Prince Pipes and Fittings IPO Dates, Allotment, Subscription, Price, GMP

Last Updated Date: Aug 07, 2023Let’s have a detailed review of the company and analytics of the Prince Pipes IPO date, IPO offer price, subscription, Prince Pipes and Fittings IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

Prince Pipes and Fittings Limited is recognized as one of the leading polymer pipes and fittings manufacturers in India in terms of production capacity, number of distributors, and number and variety of products manufactured.

- Issue Price of this IPO is Rs 177 – 178 . Check the Live Share Price here Prince Pipes Share Price

- To track the performance of this IPO, click on this link – IPO Performance

| Face Value | Rs 10 |

| Price Band | Rs 177 – 178 |

| Listing Date | 31-Dec-19 |

| Min. Order Quantity | 84 |

| Listing At | BSE, NSE |

| Offer for Sale | Rs 250 Cr |

| Fresh Issue | Rs 250 Cr |

| Issue Type | 100% Book Building |

Prince Pipes and Fittings IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 8.5/10 |

| Industry Ranking | 7.8/10 |

| Company Background | 7.9/10 |

| Company Reputation | 7.9/10 |

| Competitive Edge | 7.7/10 |

| Financial Statements | 7.8/10 |

| Popularity Index | 8.4/10 |

| Promoters Reputation | 7.7/10 |

| Retail Appetite | 7.9/10 |

| Top Brokers Review | 7.9/10 |

| Overall Ratings | 8.1/10 |

| Star Ratings | ★★★★☆ |

Summary of Prince Pipes IPO

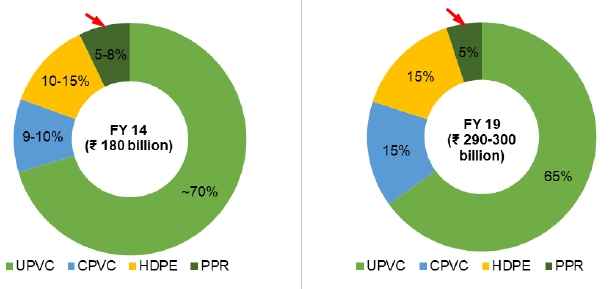

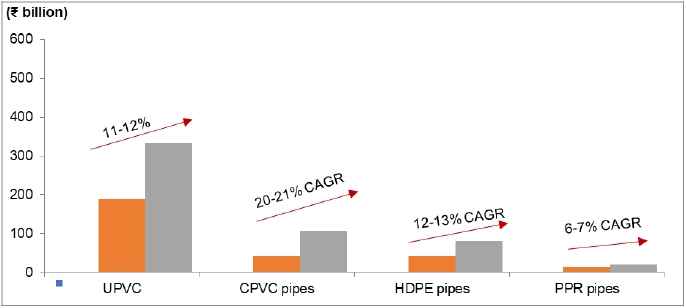

Currently manufacture polymer pipes using four different polymers: UPVC; CPVC; PPR; and HDPE, and fittings using three different polymers: UPVC; CPVC; and PPR. As at October 31, 2019, they had a product range of 7,167 SKUs.

Currently manufacture polymer pipes using four different polymers: UPVC; CPVC; PPR; and HDPE, and fittings using three different polymers: UPVC; CPVC; and PPR. As at October 31, 2019, they had a product range of 7,167 SKUs.

They have six strategically located manufacturing plants, which gives them a strong presence in North, West and South India. Their plants are located at the following locations: Athal (Union Territory of Dadra and Nagar Haveli); Dadra (Union Territory of Dadra and Nagar Haveli); Haridwar (Uttarakhand); Chennai (Tamil Nadu); Kolhapur (Maharashtra) and Jobner (Rajasthan).

The total installed capacity of their six existing plants is 241,211 tonnes per annum as at October 31, 2019. They plan to expand the installed capacity at their plant in Jobner (Rajasthan) from 6,221 tonnes per annum as at at October 31, 2019 to 17,021 tonnes per annum by December 31, 2019 and to 20,909 tonnes per annum by the end of Fiscal 2020. They use five contract manufacturers, of which two are in Aurangabad (Maharashtra), one is in Guntur (Andhra Pradesh), one is in Balasore (Odisha) and one is in Hajipur (Bihar).

From FY 2016-2017 to FY 2018-2019, as per the Restated Financial Statements,

The revenue from operations for Fiscals 2017, 2018 and 2019 was Rs. 13,300.15 million, Rs. 13,205.45 million and Rs. 15,718.69 million, respectively, representing a CAGR of 8.71%. Their revenue from operations for the three-month period ended June 30, 2019 was Rs. 3,797.66 million. Their profit before tax for Fiscals 2017, 2018 and 2019 was Rs. 959.08 million, Rs. 951.67 million and Rs. 1,114.68 million, respectively, representing a CAGR of 7.81%.

Profit before tax for the three-month period ended June 30, 2019 was Rs. 339.31 million. Their profit for the year for Fiscals 2017, 2018 and 2019 was Rs. 741.82 million, Rs. 727.66 million, Rs. 833.51 million, respectively, representing a CAGR of 6.00%. Their profit for the period for the three-month period ended June 30, 2019 was Rs. 266.69 million.

The Promoter of this company is Jayant Shamji Chheda, Tarla Jayant Chheda, Parag Jayant Chheda, Vipul Jayant Chheda and Heena Parag Chheda. The lead manager to the issue is JM Financial Institutional Securities Limited and Edelweiss Financial Services Limited and the Registrar to this issue is Link Intime India Private Limited .

Open Free* Demat A/C Now! Fill the details below

Prince Pipes IPO Date

The opening and the closing date of IPO of Prince Pipes IPO is Dec 18 – Dec 20, 2019.

Prince Pipes IPO Subscription

Find below live subscription and bid details (for both BSE+NSE):

| Day / Date | QIB | NII | RII | Total Subscription |

| 1st Day – Dec 18 | 0.05x | 0.03x | 0.52x | 0.28x |

| 2nd Day – Dec 19 | 0.68x | 0.06x | 1.06x | 0.74x |

| 3rd Day – Dec 20 | 3.56x | 1.21x | 1.88x | 2.21x |

| Shares Offered or Net Issue | 5,649,718 | 4,237,288 | 9,887,006 | 19,774,012 |

- Click for BSE Bid Details

- Click for NSE Bid Details

The shares subscribed by the public will be updated here. IPO Market Timings – 10:00 a.m. to 5:00 p.m.

| Maximum Subscription Amount for Retail Investor | Rs. 2,00,000 |

| Maximum Bid Quantity for QIB Investors | 1,97,73,936 Equity Shares in multiple of 84 Equity Shares |

| Maximum Bid Quantity for NIB Investors | 1,41,24,264 Equity Shares in multiple of 84 Equity Shares |

Prince Pipes IPO Allotment Status

Here, you can find the Allotment Status of this IPO. Allotment of Equity Shares pursuant to the Fresh Issue and transfer of the Offered Shares of the Promoter Selling Shareholders pursuant to the Offer for Sale to the successful Bidders. However, the Allotment status is not yet disclosed.

Prince Pipes IPO Listing Date

Find the dates below on basis of allotment, refund, listing and more:

| Basis of Allotment Finalization | 26-Dec-19 |

| Refunds Initiation | 27-Dec-19 |

| Credit of Shares to Demat Account | 30-Dec-19 |

| Share Listing Date | 31-Dec-19 |

Prince Pipes IPO Price Band

The face value of each share is Rs 10, but the price band of the IPO is Rs 177 – 178.

Prince Pipes IPO Size / Share Offering

Initial public offering of Upto 28,248,586 Equity Shares of Face Value of Rs.10/- each for Cash at a Price of Rs.178 Per Equity Share (Including a Share Premium of Rs.168 per Equity Share) aggregating to Rs.500 Cr.

- Fresh Issue – Rs.250 Crore

- Offer for Sale – Rs.250 Crore

Prince Pipes and Fittings Limited – Company Overview

Prince Pipes and Fittings Private Limited Company is recognized as one of the leading polymer pipes and fittings manufacturers in India in terms of production capacity, number of distributors, and number and variety of products manufactured . The Company market their products under two brand names: Prince Piping Systems; and Trubore Piping Systems. Due to their comprehensive product range, the Company is positioned as an end-to-end polymer piping systems solution provider. The Company has more than 30 years‘ experience in manufacturing polymer pipes and more than 20 years‘ experience in manufacturing fittings.

The Company has five strategically located manufacturing plants, which has enabled them to develop a strong presence in North, West and South India.The Company plan to set up two new manufacturing plants, one in Jobner (Rajasthan), which is near Jaipur, and the other in Sangareddy (Telangana).The Company distribute their products from their plants and from eight warehouses. The warehouses are managed by clearing and forwarding agents.

Competitive Strengths of Prince Pipes and Fittings Limited:

- Strategically located manufacturing facilities with a core focus on quality

- Strong management team

- Their technical collaboration with a reputed international player, which helps to improve the quality of the products and their manufacturing efficiency

- Large and growing distribution network

- Comprehensive product portfolio across polymers serving diverse end-use applications

Business strategies of Prince Pipes and Fittings Limited:

- Continue to optimize the product mix to improve margins.

- Increase the focus on building their brands.

- Expand the Trubore brand to new product lines and new states.

- Set up two new manufacturing plants

- Increase sales of the Prince Piping Systems products by reaching out to more retailers and expanding the distribution network both in new areas as well as in areas where the company already have a strong presence.

Prince Pipes and Fittings Limited – Financial Statements

They sell their Prince Piping Systems products to distributors, who then resell the products to wholesalers, retailers, and plumbers. As at October 31, 2019, they sold their Prince Piping Systems products to 1,151 distributors in India.

They sell their Trubore products directly to wholesalers and retailers. As at October 31, 2019, they sold their Trubore products to 257 wholesalers and retailers.

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

PPFL Financial Summary

| Amount (in INR & millons) | |||||

| June 30, 2019 | March 31, 2019 | March 31, 2018 | *March 31, 2017 | March 31, 2016 Proforma | |

| Total Assets | 10,144.57 | 10,404.13 | 9,798.77 | 7,605.05 | 6,533.00 |

| Total Revenue | 3,801.92 | 15,789.95 | 13,265.71 | 13,324.95 | 10,816.18 |

| Total Expense | 3,462.61 | 14,675.27 | 12,314.04 | 12,365.87 | 10,446.19 |

| Profit After Tax | 266.69 | 833.51 | 727.66 | 741.82 | 295.35 |

Earnings per Equity Share (in millions)

| June 30, 2019 | March 31, 2019 | March 31, 2018 | March 31, 2017 | March 31, 2016 Proforma | |

| Basic & Diluted | 2.96 | 9.26 | 8.08 | 7.85 | 3.18 |

From the above statements, one could find that the IPO will perform well and will be over subscribed.

Prince Pipes IPO – Promoters

The Promoter of this company are:

- Jayant Shamji Chheda,

- Tarla Jayant Chheda,

- Parag Jayant Chheda,

- Vipul Jayant Chheda and

- Heena Parag Chheda

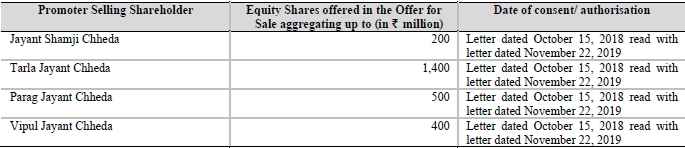

The Promoter Selling Shareholders have consented to their respective portion of the Offer for Sale as follows:

List of Related Parties (Key Managerial Personnel)

- Ashok Mehra

- Hemant Kumar

- Ram Manohar

- Prakash Hegde

- Shailesh Kanji Bhaskar

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Prince Pipes IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | Up to [●] Equity Shares aggregating up to Rs. 5000 million |

| Fresh Issue

|

Up to [●] Equity Shares aggregating up to Rs. 2500 million |

| Offer for Sale | Up to [●] Equity Shares aggregating up to Rs. 2500 million |

| Of which: | |

| Net Issue to the Public | Not less than [●] Equity Shares |

| Of which: | |

| Retail Investors Portion | Not less than [●] Equity Shares |

| Equity Shares outstanding prior to the Issue | 95,980,816 Equity Shares |

| Equity Shares outstanding after the Issue | [●] Equity Shares |

Prince Pipes IPO Issue Object

These are the IPO Issue Objects of the company-

- repayment or prepayment of certain outstanding loans of theCompany;

- financing the project cost towards establishment of a new manufacturing facility;

- upgradation of equipment at their manufacturing facilities;

- general corporate purposes, subject to the applicable laws.

Prince Pipes IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Strong brands in the pipes and fittings segment with over 30 years‘ experience and multiple industry awards and accolades.

- Comprehensive product portfolio across polymers serving diverse end-use applications.

- Strategically located manufacturing facilities with a core focus on quality.

- Large and growing distribution network.

- Technical collaboration with a reputed international player, which helps to improve the quality of the products and their manufacturing efficiency.

- Strong management team

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW (%) | NAV (Rs.) | |

| 31-Mar-17 | 7.85 | 31.47% | 52.37 |

| 31-Mar-18 | 8.08 | 23.52% | 34.36 |

| *31-Mar-19 | 9.26 | 21.18% | 43.71 |

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | 38.89 |

| Highest | 65.37 |

| Lowest | 21.47 |

- Competitive Peers:

| Particulars | Face Value (in Rs.) | EPS (In Rs.) | P/E Ratio | RONW (%) | NAV (In Rs.) |

| Astral Poly Technik | 1 | 12.08 | 59.55x | 17.07 | 70.71 |

| Finolex Industries | 10 | 28.59 | 21.47x | 15.33 | 186.53 |

| Supreme Industries | 2 | 33.88 | 33.86x | 22.21 | 133.49 |

Prince Pipes IPO Lead Managers

| Lead Managers |

| JM Financial Institutional Securities Limited

Edelweiss Financial Services Limited |

Prince Pipes IPO Registrar to offer

| Registrar to the Offer |

| LINK INTIME INDIA PRIVATE LIMITED C-101, 1st Floor, 247 Park, L.B.S. Marg, Vikhroli (West), Mumbai – 400 083, India Tel: +91 22 49186200; Fax: +91 22 4918 6195 Website: www.linkintime.co.in Email: electra.ipo@linkintime.co.in Investor Grievance Id: electra.ipo@linkintime.co.in Contact Person: Shanti Gopalkrishnan SEBI Registration Number: INR000004058 |

Other Details:

- Statutory Auditor – M/s. Khimji Kunverji & Co., Chartered Accountants

- Legal Counsel to the BRLMs – AZB & Partners

- Peer Review Auditor-M/s. Khimji Kunverji & Co., Chartered Accountants

- Bankers to the Company – ICICI Bank of India, Standard Chartered Bank, TheFederal Bank Limited, Bank of India

Prince Pipes and Fittings IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 8.5/10 | 8.1/10 | 8.5/10 | 7.3/10 | 7.5/10 |

| Sharekhan | 8.6/10 | 8.3/10 | 8.6/10 | 8.5/10 | 8.1/10 |

| Kotak Securities | 7.3/10 | 7.5/10 | 7.5/10 | 8.1/10 | 7.3/10 |

| ICICI Direct | 8.5/10 | 8.1/10 | 8.1/10 | 8.0/10 | 7.1/10 |

| IIFL | 8.6/10 | 8.1/10 | 7.3/10 | 7.5/10 | 7.1/10 |

| Edelweiss | 7.5/10 | 7.4/10 | 8.5/10 | 8.1/10 | 7.2/10 |

| Zerodha | 7.4/10 | 7.1/10 | 7.1/10 | 8.1/10 | 7.0/10 |

| 5Paisa | 8.5/10 | 8.1/10 | 8.4/10 | 7.3/10 | 7.5/10 |

| Karvy | 8.6/10 | 8.1/10 | 7.2/10 | 8.5/10 | 8.1/10 |

| Motilal Oswal | 7.1/10 | 7.1/10 | 8.6/10 | 8.3/10 | 7.2/10 |

Prince Pipes and Fittings IPO Grey Market Premium

The Prince Pipes and Fittings IPO Grey Market Premium price is Rs 40-45, the Kostak rate is Rs 350 and the Subject to Sauda is X.

Subscribe to Prince Pipes and Fittings IPO

Market Guide

Featured Topics