Priti International IPO – Review, Allotment Status, Subscription, Price, Date & more

Last Updated Date: Nov 19, 2022Priti International is one of the leading manufacturer and exporter of Handicraft Products. Priti International IPO consists of 700,800 Equity Shares of Rs 10 aggregating up to Rs. 5.26 Crores. Let’s have a detailed review of the company and analytics of the Priti International IPO release date, IPO offer price, subscription, Priti International IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

- Issue Price of this IPO is Rs 75. Check the Live Share Price here Priti International Share Price

- To track the performance of this IPO, click on this link – IPO Performance

Priti International IPO Review & Ratings – AVOID

| Priti International IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.5/10 |

| Industry Ranking | 6.3/10 |

| Company Background | 6.3/10 |

| Company Reputation | 6.3/10 |

| Competitive Edge | 6.4/10 |

| Financial Statements | 6.5/10 |

| Popularity Index | 6.2/10 |

| Promoters Reputation | 6.3/10 |

| Retail Appetite | 6.6/10 |

| Top Brokers Review | 6.3/10 |

| Overall Ratings | 6.4/10 |

| Star Ratings | ★★★☆☆ |

Summary of Priti International IPO

The company was originally incorporated as “Priti International Limited”, Rajasthan in year 2013. They deal in manufacturing of wooden, metal and textile based furniture and handicrafts products. They export products to wholesalers and retailers from countries such as Spain, Belgium, Holland, Netherlands, Turkey, England, China, Greece, Germany etc. Apart from them, we also export our products to customers working on some specific projects e.g. newly constructed hotels, restaurants, bars & pubs, etc.

The company was originally incorporated as “Priti International Limited”, Rajasthan in year 2013. They deal in manufacturing of wooden, metal and textile based furniture and handicrafts products. They export products to wholesalers and retailers from countries such as Spain, Belgium, Holland, Netherlands, Turkey, England, China, Greece, Germany etc. Apart from them, we also export our products to customers working on some specific projects e.g. newly constructed hotels, restaurants, bars & pubs, etc.

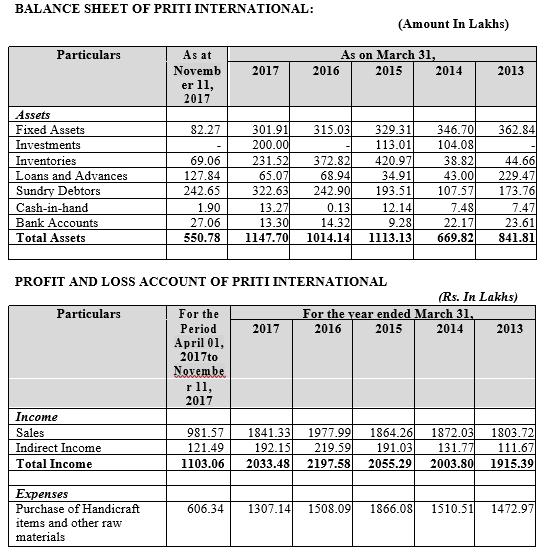

The financial performance (based on the audited financials of the M/s. Priti International i.e. the erstwhile proprietorship of the Promoter Priti Lohiya) reflects decline in total revenue from Rs. 2,055.29 lakhs in the FY 2014-15 to Rs. 1,978.91 lakhs in the FY 2016-17. However, the EBITDA has increased from Rs. 180.18 lakhs in the FY 2014-15 to Rs. 226.76 lakhs in the FY 2016-17, representing a CAGR of 12.18%. Further, our EBITDA margin has increased from 8.77% in FY 2014-15 to 11.46% in the FY 2016-17 and the profits for the year has increased from Rs. 130.40 lakhs in the FY 2014-15 to Rs. 164.79 lakhs in the FY 2016-17, representing a CAGR of 12.42%.

The Promoter of this company are GOVERDHAN DAS LOHIYA, PRITI LOHIYA, RITESH LOHIYA, GOVERDHAN DAS LOHIYA – HUF AND RITESH LOHIYA – HUF. The lead manager to the issue is PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED and the Registrar to this issue is BIGSHARE SERVICES PRIVATE LIMITED.

Open Free* Demat A/C Now! Fill the details below

Priti International IPO Date

The opening and the closing date of IPO is from Jun 11, 2018 – Jun 13, 2018.

Priti International IPO Subscription

| Subscription | |

| Day 1 | 43,200 share |

| Day 2 | 160,000 share |

| Day 3 | 5,163,200 share |

| Day 4 | – |

| Day 5 | – |

NOTE: The total equity shares offered was 700,800.

Priti International IPO Allotment Status

Bigshare Website (Click on the Link): http://www.bigshareonline.com/bssipoapplicationstatus.aspx

IMPORTANT DATES:

- Listing Date: on or Before 21st June 2018

- Credit of Equity Shares: on or Before 20th June 2018

- Initiation of Refunds: on or Before 19th June 2018

- Finalization of Basis of Allotment: on or Before 18th June 2018

Priti International IPO Price Band

The face value of each share is Rs 10, and the Issue price is Rs 75, so the premium price is Rs 65.

Priti International IPO Equity Share Offering

700,800 Equity Shares of Rs 10 aggregating up to Rs 5.256 Crores at Issue Price is Rs 75. The Minimum Order Quantity is 1600 Equity Shares.

Priti International Limited – Company Overview

Priti International Private Limited was incorporated dated February 21, 2011 under the provision of Companies Act, 1956 by Registrar of Companies, Pune. The Company is engaged in the business of IT staffing and consultancy. They have their registered office in Pune, corporate office in Bangalore and virtual offices in Mumbai and Chennai. They are engaged in the business of providing Oracle Consultancy Services, IT staffing and solutions and Corporate

Priti International Limited

Plot No. F-43, Basni, 1st Phase,

Jodhpur – 342 001, Rajasthan, India.

Tel: 0291- 2431367

Email: info@pritiinternationallimited.com

Website: www.pritiinternationallimited.com

KEY MEMBERS:

- Mr. Goverdhan Das Lohiya (Designation: Chairman & Director)

- Ms. Leela Lohiya (Designation: Non-Executive Director)

- Mr. Ritesh Lohiya (Designation: Director and CFO)

Competitive Strengths of Priti International Limited :

- Experienced Management team

- Scalable Business Model

- Global Presence

- Locational Advantage

Business strategies of Priti International Limited :

- Create a domestic presence and expand international presence

- Customer Satisfaction

- Brand image

- Leveraging our market skills and relationship

- Improving our functional efficiency

Priti International Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Till 31 DEC 2017 (in Rs. Lakhs) | |

| Total Assets | 769.37 |

| Total Revenue | 323.63 |

| Profit After Tax | 15.97 |

- Minimum Return on Total Net Worth post Issue needed to maintain Pre Issue EPS for the year ended March 31, 2017 is [●] %

- THE ISSUE AND THE NET ISSUE WILL CONSTITUTE 27.01% AND 25.66% RESPECTIVELY OF THE FULLY DILUTED POST ISSUE PAID UP EQUITY SHARE CAPITAL OF OUR COMPANY.

Priti International IPO – Promoters

The Promoter of this company are:

- GOVERDHAN DAS LOHIYA,

- PRITI LOHIYA,

- RITESH LOHIYA,

- GOVERDHAN DAS LOHIYA – HUF and

- RITESH LOHIYA – HUF

Interest in promotion of the Company

Some of their Directors may be deemed to be interested in the promotion of the Company to the extent of the Equity Shares held by them and also to the extent of any dividend payable to them and other distributions in respect of the aforesaid Equity Shares.

Interest as member of our Company

As on date of this Draft Prospectus, the Directors together hold 16,57,892 Equity Shares in our Company i.e. 87.56% of the pre issue paid up share capital of the Company. Therefore, some of the Directors are interested to the extent of their respective shareholding and the dividend declared and other distributions, if any, by the Company.

Interest as a Creditor of their Company

As on the date of this Draft Prospectus, their Company has not availed loans from Directors of their Company.

Interest as Director of their Company

Except as stated above and in the chapter titled “Capital Structure” beginning on page 67 of this Draft Prospectus our Directors, may be deemed to be interested to the extent of remuneration and reimbursement of expenses payable to them for services rendered to them in accordance with the provisions of the Companies Act and in terms of agreements entered into with their Company, if any and Articles of Association of their Company.

Priti International IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | Issue of 7,00,800 Equity Shares of face value of Rs.10/- each |

| Of which: | |

| Reserved for Market Makers | 35,200 Equity Shares of face value of Rs. 10/- |

| Net Issue to the Public | 6,65,600 Equity Shares of face value of Rs.10/- each |

| Of which: | |

| Retail Investors Portion | 3,32,800 Equity Shares of face value of Rs. 10/- |

| Non-Retail Investors Portion | 3,32,800 Equity Shares of face value of Rs. 10/- |

| Equity Shares outstanding prior to the Issue | 18,93,532 Equity Sharesof Rs 10/- each |

| Equity Shares outstanding after the Issue | 25,94,332 Equity Shares of Rs 10/- each |

Priti International IPO Issue Object

These are the IPO Issue Objects of the company

- Purchase of Plant and Machinery and related civil work.

- Funding the working capital requirements of the Company.

- General Corporate Purposes.

Priti International IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

-

- Diverse portfolio of Services

- Experienced management and operational team

- Customer Satisfaction

- Diversified Industry Sectors

- International Presence

The relevant quantitative factors are:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

| 3.47 | 21.61 | 3.99% | 21.13 |

Priti International IPO Lead Managers

| Lead Managers |

| PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED

406-408, Keshva Premises, Behind Family Court, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051, Maharashtra, India |

Priti International IPO Registrar to offer

| Registrar to the Offer |

| BIGSHARE SERVICES PRIVATE LIMITED

1st Floor, Bharat Tin Works Building, Opp. Vasant Oasis |

Other Details:

| Summary Details | INFO |

| ISSUE OPEN | 11-Jun-18 |

| ISSUE CLOSE | 13-Jun-18 |

| FACE VALUE | Rs. 10 |

| ISSUE PRICE | Rs. 75 |

| MINIMUM INVESTMENT (INR) | 1,20,000 |

| MINIMUM LOT | 1,600 |

| P/E VALUE | 12.76 |

| ISSUE SIZE (INR) | 5.26 Crores |

| TOTAL EQUITY SHARES OFFERED (FRESH) | 7,00,800 |

| EQUITY SHARES PRIOR | 18,93,532 |

| EQUITY SHARES AFTER THE ISSUE | 25,94,332 |

- Statutory Auditor – J K Daga & Associates Chartered Accountants

- Peer Review Auditor – K. Aswani & Co.

- Bankers to the Company – ICICI Bank

Priti International IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

Priti International IPO Grey Market Premium

The Priti International IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Open Free* Demat A/C Now! Fill the details below

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics