GKP Printing & Packaging IPO – Allotment, Subscription, GMP & DRHP

Last Updated Date: Nov 17, 2022Let’s have a detailed review of the company and analytics of the GKP Printing & Packaging IPO release date, GKP IPO offer price, subscription, GKP Printing & Packaging IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

G. K. P. Printing & Packaging engaged in the manufacturing of corrugated boxes. This company deals in various types of corrugated boxes such as master cartons, mono cartons, Honey comb partition boxes, Die cut self-locking boxes, storage bins, adjustable depth book flap, Ring flap boxes and unit cartons.

- Issue Price of this IPO is NA . Check the Live Share Price here GKP Printing Share Price

- To track the performance of this IPO, click on this link – IPO Performance

GKP Printing & Packaging IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.5/10 |

| Industry Ranking | 7.8/10 |

| Company Background | 7.9/10 |

| Company Reputation | 7.9/10 |

| Competitive Edge | 6.7/10 |

| Financial Statements | 6.8/10 |

| Popularity Index | 6.4/10 |

| Promoters Reputation | 7.7/10 |

| Retail Appetite | 6.9/10 |

| Top Brokers Review | 7.9/10 |

| Overall Ratings | 7.1/10 |

| Star Ratings | ★★★★☆ |

Summary of GKP Printing & Packaging IPO

G. K. P. Printing & Packaging engaged in the manufacturing of corrugated boxes. This company deals in various types of corrugated boxes such as master cartons, mono cartons, Honey comb partition boxes, Die cut self-locking boxes, storage bins, adjustable depth book flap, Ring flap boxes and unit cartons.

G. K. P. Printing & Packaging engaged in the manufacturing of corrugated boxes. This company deals in various types of corrugated boxes such as master cartons, mono cartons, Honey comb partition boxes, Die cut self-locking boxes, storage bins, adjustable depth book flap, Ring flap boxes and unit cartons.

It is also engaged in the trading of Kraft paper, Duplex paper and Low – Density Plastic Rolls (LD Rolls). Initial public offering of up to 20,56,000 Equity Shares of face value of Rs.10/- each fully paid up of the Company for cash at price of Rs. 32/- per Equity Share aggregating Rs. 657.92 lakhs. The Issue and the Net Issue will constitute 28.04% and 26.62% respectively of the Post Issue Paid up Equity Share Capital of the company.

For 30th Sept 2018, as per the Restated Financial Statements,

- The revenue from operations in Fiscal 2018 as on Sept 30, 2018 is Rs. 1327.57 lakhs.

- The Net worth as restated is Rs 571.30 lakhs, as per the Restated Standalone Financial Statements.

- The net asset value per Equity Share was Rs. 15.38 and Rs. 22.62 as of Sept 30, 2018 and March 31, 2018, respectively, as per the Restated Standalone Financial Statements.

- Profit after Tax for FY 2017-18 Sept 30, is Rs. 199.81 lakhs.

The Promoters of this company are Mr. Keval Harshad Goradia and Mrs. Payal Keval Goradia. The lead manager to the issue is Holani Consultants Private Limited and the Registrar to this issue is Link Intime India Private Limited.

Open Free* Demat A/C Now! Fill the details below

GKP Printing & Packaging IPO Dates

The opening and the closing date of GKP Printing & Packaging IPO is Apr 23, 2019 – Apr 26, 2019.

GKP Printing & Packaging IPO Subscription

| Day / Date | QIB | NII | RII | Total Subscription |

| 1st Day – Apr 23 | – | 0.11x | 0.05x | 0.08x |

| 2nd Day – Apr 24 | – | 0.11x | 0.18x | 0.15x |

| 3rd Day – Apr 25 | – | 1.51x | 0.61x | 1.06x |

| 4th Day – Apr 26 | – | 1.54x | 1.56x | 1.56x |

| Shares Offered or Net Issue | – | 976,000 | 976,000 | 1,952,000 |

The shares subscribed by the public will be updated here.

GKP Printing & Packaging IPO Allotment Status

Here, you can find the Allotment Status of this IPO.

| Basis of Allotment Finalization | 3-May-19 |

| Refunds Initiation | 6-May-19 |

| Credit of Shares to Demat Account | 7-May-19 |

| Share Listing Date | 8-May-19 |

GKP Printing & Packaging IPO Price Band

The face value of each share is Rs 10, but the price band of the IPO is not yet disclosed.

GKP Printing & Packaging IPO Equity Share Offering

Initial public offering of upto 20,56,000 Equity Shares of face value of Rs.10/- each fully paid up of the Company for cash at price of Rs. 32/- per Equity Share aggregating Rs. 657.92 lakhs.

G. K. P. Printing & Packaging Limited – Company Overview

G. K. P. Printing & Packaging Limited was originally incorporated on April 3rd, 2018 as a Public Limited Company under the name and style of “G. K. P. Printing & Packaging Limited” under the provisions of the Companies Act, 2013 with the Registrar of Companies, Mumbai, Maharashtra.

G. K. P. Printing & Packaging engaged in the manufacturing of corrugated boxes. This company deals in various types of corrugated boxes such as master cartons, mono cartons, Honey comb partition boxes, Die cut self-locking boxes, storage bins, adjustable depth book flap, Ring flap boxes and unit cartons.

It is also engaged in the trading of Kraft paper, Duplex paper and Low – Density Plastic Rolls (LD Rolls). Kraft paper and Duplex papers are the primary raw material in corrugated boxes manufacturing and their trading provides the benefits of backward integration to the company by enabling them to procure raw material at very competitive prices as compared to other manufacturers of the corrugated boxes. The company is registered with the Ministry of MSME as a manufacturer of corrugated paper containers.

This company is also well equipped with in house testing equipment’s for the testing of raw material and finished products which enable their company to deliver quality products as per the specification of the clients.

Competitive Strengths of G. K. P. Printing & Packaging Limited:

- Well established manufacturing facilities

- Experienced Management and Operational Team

- Existing relationship with the clients

- Wide array of Quality Products and Services

- Focus on quality

Business strategies of G. K. P. Printing & Packaging Limited:

- Invest in infrastructure and technology

- Expanding their customer base

- Improving functional efficiency

- Enhancing existing products base and product quality

G. K. P. Printing & Packaging Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

On the basis of Standalone statement:-

| Amount (in INR & Lakhs) | ||||

| 31-April-18 | 31-Mar-18 | 31-Mar-17 | 31-Mar-16 | |

| Total Assets | 1,021.69 | 1,021.69 | 635.22 | 346.13 |

| Total Revenue | – | 1,407.70 | 569.02 | 511.51 |

| Profit After Tax | – | 54.71 | 24.95 | 25.12 |

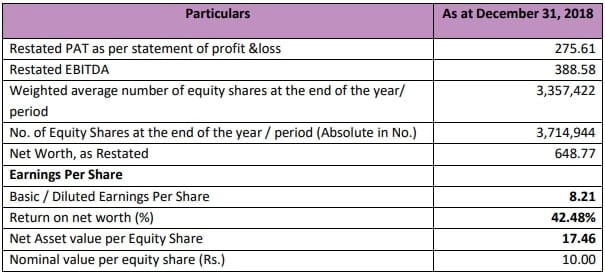

OTHER FINANCIAL INFORMATION AS RESTATED – (in lakhs)

From the above statements, one could find that the G. K. P. Printing & Packaging Limited may perform well.

GKP Printing & Packaging IPO – Promoters

The Promoters of this company are:

- Mr. Keval Harshad Goradia

- Mrs. Payal Keval Goradia

Promoter Holdings:

- Pre Issue Share Holding is around 73.57%

- Post Issue Share Holding is around 53.50%

List of Related Parties (Key Managerial Personnel)

- Keval Harshad Goradia- Promoter and Managing Director

- Pooja Harshad Goradia-Whole-Time Director and Chief Financial Officer

- Manoj Valjibhai Ayadi- company Secretary and compliance officer

Interest in promotion of the Company

Company is currently promoted by the Promoters in order to carry on its present business. Promoters are interested in the Company to the extent of their shareholding and directorship of the Individual Promoter in the Company and the dividend declared, if any, by the Company. The Promoters are interested in the transactions entered into the Company and the Promoter Group.

Property Interest

The promoters along with the promoter group will continue to hold collectively some percentage of the equity share capital of the company. As a result of the same, they will be able to exercise significant influence over the control of the outcome of the matter that requires approval of the majority shareholders vote.

Interest in Intellectual Rights of the Company

Promoters has not shown any interest in acquiring the intellectual rights of the company.

GKP Printing & Packaging IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | 20,56,000 Equity Shares of face value of Rs.10/- each fully paid up of the Company for cash at price of Rs. 32/- per Equity Share aggregating Rs. 657.92 lakhs |

| Of which: | |

| Reserved for Market Makers | 1,04,000 Equity Shares of face value of Rs. 10/- each fully paid up of the Company for cash at price of Rs. 32 /- per Equity Share aggregating Rs. 33.28 lakhs |

| Net Issue to the Public | 19,52,000 Equity Shares of face value of Rs.10/- each fully paid up of the Company for cash at price of Rs. 32/- per Equity Share aggregating Rs. 624.64 lakhs |

| Of which: | |

| Retail Investors Portion | 9,76,000 Equity Shares of face value of Rs. 10/- each fully paid up of the Company for cash at price of Rs. 32/- per Equity Share aggregating Rs. 312.32 lakhs will be available for allocation for allotment to Investors of up to Rs. 2 lakhs |

| Non-Retail Investors Portion | 9,76,000 Equity Shares of face value of Rs. 10/- each fully paid up of the Company for cash at price of Rs. 32/- per Equity Share aggregating Rs. 312.32 lakhs will be available for allocation to investors above Rs. 2 lakhs |

| Equity Shares outstanding prior to the Issue | 52,76,944 Equity Shares |

| Equity Shares outstanding after the Issue | Upto 73,32,944 Equity Shares of face value of Rs. 10 each |

GKP Printing & Packaging IPO Issue Object

These are the IPO Issue Objects of the company

- Funding the Working Capital requirements of the Company

GKP Printing & Packaging IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Well established manufacturing facilities

- Experienced Management and Operational Team

- Existing relationship with the clients

- Wide array of Quality Products and Services

- Focus on quality

The relevant quantitative factors are:

On the basis of standalone statement:-

| Basic & Diluted EPS | RONW in % | NAV (Rs.) | |

| 31-Mar-17 | – | – | – |

| 31-Mar-18 | – | – | 22.62 |

| 31-Sept-18 | 6.29 | 34.97 |

15.38 |

- Pre-Issue Price to Earnings (P/E) ratio in relation to Issue price of Rs. 32/- per Equity Share of Rs. 10/- each fully paid up:

| Particulars | P/E ratio |

| Highest | 19.81 |

| Average | 15.92 |

| Lowest | 12.04 |

- Competitive Peers:

| Sr. No. | Particulars | Face Value (in Rs.) | Basic EPS (In Rs.) | P/E Ratio | RONW (%) | NAV (In Rs.) |

| 1 | G. K. P.Printing & Packaging Limited | 10 | 6.29 | 5.09 | 34.97 | 15.38 |

| 2 | Worth Peripherals Limited |

10 | 5.40 | 13.33 | 11.23 | 41.82 |

GKP Printing & Packaging IPO Lead Managers

| Lead Managers |

| HOLANI CONSULTANTS PRIVATE LIMITED 401-405 & 416-418, 4th Floor, Soni Paris Point, Jai Singh Highway, Bani Park, Jaipur 302016 Tel.: +91 0141-2203996, Fax: +91 0141-2201259 Website: www.holaniconsultants.co.in Email: ipo@holaniconsultants.co.in Investor Grievance Id: complaints.redressal@holaniconsultants.co.in Contact Person: Mr. Gaurav Kumar SEBI Registration No.: INM000012467 |

GKP Printing & Packaging IPO Registrar to offer

| Registrar to the Offer |

| LINK INTIME INDIA PRIVATE LIMITED C-101, 1st Floor, 247 Park, Lal Bahadur Shastri Marg, Vikhroli (West), Mumbai 400083 Maharashtra, India Tel: +91 022-49186200 Fax: +91 022-49186195 Website: www.linkintime.co.in Email: gkp.ipo@linkintime.co.in Investor Grievance idgkp.ipo@linkintime.co.in Contact Person: Ms. Shanti Gopalkrishnan SEBI Registration Number: INR000004058 |

Other Details:

- Statutory Auditor – M/s. DV Barfiwala & Co., Chartered Accountants.

- Peer Review Auditor – M/s. DV Barfiwala & Co., Chartered Accountants.

- Bankers to the Company – Bharat Co-op Bank (Mumbai) Ltd, Oriental Bank of Commerce

GKP Printing & Packaging IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 7.5/10 | 7.4/10 | 8.5/10 | 8.1/10 | 7.1/10 |

| Sharekhan | 7.2/10 | 7.1/10 | 8.6/10 | 8.1/10 | 7.2/10 |

| Kotak Securities | 7.3/10 | 7.5/10 | 8.4/10 | 8.1/10 | 7.3/10 |

| ICICI Direct | 7.3/10 | 7.3/10 | 8.7/10 | 8.1/10 | 7.1/10 |

| IIFL | 7.5/10 | 7.2/10 | 8.8/10 | 8.0/10 | 7.1/10 |

| Edelweiss | 7.5/10 | 7.4/10 | 8.4/10 | 8.3/10 | 7.2/10 |

| Zerodha | 7.4/10 | 7.1/10 | 8.5/10 | 8.1/10 | 7.0/10 |

| 5Paisa | 7.1/10 | 7.1/10 | 8.4/10 | 8.1/10 | 7.1/10 |

| Karvy | 7.4/10 | 7.3/10 | 8.2/10 | 8.1/10 | 7.1/10 |

| Motilal Oswal | 7.1/10 | 7.1/10 | 8.6/10 | 8.3/10 | 7.2/10 |

GKP Printing & Packaging IPO Grey Market Premium

The GKP Printing & Packaging IPO Grey Market Premium price is Rs X, the Kostak rate is Rs X and the Subject to Sauda is X.

Open Free* Demat A/C Now! Fill the details below

GKP Printing & Packaging IPO News

News 1 – IPO ISSUE OPENS SOON [Download Prospectus]

News 2 – Download RHP

Market Guide

Featured Topics