How to Start Commodity Trading? – A Step by Step Beginners Guide

Last Updated Date: Nov 17, 2022Here is a beginners guide to commodity trading. You will find out step by step guide on How to Start Commodity Trading in India.

A lot of traders, at the beginning of their trading careers, have this question in mind. While the stock market is popular, not many look at the commodities market in the same way.

The commodity market is much different in nature when compared to the equity market. Retail investors are now looking into commodity trading as a safer investment avenue.

More and more people are trying their hands in this market in order to diversify their portfolio. There are high returns and high risks involved.

But, with time, commodity traders can learn how this market functions and develop their strategies for profits.

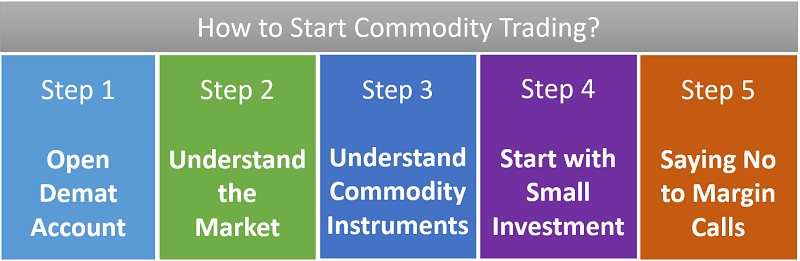

A Beginners Guide to Start Commodity Trading

Here you will find step by step guide to start commodity trading in India.

Step 1 – To Start Commodity Trading – “Open a Demat account”

The first essential requirement to start commodity trading is to have a Demat account. The Demat account has to be opened with the National Securities Depository Limited.

The Demat account is just like a usual bank account. The difference here being, instead of cash, it acts as a storage space for your trades information. It includes all your trades in equity or commodities.

The Demat account and the trading account are opened with a stockbroker by filling up the required forms and submitting income proof, pan card details, and any other details, as required by the broker.

Many stockbrokers deal in the commodity segment. You can choose any broker by comparing their features, brokerage charges, UI, etc.

The choice of the broker should be made wisely, as it would significantly impact your overall trading experience.

Open Demat Account in 10 Min & Start Commodity Trading

Step 2 – To Start Commodity Trading – “Understanding the Market”

Stepping into the market without having the knowledge about how it works can be a fatal mistake.

The commodity market works on the concept of price determination using market forces. The forces of demand and supply are the primary acting forces.

However, other factors like global social and economic events, changes in monetary policies, etc. can have an impact on the prices of specific commodities in the market.

You can learn about this market using different resources like online courses, books, videos, and more.

Entering the market with a defined trading plan in your mind will improve your chances of success manifold times!

A trader needs to be aware of all the challenging situations that can come his way during this trading journey.

Entering the market just with the aim of profits and not focusing on risk is the stupidest mistake one can make.

The trader needs to understand that there is no way to be right every time. While speculating, there is a high chance that the market can go the other way as well.

But, the trader needs to limit his losses by placing strict stop loss as per his risk appetite.

Step 3 – “Understanding the Instruments of Trade”

The commodity market deals in all physical commodities. There are more than 100 commodities that are being traded on the exchanges. Unlike stocks, different commodities have different natures.

Basically, the commodities can be divided as hard and soft. Hard commodities include precious metals, energy, petroleum, etc. On the other hand, soft commodities include agricultural products, Livestock, etc.

In order to be able to start trading, it is imperative to know the commodity which you will be trading in.

You also need to be aware of all the global happenings which could affect that particular commodity. Having information about the producing companies can also prove to be beneficial.

Learn everything about Commodity Trading here

Step 4 – “Start with Small Investment”

After opening the trading account, the trader has to deposit some initial amount to start trading.

Since margin trading happens, the trader needs to have 5-10% of the contract value in his account while placing the trade.

For example, if the contract value is supposed INR 5000, and the broker offers a 10% margin, so, the trader needs to have atleast INR 500 in his account at the time of placing the trade.

Along with this initial margin, the trade also needs to keep a maintenance margin—the maintenance margin work in the following manner.

Suppose, the contract was made at INR 5000. Now, the next day, the contract value falls to INR 4500, so the buyer of the contract needs to have some amount in the account so that the exchange can make this settlement.

The exchange follows a mark-to-market settlement policy.

Step 5 to Start Commodity Trading – “Saying no to Margin Calls”

Margin calls are like the ultimate signal that it is time to exit and book the loss that has occurred already.

For those who are just beginning with their commodity trading journey should keep this golden truth in mind forever.

The margin calls occur when your trade has gone downside more than you expected. In this situation, the smartest thing to do is to accept your mistake and admit to yourself that you made the wrong trade. Exiting at this point would save you from any further losses.

There is always a hope that the trade will, at some point, turn in your favor, but it is better to ignore this and exit. If you are very sure that the positive change will happen, the smart way is to exit half your position.

This would save you from both the regrets- if the positive change occurs, you will still be able to book some profits.

In case the losses continue, you would be happy that you minimized them. Whatever the situation might be, but the golden rule stays- “Never answer margin calls.”

Understand in Detail about Commodity Market here

| Learn about Commodity Options | Commodity Exchanges |

| Learn about Commodity Futures | Commodity Trading Tax |

| What is Hedging in Commodity? | What is MCX? |

| Commodity Market | What is NCDEX? |

Advice to Beginner Commodity Traders

Most people consider the markets as an easy way to earn money. This is not something that you should have in mind while starting your journey.

In order to be able to gain from the markets, you need to put in lots of time and effort in first understanding the market.

There is no shortcut or easy way to do this. It would be best if you were prepared to face losses and setbacks.

However, you would be forced to exit the commodity market if you are not aware of your risk appetite from the beginning itself.

You cannot, and even should not, make yourself vulnerable to the risks you cannot afford, both financially and emotionally.

The journey towards success in the commodity market would be full of hardships, and you need to be prepared to face them. For success comes to those who plan for it!

Conclusion: How to Start Commodity Trading?

To start your trading journey, first, you need to choose your stock broker, then after completing all the paperwork and formalities, you open your Demat account.

After opening the Demat account, you can start trading using the minimum investment that you have.

It is always advisable to start small. Before entering the market, it is advisable to learn how it works and behaves!

Open Demat Account in 10 Min & Start Trading Now!

Most Read Articles