issue | [●] Equity Shares aggregating up to ₹ 3,000 million. Our Company, in consultation with the BRLMs, is considering a Pre-IPO Placement of up to 7,000,000 Equity Shares for cash consideration aggregating up to ₹ 1,500 million, at its discretion, prior to filing of the Red Herring Prospectus with the RoC. If the Pre-IPO Placement is completed, the size of the Fresh Issue will be reduced to the extent of such Pre-IPO Placement, subject to compliance with Rule 19(2)(b) of the SCRR |

| Offer for Sale | Up to 12,600,000 Equity Shares aggregating up to ₹[●] milion |

| Offer for Sale by Dr. K.V. Prasad | Up to 4,500,000 Equity Shares aggregating up to ₹[●] million |

| Offer for Sale by Ms. K. Suryanarayanamma | Up to 900,000 Equity Shares aggregating up to ₹[●] million |

| Offer for Sale by Mr. K. Anand Kumar | Up to 3,600,000 Equity Shares aggregating up to ₹[●] million |

| Offer for Sale by Mr. K. Arun Kumar | Up to 3,600,000 Equity Shares aggregating up to ₹[●] million |

| The Offer consists of: | |

| Employee Reservation Portion | Up to [●] Equity Shares aggregating up to ₹[●] million |

| Net Offer | [●] Equity Shares aggregating ₹[●] million |

| The Net Offer consists of: | |

| A) QIB Portion | [●] Equity Shares |

| Of which: | |

| Anchor Investor Portion | Upto [●] Equity Shares |

| Balance available for allocation to QIBs other than Anchor Investors (assuming Anchor Investor Portion is fully subscribed) | [●] Equity Shares |

| Of which: | |

| Available for allocation to Mutual Funds only (5% of the QIB Portion (excluding the Anchor Investor portion) | [●] Equity Shares |

| Balance for all QIBs including Mutual Funds | [●] Equity Shares |

| B) Non-Institutional Portion | Not less than [●] Equity Shares |

| C) Retail Portion | Not less than [●] Equity Shares |

Objects of Sandhya Marines IPO issue

The main objects and the objects ancillary to the main objects of our MoA enables our Company

(i) to undertake our existing business activities;

(ii) to undertake activities for which funds are being raised by us through the

Offer; and

(iii) activities undertaken for which loans were raised and which are proposed to be prepaid from the

Net Proceeds

Sandhya Marines IPO : Basis of Offer Price

The equity share face value is Rs 10 and the offer price is yet to be determined by the company in consultation with BRLM. Below are the various factors both qualitative and quantitative, that will determine the offer price:

Qualitative Factors:

- Established Reputation as a Supplier of Quality Seafood Products;

- Global Revenue Base with a Growing Presence in the US Market;

- Experienced Promoters and Management Team;

- Strategically Located Processing Facilities with Modern Equipment

- Strong Procurement Network; and

- Track Record of Robust Financial Performance and Profitability.

Quantitative Factors:

- Earnings Per Share (“EPS”) (as adjusted for changes in capital, if any)

- Price / Earning (P/E) Ratio in relation to Offer Price of Rs [●] per Equity Share

- Minimum return on increased net worth after the Offer required for maintaining pre-offer EPS at

March 31, 2017 - NET ASSET VALUE (“NAV”) PER EQUITY SHARE

- PEER GROUP COMPARISON

- AVERAGE RETURN ON NET WORTH (“RoNW”)

Return on net worth (%) = Profit after tax as restated * 100 / Net worth at the end of the year / period i.e., Ma

31 of the respective years.

Net Worth = Equity Share Capital + Securities Premium Account + General Reserve + Surplus / (Deficit) in

statement of profit and loss + Other Reserves created out of profits but does not include revaluation reserve.

IPO Lead Managers

| Karvy Investor Services Ltd |

| SBI Capital Markets Ltd |

IPO Registrar of the Offer

| Registrar |

| Karvy Computershare Pvt Ltd |

Sandhya Marines IPO Review by Top 10 Stock Brokers

Here is what stock brokers & their research analyst has to say about the IPO:

| Top Stock Brokers Review | Company Repu-tation | Compe-titive Edge | Finan-cial State-ment | Popu-larity Index | Promo-ters Repu-tation |

| Angel Broking | 6.0/10 | 6.5/10 | 6.0/10 | 6.3/10 | 6.5/10 |

| Sharekhan | 6.1/10 | 6.6/10 | 6.8/10 | 6.5/10 | 6.7/10 |

| Kotak Securities | 6.3/10 | 6.5/10 | 6.9/10 | 6.5/10 | 6.6/10 |

| ICICI Direct | 6.3/10 | 6.3/10 | 6.2/10 | 6.4/10 | 6.4/10 |

| IIFL | 6.5/10 | 6.5/10 | 6.2/10 | 6.0/10 | 6.5/10 |

| Edelweiss | 6.5/10 | 6.5/10 | 6.1/10 | 6.3/10 | 6.6/10 |

| Zerodha | 6.4/10 | 6.4/10 | 6.0/10 | 6.1/10 | 6.5/10 |

| 5Paisa | 6.1/10 | 6.6/10 | 6.8/10 | 6.5/10 | 6.3/10 |

| Karvy | 6.4/10 | 6.3/10 | 6.7/10 | 6.6/10 | 6.5/10 |

| Motilal Oswal | 6.1/10 | 6.5/10 | 6.9/10 | 6.3/10 | 6.4/10 |

Sandhya Marines IPO Grey Market Premium

The Grey Market Premium of Sandhya Marines IPO has not been released yet. It will release 2 weeks before the IPO issue date.

Open Free* Demat A/C Now! Fill the details below

Sandhya Marines IPO News

News 1 – Public Issues : Sandhya Marines Limited Draft Offer Documents filed with SEBI

Market Guide

Featured Topics