COSBOARD Industries IPO – Review, Allotment, Subscription, Price, Date & more

Last Updated Date: Nov 16, 2022COSBOARD Industries is the leading manufacturer of grey board, Kraft Paper Media, News Print Paper, High B.F. Kraft Paper. The Company has issued 42,93,000 Equity shares of Rs.10 each. Let’s have a detailed review of the company and analytics of the COSBOARD Industries IPO release date, IPO offer price, subscription, COSBOARD Industries IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

COSBOARD Industries IPO Review & Ratings

| COSBOARD Industries IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.3/10 |

| Industry Ranking | 6.3/10 |

| Company Background | 6.1/10 |

| Company Reputation | 6.4/10 |

| Competitive Edge | 6.4/10 |

| Financial Statements | 6.5/10 |

| Popularity Index | 6.2/10 |

| Promoters Reputation | 6.3/10 |

| Retail Appetite | 6.2/10 |

| Top Brokers Review | 6.3/10 |

| Overall Ratings | 6.3/10 |

| Star Ratings | ★★★☆☆ |

Summary of COSBOARD Industries IPO

COSBOARD Industries is the leading manufacturer of grey board, Kraft Paper Media, News Print Paper, High B.F. Kraft Paper. The Company has issued 42,93,000 Equity shares of Rs.10 each. The Company commenced its manufacturing operations in 1980 with an installed production capacity of 3300 tonnes per annum (TPA) with one production plant. The entire unit is located adjacent to Mahanadi River, the lifeline of Odisha, from which the plant meets its water requirements. At present, the Company is having 4 plants out of which 3 plant is running with installed capacity combined 39000 TPA.

COSBOARD Industries is the leading manufacturer of grey board, Kraft Paper Media, News Print Paper, High B.F. Kraft Paper. The Company has issued 42,93,000 Equity shares of Rs.10 each. The Company commenced its manufacturing operations in 1980 with an installed production capacity of 3300 tonnes per annum (TPA) with one production plant. The entire unit is located adjacent to Mahanadi River, the lifeline of Odisha, from which the plant meets its water requirements. At present, the Company is having 4 plants out of which 3 plant is running with installed capacity combined 39000 TPA.

Company is also engaged in trading of Papers which constitutes around 41% of the Total Revenue as on December 31, 2017. The Company’s total revenue as restated in Nine months‘ period ended on 31st December, 2017, FY 2017, FY 2016 and FY 2015 is Rs. 7993.13 Lakhs, Rs. 7735.41 Lakhs, 6287.66 Lakhs and 4160.63 Lakhs respectively. The Company’s profit after tax as restated in Nine months‘ period ended on 31st December, 2017, FY 2017, FY 2016 and FY 2015 is Rs. 59.11 Lakhs, 27.10 Lakhs, Rs. 175.63 Lakhs and Rs. 229.57 Lakhs, respectively.

The Promoter of this company are MR. SHIV SHANKAR TAPARIA AND MR. ANIL KUMAR GILRA. The lead manager to the issue is Mark Corporate Advisors Private Limited and the Registrar to this issue is BIGSHARE SERVICES PRIVATE LIMITED.

Subscribe to COSBOARD Industries IPO

COSBOARD Industries IPO Date

The opening and the closing date of IPO of COSBOARD Industries is not known yet.

COSBOARD Industries IPO Subscription

| Subscription | |

| Day 1 | X |

| Day 2 | X |

| Day 3 | X |

| Day 4 | X |

| Day 5 | X |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

COSBOARD Industries IPO Allotment Status

The Issue is being made through the Fixed Price Process wherein up to ___Equity Shares shall be reserved for Market Maker upto __Equity shares will be allocated on a proportionate basis to Retail Individual Applicants, subject to valid applications being received from Retail Individual Applicants at the Issue Price. The balance of the Net Issue will be available for allocation on proportionate basis to Non Retail Applicants.

COSBOARD Industries IPO Price Band

The face value of each share is Rs 10, but the price band is not fixed yet.

COSBOARD Industries IPO Equity Share Offering

42,93,800 Equity Shares of Rs 10/- each with the Issue Price of Rs __ which will be aggregated to Rs ___ lakhs.

COSBOARD Industries- Company Overview

COSBOARD Industries was originally incorporated as ―Central Orissa Straw Board Private Limited‖ in Cuttack Orissa as a Private Limited Company under the provisions of the Companies Act, 1956 vide certificate of incorporation dated 30th December, 1980 and the constitution of the Company has been changed to a limited company vide fresh certificate of incorporation dated 20th May, 1993 and name of the Company was changed to ―Cosboard Industries Limited. The Company Manufacture grey board, Kraft Paper media, News Print Paper, High B.F. Kraft Paper, this classification of products is based on its composition which ultimately determines the usage.

Competitive Strengths of COSBOARD Industries

- Strategic location of the manufacturing facility

- Availability and access to raw materials

- Strong Sales and Marketing Network

- Proven and experience management team

Business strategies of COSBOARD Industries:

- Increase in the Scale of Business Operations

- Expanding operations and the distribution network in new markets

- Optimizing cost of operations

COSBOARD Industries – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | |||||

| 31-Dec-17 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | |

| Total Assets | 9403.34 | 9621.42 | 7624.79 | 5430.75 | 3939.47 |

| Total Revenue | 7993.13 | 7735.41 | 6287.66 | 4160.63 | 3430.36 |

| Total Expense | 7890.18 | 7638.3 | 6099.46 | 3938.13 | 3408.50 |

| Profit After Tax | 59.11 | 26.92 | 177.03 | 220.01 | 23.50 |

Earnings per Equity Share (in Lakhs)

| 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | |

| Basic | 0.39 | 0.17 | 0.02 |

| Diluted | 0.39 | 0.17 | 0.02 |

From the above statements, one could find that the COSBOARD Industries may perform well.

COSBOARD Industries IPO – Promoters

The Promoter of this company are:

- MR. Shiv Shankar Taparia

- MR. Anil Kumar Girla

List of Related Parties (Key Managerial Personnel)

- Mr. Inderpal Singh Pasricha

- Mrs. Rekha Bhawsinka

- Mr. Akram Abu

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

COSBOARD Industries IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | 42,93,800 Equity Shares of Rs 10/- each at an Issue Price of Rs Rs 25 aggregating up to Rs 1502.83 lacks |

| Of which: | |

| Reserved for Market Makers | __Equity Shares of Rs 10/- each at an issue price. |

| Net Issue to the Public | ___ Equity Shares of Rs 10/- each at an issue price. |

| Of which: | |

| Retail Investors Portion | ____Equity Shares of Rs 10/- each at an Issue Price |

| Non-Retail Investors Portion | __Equity Shares of Rs 10/- each at an Issue Price. |

| Equity Shares outstanding prior to the Issue | ___ Equity Shares of Rs 10/- each |

| Equity Shares outstanding after the Issue | 85,87,600 Equity Shares of Rs 10/- each |

COSBOARD Industries IPO Issue Object

These are the IPO Issue Objects of the company

- Site development and purchase of equipment for up-gradation of existing plants and machineries

- General corporate purposes

- Issue related expenses.

List of Upcoming IPOs in 2018

| Pommys Garments IPO | Indo US Biotech IPO | Medibios Laboratories IPO | Shree Vasu Logistics IPO |

| R R Industrial IPO | Sorich Foils IPO | 20 Microns IPO |

COSBOARD Industries IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Diversified Variety of readily available Paper Products and diversified Customer-base.

- In-house Logistics

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW (%) | NAV (Rs.) | |

| 31-Mar-15 | 5.12 | 52.51% | NA |

| 31-Mar-16 | 4.12 | 26.75% | NA |

| 31-Mar-17 | .63 | 4.34% | 15.81 |

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | 12.50 |

| Highest | 100.30 |

| Lowest | 4.30 |

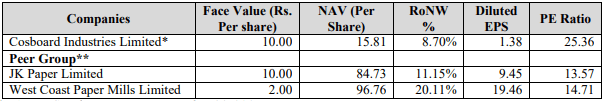

- Competitive Peers:

List of Latest IPOs of 2018

| Fine Organic IPO | IndoStar Capital IPO | Capricorn Food Products IPO | Flemingo Travel Retail IPO |

| Nazara Technologies IPO | Genius Consultants IPO | Rail Vikas Nigam IPO | Verroc Engineering IPO |

COSBOARD Industries IPO Lead Managers

| Lead Managers |

| Mark Corporate Advisors Private Limited CIN: U67190MH2008PTC181996 404/1, The Summit Business Bay, Sant Janabai Road (Service Lane), Off W. E. Highway, Vile Parle (East), Mumbai-400 057. Contact Person: Mr. Manish Gaur, Tel. No.: +91 22 2612 3207/08 E-Mail ID: info@markcorporateadvisors.com SEBI Regn No.: INM000012128 Investor Grievance Email: investorgrievance@markcorporateadvisors.com |

COSBOARD Industries IPO Registrar to offer

| Registrar to the Offer |

| Bigshare Services Private Limited 1st Floor, Bharat Tin Works Building, Opp. Vasant Oasis, Makwana Road, Marol, Andheri (E), Mumbai – 400 059 Contact person: Mr. Srinivas Dornala Tel: +91-22-6263 8200; Fax: +91-22-6263 8299 E-Mail: rightsissue@bigshareonline.com, Website: www.bigshareonline.com SEBI Regn No: INR000001385 Investor Grievance Email: investor@bigshareonline.com |

Other Details:

- Statutory Auditor –M/s B R R & Associates, Chartered Accountants

- Peer Review Auditor – M/s B R R & Associates,Chartered Accountants

- Bankers to the Company – Cosmos Co-operative Bank

COSBOARD Industries IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

COSBOARD Industries IPO Grey Market Premium

The COSBOARD Industries IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Subscribe to COSBOARD Industries IPO

COSBOARD Industries IPO News

News 1 – IPO ISSUE OPENS SOON (Download Prospectus)

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics