How to become an Advanced Commodity Trader? – Know Everything

Last Updated Date: Nov 17, 2022Know everything about How to Become an Advanced Commodity Trader here. To reach the levels of advanced commodity trading, one needs to have a lot of patience and expertise.

In this blog, we have discussed some popular strategies which are used by advanced commodity traders to earn high returns on their capital.

Advanced commodity trading is too complicated for a beginner to understand. So it is advisable that you try these out once you have all your basics cleared.

Jumping directly to these strategies in hopes of higher returns would not be a wise decision.

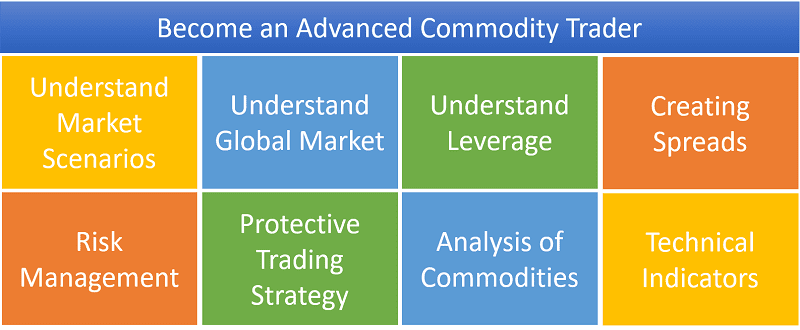

Requirements to Become an Advanced Commodity Trader

Here are some of the most important traits any commodity trader needs to have in order to become an advanced commodity trader. Lets have a detailed look into all of these traits –

Understanding Market Phases

To become an advanced commodity trader, you must know about various market scenarios & accordingly take your investment decisions.

When there is an upsurge in prices, the market is bullish. Whereas, in case of a downtrend, the commodity market is said to be bearish.

A successful trader aims to buy low and sell high. This can be achieved by observing the market pattern for any specific commodity.

During a downtrend, the prices are below the moving averages, and hence, this is the best time to opt for a long position.

Whereas, when the bullish phase has reached its peak, and the downtrend is about to come, the trader can go for a short position to earn profits.

The accuracy of understanding chart patterns comes with time. No trader should expect to be proficient in a day or two.

Open a Commodity Trading Account Now! – Fill up the Form

Understanding the Global Market

Another very important attributes of an advanced commodity trader is to understand what is happening in the global market as it significantly impacts the Indian Commodity Market.

Commodities are the raw materials that help the global economy run well. The commodity market can be understood as a whole to analyze the trends.

When we know the advanced commodity trading strategies, we do not consider individual commodities as they show different price movements.

To be able to make better decisions, one needs to have a macro view of the market as a whole. The market has bearish and bullish phases, which are influenced by global macroeconomic changes.

The factors that can have a bearing on the movements in the commodity market include natural calamities, monetary policy changes, interest rate changes, etc.

The demand and supply forces get affected by these factors, and hence, the commodity market as a whole develops trends.

Learn everything about Commodity Trading here

An Advanced Commodity Trader Understands Leverage

If you have reached the advanced commodity trading level, you must undoubtedly be aware of how much risk management is essential.

Usually, all beginner traders focus on profit maximization more than risk management. While for some, this works out well, but others can face tremendous losses.

These initial risks can destroy the overall trading account, and massive losses might just make people step out. The vital point to understand here is that there is no need to assume such vulnerable positions.

Profits can be maximized even while doing protective trading. This is done by well understanding the concepts of leverage.

Excessive leverage should not be used in the market. The brokers in the market are offering high leverages to the clients in order to attract them to the commodity market.

The beginners who do not have an understanding of this try to use the leverage as a way to increase profitability.

This usually ends up in the wrong way, and they end up losing all their account.

Creating Spreads – Attribute of an Advanced Commodity Trader

This advanced trading strategy involves buying and selling of futures contracts simultaneously. The relationship between the purchase price and the selling price is used to get a profitable position.

This understanding can be developed by analyzing the commodity trend and taking a look at all the factors affecting its price.

Both fundamental and technical aspects need to be understood well. An example of a spread strategy can be taking a long position for July and a short position for September with the hope that the gap between the buying and selling price will widen.

If the actuals work out per your calculation, your profit will be equal to the net spread created. However, the loss potential is also limited to the spread made.

Understand in Detail about Commodity Market here

| Learn about Commodity Options | Commodity Exchanges |

| Learn about Commodity Futures | Commodity Trading Tax |

| What is Hedging in Commodity? | What is MCX? |

| Commodity Market | What is NCDEX? |

Risk Management & Profit Maximization

There might be ten trading avenues right infront of your eyes, but it is never a wise decision to enter into all the trades at the same time.

A trader needs to be aware that risk management should also be a goal along with profit maximization.

A successful trader finds the best trading opportunity amongst all available one and takes an appropriate position in that commodity. At a given point in time, a risk of 2-3% is considered ideal.

Maintaining a balance between leverage and risk is the most vital strategy to succeed as a commodity trader.

You need to be prudent enough to take up positions that do not expose you to high risks and also maximize your profits. Greed can be a big poison and should be controlled!

Use Protective Trading Strategy

Taking a conservative stand right from the beginning can help you overcome all the potential risks.

In this type of trading, the trader has the clarity that the market is unpredictable, and hence, it is not wise to become vulnerable to risks which you cannot afford.

So, here the trader ensures a strict risk management approach. Till the time these traders reach the advanced level, they have their strategy, which maximizes profit and reduces risks exposure.

These protective rules might look like shackles in the beginning, but in the long run, they guarantee success.

The work of a profitable trader is not to be right every time. Instead, his job is to ensure that he ends up in profits even when some part of his estimation did not go right.

A Pro Commodity Trader will always use a Protective Trading Strategies to safeguard his profits.

Analysis of Companies involved with Commodity Market

Paying close attention to the companies that produce or are involved in the production of your chosen commodity.

Commodity markets do not work independently. It might seem initially that the stock market has no impact on the prices of the commodities.

However, this is not correct. The experienced traders know that commodities are just raw materials.

So, in order to assess the trend of a particular commodity, one can always have a look at the top 5 producer companies and their stock performances. This would give a better idea about the movements in the specific commodity.

The company fulfils the supply and demand of that particular commodity, so understanding the company plays an important role.

It is not essential to keep a look at all producers. Instead, the focus should be maintained on the top 5 or 6.

Trade using Moving Averages

Commodity Traders make use of moving averages to assess the momentum.

Any trader who uses technical analysis for taking active trading positions in the commodity market needs to be aware of the concept of moving average.

Most of the charting strategies used by experts are based on this concept. The moving averages give an objective view of the market movements.

The traders can analyze the technical better and interpret where the commodity’s price will move next. In simple words, when the commodity prices are above the moving average, it is a bullish trend.

Whereas, when the prices are below the moving average, it is a bearish directional momentum, and a short position needs to be taken by the trader.

One must do technical analysis & use Moving Average to become an Advanced Commodity Trader.

Using CCI Indicator – Trait of Advanced Commodity Trader

To become an advanced Commodity Trader, it is very important to use CCI i.e. Commodity Channel Index.

This technical indicator uses the past trends of a commodity to understand the price movements and gives a buy or sell signal accordingly.

The signals are given when the commodity reaches the level when an old trend is about to end, or there is a possibility of the emergence of any new movement in the market.

The CCI indicator is plotted using a scale of -100 to 0 to +100. In this, -100 signifies oversold status.

Here, it means that the prices have fallen beyond the standard averages, and a price correction is likely to happen that will bring the price back in its usual range.

Similarly, a +100 signifies an overbought situation, which should be considered a sell signal. The general rule says that buy low and sell high, which is the main idea of this indicator.

Since financial trading is all done with the use of online modes, using the technical indicators can be really helpful!

Fibonacci Analysis – Important for an Advanced Commodity Trader

The Fibonacci analysis is one of the most popular trading strategies used by advanced commodity traders to get an objective broader view of the commodity market.

The Fibonacci tool sets up support and resistance levels on a chart based on the changes in price levels of the commodity.

Different traders use varied strategies while using the Fibonacci ratios for increasing their profitability.

The Fibonacci retracement levels can be used for determining the correct entry points. The strategy can be easily applied in both uptrends as well as downtrend markets.

Conclusion: Advanced Commodity Trader

Once the advanced level is reached in commodity trading, the traders can focus on maintaining a stable portfolio with limited risk exposure. The use of advanced strategies can help achieve this aim.

Commodity trading requires a broader outlook when compared to stocks and derivatives. Hence, a trader can reach this level of expertise with dedicated efforts and a lot of patience.

Every loss in the journey should be considered a lesson! This is the best way of growing and becoming a successful trader.

Open a Commodity Trading Account Now! – Fill up the Form

Most Read Articles