MDC Pharmaceuticals IPO – Review, Allotment Status, Subscription, Price, Date & more

Last Updated Date: Nov 18, 2022MDC Pharmaceuticals is engaged in the development and manufacturing of pharmaceutical formulations, nutraceutical formulations and marketing of cosmetic and skin care products.The Company has issued 52,86,000 Equity shares of Rs.10 each. Let’s have a detailed review of the company and analytics of the MDC Pharmaceuticals IPO release date, IPO offer price, subscription, MDC Pharmaceuticals IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

MDC Pharmaceuticals IPO Review & Ratings

| MDC Pharmaceuticals IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.3/10 |

| Industry Ranking | 6.3/10 |

| Company Background | 6.1/10 |

| Company Reputation | 6.4/10 |

| Competitive Edge | 6.4/10 |

| Financial Statements | 6.5/10 |

| Popularity Index | 6.2/10 |

| Promoters Reputation | 6.3/10 |

| Retail Appetite | 6.2/10 |

| Top Brokers Review | 6.3/10 |

| Overall Ratings | 6.3/10 |

| Star Ratings | ★★★☆☆ |

Summary of MDC Pharmaceuticals IPO

MDC Pharmaceuticals is engaged in the development and manufacturing of pharmaceutical formulations, nutraceutical formulations and marketing of cosmetic and skin care products. Company is present in various areas such as Anti-Hypertensive formulations, Cardio-Vascular pharmaceutical formulations,Antibiotics, Anti-Malarials, Anti-Histamine drugs etc. We deal in cosmetics range and skin care products through our brand Mutrela. The Issue comprises of a Public Issue of 52,86,000 Equity shares of face value of Rs.10.00 each.

MDC Pharmaceuticals is engaged in the development and manufacturing of pharmaceutical formulations, nutraceutical formulations and marketing of cosmetic and skin care products. Company is present in various areas such as Anti-Hypertensive formulations, Cardio-Vascular pharmaceutical formulations,Antibiotics, Anti-Malarials, Anti-Histamine drugs etc. We deal in cosmetics range and skin care products through our brand Mutrela. The Issue comprises of a Public Issue of 52,86,000 Equity shares of face value of Rs.10.00 each.

From FY 2012-13 to FY 2016-17, as per our Restated Financial Statements,

- Their total revenue has shown growth from Rs. 3,465.40 lakhs to Rs. 4,765.17 lakhs, representing a CAGR of 6.57%.

- Their EBITDA has shown growth from Rs. 378.80 lakhs to Rs. 661.15 lakhs, representing a CAGR of 11.78%.

- Their profit after tax has shown growth from Rs. 92.69 lakhs to a profit of Rs. 292.57 lakhs representing a CAGR of 25.83% .

- Their return on net worth has shown a growth from 7.53% to 15.59%.

Our restated total revenue, EBITDA and profit after tax for the nine months ended December 31, 2017 was Rs. 3,767.02 lakhs, Rs. 797.35 lakhs and Rs. 486.04 lakhs respectively, with an EBITDA margin of 21.17% and PAT margin of 12.90%. Our RONW for the period ended December 31, 2017 was 21.22%.

The Promoter of this company is Mr. Parvinder Singh Gulati, Mr. Gurmeet Singh Narula and Sham Lal Singla. The lead manager to the issue is PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED and the Registrar to this issue is LINK INTIME INDIA PRIVATE LIMITED

Subscribe to MDC Pharmaceuticals IPO

MDC Pharmaceuticals IPO Date

The opening and the closing date of IPO of MDC Pharmaceuticals is not known yet.

MDC Pharmaceuticals IPO Subscription

| Subscription | |

| Day 1 | X |

| Day 2 | X |

| Day 3 | X |

| Day 4 | X |

| Day 5 | X |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

MDC Pharmaceuticals IPO Allotment Status

The Issue is being made through the Fixed Price Process wherein portion of Market maker reservation is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price. Equity shares will be allocated on a proportionate basis to Retail Individual Applicants, subject to valid applications being received from Retail Individual Applicants at the Issue Price. The balance of the Net Issue will be available for allocation on proportionate basis to Non Retail Applicants.

MDC Pharmaceuticals IPO Price Band

The face value of each share is Rs 10, but the price band of the IPO is not yet disclosed.

MDC Pharmaceuticals IPO Equity Share Offering

52,86,000 Equity Shares of Rs 10/- each but Issue Price is yet to be disclosed so it will be aggregated to Rs (52,86,000* Issue Price).

MDC Pharmaceuticals Limited – Company Overview

MDC Pharmaceuticals Private Limited was incorporated dated February 21, 2011 under the provision of Companies Act, 1956 by Registrar of Companies, Pune. The Company is engaged in the business of IT staffing and consultancy. They have their registered office in Pune, corporate office in Bangalore and virtual offices in Mumbai and Chennai. They are engaged in the business of providing Oracle Consultancy Services, IT staffing and solutions and Corporate Training Services across various industries including viz. banking and financial services, automotive and engineering, telecom, healthcare, Retail and Entertainment in India and US. As of March 31, 2018, we served 22 clients and have 103 employees.

Key clients include Herbalife International India Private Ltd, Clairvoyant India Private Limited, Inspirage Software Consulting Private Limited, HTC Global Services (India) Private Ltd. etc

The Company is promoted by Ritesh R Sharma, who has over a decade of experience in the IT industry. He is the guiding force behind the growth and strategic decisions of the Company.

Competitive Strengths of MDC Pharmaceuticals Limited:

- Experienced Promoters and management team.

- Focus on Quality Assurance

- Widespread distribution channel through franchisee network strategy across various stated..

- Wide and diverse range of product offerings.

Business strategies of MDC Pharmaceuticals Limited:

- Expanding our nutraceutical product basket with installation of Soft Gel Encapsulation

machineries. - Focus on increasing our global sales.

- Making their existing manufacturing units compliant with WHO GMP guidelines.

- Increasing Operational efficiency

- Pursuing value added acquisitions and expanding through strategic investments.

MDC Pharmaceuticals Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | |||||

| 31-Dec-17 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | |

| Total Assets | 4,332.07 | 3,327.19 | 3,197.31 | 3,007.91 | 2,723.20 |

| Total Revenue | 3,767.02 | 4,765.17 | 4,785.92 | 4,127.64 | 3,596.03 |

| Total Expense | 3,088.32 | 4,316.39 | 4,575.61 | 4,069.45 | 3,384.19 |

| Profit After Tax | 486.04 | 292.57 | 128.18 | 54.65 | 170.17 |

- Earnings per Equity Share (in Lakhs)

| 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | |

| Basic & Diluted | 2.44 | 1.07 | 0.46 |

MDC Pharmaceuticals IPO – Promoters

The Promoters of this company are:

- Mr. Parvinder Singh Gulati

- Mr. Gurmeet Singh Narula

- Sham Lal Singla

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

MDC Pharmaceuticals IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | 52,86,000 Equity Shares of Rs 10/- each at an Issue Price (yet to be disclosed). |

| Of which: | |

| Reserved for Market Makers | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price. |

| Net Issue to the Public | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price. |

| Of which: | |

| Retail Investors Portion | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price.This is not less than 35% of the Net Issue. |

| Non-Retail Investors Portion | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price.This is not more than 50% of the Net Issue. |

| Equity Shares outstanding prior to the Issue | 1,27,68,800 Equity Shares of Rs 10/- each |

| Equity Shares outstanding after the Issue | Not yet disclosed |

MDC Pharmaceuticals IPO Issue Object

These are the IPO Issue Objects of the company

- Funding of working capital requirements of the Company

- General Corporate Purpose

- Issue Expenses

List of Upcoming IPOs in 2018

| Pommys Garments IPO | Indo US Biotech IPO | Medibios Laboratories IPO | Shree Vasu Logistics IPO |

| R R Industrial IPO | Sorich Foils IPO | 20 Microns IPO |

MDC Pharmaceuticals IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

-

- Diverse portfolio of Services

- Established relationship with clients leading to recurring business

- Experienced management and operational team

- Customer Satisfaction

- Diversified Industry Sectors

- International Presence

The relevant quantitative factors are:

| Year | Basic & Diluted EPS | RONW (%) |

| 31-Mar-15 | 0.46 | 3.75 |

| 31-Mar-16 | 1.07 | 8.09 |

| 31-Mar-17 | 2.44 | 15.59 |

- Net Asset Value per Equity Share as of March 31, 2017 and December 31, 2017 is Rs 15.64 and Rs 19.09 respectively.

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | 45.38 |

| Highest | 98.41 |

| Lowest | 6.14 |

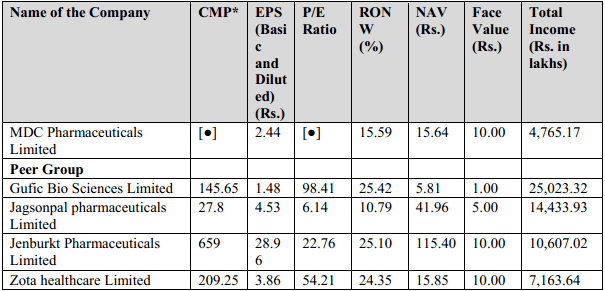

- Competitive Peers:

List of Latest IPOs of 2018

| Fine Organic IPO | IndoStar Capital IPO | Capricorn Food Products IPO | Flemingo Travel Retail IPO |

| Nazara Technologies IPO | Genius Consultants IPO | Rail Vikas Nigam IPO | Verroc Engineering IPO |

MDC Pharmaceuticals IPO Lead Managers

| Lead Managers |

| Pantomath Capital Advisors Private Limited

406-408, Keshava Premises, Behind Family Court, |

MDC Pharmaceuticals IPO Registrar to offer

| Registrar to the Offer |

| Link Intime India Private Limited

C-101, 1st Floor, 247 Park, L.B.S. Marg, |

Other Details:

- Statutory Auditor –G. S. Gambhir & Associates Chartered Accountants

- Peer Review Auditor –P S D & Associates, Chartered Accountants

- Bankers to the Company – ICICI Bank

MDC Pharmaceuticals IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

MDC Pharmaceuticals IPO Grey Market Premium

The MDC Pharmaceuticals IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Subscribe to MDC Pharmaceuticals IPO

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics