Mindspace REIT IPO Review, Dates, Allotment, Size, Subscription, GMP & RHP

Last Updated Date: Aug 31, 2023Let’s have a detailed review of the company and analytics of the Mindspace REIT IPO release date, IPO offer price, subscription, Mindspace Business Parks REIT IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

Mindspace Business Park IPO has started with issue size of Rs.4,500 Cr. & the price range will be around Rs.274 – Rs.275.

Mindspace REIT IPO Live Performance

The listing date of this IPO is August 8th 2020. You can check the live performance of this IPO here.

Mindspace REIT IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 8.1/10 |

| Industry Ranking | 7.2/10 |

| Company Background | 8.2/10 |

| Company Reputation | 7.8/10 |

| Competitive Edge | 7.2/10 |

| Financial Statements | 8.2/10 |

| Popularity Index | 7.9/10 |

| Promoters Reputation | 7.8/10 |

| Retail Appetite | 7.3/10 |

| Top Brokers Review | 7.7/10 |

| Overall Ratings | 7.5/10 |

| Star Ratings | ★★★★☆ |

Summary of Mindspace REIT IPO

They own a quality office portfolio located in four key office markets of India. Their Portfolio has Total Leasable Area of 29.5 msf and is one of the largest Grade-A office portfolios in India.

This Company’s Portfolio comprises 19.8 msf of Completed Area, 6.1 msf of Under Construction Area and 3.6 msf of Future Development Area.

Their Portfolio has five integrated business parks with superior infrastructure and amenities (such as restaurants, crèches and outdoor sports arenas) and five quality independent offices.

This company’s assets provide a community-based ecosystem and they believe that they have been developed to meet the evolving standards of tenants and the demands of “new age businesses”, which makes them among the preferred options for both multinational and domestic corporations.

From FY 2016-17 to FY 2018-2019, as per the Restated Financial Statements

- They derive their revenue from the leasing of office space and incidental activities. Their facility rental income amounted to 76.7%, 77.3%, 76.2% and 75.9% of their revenue from operations for the three months ended June 30, 2019 and the financial years 2019, 2018 and 2017, respectively.

- Their revenue from operations increased by 5.6% to Rs. 12,631 million for the financial year 2018 from Rs. 11,959 million for the financial year 2017.

The Sponsors of this company are Axis Trustee Services Limited, Cape Trading LLP and Anbee Constructions LLP.

The Registrar to this issue is KFin Technologies Private Limited.

Mindspace REIT IPO Dates

The opening and the closing date of Mindspace Business Parks REIT IPO is provided here.

| IPO Opening Date | 27 July 2020 |

| IPO Closing Date | 29 July 2020 |

| Finalisation of Basis of Allotment | 6 August 2020 |

| Designated Date | 7 August 2020 |

| Closing Date | 7 August 2020 |

| Initiation of refunds | 7 August 2020 |

| Listing Date | 12 August 2020 |

| Opening Price on NSE | To be updated |

| Closing Price on NSE | To be updated |

Mindspace REIT IPO Subscription

| Day / Date | QIB | NII | Total Subscription |

| 1st Day – 27 July | 0.37x | 0.17x | 0.22x |

| 2nd Day -28 July | 0.83x | 1.65x | 1.23x |

| 3rd Day -29 July | 10.62x | 15.51x | 12.96x |

| Shares Offered or Net Issue | 3,69,52,600 | 3,07,93,800 | 6,77,46,400 |

The shares subscribed by the public will be updated here.

Mindspace Business Parks REIT IPO Allotment Status

Here, you can find the Allotment Status of this IPO. Allotment of Equity Shares pursuant to the Fresh Issue and transfer of the Offered Shares of the Promoter Selling Shareholders pursuant to the Offer for Sale to the successful Bidders. However, the Allotment status is not yet disclosed.

| Basis of Allotment Finalization | Aug 6, 2020 |

| Refunds Initiation | Aug 7, 2020 |

| Credit of Shares to Demat Account | Aug 7, 2020 |

| Share Listing Date | Aug 12, 2020 |

Mindspace REIT IPO Price Band / Cash Price

The face value of each share is Rs.0 and the cash price of the IPO is Rs. 274 to Rs. 275

Mindspace Business Parks REIT IPO Size

This Initial Public Issue of [●] Equity Shares of Rs.0, each for cash at a price of Rs. 274 to Rs. 275 per equity share aggregating to Rs.[●] Million.

Mindspace Business Parks REIT IPO Share Offering

Fresh Issue: The Fresh Issue of [●] Equity Shares by their Company at a price of Rs. 274 to Rs. 275 per equity share aggregating to Rs.10,000 million,

Mindspace Business Parks REIT Ltd – Company Overview

Mindspace REIT was settled on November 18, 2019 at Mumbai, Maharashtra, India as a contributory determinate irrevocable trust under the provisions of the Indian Trusts Act, 1882, pursuant to a trust deed dated November 18, 2019.

They believe that the scale and quality of their Portfolio has given them a market leading position and replicating a similar portfolio of large-scale, integrated business parks by other players may be challenging due to long development timelines and a lack of similar sized aggregated land parcels in comparable locations.

This company is committed to tenant service and to developing long-standing relationships with their occupiers.

They have also implemented various sustainability initiatives across their Portfolio, with a focus on clean energy and recycling that enable their tenants to enjoy an efficient working environment.

Mindspace Business Parks REIT Portfolio

Their Portfolio is located in four key office markets of India, namely, Mumbai Region, Hyderabad, Pune and Chennai (“Portfolio Markets”), which accounted for approximately 62.3% of total Grade-A net absorption in the top six markets in India, namely, Chennai, Mumbai Region, Pune, Hyderabad, Bengaluru and the National Capital Region (“Top Six Indian Markets”)

Mindspace Business Parks REIT Growth Prospects

They believe their Portfolio is well positioned to achieve further organic growth through a combination of lease-up of vacant space, contractual rent escalations, re-leasing at market rents (the market rents of their Portfolio is estimated to be approximately 26.7% above In-place Rents, as of June 30, 2019), and new construction within their Portfolio to accommodate tenant demand.

Their Portfolio’s NOI is projected to grow by 64.1% over the Projections Period, primarily due to these factors.

Mindspace Business Parks REIT Approach

Their Portfolio is stabilized with 97.2% Committed Occupancy and a WALE of 5.8 years, as of June 30, 2019, which provides long-term visibility to their revenues.

Their focus on offering a comprehensive ecosystem through optimal density and well-amenitized parks to tenants that provide high value added services has enabled their assets to outperform in their respective micro-markets.

For example, at their Mindspace Airoli East and Mindspace Airoli West properties, they have achieved power cost savings for their tenants through in-house distribution of power.

Their Committed Occupancy is 820 bps higher than average 106 occupancy in their Portfolio Markets, as of June 30, 2019, while rental growth has been 247 bps higher for the last three fiscal years and three months ended June 30, 2019.

Mindspace Business Parks REIT Ltd – Financial Statements

On the basis of Standalone statement:

| Amount (in INR & Million) | ||||

| 31-Mar-20 | 31-Mar-19 | Mar-18 | 31-Mar-17 | |

| Total Assets | 1,12,224 | 91,437 | 84,738 | 81,293 |

| Total Income | 20,262 | 16,797 | 15,022 | 14,354 |

| Total Expense | 6,544 | 4,183 | 4,773 | 3,826 |

| Profit After Tax | 5,139 | 5,154 | 1,610 | 2,313 |

Mindspace Business Parks REIT: Business strategies

- Enhance the value of their Portfolio through proactive property management, asset improvements and tenant engagement;

- Increase NOI through their Portfolio’s embedded organic growth and through on-campus development

- Achieve growth through value accretive acquisitions.

Mindspace Business Parks REIT IPO – Promoters

The Sponsors of this company are:

- Axis Trustee Services Limited

- Cape Trading LLP

- Anbee Constructions LLP

List of Related Parties (Key Managerial Personnel)

- Ms. Preeti Chheda, Chief Financial Officer and Company Secretary

- Mr. Vinod Rohira, chief executive officer

Intellectual Property of their Company

The trademark ‘Mindspace Business Parks REIT’ and ‘Mindspace REIT’ and the associated name and logo have been licensed to Mindspace REIT, the Manager and the Asset SPVs, on an exclusive, non-transferrable and non-sub-licensable basis, by the Sponsors.

Mindspace Business Parks REIT IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | Up to [●] Equity Shares, aggregating up to Rs.[●] Million |

| Comprising: | |

| Fresh Issue | [●] Equity Shares, aggregating up to Rs.10,000 Million |

| Offer for Sale | Up to [●] Equity Shares, aggregating up to Rs.[●] Million |

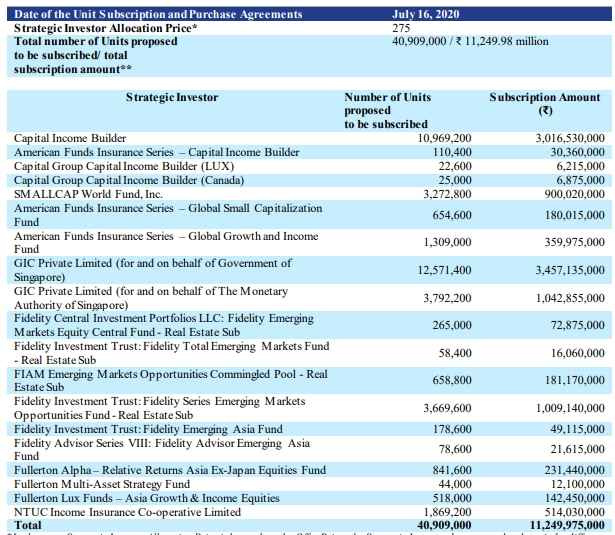

| Strategic Investor Portion | Up to [●] Units aggregating up to Rs.[●] million |

| Offer (excluding Strategic Investor Portion) | Up to [●] Units aggregating up to Rs.[●] million |

| Of Which: | |

| Institutional Investor Portion | Not more than [●] Units |

| Non-Institutional Investor Portion | Not more than [●] Units |

| Equity Shares outstanding prior to the Issue | [●] |

| Equity Shares outstanding after the Issue | [●] |

Mindspace Business Parks REIT IPO Issue Object

These are the IPO Issue Objects of the company:

- Partial or full pre-payment or scheduled repayment of certain debt facilities of the Asset SPVs availed from banks/financial institutions (including any accrued interest and any applicable penalties/ premium);

- Purchase of NCRPS of MBPPL; and

- General purposes.

Mindspace Business Parks REIT: Competitive Strengths

- Portfolio with significant scale;

- Diversified and quality tenant base with long-standing relationships;

- Stable cash flows and strong growth potential;

- Strong industry fundamentals;

- Presence in four key office markets of India; and

- Experienced management team backed by the KRC group.

Mindspace Business Parks REIT IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of:

Qualitative factors

- Portfolio with significant scale;

- Diversified and quality tenant base with long-standing relationships;

- Stable cash flows and strong growth potential;

- Strong industry fundamentals;

- Presence in four key office markets of India; and

- Experienced management team backed by the KRC group.

Mindspace Business Parks REIT: Competitive Peers

| Premium / (Discount to NAV) % | NAV per share (Rs.) | |

| Mindspace Business Parks REIT | – | – |

| Listed Peers | ||

| Embassy Office Parks REIT | 23% | 362 |

Mindspace Business Parks REIT IPO Lead Managers

| Lead Managers |

| Morgan Stanley India Company Private Limited,

Axis Capital Limited, DSP Merrill Lynch Limited, Citigroup Global Markets India Private Limited, JM Financial Limited, Kotak Mahindra Capital Company Limited, CLSA India Private Limited, Nomura Financial Advisory and Securities, UBS Securities India Private Limited, Ambit Capital Private Limited, HDFC Bank Limited, IDFC Securities Limited, ICICI Securities Limited |

Mindspace Business Parks REIT IPO Registrar to Offer

| Registrar to the Offer |

| KFin Technologies Private Limited Selenium Tower B Plot 31 & 32, Gachibowli Financial District, Nanakramguda, Serilingampally, Hyderabad 500 032 Tel: +91 40 6716 2222, Fax: +91 40 2343 1551 E-mail: kraheja.reit@kfintech.com Investor grievance e-mail: einward.ris@kfintech.com Website: www.karvyfintech.com Contact Person: M. Murali Krishna SEBI Registration No.: INR000000221 |

Mindspace Business Parks REIT IPO – Other Details:

- Statutory Auditor – Deloitte Haskins & Sells LLP

- Legal Counsel to the Company – Shardul Amarchand Mangaldas & C

Mindspace Business Parks REIT IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 7.5/10 | 7.4/10 | 8.5/10 | 8.1/10 | 7.1/10 |

| Sharekhan | 7.2/10 | 7.1/10 | 8.6/10 | 8.1/10 | 7.2/10 |

| Kotak Securities | 7.3/10 | 7.5/10 | 8.4/10 | 8.1/10 | 7.3/10 |

| ICICI Direct | 7.3/10 | 7.3/10 | 8.7/10 | 8.1/10 | 7.1/10 |

| IIFL | 7.5/10 | 7.2/10 | 8.8/10 | 8.0/10 | 7.1/10 |

| Edelweiss | 7.5/10 | 7.4/10 | 8.4/10 | 8.3/10 | 7.2/10 |

| Zerodha | 7.4/10 | 7.1/10 | 8.5/10 | 8.1/10 | 7.0/10 |

| 5Paisa | 7.1/10 | 7.1/10 | 8.4/10 | 8.1/10 | 7.1/10 |

| Karvy | 7.4/10 | 7.3/10 | 8.2/10 | 8.1/10 | 7.1/10 |

| Motilal Oswal | 7.1/10 | 7.1/10 | 8.6/10 | 8.3/10 | 7.2/10 |

Mindspace REIT IPO Grey Market Premium

The Mindspace Business Parks REIT IPO Grey Market Premium price is Rs X, the Kostak rate is Rs X and the Subject to Sauda is X.

Subscribe to Mindspace Business Parks REIT IPO

Mindspace Business Parks REIT IPO News1,12,224

News 1 – IPO ISSUE OPENS SOON [Download Prospectus]

News 2 – Mindspace Business Parks REIT IPO [Download RHP Prospectus]

Market Guide

Featured Topics