HDFC AMC IPO – Review, Allotment, Subscription, GMP Price, Date & more

Last Updated Date: Aug 21, 2023HDFC AMC IPO or HDFC Asset Management Company IPO is the latest IPO drafted under SEBI. The IPO issue size is Rs. 2,800.33 Crores with Equity shares offering of 25,457,555 crores approx & the price band is Rs 1095 – Rs 1100 per share.

In this article, we will have a detailed HDFC AMC IPO Review along with in-depth analysis of this IPO’s Object, Offerings, Companies Financials, Companies reputation, Allotment Status, Grey Market pricing, Release Date, Price & more.

- Issue Price of this IPO is Rs 1095 – Rs 1100. Check the Live Share Price here HDFC AMC Share Price

- To track the performance of this IPO, click on this link – IPO Performance

HDFC AMC IPO Review & Ratings

- Good for Short Term & Long Term Investment

| HDFC AMC IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 9.0/10 |

| Industry Ranking | 9.3/10 |

| Company Background | 9.5/10 |

| Company Reputation | 9.0/10 |

| Competitive Edge | 9.5/10 |

| Financial Statement | 9.0/10 |

| Popularity Index | 9.3/10 |

| Promoters Reputation | 9.5/10 |

| Retail Appetite | 9.6/10 |

| Top Brokers Review | 9.5/10 |

| Overall Ratings | 9.3/10 |

| Star Ratings | ★★★★★ |

Summary – HDFC AMC IPO

Lets have a short summary of HDFC AMC IPO. HDFC Asset Management IPO is commonly known as HDFC Mutual Fund IPO. It is one of most famous IPO of 2018 drafted with SEBI. This IPO has been on March 16th 2018.

HDFC AMC has hired multiple companies as its Book Running Lead Managers like Kotak Mahindra Capital, Axis Capital, DSP Merill Lynch Limited, CITIGroup Global Markets, CLSA India, HDFC Bank Limited, ICICI Securities Limited, IIFL Holdings Limited, JM Financial Limited, JP Morgan India, Morgan Stanley India, Nomura Financial Advisory.

HDFC AMC has hired multiple companies as its Book Running Lead Managers like Kotak Mahindra Capital, Axis Capital, DSP Merill Lynch Limited, CITIGroup Global Markets, CLSA India, HDFC Bank Limited, ICICI Securities Limited, IIFL Holdings Limited, JM Financial Limited, JP Morgan India, Morgan Stanley India, Nomura Financial Advisory.

Other than this, they have hired Karvy Computershare Private Limited as their Registrar of the offer.

HDFC AMC is a joint venture between HDFC & Standard Life Investments Limited (SLI). The Company is delivering Asset Management Services like Mutual Funds Investment, Portfolio Management & Segregated Account Services for HNI’s.

The Company has a massive client base of 7.61 million Live accounts. They offer 127 Mutual Fund Schemes. HDFC AMC has a total AUM of INR 2932.54 billion in Dec, 2017. The AMC is one of the largest mutual fund investment providers in the country.

Open Free* Demat A/C Now! Fill the details below

HDFC AMC IPO Date

IPO issue Date is – July 25, 2018 – July 27, 2018

HDFC AMC IPO Subscription

| Subscription | |

| Day 1 – July 25, 2018 | 1.03X (19396884 shares) |

| Day 2 – July 26, 2018 | 5.52X (103877982 shares) |

| Day 3 – July 27, 2018 | 82.99X (1560636688 shares) |

| Day 4 | – |

| Day 5 | – |

HDFC AMC IPO Allotment Status

Here, you can find the Allotment Status of this IPO. Please check the IPO allotment status post issue of IPO.

OR

Click this BSE link to check ALLOTMENT if the above link is too busy or not functioning now.

HDFC AMC IPO Price Band

The Face value is Rs 5 only and the price band of the IPO will be in the range of Rs 1095 – Rs 1100.

HDFC AMC IPO Issue Size

The IPO Issue size is expected to be close to INR 2,800.33 Crores.

HDFC AMC IPO Equity Share Offerings

The equity shares under offering is 25,457,555 Equity Shares of Rs 5 aggregating up to Rs 2,800.33 Cr with a minimum order quantity of 13 shares. The share are listed on BSE and NSE.

HDFC Asset Management Company – Company Overview

HDFC AMC is one of the largest mutual fund house in the country. The Company is headquartered in Mumbai. The Financial company was approved to work as an Asset Management Company of the HDFC Mutual Fund by SEBI in June 2000. Some of the key members of the company are –

- Piyush Surana (CFO)

- V. Suresh Babu (Head of Operations)

- Anil Kumar Hirjee (Chairman)

Let’s understand about companies key strategies –

- Maintain strong investment performance

- Expand our reach and distribution channels

- Enhance product portfolio

- Invest in digital platforms to establish leadership in the growing digital

Companies Competitive Edge –

- Consistent market leadership position in the Indian mutual fund industry.

- Trusted brand and strong parentage

- Strong investment performance supported by comprehensive investment philosophy and risk management

- Superior and diversified product mix distributed through a multi-channel distribution network

- Focus on individual customers and customer centric approach

- Consistent profitable growth

- Experienced and stable management and investment teams

Read about other IPO Reviews

| Capricorn Food Products IPO | Energy Efficiency Services IPO | Nazara Technologies IPO | Anmol Industries IPO |

| Sorich Foils IPO | Accuracy Shipping IPO | ICL Multitrading IPO | Sirca Paints IPO |

HDFC Asset Management Company – Financial Statement

Let’s check some of the important metric to analyse their financial power-

Assets of the Company

| Assets (in Millions) | |||||

| Mar’17 | Mar’16 | Mar’15 | Mar’14 | Mar’13 | |

| Non-Current Assets | 2,808 | 3,034 | 3,841 | 2,910 | 1,405 |

| Current Assets | 13,188 | 11,193 | 9,277 | 8,303 | 6,890 |

| Total Assets | 15,996 | 14,227 | 13,118 | 11,213 | 8,294 |

Revenue & PAT of the Company

| Revenue & Profits (in Millions) | |||||

| Mar’17 | Mar’16 | Mar’15 | Mar’14 | Mar’13 | |

| Total Revenue | 15,879 | 14,943 | 10,643 | 9,031 | 7,840 |

| Profit After Tax (PAT) | 5,502 | 4,779 | 4,155 | 3,578 | 3,187 |

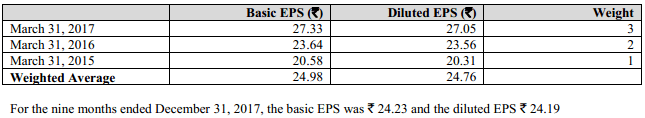

Earnings per Equity Share

| Earnings per Equity Share (Face Value Rs.5 per Share) | |||||

| Basic | 27.33 | 23.64 | 20.58 | 17.71 | 15.80 |

| Diluted | 27.05 | 23.56 | 20.31 | 17.60 | 15.75 |

The Companies growth in terms of Revenue & PAT has been significant. There is a 2x growth in companies revenue in last 5 years & close to 1.7x growth in PAT.

HDFC AMC Promoters

Two large conglomerate are the promoters of HDFC Asset management company.

- HOUSING DEVELOPMENT FINANCE CORPORATION LIMITED

- STANDARD LIFE INVESTMENTS LIMITED

1st is HDFC & 2nd Standard Life Investments. Both the promoters are extremely big in terms of Brand & Financials & are known to be one of the large firms in their respective country. As on 16th march 2018, HDFC holds 120,772,800 shares & SLI holds 80,515,200 shares i.e. 57.36% & 38.24% respectively of HDFC AMC.

Promoters Holdings:

| Promoters | ||

| Pre-issued Equity | Percentage | |

| HDFC Ltd. | 120,772,800 | 57.36% |

| Standard Life Investments | 80,515,200 | 38.24% |

HDFC AMC IPO Offer Details or IPO issue Details

Check the Table below for detailed understanding of the HDFC AMC IPO Offer:

| Offer | Up to 25,457,555 Equity Shares |

| of which | |

| Reservation Portions | |

| HDFC AMC Employee Reservation Portion | Up to 320,000 Equity Shares |

| HDFC Employee Reservation Portion | Up to 560,000 Equity Shares |

| HDFC Shareholders Reservation Portion | Up to 2,400,000 Equity Shares |

| Net Offer | Up to 22,177,555 Equity Shares |

| Accordingly, | |

| A. QIB Portion | Up to 11,088,776 Equity Shares |

| of which | |

| Anchor Investor Portion | Up to 6,653,265 Equity Shares |

| Balance available for allocation to QIBs other than Anchor Investors (assuming Anchor Investor Portion is fully subscribed) | Up to 4,435,511 Equity Shares |

| of which | |

| Available for allocation to Mutual Funds only is 5% of the QIB Portion (excluding the Anchor Investor Portion) | Up to 221,776 Equity Shares |

| Balance of the QIB portion for all QIBs including Mutual Funds | Up to 4,213,735 Equity Shares |

| B. Non-Institutional Portion | Not less than 3,326,634 Equity Shares |

| C. Retail Portion | Not less than 7,762,145 Equity Shares |

The Retail portion of this IPO will be offered & allotted to the individual investors.

HDFC AMC IPO Issue Objects

Following are the Objects of the HDFC AMC IPO issue:

- Achieve the benefits of listing the Equity Shares in the Stock Exchages

- Listing of Shares in the Stock Exchange will enhance the visibility & Brand image of the Company

Read about new IPO Reviews

| Genius Consultants IPO | Gandhar Oil Refinery IPO | Dinesh Engineers IPO | Bharat Serum IPO |

| Varroc Engineering IPO | National Insurance IPO | Garden Reach Shipbuilders IPO | ReNew Power IPO |

HDFC Asset Management Company IPO – Basis of Offer Price

The offer price of the IPO is determined by the Company & Selling Shareholders in consultation with BRLMs on the basis of market demand of the equity offered. The Qualitative & Quantitative factors involved while determining the IPO offer price are:

Qualitative Factors

Some of the qualitative factors which form the basis for computing the Offer Price are:

- Consistent market leadership position in the Indian mutual fund industry;

- Trusted brand and strong parentage;

- Strong investment performance supported by comprehensive investment philosophy and risk management;

- Superior and diversified product mix distributed through a multi-channel distribution network;

- Focus on individual customers and customer centric approach;

- Consistent profitable growth; and

- Experienced and stable management and investment teams.

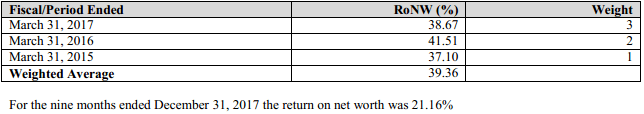

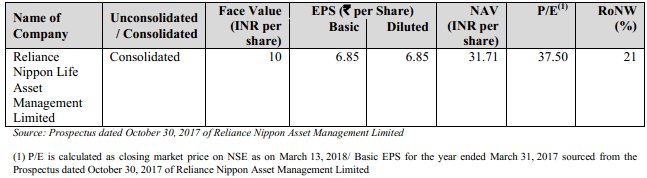

Quantitative Factors:

- Basic and diluted earnings per share (“EPS”)

- Price/Earning (“P/E”) ratio in relation to Price Band

- Average Return on Net Worth (RoNW)

- Net asset value per Equity Share (face value of Rs.5 each) – Mar, 2017 value was Rs.70.68

- Comparison with listed industry peers

Other Important Details:

Important dates:

- Finalization of Basis of Allotment: Around Aug 1, 2018

- Initiation of refunds: Around Aug 2, 2018

- Credit of Shares to Demat accounts: Around Aug 3, 2018

- Commencement of trading on the Stock Exchanges: Around Aug 6, 2018

Read about more IPO Reviews

| IRCON International IPO | Kalyan Jewellers IPO | KPR Agrochem IPO | Seven Islands Shipping IPO |

| Atria Convergence Technologies IPO | Lite Bite Foods IPO | Nekkanti Seafoods IPO | SREI Equipment Finance IPO |

HDFC AMC IPO – Lead Managers

| Lead Managers |

| Kotak Mahindra Capital Company Limited |

| Axis Capital Limited |

| DSP Merill Lynch Limited |

| CitiGroup Global Markets India Private Limited |

| CLSA India Private Limited |

| HDFC Bank Limited |

| ICICI Securities Limited |

| IIFL Holdings Limited |

| JM Financial Limited |

| JP Morgan India Private Limited |

| Morgan Stanly India Company Private Limited |

| Namura Financial Advisory & Securities (India) Private Limited |

HDFC Mutual Fund IPO Registrar of the Offer

| Registrar of the Offer |

| Karvy Computershare Private Limited |

HDFC AMC IPO Grey Market Premium

Grey Market Premium is Rs 460-470 and the Kostak Rate is Rs 1800 and Subject to Sauda at Rs 5300.

HDFC AMC IPO Review by Top Stock Brokers

Here is the tabular representation of IPO review by top equity research firms on 5 major parameters.

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 9.0/10 | 9.5/10 | 9.0/10 | 9.3/10 | 9.5/10 |

| Sharekhan | 9.1/10 | 9.6/10 | 8.8/10 | 9.5/10 | 9.7/10 |

| Kotak Securities | 9.3/10 | 9.5/10 | 8.9/10 | 9.5/10 | 9.6/10 |

| ICICI Direct | 9.2/10 | 9.3/10 | 9.2/10 | 9.4/10 | 9.4/10 |

| IIFL | 9.6/10 | 9.5/10 | 9.2/10 | 9.0/10 | 9.5/10 |

| Edelweiss | 9.5/10 | 9.5/10 | 9.1/10 | 9.3/10 | 9.6/10 |

| Zerodha | 9.2/10 | 9.4/10 | 9.0/10 | 9.1/10 | 9.5/10 |

| 5Paisa | 9.3/10 | 9.6/10 | 8.8/10 | 9.5/10 | 9.3/10 |

| Karvy | 9.1/10 | 9.3/10 | 8.7/10 | 9.6/10 | 9.5/10 |

| Motilal Oswal | 9.4/10 | 9.5/10 | 8.9/10 | 9.3/10 | 9.4/10 |

Open Free* Demat A/C Now! Fill the details below

IPO News

News 1 – HDFC AMC files draft papers for IPO with Sebi

News 2 – Download Prospectus

Market Guide –