Artedz Fabs IPO – Review, Allotment, Subscription, Price, GMP, Date and more

Last Updated Date: Nov 16, 2022Artedz Fabs Limited is engaged in manufacturing and trading of textile fabrics for shirtings and suitings. They specialize in manufacturing of textile fabrics majorly from cotton yarn. The Company has issued 23,10,000 Equity shares of Rs.10 each. Let’s have a detailed review of the company and analytics of the Artedz Fabs IPO release date, IPO offer price, subscription, Artedz Fabs IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

- Issue Price of this IPO is Rs 34 – Rs 36 . Check the Live Share Price here – Artedz Fabs Share Price

- To track the performance of this IPO, click on this link – IPO Performance

Artedz Fabs IPO Review & Ratings

| Artedz Fabs IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.3/10 |

| Industry Ranking | 6.3/10 |

| Company Background | 6.1/10 |

| Company Reputation | 6.4/10 |

| Competitive Edge | 6.4/10 |

| Financial Statements | 6.5/10 |

| Popularity Index | 6.2/10 |

| Promoters Reputation | 6.3/10 |

| Retail Appetite | 6.2/10 |

| Top Brokers Review | 6.3/10 |

| Overall Ratings | 6.3/10 |

| Star Ratings | ★★★☆☆ |

Summary of Artedz Fabs IPO

Artedz Fabs is engaged in the manufacturing and trading of textile fabrics for shirtings and suitings. They also use linen yarn as well as blended yarns as the raw material. They also use linen yarn as well as blended yarns as the raw material and are primarily engaged in the manufacturing of grey fabrics with high-end and fashion forward designs, using the expertise of our in-house designing team. They are primarily engaged in the manufacturing of grey fabrics with high-end and fashion forward designs, using the expertise of their in-house designing team. The Issue comprises of a Public Issue of 23,10,000 Equity shares of face value of Rs.10.00 each. From FY 2012-13 to FY 2016-17, as per our Restated Financial Statements:

Artedz Fabs is engaged in the manufacturing and trading of textile fabrics for shirtings and suitings. They also use linen yarn as well as blended yarns as the raw material. They also use linen yarn as well as blended yarns as the raw material and are primarily engaged in the manufacturing of grey fabrics with high-end and fashion forward designs, using the expertise of our in-house designing team. They are primarily engaged in the manufacturing of grey fabrics with high-end and fashion forward designs, using the expertise of their in-house designing team. The Issue comprises of a Public Issue of 23,10,000 Equity shares of face value of Rs.10.00 each. From FY 2012-13 to FY 2016-17, as per our Restated Financial Statements:

- Their total revenue has shown growth from Rs. 2780.49 lakhs to Rs. 5310.81 lakhs, representing a increase of 91.00%.

- Their EBITDA has shown growth from Rs. 363 lakhs to Rs. 786 lakhs, representing an increase of of 116%.

- Their profit after tax has shown growth from Rs. 92.69 lakhs to a profit of Rs. 178.87 lakhs representing a CAGR of 25.83% .

- The pre-issue net worth of the Company as per Restated Standalone Financial Statements was Rs. 802.11 lakhs as of December 31, 2017 and Rs. 487.46 lakhs for the year ended March 31, 2017. The book value of Equity Share after Issue of Bonus was Rs 12.83 as at December 31, 2017 and Rs. 7.80 as at March 31, 2017.

The Promoters of this company are Kashyap Gambhir and Satbinder Singh Gill. The lead manager to the issue is PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED and the Registrar to this issue is BIGSHARE SERVICES PRIVATE LIMITED.

Open Free* Demat A/C Now! Fill the details below

Artedz Fabs IPO Date

The opening and the closing date of IPO of Artedz Fabs is Mar 18, 2019 – Mar 20, 2019

Artedz Fabs IPO Subscription

| Day / Date | QIB | NII | RII | Total Subscription |

| 1st Day – Mar 18 | – | 0.11x | 0.32x | 0.21x |

| 2nd Day – Mar 19 | – | 0.20x | 0.53x | 0.37x |

| 3rd Day – Mar 20 | – | 0.23x | 0.59x | 0.41x |

| Shares Offered or Net Issue | – | 1,095,000 | 1,095,000 | 2,190,000 |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

Artedz Fabs IPO Allotment Status

Here, you can find the Allotment Status of this IPO.

| Basis of Allotment Finalization | 26-Mar-19 |

| Refunds Initiation | 27-Mar-19 |

| Credit of Shares to Demat Account | 28-Mar-19 |

| Share Listing Date | 29-Mar-19 |

Artedz Fabs IPO Price Band

The face value of each share is Rs 10, but the price band of the IPO is Rs 34 – Rs 36.

Artedz Fabs IPO Equity Share Offering

23,10,000 Equity Shares of Rs 10/- each and Issue Price is Rs 34 – Rs 36, so it will be aggregated to Rs 8.32 Crores.

Open Free Demat Account Now!

Artedz Fabs Limited – Company Overview

Artedz Fabs Private Limited was originally incorporated as “Artedz Fabs Private Limited” at Mumbai, Maharashtra as a Private Limited Company under the provisions of the Companies Act, 1956 vide Certificate of Incorporation dated August 08, 2006. This Company is engaged in manufacturing and trading of textile fabrics for shirtings and suitings.

They specialize in manufacturing of textile fabrics majorly from cotton yarn. They also use linen yarn as well as blended yarns as the raw material. They are primarily engaged in the manufacturing of grey fabrics with high-end and fashion forward designs, using the expertise of their in-house designing team. The Company caters to orders from both domestic and international markets.

Competitive Strengths of Artedz Fabs Limited:

- Experienced Promoters.

- Timely Delivery.

- In house Design

- Wide and diverse range of product offerings.

Business strategies of Artedz Fabs Limited:

- Diversify into women wear.

- Printing on the Solid Fabrics.

- Negotiate with Creditors for pricing.

- Strong Customer Relationship.

Artedz Fabs Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | ||||||

| 31-Dec-17 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | 31-Mar-13 | |

| Total Assets | 6,034.94 | 4434.35 | 3654.45 | 3,920.79 | 2922.95 | 1996.99 |

| Total Revenue | 4995.05 | 5310.81 | 3877.97 | 3097.96 | 2652.12 | 2780.49 |

| Total Expense | 4,547.20 | 5,051.81 | 3,929.62 | 3,210.91 | 2,716.84 | 2,833.76 |

| Profit After Tax | 314.65 | 178.87 | -35.55 | -76.99 | -44.82 | -36.95 |

Earnings per Equity Share (in Lakhs)

| 31-Dec-17 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | 31-Mar-13 | |

| Basic & Diluted | 5.03 | 2.86 | -0.59 | -1.47 | -1.05 | -1.34 |

From the above statements, one could find that the Artedz Fabs Limited may perform well.

Artedz Fabs IPO – Promoters

The Promoters of this company are:

- Kashyap Gambhir

- Satbinder Singh Gill

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

Artedz Fabs IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | 23,10,000 Equity Shares of Rs 10/- each at an Issue Price (yet to be disclosed). |

| Of which: | |

| Reserved for Market Makers | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price. |

| Net Issue to the Public | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price. |

| Of which: | |

| Retail Investors Portion | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price.This is not less than 35% of the Net Issue. |

| Non-Retail Investors Portion | This portion is not yet disclosed while face value of Equity Shares is of Rs 10/- each at an issue price.This is not more than 50% of the Net Issue. |

| Equity Shares outstanding prior to the Issue | 62,50,000 Equity Shares of Rs 10/- each |

| Equity Shares outstanding after the Issue | Not yet disclosed |

Artedz Fabs IPO Issue Object

These are the IPO Issue Objects of the company

- Funding of working capital requirements of the Company

- General Corporate Purpose.

Artedz Fabs IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

-

- Experienced Promoters.

- On time Delivery of Products.

- In-house designing of the fabrics.

- Strong long maintained relationship with the customer.

The relevant quantitative factors are:

| Year | Basic & Diluted EPS | RONW (%) |

| 31-Mar-15 | (1.47) | (31.53) |

| 31-Mar-16 | (0.59) | (11.52) |

| 31-Mar-17 | 2.86 | 36.69 |

- NAV

Particulars Amount(in Rs.) NAV as on March 31,2017 7.8 NAV as on December 31,2017 12.83

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | 17.47 |

| Highest | 24.02 |

| Lowest | 10.92 |

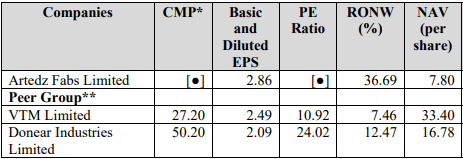

- Competitive Peers:

Artedz Fabs IPO Lead Managers

| Lead Managers |

| Pantomath Capital Advisors Private Limited

406-408, Keshava Premises, Behind Family Court, |

Artedz Fabs IPO Registrar to offer

| Registrar to the Offer |

| BIGSHARE SERVICES PRIVATE LIMITED 1st Floor, Bharat Tin Works Building, Opp.Vasant Oasis, Makwana Road, Marol, Andheri (East), Mumbai – 400059, Maharashtra, India. Tel: +91 22 62638200 Fax: +91 22 62638299 Email: ipo@bigshareonline.com Website: www.bigshareonline.com Investor Grievance Id: investor@bigshareonline.com Contact Person: Srinivas Dornala SEBI Registration Number: INR000001385 |

Other Details:

- Statutory Auditor –M/s. B.T. Bhomawat & Co., Chartered Accountants.

- Peer Review Auditor –M/s N. K. Aswani & Co., Chartered Accountant.

- Bankers to the Company – ICICI Bank

Artedz Fabs IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

Artedz Fabs IPO Grey Market Premium

The Artedz Fabs IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Open Free* Demat A/C Now! Fill the details below

Artedz Fabs IPO News

News 1 – IPO ISSUE OPENS SOON (Download Prospectus)

Market Guide

Featured Topics