Rex Industries IPO – Review, Allotment Status, Subscription, Price, Date & more

Last Updated Date: Aug 31, 2023Rex Pipes and Cables Industries is to issue upto 24,00,000 Equity Shares through its IPO, having face value of Rs. 10.00 each. Let’s have a detailed review of the company and analytics of the Rex Industries IPO release date, IPO offer price, subscription, Rex Industries IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

Rex Industries IPO Review & Ratings

| Rex Industries IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.2/10 |

| Industry Ranking | 6.1/10 |

| Company Background | 6.1/10 |

| Company Reputation | 6.0/10 |

| Competitive Edge | 6.o/10 |

| Financial Statements | 6.2/10 |

| Popularity Index | 6.0/10 |

| Promoters Reputation | 6.0/10 |

| Retail Appetite | 6.2/10 |

| Top Brokers Review | 6.1/10 |

| Overall Ratings | 6.1/10 |

| Star Ratings | ★★★☆☆ |

Summary of Rex Pipes and Cables Industries IPO

Company is engaged in the Trading and production/Manufacturing product range encompassing uPVC pipes, HDPE pipe, Cables, fittings and abundance of accessories. The company produces excellent Three Core flat cables , Single Core Flexible Home wire , Poly Wrapped Winding wire along with UPVC, HDPE, etc. Total Issue of upto 24,00,000 Equity Shares having face value of Rs. 10.00 each. The brief comparison of financial differences each year are as follows:

Company is engaged in the Trading and production/Manufacturing product range encompassing uPVC pipes, HDPE pipe, Cables, fittings and abundance of accessories. The company produces excellent Three Core flat cables , Single Core Flexible Home wire , Poly Wrapped Winding wire along with UPVC, HDPE, etc. Total Issue of upto 24,00,000 Equity Shares having face value of Rs. 10.00 each. The brief comparison of financial differences each year are as follows:

- Depreciation expenses for the Financial Year 2016-2017 have decreased to Rs. 57.66 lacs as compared to Rs. 68.85 lacs for the Financial Year 2015-2016. The decrease in depreciation was majorly due to decrease in value of tangible assets.

- Finance Charges which consists of interest, processing fees and charges decreased by 26.67% in FY 2016-17 as compared to FY 2015-16 due to decrease in interest expenses and Bank charges.

- Profit before tax increased by 40.32% from Rs. 60.77 lacs in financial year 2015-16 to Rs. 85.27 lacs in financial year 2016-17.

- The profit after tax increased by 40.94% from Rs. 39.37 lacs in financial year 2015-16 to Rs. 55.49 lacs in financial year 2016-17. This increment was in line with increase in operational income.

The Promoters of this company are MR. SHARWAN KUMAR KALER AND MRS. SOHANI DEV. The lead manager to the issue is NAVIGANT CORPORATE ADVISORS LIMITED and the Registrar to this issue is KARVY COMPUTERSHARE PRIVATE LIMITED.

Subscribe to Rex Industries IPO

Rex Industries IPO Date

The opening and the closing date of IPO of Rex Pipes and Cables Industries is not known yet.

Rex Industries IPO Subscription

| Subscription | |

| Day 1 | X |

| Day 2 | X |

| Day 3 | X |

| Day 4 | X |

| Day 5 | X |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

Rex Industries IPO Allotment Status

Karvy Computershare Pvt Ltd – Rex Industries Allotment

Rex Industries IPO Price Band

The face value of each share is Rs 10, but the price band of the IPO is not yet disclosed.

Rex Industries IPO Equity Share Offering

24,00,000 Equity Shares of Rs 10/- each but Issue Price is yet to be disclosed so it will be aggregated to Rs (24,00,000* Issue Price).

Rex Pipes and Cables Industries Limited – Company Overview

Company is engaged in the Trading and production/Manufacturing product range encompassing uPVC pipes,

HDPE pipe, Cables, fittings and abundance of accessories under the brand name “REX”. The brand “REX” is the

hall mark showcasing the entire Product range. It has just taken a little over two decades for The Rex group of

Industries to emerge as one of India’s leading manufacturers in the field of PVC Pipes & Fittings and PVC

insulated electrical wires.

The company produces excellent Three Core flat cables , Single Core Flexible Home wire , Poly Wrapped Winding wire along with UPVC, HDPE and sprinklers with unique skills, continuous technological upgrading machines, professional management testing and persistent dedication without compromising on quality leading the entire organization to National and International name and reputation.

Rex Pipes And Cables Industries Limited has emerged into a national entity as a complete innovation for its own

type of manufactured products. We offer a wide range of PVC pipes, HDPE pipe, Cables classified in a

systematic manner to ensure easy and accurate selection, with the simultaneous advantage of providing the

most cost-effective solutions for customers. We have established itself as an innovative leader and quality

manufacturer by continuously upgrading its technology, modernizing manufacturing facilities and maintaining

highest standards of quality and services.

Competitive Strengths of Rex Pipes and Cables Industries Limited:

- Diversified Product Portfolio

- Strategically located manufacturing facilities with a core focus on quality

- Experienced Promoters and a well trained employee base

- Customer Satisfaction.

- Quality Assurance

- Strong brands in the pipes and fittings segment with over 15 years’ experience

- Improving functional efficiency

Business strategies of Rex Pipes and Cables Industries Limited:

- Technology and Operational Excellence.

- Develop and maintain relationships with the Clients.

- Enhancing Operating Effectiveness and Efficiency.

- Attract and retain talented employee.

- Strong Business Development and Sales team.

Rex Pipes and Cables Industries Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | |||||

| 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | 31-Mar-13 | |

| Total Assets | 1204.12 | 1612.88 | 1273.37 | 931.28 | 325.73 |

| Total Revenue | 1,734.41 | 2376.67 | 1952.71 | 2357.17 | 1457.46 |

| Total Expense | 1,532.37 | 2,222.92 | 1,755.71 | 1958.56 | 1,226.69 |

| Profit After Tax | 142.99 | 102.02 | 132.85 | 266.47 | 155.00 |

Earnings per Equity Share (in Lakhs)

| 31-Dec-17 | 31-Mar-17 | 31-Mar-16 | |

| Basic | 4.75 | 3.39 | 4.75 |

| Diluted | 5.62 | 4.30 | (1.13) |

From the above statements, one could find that the Rex Pipes and Cables Industries Limited may perform well.

Rex Industries IPO – Promoters

The Promoter of this company are:

| Promoter |

| Mr. Sharwan Kumar Kaler |

| Mrs. Sohani Devi |

| Promoter Group |

| Mr. Bajrang Lal Kaler |

| M/s Sharwan Kumar Kaler HUF |

| Mr. Raghunath Singh Kaler |

| Mrs. Dhanni Devi Kaler |

| Mrs. Kohil Devi |

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

Rex Industries IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | Issue of upto 24,00,000 Equity Shares having face value of Rs. 10.00 each |

| Of which: | |

| Reserved for Market Makers | Upto 1,20,000 Equity Shares of face value of Rs. 10 each |

| Net Issue to the Public | Upto 22,80,000 Equity Shares of face value of Rs.10 each |

| Of which: | |

| Retail Investors Portion | Not less than 11,40,000 Equity Shares of face value of Rs.10 each (available for allocation to investors up to Rs. 2.00 Lacs) |

| Non-Retail Investors Portion | Not less than 11,40,000 Equity Shares of face value of Rs.10 each (available for allocation to investors up to Rs. 2.00 Lacs) |

| Equity Shares outstanding prior to the Issue | 62,00,000 Equity Shares of face value of Rs.10 each |

| Equity Shares outstanding after the Issue | Upto 86,00,000 Equity Shares of face value of Rs. 10 each |

Rex Industries IPO Issue Object

These are the IPO Issue Objects of the company

- To finance the Expenditure towards Land & Site Development and Other Civil Work;

- To Acquire the Plant & Mechinery;

- To part finance the requirement of Working Capital;

- To meet General corporate purposes;

- To meet the expenses of the Issue.

List of Upcoming IPOs in 2018

| Pommys Garments IPO | Indo US Biotech IPO | Medibios Laboratories IPO | Shree Vasu Logistics IPO |

| R R Industrial IPO | Sorich Foils IPO | 20 Microns IPO |

Rex Industries IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Diversified Product Portfolio

- Strategically located manufacturing facilities with a core focus on quality

- Experienced Promoters and a well trained employee base

- Quality Assurance

- Strong brands in the pipes and fittings segment with over 15 years’ experience

- Improving functional efficiency

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW (%) | NAV (Rs.) | |

| 31-Mar-17 | 0.70 | 6.99 | 11.35 |

| 31-Nov-17 | 0.64 | 6.08 | 12.65 |

| 31-Mar-18 | 0.90 | 7.89 | NA |

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | 36.30 |

| Highest | 257.90 |

| Lowest | 3.80 |

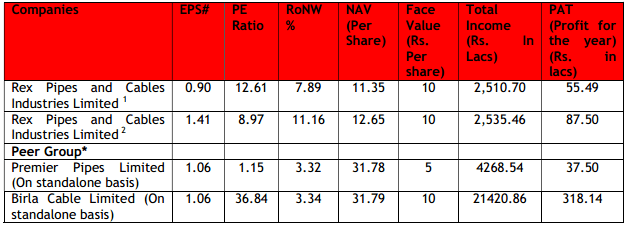

- Competitive Peers

List of Latest IPOs of 2018

| Fine Organic IPO | IndoStar Capital IPO | Capricorn Food Products IPO | Flemingo Travel Retail IPO |

| Nazara Technologies IPO | Genius Consultants IPO | Rail Vikas Nigam IPO | Verroc Engineering IPO |

Rex Industries IPO Lead Managers

| Lead Managers |

| NAVIGANT CORPORATE ADVISORS LIMITED 423, A Wing, Bonanza, Sahar Plaza Complex, J B Nagar, AndheriKurla Road, Andheri East, Mumbai-400 059 Tel No. +91-22-41204837/49735078 Email Id- navigant@navigantcorp.com Investor Grievance Email: info@navigantcorp.com Website: www.navigantcorp.com SEBI Registration Number: INM000012243 Contact Person: Mr. Sarthak Vijlani |

Rex Industries IPO Registrar to offer

| Registrar to the Offer |

| KARVY COMPUTERSHARE PRIVATE LIMITED Karvy Selenium Tower B, Plot 31-32, Gachibowli, Financial District, Nanakramguda, Hyderabad 500 032 Tel : +91 40 6716 2222, Fax : + 91 40 2343 1551 Website: https://karisma.karvy.com, E-mail: einward.ris@karvy.com Investor Grievance E-mail: rexpipes.ipo@karvy.com Contact Person : Mr. M Murali Krishna SEBI Registration : INR000000221 |

Other Details:

- Statutory Auditor – NA

- Peer Review Auditor – NA

- Bankers to the Company – NA

Rex Industries IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

Rex Industries IPO Grey Market Premium

The Rex Industries IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Subscribe to Rex Industries IPO

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics