IndoStar Capital IPO – Review, Allotment Status, Subscription, Price, Date & more

Last Updated Date: Aug 30, 2023The IPO issue Bid/Offer date is from 9th May 2018 – 11th May 2018. The Issue size of this IPO is Rs 1,844 Crore & the equity shares offered is 32,237,762 and the offer includes fresh issue of 12,237,762 and offer for sale of 20,000,000 at the price band of Rs.570 to Rs.572 per share. In this article, we will have a detailed IndoStar Capital IPO Review along with deep analysis of their IPO object, Allotment Status, Issue Details, Company background, Company Financials, IPO release date, IPO price band Grey market & more.

- Issue Price of this IPO is Rs — . Check the Live Share Price here Indostar Capital Share Price

- To track the performance of this IPO, click on this link – IPO Performance

IndoStar Capital IPO Review & Ratings

| IndoStar Capital IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 8.3/10 |

| Industry Ranking | 8.2/10 |

| Company Background | 8.7/10 |

| Company Reputation | 8.3/10 |

| Competitive Edge | 8.4/10 |

| Financial Statements | 8.8/10 |

| Popularity Index | 8.3/10 |

| Promoters Reputation | 8.2/10 |

| Retail Appetite | 8.4/10 |

| Top Brokers Review | 8.3/10 |

| Overall Ratings | 8.4/10 |

| Star Ratings | ★★★★☆ |

Summary of Indostar Capital IPO

The Indostar Capital Finance Limited is a Non-Banking Financial Institution that has filed its draft papers with SEBI to raise an amount of Rs 2000 crore as an initial share sale.The allocated percentage for NII category is around 15%; the allocated QIBs is around 50% of the share and 35% is for retail. The issue type is Book Built Issue IPO. The listing is at both NSE and BSE. The market lot and the minimum order quantity is 26 shares.

The Indostar Capital Finance Limited is a Non-Banking Financial Institution that has filed its draft papers with SEBI to raise an amount of Rs 2000 crore as an initial share sale.The allocated percentage for NII category is around 15%; the allocated QIBs is around 50% of the share and 35% is for retail. The issue type is Book Built Issue IPO. The listing is at both NSE and BSE. The market lot and the minimum order quantity is 26 shares.

The Securities and Exchange Board of India(SEBI) has mentioned that there are new shares about to be sold for an amount of Rs 700 crores and the already existing shareholders can avail up to Rs 2 Crore scrips.

The share is being raised in order to build up the capital base of the company to strengthen its future investments. Many merchant banking sources suggest that the IPO would definitely fetch Rs 2000 crores.

The company was capitalized in the year 2011. It has also expanded its operation to provide housing and vehicle loans. The credit company focused on corporate and SMEs’ earlier.

The ratio of share holding patterns between the promoters and the public shareholding is around 91.55% and 8.45% stake, at present.

Important Possible Dates:

Basis of Allotment Finalization is possibly be on 16th May 2018.

Refunds initiation would on or around 17th May 2018.

The credit of Equity Shares to Demat accounts is possible on or around 18th May 2018.

The initiation of of trading of the Equity Shares on the Stock Exchanges is 21st May 2018.

The IPO issued by the company will be managed by

- JM Financial

- Kotak Mahindra Capital Company

- Morgan Stanley India Company

- Motilal Oswal Investment Advisors

- Nomura Financial Advisory and Securities (India) Pvt Ltd

The idea of buying an IPO from Indostar is definitely a great idea.

Open Free* Demat A/C Now! Fill the details below

IndoStar Capital IPO Date

The IPO issue date is from 9th May 2018 – 11th May 2018.

IndoStar Capital Finance Limited IPO Subscription

| Subscription | |

| Day 1 – 09th May ’18 | 41% (91,83,954 shares) |

| Day 2 – 10th May ’18 | 69% (1,55,94,982 shares) |

| Day 3 | X |

| Day 4 | X |

| Day 5 | X |

IndoStar Capital IPO Allotment Status

Since the issue date has not been fixed yet, the Allotment Status is not out. The Allotment status will be announced about 3-4 weeks of the IPO issue date.

IndoStar Capital Finance Limited IPO Price Band

The price band of the IPO is Rs.570 to Rs.572 per share

The face value of each equity share is Rs 10 each and the Offer Price would be 57 times the Face Value at the lower end of the Price Band and 57.2 times the Face Value at the higher end of the Price Band.

Indostar Capital Finance Limited IPO issue size

The IndoStar IPO issue size is Rs.1844 crores. This is big IPO to look out for.

IndoStar Capital Finance Limited IPO Equity Shares Offerings

The equity shares up for sale is 3,23,50,877.

Open Free Demat Account Now!

IndoStar Capital Finance Limited – Company Overview

IndoStar Capital Finance Limited is a Non-Banking Financial Institution company that is based out of Chennai. The group had humble beginnings. It started with providing financial support to the corporate companies as well as the Small and Medium Scale Enterprises(SME).

The company is registered as a non-deposit credit providing company under the Reserve Bank of India. The company has now expanded its services into housing loan sanctioning and vehicle loan sanctioning.

Key Members of the Company

- Dhanpal Jhaveri (Chairman & Non-Executive Director)

- Sameer Sain (Non-Executive Director)

- Alok Oberoi (Non-Executive Director)

- R Sridhar (CEO & Executive Vice-Chairman)

Some of IndoStar Capital’s Principal line of Business are:

Corporate Lending:

Their Corporate lending business primarily consists of (i) lending to mid-to-large sized corporates in manufacturing, services and infrastructure industries (ii) lending to real estate developers.

SME Lending:

SME lending business, which they commenced in 2015, primarily involves extending secured loans for business purposes to small and medium size enterprises, including businessmen, traders, manufacturers and self-employed professionals.

Vehicle Finance:

The Vehicle finance business primarily involves providing financing for purchases of used or new commercial vehicles, passenger vehicles and two-wheelers.

Housing Finance:

The Housing finance business comprises two business lines, namely (i) affordable housing finance, which commenced operations in September 2017, and (ii) retail housing finance, which is expected to commence operations by March 2018.

IndoStar Capital Finance Limited – Financial Statement

Have a look at the Financial Stability of the company before you invest in it.

The Asset of the Company

| Assets (in INR & Millions) | |||||

| Mar’17 | Mar’16 | Mar’15 | Mar’14 | Mar’13 | |

| Non-Current Asset | 40,213 | 31,133 | 25,031 | 22,173 | 13,739 |

| Current Asset | 14,675 | 15,800 | 14,885 | 9,435 | 8,332 |

| Total Asset | 54,888 | 46,933 | 39,916 | 31,608 | 22,071 |

Revenue and PAT of the Company

| Revenue & Profits (in INR & Millions) | |||||

| Mar’17 | Mar’16 | Mar’15 | Mar’14 | Mar’13 | |

| Total Revenue | 7199 | 6441 | 5281 | 3969 | 2416 |

| Profit after Tax (PAT) | 2108 | 1916 | 1490 | 1121 | 901 |

Earnings per Equity Share

| Earning per Equity Share (in INR) | |||||

| Mar’17 | Mar’16 | Mar’15 | Mar’14 | Mar’13 | |

| Basic | 14.05 | 28.69 | 26.75 | 21.72 | 16.34 |

| Diluted | 12.67 | 26.31 | 26.41 | 21.43 | 16.27 |

The Non-Banking Financial Institution has grown tremendously in the past few years and it is evident from the above data.

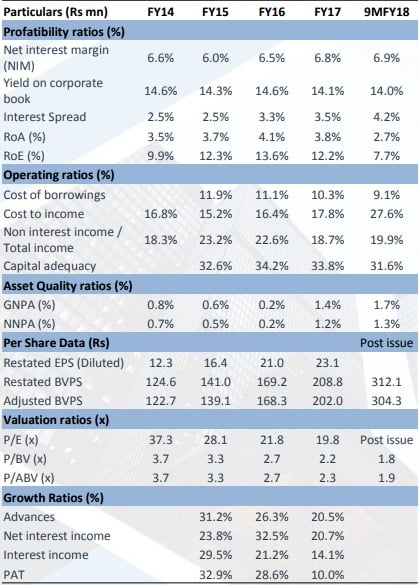

IndoStar Financial Ratio:

IndoStar Capital Finance Limited Promoters

The Promoter of the Company is Indostar Capital. Apart from the Promoter, the entities comprising the Promoter Group are as follows

- Indostar Everstone

- Everstone Capital Partners II LLC

- ACP LIBRA Limited; and

- Beacon India Private Equity Fund

The promoter has confirmed that it has not been identified as a willful defaulter as defined under the SEBI ICDR Regulations. The Promoter is not related to any of the sundry debtors of the Company.

Interest of Promoters

Interest of Promoters in the promotion of the company and property of the company

The promoter of the company is Indostar Everstone. The company has only the right to interfere in the matters of the organization. The other companies are not directly involved.

The Company and the Promoter Selling Shareholder may, in consultation with the BRLMs, allocate up to 60% of the QIB Portion to Anchor Investors on a discretionary basis, in accordance with the SEBI ICDR Regulations.

Anchor Investors shall Bid on the Anchor Investor Bidding Date. The Company and the Promoter Selling Shareholder, in consultation with the BRLMs, reserve the right to revise the Price Band during the Bid/Offer Period in accordance with the SEBI ICDR Regulations.

IndoStar Capital IPO Offer Details or Issue Details

| Offer | Up to 3,23,50,877 Equity Shares aggregating up to Rs.184.4 million |

| Of which: | |

| Fresh Issue | Up to [●] Equity Shares aggregating up to INR 7,000 million |

| Offer for Sale | Up to 20,000,000 Equity Shares aggregating up to ` [●] million |

| By Promoter Selling Shareholder | Up to 18,508,407 Equity Shares aggregating up to ` [●] million |

| By Other Selling Shareholders | Up to 1,491,593 Equity Shares aggregating up to ` [●] million |

| The Offer consists of: | |

| A. QIB Portion | [●] Equity Shares |

| Of which: | |

| Anchor Investor Portion* | Up to [●] Equity Shares |

| Net QIB Portion (assuming Anchor Investor Portion is fully subscribed) | [●] Equity Shares |

| Of which: | |

| Mutual Fund Portion [●] Equity Shares Balance for all QIBs including Mutual Funds | [●] Equity Shares |

| B. Non-Institutional Portion | Not less than [●] Equity Shares |

| C. Retail Portion | Not less than [●] Equity Shares |

| Pre and post-Offer Equity Shares | |

| Equity Shares outstanding prior to the Offer | 78,679,259 Equity Shares |

| Equity Shares outstanding after the Offer | [●] Equity Shares |

The Equity Shares offered by finance company as talked about in the news & provided in the draft is 2 crore equity shares & they intend to raise Rs.2000 crore from the stock market.

IndoStar Capital Finance IPO Issue Object

Following are the Objects of the Indostar Capital IPO issue:

- Company proposes to utilize the Net Proceeds from the Fresh Issue towards augmenting its capital base to meet future capital requirements.

- Company expects to receive the benefits of listing of the Equity Shares on the Stock Exchanges.

- Enhancement of our Company‘s brand name and creation of a public market for their Equity Shares in India.

- Undertake its existing activities and the activities for which funds are being raised through the Fresh Issue.

IndoStar Capital Finance Limited IPO – Basis of Offer Price

The Offer Price will be determined by the Company, in consultation with the BRLMs, on the basis of assessment of market demand for the Equity Shares offered through the Book Building Process and on the basis of quantitative and qualitative factors as described below

Qualitative Factors

It is believed that the following are competitive strengths of the company

- Highly motivated, professional and experienced management team

- Well-established corporate and strong SME lending businesses

- High asset quality achieved through robust credit assessment and risk management framework

- Proven track record of delivering results

- Well diversified funding profile

- Ownership by institutional investors ensuring international corporate governance standards

Quantitative factors

Some of the information presented in this section relating to the Company is derived from the Restated Financial Statements prepared in accordance with the Indian GAAP and the Companies Act and restated as per the SEBI ICDR Regulations. Some of the quantitative factors, which form the basis for computing the Offer Price, are as follows:

- Basic Earnings per Share excluding exceptional items (Basic EPS) & Diluted Earnings Per Share excluding exceptional items (Diluted EPS) is Rs 26.31

- Price Earning (P/E) Ratio in relation to the Price Band of 21.66 – 21.74 per Equity Share of 10 each

- Price/Book (P/B) Ratio

- Return on Net worth (RoNW) is 11.08%

- Minimum Return on Net Worth after Offer to maintain Pre-Offer EPS

- Net Asset Value per Equity Share is Rs 263.96 per share

- Comparison of Accounting Ratios with Listed Industry Peers

Indostar Capital IPO Lead Managers

| Lead Managers |

| JM Financial Limited |

| Kotak Mahindra Capital Company Limited |

| Morgan Stanley India Company Private Limited |

| Motilal Oswal Investment Advisors Limited |

| Nomura Financial Advisory and Securities (India) Private Limited |

Indostar Capital Finance Limited IPO Registrar to the Offer

| Registrar of the Offer |

| Link Intime India Private Limited |

IndoStar Capital IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 8.5/10 | 8.4/10 | 8.5/10 | 8.1/10 | 8.1/10 |

| Sharekhan | 8.2/10 | 8.1/10 | 8.6/10 | 8.1/10 | 8.2/10 |

| Kotak Securities | 8.3/10 | 8.5/10 | 8.4/10 | 8.1/10 | 8.3/10 |

| ICICI Direct | 8.3/10 | 8.3/10 | 8.7/10 | 8.1/10 | 8.1/10 |

| IIFL | 8.5/10 | 8.2/10 | 8.8/10 | 8.0/10 | 8.1/10 |

| Edelweiss | 8.5/10 | 8.4/10 | 8.4/10 | 8.3/10 | 8.2/10 |

| Zerodha | 8.4/10 | 8.1/10 | 8.5/10 | 8.1/10 | 8.0/10 |

| 5Paisa | 8.1/10 | 8.1/10 | 8.4/10 | 8.1/10 | 8.1/10 |

| Karvy | 8.4/10 | 8.3/10 | 8.2/10 | 8.1/10 | 8.1/10 |

| Motilal Oswal | 8.1/10 | 8.1/10 | 8.6/10 | 8.3/10 | 8.2/10 |

Indostar Capital Finance Limited IPO Grey Market Premium

The Indostar Capital Finance Limited IPO Grey Market Premium will be announced two weeks before the price of the issue is announced.

Open Free* Demat A/C Now! Fill the details below

IndoStar Capital IPO News

New 1 – IndoStar Capital files Rs 2,000-cr IPO papers with SEBI

Market Guide

Featured Topics