Stocks Clearing & Settlement – Process, Types, Entities Involved & more

Last Updated Date: Nov 17, 2022In this article, you will learn everything about stock clearing & settlement process.

One of the most stunning accomplishments of the entire stock trading process is, on your end, it seems pretty straightforward, whereas, in reality, it is quite a complicated process.

A ton of process does run in the background which the regular trader doesn’t even know of. So, today we will discuss two such crucial processes that you should know about – Clearing and Settlement.

In this article, we will explore various aspects of Clearing and Settlement processes. Alongside that, we will discuss the steps to let you know about what happens when you purchase a company share.

Subsequently, we will also talk about the possibilities when you sell a stock as well. So, let us dive in.

About Stock Clearing & Settlement

When you purchase or sell stocks, the trading process happens online. If you are working on purchase transactions, then money will be debited from your account and you will get the shares.

For sale transactions, shares have to be taken from the Demat account and the selling price is credited back to the bank account.

The process is not quick and to make sure there is minimal risk for the trader, the regulators have come up with a trading cycle.

This cycle is called the Stock Clearing and Settlement process. This article discusses the basics of clearing and settlement.

Open Demat Account Now! – Get Free Brokerage on Delivery

Stock Clearing & Settlement Process – Buying a Stock

The purpose of this article is to let you know about somethings that you may not have an idea. So, when you buy a company share, it goes through a series of actions on each passing day:

Day 1 Activities:

The day when you place an order, and you get the allotted shares, the first thing that will happen is your broker charge the money from your Savings account.

The day you buy the stocks, which we call the Trade day or T-Day, is not the day when you receive the shares in your Demat account.

Instead, the broking company will give you a bill that contains all the information on the trades that you did on that day.

They also charge brokerage fees and a couple of more fees for the shares that you decided to hold.

Day 2 Activities:

In terms of movement, nothing really happens on this day. Most trader and brokers call it the T+1 Day.

As of now, you have already paid for the shares, which typically don’t reflect on your Demat account in Day 2.

However, if you wish to trade further on this day, you can do that. It will all get adjusted in your Demat account automatically.

Of course, you may have done Intraday trading as well in the T Day.

Day 3 Activities:

It is the T+2 Day, and on this day, you should see the allotted number of shares in your Demat account. You however, may have sold the shares, if you wish on the T Day or T+1 Day.

Meanwhile, you have to bear the brokerage charge along with all the other fees till the day you sell your stocks.

Learn about Share Market & make More Money

| Free Share Market Courses | ||

| CDSL vs NSDL | Stock Market Regulator | Stock Market Holidays |

| SEBI | Virtual Trading | Share Market Timings |

| NSE vs BSE | Stock Market Intermediaries | Share Market Jargons |

Stock Clearing & Settlement Process – Selling a Stock

Now when you have a slight idea of the Clearing and Settlement Process while you buy a stock, it is time you should also know about what happens when you sell them to another trader:

Day 1 Activities: While you sell your shares, the Stock Exchange will block your Demat account. This is to prevent the sale of the same volume of shares again in a single day.

So, the bottom line is you can’t sell the same stocks again.

Day 2 Activities: On this day, you usually don’t see any change from your end. This is because, on the T+1 Day, your stockbroking company submits the number of shares to the Stock Exchange.

Meanwhile, the buyer won’t receive the allotted stocks to their Demat account on T+1 Day as well.

Day 3 Activities: The T+2 Day is the most significant day of the lot. It is payday. Yes, on this day you will get the funds to your Savings account.

You can also access your Demat account thereafter. Please note that every broker levies a particular set of charges on top of the brokerage fees.

So, you will receive the amount after they charge what’s their fees.

Stock Clearing Process

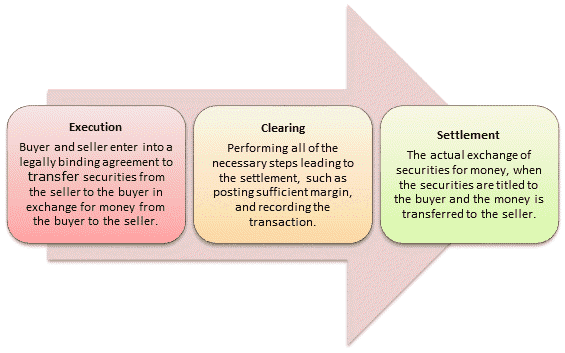

In the stock market, the investment process takes place in three steps, namely – Trading, Clearing, and Settlement. The clearing is a process through which the financial transactions are settled.

Bilateral clearing facilitates all the legal steps to guarantee a successful transaction for the parties involved in the transaction to follow.

A third-party is present in the central clearing process. The third party is what we call the clearing house.

When buyers and sellers carry out the trade, they take the front seat. The third-party acts as the middleman between the buyers and the sellers.

They agree and make the transaction transparent. It is their responsibility to ensure that all the concerned parties uphold their contractual obligation.

They abide by strict compliance with all trade legislation and exchange commitments.

Clearing houses aggregate the transactions of each of their members and calculate the transactions of transferable securities for the trading day.

The trades which do not undergo this process can have serious settlement risks.

Governments around the world are now encouraging, or even demanding, central clearing so that they can assess the systemic risk that their financial institutions are placing on economies, especially in the trading of derivatives.

The best means of holding records so that the financial risks to the economy can be properly measured is Central clearing.

Learn about Share Market & make More Money

Settlement Process

In the stock market, investors play the position of buyers as well as sellers. They work on buying or selling their shares.

A settlement is a term applicable for exchange of payment to the seller and securities being transferred to the buyer in a trade.

It is considered as the final step in the life cycle of Security Transaction.

Rolling Settlement

A rolling settlement interval of T+2 is what the Indian stock market follows. It is a process of setting the security trades on a successive period based on a particular date.

This date is when the original trade is made, i.e. the one happening today will have a settlement date after one business day.

It is a two-way mechanism that is the final step of every transaction. The process is complete after this method.

The settlement is complete once the buyer receives their share while the seller receives his credit by the end of T+2 day.

The broker deals with the transfer process here too. While the official agreement starts on the day of exchange, all the final ownership for the transfer takes place on that day.

A total of five days is a must when this procedure is in physical format. This makes the settlement date T+5, but it is T+2 since the digital age.

On-Spot Settlement

On the spot settlement is the form of settlement where the funds are exchanged immediately and the usual T+2 is the pattern followed.

Thus, the transaction which took place on Wednesday will be settled by Friday that is by the second working day.

There is one more settlement that is referred to as the forward settlement where the two parties concerned, decide on the day the settlement must take place.

It can be T+5 or t+9 and so on.

Learn about Share Market & Make more Money

Entities involved in Stock Clearing and Settlement Process

There are different items involved in this whole process of clearance and settlement.

Initially, shares were kept in a physical certificate format, but in the post computerized period, they are stored in electronic form.

The purchasing and sale of shares include a Demat account where the shares are stored. Hence, it is also necessary to have a Demat account.

SEBI has come up with a different framework to ensure a good output and optimize its authority over Demat accounts by building depositories.

Depository Services

The depository is very helpful for an investor if they want to purchase or sell securities.

National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) are the two depositories in India.

Clearing Corporation receives the funding and securities from the clearing banks and depositories for the transactions and trading accordingly.

Clearing Member

There is a professional clearing member appointed by the NSCCL. Even though they are restricted to trade, they have the authority to clear and settle the trades.

The clearing corporation is designed to manage the confirmation, settlement, and distribution of shares.

Their function is central to this entire process. If two investors agree to carry out a transaction, they ease the entire buying and selling process.

It is their responsibility to ensure that the settlement cycles do not prolong. It also ensures the transaction attracts no significant threats and risks further.

They participate at every stage and act as a protective shield for all the secondary market transactions with effective risk management systems.

Clearing Corporation

The clearing corporation ensures that their task is completed by passing each trade to a clearing member or custodian.

Their main obligation is to make sure that all the funds and shares are available on the day of T+2. They clear the trade by ensuring pay-in and pay-outs of securities and funds to the clearing banks.

They are responsible for the safety of customers’ assets. On behalf of other trading participants, they settle trades.

A trading member may delegate a specific trade for settlement to a custodian. The custodian settles the transaction further.

Clearing Banks

Then there are the clearing banks. Here, the transfer and movement of money happen.

SEBI has established a list of 13 designated clearing banks that aid in the settlement of funds. Each clearing member must make sure that they have a clearing account in any one of these banks.

Some of these banks include the HDFC bank, ICICI bank, Axis bank, Stock holding and Corporation of India Ltd, and State bank of India.

The 3 core steps of Clearing and Settlement Process

If we summarize everything, we will get some conclusions:

- On Trade Day, you either buy or sell stocks. So, either your Funds will get debited by the number of shares you purchased or processed the stocks and let them do what they need to do.

- Then, it is the job of the Clearing corporation is to double-check whether you wish to sell or buy the stocks.

- On the T+3 Day, you will get the funds minus the brokerage and other levied charges.

Stock Clearing & Settlement Process – Conclusion

So, this is what we have to say about the Clearing and Settlement Process. Of course, these are all theoretical knowledge.

As you don’t usually need to interact with any institution apart from your broker, you don’t really need to bother much.

Then again, you should be completely aware of all the norms and regulations in order to be a successful trader. Therefore, we believe we have conveyed the right concept of Clearing and Settlement Process.

What you also need to understand is there are tons of other institutions that are closely associated with the stock market.

So, the Clearing and Settlement authority checks everything to avoid any miscommunication between the buyers, sellers, and brokers.

Open Demat Account Now! – Get 90% discount on Brokerage

Learn about Share Market & make More Money

| Blue Chip Companies | Bear Market | Value Investing |

| Multibagger Stocks | Bull Market | Foreign Stocks |

| Penny Stocks | Stop Loss | Brokerage Charges |