Hinduja Leyland Finance IPO – Review, Allotment, Subscription, Price, Date & more

Last Updated Date: Nov 17, 2022The Hinduja Leyland Finance is a multi-billion dollar vehicle finance NBFCs in India with a focus on urban and semi-urban markets. The Company has issued 30,682,475 Equity shares of Rs.10 each. Let’s have a detailed review of the company and analytics of the Hinduja Leyland Finance IPO release date, IPO offer price, subscription, Hinduja Leyland Finance IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

Hinduja Leyland Finance IPO Review & Ratings

| Hinduja Leyland Finance IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.3/10 |

| Industry Ranking | 6.3/10 |

| Company Background | 6.1/10 |

| Company Reputation | 6.4/10 |

| Competitive Edge | 6.4/10 |

| Financial Statements | 6.5/10 |

| Popularity Index | 6.2/10 |

| Promoters Reputation | 6.3/10 |

| Retail Appetite | 6.2/10 |

| Top Brokers Review | 6.3/10 |

| Overall Ratings | 6.3/10 |

| Star Ratings | ★★★☆☆ |

Summary of Hinduja Leyland Finance IPO

Hinduja Leyland Finance is a leading vehicle finance NBFCs in India with a focus on urban and semi-urban markets. The Company provides retail finance through a wide range of vehicle financing and housing finance products. The assets of the company under management have grown at a CAGR of 48.30% from ₹ 41,370.54 million as of March 31, 2014 to ₹ 200,091.66 million as of March 31, 2018. The company finance a wide range of commercial and personal vehicles, which include medium and heavy commercial vehicles (“MHCVs”), light commercial vehicles (“LCVs”), small commercial vehicles (“SCVs”), cars, multiutility vehicles, tippers, three wheelers, and two-wheelers, tractors and construction equipment including used vehicles. The Issue comprises of a Public Issue of 30,682,475 Equity shares of face value of Rs1 0 each fully paid (the “Equity Shares”) for cash at a price of Rs X million (including a premium of Rs.X per Equity Share) aggregating to Rs Rs5,000 million.

Hinduja Leyland Finance is a leading vehicle finance NBFCs in India with a focus on urban and semi-urban markets. The Company provides retail finance through a wide range of vehicle financing and housing finance products. The assets of the company under management have grown at a CAGR of 48.30% from ₹ 41,370.54 million as of March 31, 2014 to ₹ 200,091.66 million as of March 31, 2018. The company finance a wide range of commercial and personal vehicles, which include medium and heavy commercial vehicles (“MHCVs”), light commercial vehicles (“LCVs”), small commercial vehicles (“SCVs”), cars, multiutility vehicles, tippers, three wheelers, and two-wheelers, tractors and construction equipment including used vehicles. The Issue comprises of a Public Issue of 30,682,475 Equity shares of face value of Rs1 0 each fully paid (the “Equity Shares”) for cash at a price of Rs X million (including a premium of Rs.X per Equity Share) aggregating to Rs Rs5,000 million.

The Promoter of this company are Ashok Leyland Limited, Hinduja Ventures Limited, Aasia Corporation LLP, Mr. S Nagarajan , and Hinduja Power Limited. The lead manager to the issue are Axis Capital Limited, City Grouo Global Marketers India Private Limited, and YES Securities Limited. The Registrar to this issue is Karvy Computershare Private Limited.

Open Free* Demat A/C Now! Fill the details below

Hinduja Leyland Finance IPO Date

The opening and the closing date of IPO of Hinduja Leyland Finance is not known yet.

Hinduja Leyland Finance IPO Subscription

| Subscription | |

| Day 1 | X |

| Day 2 | X |

| Day 3 | X |

| Day 4 | X |

| Day 5 | X |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

Hinduja Leyland Finance IPO Allotment Status

The Issue is being made through the Fixed Price Process wherein up to 30,682,475 Equity Shares shall be reserved for Market Maker upto X Equity shares will be allocated on a proportionate basis to Retail Individual Applicants, subject to valid applications being received from Retail Individual Applicants at the Issue Price. The balance of the Net Issue will be available for allocation on proportionate basis to Non Retail Applicants.

Hinduja Leyland Finance IPO Price Band

The face value of each share is Rs 10, but the price band of the IPO is not yet disclosed.

Hinduja Leyland Finance IPO Equity Share Offering

30,682,475 Equity Shares of Rs 10 each but Issue Price is yet to be disclosed so it will be aggregated to Rs 5,000 million.

Open Free Demat Account Now!

Hinduja Leyland Finance – Company Overview

Hinduja Leyland is the leading vehicle finance NBFCs in India with a focus on urban and semi-urban markets (Source: CRISIL Report). They provide retail finance through a wide range of vehicle financing and housing finance products. The assets under management (“AUM”) have grown at a CAGR of 48.30% from ₹ 41,370.54 million as of March 31, 2014 to ₹ 200,091.66 million as of March 31, 2018.

The Compny commenced its housing finance business in Fiscal 2016 through wholly-owned subsidiary, Hinduja Housing Finance Limited, which focuses on providing finance for housing loans including affordable housing loans. As of March 31, 2018, retail mortgage loans (comprising the comoany’s home loans and loans against property) represented 14.95% of the total AUM. The company also extend loans to other NBFCs that provide financing products including microfinance, vehicle loans, affordable housing, and MSME loans

Competitive Strengths of Hinduja Leyland Finance:

- Track record of business growth and consistent financial performance

- Synergy with ALL and parentage of the Hinduja group

- Experienced and proven leadership supported by a senior management team

- Wide range of assets financed and a geographically diversified AUM with a focus on urban and semi-urban

markets - Expansive and cost effective operational network

- Independent risk management processes for credit analysis and underwriting

Business strategies of Hinduja Leyland Finance

- Leverage the sourcing channels through ALL, other motor vehicle OEMs and automotive dealers

- Continue to diversify the asset portfolio

- Leverage the existing network and customer base to cross-sell the products

- Continue to streamline the operational network and improve operating efficiencies

- Explore various financing options to rationalize funding cost

Hinduja Leyland Finance- Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | |||||

| 31-Mar-18 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | |

| Total Assets | 154,938.09 | 115,618.69 | 87,785.55 | 59,814.69 | 38,453.06 |

| Total Revenue | 19,723.65 | 15,023.46 | 11,516.31 | 8,205.33 | 6,399.95 |

| Total Expense | 16,353.18 | 12,541.08 | 9,356.97 | 6,728.67 | 5,252.50 |

| Profit After Tax | 2,223.13 | 1,599.29 | 1,443.68 | 999.38 | 765.79 |

Earnings per Equity Share (in Lakhs)

| 31-MAr-18 | 31-Mar-17 | 31-Mar-16 | |

| Basic | 5.14 | 4.12 | 3.81 |

| Diluted | 5.14 | 4.12 | 3.81 |

From the above statements, one could find that the Hinduja Leyland Finance may perform well.

Hinduja LEyland Finance IPO – Promoters

The Promoter of this company are:

- Ashok Leyland Limited

- Hinduja Ventures Limited

- Aasia Corporation LLP

- Mr. S Nagarajan

- Hinduja Power Limited

List of Related Parties (Key Managerial Personnel)

- Mr S. Nagarajan

- Mr Dheeraj G Hinduja

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

Hinduja Leyland Finance IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | 30,682,475 Equity Shares of Rs 10/- each at an Issue Price (yet to be disclosed aggregating to 5,000 million |

| Of which: | |

| Reserved for Market Makers | X Equity Shares of Rs 10/- each at an issue price. |

| Net Issue to the Public | X Equity Shares of Rs 10/- each at an issue price. |

| Of which: | |

| Retail Investors Portion | XEquity Shares of Rs 10/- each at an Issue Price |

| Non-Retail Investors Portion | X Equity Shares of Rs 10/- each at an Issue Price. |

| Equity Shares outstanding prior to the Issue | 456,494,968 Equity Shares of Rs 10/- each |

| Equity Shares outstanding after the Issue | X Equity Shares of Rs 10/- each |

Hinduja Leyland Finance IPO Issue Object

These are the IPO Issue Objects of the company

- Utilisation of the proceeds of the Fresh Issue

- Schedule of Implementation and Deployment of Funds

Hinduja Leyland Finance IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Track record of business growth and consistent financial performance

- Synergy with ALL and parentage of the Hinduja group

- Experienced and proven leadership supported by a senior management team

- Wide range of assets financed and a geographically diversified AUM with a focus on urban and semi-urban markets

- Expansive and cost effective operational network

- Independent risk management processes for credit analysis and underwriting.

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW (%) | NAV (Rs.) | |

| 31-Mar-18 | 5.14 | 10.47% | 49.15 |

| 31-Mar-17 | 4.12 | 11.04% | 37.35 |

| 31-Mar-16 | 3.81 | 13.95% | 27.33 |

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | 29.35 |

| Highest | 26.15 |

| Lowest | 23.23 |

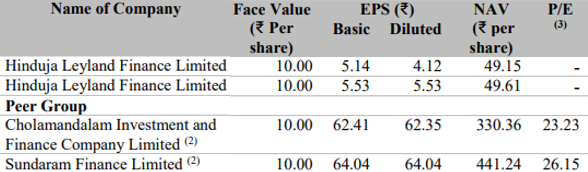

- Competitive Peers

Hinduja Leyland Finance IPO Lead Managers

| Lead Managers |

| Axis Capital Limited,

Citigroup Global Markets India Private Limited, YES Securities (India) Limited |

Hinduja Leyland Finance IPO Registrar to offer

| Registrar to the Offer |

| Karvy Computershare Private Limited Karvy Selenium Tower B, Plot 31 and 32, Gachibowli Financial District, Nanakramguda, Hyderabad 500 032, Telengana, India Tel: +91 40 6716 2222, Fax: +91 40 2343 1551 E-mail: hlf.ipo@karvy.com Investor Grievance E-mail: hlf.ipo@karvy.com Website: www.karisma.karvy.com, Contact Person: Murali Krishna SEBI Registration No.: INR000000221 |

Other Details:

- Statutory Auditor – M/s B S R & Co. LLP, Chartered Accountants

- Peer Review Auditor – B S R & Co. LLP Chartered Accountants

- Bankers to the Company – Axis Bank, City Bank, YES Securities

Hinduja Leyland Finance IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

Hinduja Leyland Finance IPO Grey Market Premium

The Hinduja Leyland Finance IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Open Free* Demat A/C Now! Fill the details below

Hinduja Leyland Finance IPO News

News 1 – IPO ISSUE OPENS SOON (Download Prospectus)

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics