Mac Hotels Limited IPO – Review, Allotment Status, Subscription, Price, Date & more

Last Updated Date: Nov 17, 2022Mac Hotels is one of the leading hospitality Services Provider delivering top rate hotels all over the world. The Company has issued 8,10,000 Equity shares of Rs.10 each. Let’s have a detailed review of the company and analytics of the Mac Hotels Limited IPO release date, IPO offer price, subscription, Mac Hotels Limited PO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

Mac Hotels Limited IPO Review & Ratings

| Mac Hotels Limited IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.7/10 |

| Industry Ranking | 6.8/10 |

| Company Background | 6.9/10 |

| Company Reputation | 6.4/10 |

| Competitive Edge | 6.6/10 |

| Financial Statements | 6.5/10 |

| Popularity Index | 6.9/10 |

| Promoters Reputation | 6.5/10 |

| Retail Appetite | 6.8/10 |

| Top Brokers Review | 6.3/10 |

| Overall Ratings | 6.6/10 |

| Star Ratings | ★★★☆☆ |

Summary of Mac Hotels Limited IPO

Mac Hotels is one of the leading hospitality Services Provider delivering top rate hotels all over the world. The Company has issued 8,10,000 Equity shares of Rs.10 each. The Company is the subsidiary company of Hotel Miramar Comfort Private Limited which holds 88.27% of equity shares in the Company as on date of this Draft Prospectus. Mac Hotels are primarily engaged in the business of owning, operating and managing hotels, restaurants and resorts in Goa since last 25 years.

Mac Hotels is one of the leading hospitality Services Provider delivering top rate hotels all over the world. The Company has issued 8,10,000 Equity shares of Rs.10 each. The Company is the subsidiary company of Hotel Miramar Comfort Private Limited which holds 88.27% of equity shares in the Company as on date of this Draft Prospectus. Mac Hotels are primarily engaged in the business of owning, operating and managing hotels, restaurants and resorts in Goa since last 25 years.

The Company has been incorporated with the main object to carry on the business of hotels, restaurant, café, caravan site, apartment house-keeper etc and related services. the company’s hotels and Resorts are tourist destinations for domestic as well as international tourists and are one of the frequented hotels in Goa.

The Promoter of this company are EDGAR COTTA, EDWIN COTTA, and HOTEL MIRAMAR COMFORT PRIVATE LIMITED The lead manager to the issue is GRETEX CORPORATE ADVISORS PRIVATE LIMITED and the Registrar to this issue is BIGSHARE SERVICES PRIVATE LIMITED.

Open Free* Demat A/C Now! Fill the details below

Mac Hotels Limited IPO Date

The opening and the closing date of IPO of Mac Hotels is 19 Sept 2018 – 25 Sept 2018.

Mac Hotels Limited IPO Subscription

| Subscription | |

| Day 1:19 Sept 2018 | X |

| Day 2 : 20 Sept 2018 | X |

| Day 3 | X |

| Day 4 | X |

| Day 5 | X |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

Mac Hotels Limited IPO Allotment Status

Here, you can find the Allotment Status of this IPO.

Mac Hotels Limited IPO Price Band

The face value of each share is Rs 10, and the price band of the IPO is Rs. 24.

Mac Hotels IPO Equity Share Offering

8,10,000 Equity Shares of Rs 10/- each, Issue Price is is Rs. 24, aggregated to up to Rs 1.94 Crores.

Open Free Demat Account Now!

Mac Hotels Limited – Company Overview

Originally incorporated as “Mac Hotels Private Limited” , Mac Hotels is settled in Panaji, Goa. The Company was converted into Public Company and the name of this Company was changed to “Mac Hotels Limited” in the year 2017. Since then, the company has developed and marked its positions among the top hotels and resorts in India. the company is also the subsidiary company of Hotel Miramar Comfort Private Limited which holds 88.27% of equity shares in the Company as on date of this Draft Prospectus.

Competitive Strengths of Mac Hotels Limited:

- Experienced Management Team

- Quality of Services

- Locational Advantage

- Food and Beverages.

Business strategies of Mac Hotels Limited:

- Improving the functional efficiency

- Customer Satisfaction

- Brand Image

- Leveraging the market skills and relationship

Mac Hotels Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | |||||

| 31-Dec-17 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | |

| Total Assets | 575.15 | 563.78 | 301.09 | 259.04 | 265.69 |

| Total Revenue | 239.77 | 310.13 | 188.32 | 193.10 | 141.76 |

| Total Expense | 228.20 | 290.17 | 179.83 | 185.48 | 132.30 |

| Profit After Tax | 8.00 | 13.05 | 8.43 | 8.76 | 8.83 |

Earnings per Equity Share (in Lakhs)

| 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | |

| Basic | 7.86 | 5.03 | 4.43 |

| Diluted | 7.86 | 5.03 | 4.43 |

From the above statements, one could find that the Mac Hotels Limited may perform well.

Mac Hotels Limited IPO – Promoters

The Promoter of this company are:

- Edgar Cotta

- Edwin Cotta

- Hotel Miramar Comfort Private Limited

List of Related Parties (Key Managerial Personnel)

- Mr. Blaise Lawrence Costabir

- Mr. Ephrem Frederick Mendanha

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

Mac Hotels Limited IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | 8,10,000 Equity Shares of Rs 10/- each at an Issue Price |

| Of which: | |

| Reserved for Market Makers | 42,000 Equity Shares of Rs 10/- each at an issue price. |

| Net Issue to the Public | 7,68,000 Equity Shares of Rs 10/- each at an issue price. |

| Of which: | |

| Retail Investors Portion | 3,84,000 Equity Shares of Rs 10/- each at an Issue Price |

| Non-Retail Investors Portion | __ Equity Shares of Rs 10/- each at an Issue Price. |

| Equity Shares outstanding prior to the Issue | 30,00,000 Equity Shares of Rs 10/- each |

| Equity Shares outstanding after the Issue | 30,00,000 Equity Shares of Rs 10/- each |

Mac Hotels IPO Issue Object

These are the IPO Issue Objects of the company

- Public Offer Expense

- Monitoring Utilization of Funds

- Issue Expenses

Mac Hotels Limited IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Well Experienced Management

- Quality assurance

- Location advantage

- Food & Beverages Services

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW (%) | NAV (Rs.) | |

| 31-Mar-15 | 2.69 | 66.02% | NA |

| 31-Mar-16 | 2.59 | 38.85% | NA |

| 31-Mar-17 | 3.84 | 4.32% | 10.07 |

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | NA |

| Highest | NA |

| Lowest | NA |

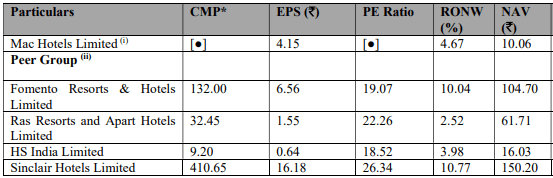

- Competitive Peers:

Mac Hotels IPO Lead Managers

| Lead Managers |

| GRETEX CORPORATE SERVICES PRIVATE LIMITED

Registered Office: Office no.102, 1st Floor, Kanakia Atrium-2, Chakala Andheri Kurla Road, Behind Courtyard Marriot, Mumbai – 400093 Tel No.: +91 – 33 – 40069278, Fax No.: +91 – 33 – 40069278 SEBI Registration No: INM000012177 Email:info@gretexgroup.com, Website:www.gretexcorporate.com Contact Person: Ms. Kritika Rupda |

Mac Hotels IPO Registrar to offer

| Registrar to the Offer |

| BIGSHARE SERVICES PRIVATE LIMITED

1st Floor, Bharat Tin Works Building, Opp. Vasant Oasis, Makwana Road, Marol, Andheri East, Mumbai – 400 059 Tel: +91 22 62638200, Fax: +91 22 62638299 Email: ipo@bigshareonline.com, Website: www.bigshareonline.com Investor Grievance Id: investor@bigshareonline.com Contact Person: Nilesh S Chalke SEBI Registration Number: INR000001385 |

Other Details:

- Statutory Auditor – Milind Kulkarni & Associates, Chartered Accountants.

- Peer Review Auditor – M/s N. K. Aswani & Co.

- Bankers to the Company – ICICI Bank Limited

Mac Hotels IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

Mac Hotels IPO Grey Market Premium

The Mac Hotels IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Open Free* Demat A/C Now! Fill the details below

Mac Hotels IPO News

News 1 – IPO ISSUE OPENS SOON (Download Prospectus)

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics