Deep Polymers Limited IPO – Review, Allotment, Subscription, Price, GMP, Date & more

Last Updated Date: Nov 16, 2022Deep Polymers is engaged in manufacturing colour and additive masterbatches for engineering plastics and compounds that includes wide range of quality products like antifab fillers, transparent fillers, colour fillers, which is used as cost effective replacements for polymers and acts as anti-fibrillating, anti-blocks, anti-slip agents. The Company has issued 38,10,000 Equity shares of Rs.10 each.

Let’s have a detailed review of the company and analytics of the Deep Polymers Limited IPO release date, IPO offer price, subscription, Deep Polymers Limited IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters and other related things.

- Issue Price of this IPO is Rs 40. Check the Live Share Price here Deep Polymers Share Price

- To track the performance of this IPO, click on this link – IPO Performance

Deep Polymers Limited IPO Review & Ratings

| Deep Polymers Limited IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 6.3/10 |

| Industry Ranking | 6.3/10 |

| Company Background | 6.1/10 |

| Company Reputation | 6.4/10 |

| Competitive Edge | 6.4/10 |

| Financial Statements | 6.5/10 |

| Popularity Index | 6.2/10 |

| Promoters Reputation | 6.3/10 |

| Retail Appetite | 6.2/10 |

| Top Brokers Review | 6.3/10 |

| Overall Ratings | 6.3/10 |

| Star Ratings | ★★★☆☆ |

Summary of Deep Polymers Limited IPO

Deep Polymer is engaged in manufacturing colour and additive master batches for engineering plastics and compounds that includes wide range of quality products like antifab fillers, transparent fillers, colour fillers, which is used as cost effective replacements for polymers and acts as anti-fibrillating, anti-blocks, anti-slip agents. The manufacturing facilities are well equipped with streamlined process to ensure quality of products and timely manufacturing.

Deep Polymer is engaged in manufacturing colour and additive master batches for engineering plastics and compounds that includes wide range of quality products like antifab fillers, transparent fillers, colour fillers, which is used as cost effective replacements for polymers and acts as anti-fibrillating, anti-blocks, anti-slip agents. The manufacturing facilities are well equipped with streamlined process to ensure quality of products and timely manufacturing.

The company endeavour to maintain safety in the premises by adhering to key safety norms. The well- equipped machines, with in-house printing and Quality Control facility and own logistics- dedicated fleet of trucks for timely delivery. The company is being promoted by Mr. Rameshbhai Bhimjibhai Patel having experience of more than 20 years who is the guiding force behind all the strategic decisions of the Company. The Company is also a member of the Plastics Export Promotion Council which is sponsored by Ministry of Commerce & Industry, Government of India.

Open Free* Demat A/C Now! Fill the details below

Deep Polymers Limited IPO Date

The opening and the closing date of IPO is Aug 8, 2018 – Aug 13, 2018.

Deep Polymers Limited IPO Subscription

| Subscription | |

| Day 1 – Aug 8, 2018 | 0.56x 2025000 |

| Day 2 – Aug 9, 2018 | 0.98x 3543000 |

| Day 3 – Aug 10, 2018 | X |

| Day 4 – Aug 13, 2018 | X |

| Day 5 | – |

The shares subscribed by the public will be updated herein on a daily basis, once the IPO is open for subscription.

Deep Polymers Limited IPO Allotment Status

Click to check the Allotment status.

The Issue is being made through the Fixed Price Process wherein up to 38,10,000 Equity Shares shall be reserved for Market Maker upto 1,92,000 Equity shares will be allocated on a proportionate basis to Retail Individual Applicants, subject to valid applications being received from Retail Individual Applicants at the Issue Price. The balance of the Net Issue will be available for allocation on proportionate basis to Non Retail Applicants.

- Basis of Allotment: 20-August-2018

- Refunds: 21-August-2018

- Credit to demat accounts: 23-August-2018

- Listing: 24-August-2018

Deep Polymers Limited IPO Price Band

The face value of each share is Rs 10 and the price band of the IPO is Rs 40, so the premium price is Rs 40.

Deep Polymers Limited IPO Equity Share Offering

38,10,000 Equity Shares of Rs 10/- each at an Issue Price of Rs 40 aggregating to Rs 1,524.00 Lakh.

Open Free Demat Account Now!

Deep Polymers Limited – Company Overview

Deep Polymers is engaged in manufacturing colour and additive masterbatches for engineering plastics and compounds that includes wide range of quality products like antifab fillers, transparent fillers, colour fillers, which is used as cost effective replacements for polymers and acts as anti-fibrillating, anti-blocks, anti-slip agents. In Deep group, the company have started manufacturing facility at Ahmedabad and manufacture plastic master batches with 600 MT productions per annum in year 1992 and now has achieved colour master batches and filler master batches of 12,000 MT and 25,000 MT respectively.

Competitive Strengths of Deep Polymers Limited:

- Rich management experience

- Quality Assurance.

- Existing relationship with suppliers

Business strategies of Deep Polymers Limited:

- Expanding clientele Network by Geographic expansion

- Reduction of operational costs and achieving efficiency

- Focus on cordial relationship

Deep Polymers Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary:

| Amount (in INR & Lakhs) | |||||

| 31-Mar-18 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | |

| Total Assets | 2,904.30 | 3,009.04 | 2,539.78 | 2,637.90 | 2,321.31 |

| Total Revenue | 4,110.09 | 4,274.43 | 3,600.85 | 4,113.89 | 3,473.07 |

| Total Expense | 3,817.26 | 4,078.74 | 3,649.41 | 4,016.50 | 3,524.07 |

| Profit After Tax | 214.73 | 128.02 | (35.41) | 67.05 | (36.06) |

Earnings per Equity Share (in Lakhs)

| 31-MAr-16 | 31-Mar-17 | 31-Mar-18 | |

| Basic | -4.41 | 13.40 | 2.03 |

| Diluted | -4.41 | 13.40 | 2.03 |

Deep Polymers Limited IPO – Promoters

The Promoter of this company are:

- Mr. Rameshbhai Patel

List of Related Parties (Key Managerial Personnel)

- Ms. Dhrupa Thakkar,

- Mr. Debsankar Das

Interest in promotion of the Company

The Promoter is interested in the Company to the extent that they have promoted the Company, to the extent of

their respective Equity shareholding in the Company and to such extent any dividend distribution that may be

made by the Company in the future. For details pertaining to the Promoter’ shareholding, please refer “Capital

Structure” on page 56 of the Draft Prospectus.

Interest as Director of the Company

None of the Directors are also interested to the extent of being Directors on the Board, as well as any remuneration, sitting fees and reimbursement of expenses payable to each of them. For more information, please refer “The Management” on page 119 of the Draft Prospectus.

Interest in the property of the Company

The Promoter does not have any interest in any property acquired by or proposed to be acquired by the Company two years prior to filing of the Draft Prospectus.

Deep Polymers Limited IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | 38,10,000 Equity Shares of Rs 10/- each at an Issue Price of Rs 40 aggregating to Rs 1,524.00 Lakh. |

| Of which: | |

| Reserved for Market Makers | 1,92,000 Equity Shares of Rs 10/- each |

| Net Issue to the Public | 18,09,000 Equity Shares of Rs 10/- each |

| Of which: | |

| Retail Investors Portion | X Equity Shares of Rs 10/- each |

| Non-Retail Investors Portion | X Equity Shares of Rs 10/- each |

| Equity Shares outstanding prior to the Issue | 105,11,600 Equity Shares of Rs 10/- each |

| Equity Shares outstanding after the Issue | 118,71,600Equity Shares of Rs 10/- each |

Deep Polymers Limited IPO Issue Object

These are the IPO Issue Objects of the company

- To Meet working capital requirement

- To Meet the Issue Expenses

- To Meet General corporate purpose

Deep Polymers Limited IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Diverse portfolio of Services

- Established relationship with clients leading to recurring business

- Experienced management and operational team

- Customer Satisfaction

- Diversified Industry Sectors

- International Presence

The relevant quantitative factors are:

| Basic & Diluted EPS | RONW (%) | NAV (Rs.) | |

| 31-Mar-16 | -4.41 | NA | 126.14 |

| 31-Mar-17 | 13.40 | 9.60% | 139.54 |

| 31-Mar-18 | 2.03 | 13.87% | 14.72 |

- Industry P/E Ratio:

| Particulars | P/E ratio |

| Average | NA |

| Highest | NA |

| Lowest | NA |

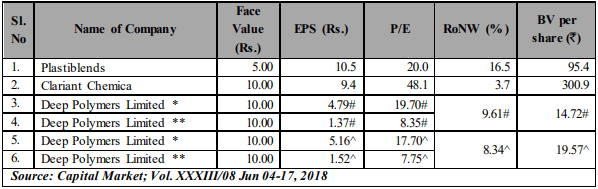

- Competitive Peers:

Deep Polymers Limited IPO Lead Managers

| Lead Managers |

| GRETEX CORPORATE SERVICES PRIVATE LIMITED 102, 1st Floor, Atrium-2, Behind Coutyard Marriott Hotel, Andheri Kurla Road, Hanuman Nagar, Andheri- East, Mumbai-400093, Maharashtra, India Tel. No.: +91-22 -4002 5273/9836822199 Fax No.: +91-22-4002 5273, Email:info@gretexgroup.com Website:www.gretexcorporate.com Contact Person: Ms. Amina Khan SEBI Registration No: INM000012177 |

Deep Polymers Limited IPO Registrar to offer

| Registrar to the Offer |

| BIGSHARE SERVICES PRIVATE LIMITED Bharat Tin Workings Building, 1st Floor, Opp. Vasant Oasis, Marol Maroshi Road, Marol, Andheri- East, Mumbai – 400059 Maharashtra Tel: +91 22 62638200, Fax: +91 22 62638299 E-mail: ipo@bigshareonline.com, Website: www.bigshareonline.com Contact Person: Mr. Srinivas Dornala SEBI Registration No.: INR000001385 |

Other Details:

- Statutory Auditor – H.K Shah & Co, Chartered Accountants

- Peer Review Auditor – H.K Shah & Co Chartered Accountants

- Bankers to the Company – HDFC Bank

Deep Polymers Limited IPO Review by Top 10 Stock Brokers

| Top Stock Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 6.5/10 | 6.6/10 | 6.6/10 | 6.4/10 | 6.4/10 |

| Sharekhan | 6.7/10 | 6.4/10 | 6.6/10 | 6.1/10 | 6.2/10 |

| Kotak Securities | 6.7/10 | 6.7/10 | 6.7/10 | 6.4/10 | 6.3/10 |

| ICICI Direct | 6.6/10 | 6.3/10 | 6.7/10 | 6.5/10 | 6.5/10 |

| IIFL | 6.4/10 | 6.7/10 | 6.8/10 | 6.4/10 | 6.7/10 |

| Edelweiss | 6.7/10 | 6.4/10 | 6.4/10 | 6.3/10 | 6.7/10 |

| Zerodha | 6.5/10 | 6.4/10 | 6.7/10 | 6.4/10 | 6.5/10 |

| 5Paisa | 6.7/10 | 6.4/10 | 6.3/10 | 6.7/10 | 6.5/10 |

| Karvy | 6.8/10 | 6.3/10 | 6.7/10 | 6.4/10 | 6.0/10 |

| Motilal Oswal | 6.6/10 | 6.4/10 | 6.6/10 | 6.6/10 | 6.4/10 |

Deep Polymers Limited IPO Grey Market Premium

The Deep Polymers Limited IPO Grey Market Premium is yet to be announced. It will be updated as soon as the premium rates are announced.

Open Free* Demat A/C Now! Fill the details below

Deep Polymers Limited IPO News

News 1 – IPO ISSUE OPENS SOON (Download Prospectus)

Calculate your return on investment!

Asset Class

ROI (Rs.)

Profit (Rs.)

Profit (%)

IPO

Equity

Savings

Real Estate

Gold

Bonds

Fixed Deposit

Mutual Fund

Market Guide

Featured Topics