Unsystematic Risk – Understand Concept, Types of Risk , Examples & more

Last Updated Date: May 12, 2022Unlike Systematic Risk, Unsystematic Risk doesn’t impact the entire industry or market; indeed, the risk is associated with specific security and portfolio of securities, which can be reduced with diversification strategies.

Know everything about Unsystematic Risk here. Lets get Started.

What is Unsystematic Risk?

Unsystematic risk is a unique type of risk mostly influenced by internal factors; hence it is also identified as “specific risk,” “nonsystematic risk,” “residual risk,” or “diversifiable risk.”

It happens when uncertainty or apparent events in an industry or company start affecting its share value, or some new entrant gives new competition in the marketplace.

Else, these entrants are likely to bit the large chunks of share in the market, resulting in low sales figures or shifts in management; all these emerging risks can be named in the unsystematic risk category.

However, in most instances, error in judgment and bad entrepreneurship leads to massive losses for a company.

For example, a significant percentage of investors will follow the same mistakes for an extensive time.

It’s a standard risk; thus, you can find it in almost every industry. Still, it’s based on the company, they handle such emerging risks by implementing numerous methods to reduce the level of risk.

Open Demat Account in 10 Min & Start Trading Now!

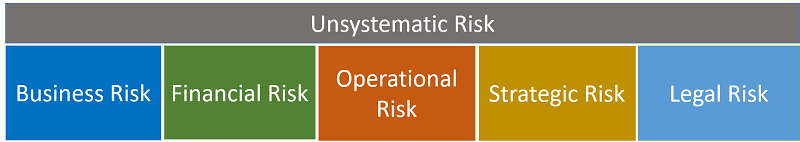

Types of Unsystematic Risk

Although Unsystematic Risk can split up into different types, still three of the most common unsystematic risks are as follows:

Unsystematic Business Risk

The origin of these risks can stem from both external and internal factors emerging within a business firm or a company.

The political, legal, economic, and social factors affecting a company’s position result in business risk and lower profits.

All these factors threaten the company’s ability, which becomes the key reason most companies fail to meet their financial goals or objectives.

The best thing is that these risks can be avoided by implementing some risk management strategies.

Even though, whatever the industry a business is operational in, the risk probability stays high in every sphere.

However, a few smart executions before time can provide rid of these unsystematic risks to the company.

However, business risk is also associated with liquidity risk. For instance, most companies fail to cover their business expenses, such as marketing costs, salaries, etc.

Financial Risk/Credit Risk

The term ‘Financial Risk or Credit Risk’ implies when the company is arranging funds for its business operations through loans or financial leverages.

In short, it’s like a liability for the company, and the company is paying interest for it. Apart from these, other debt-related factors also include in the financial risk.

In most instances, when the firm fails to generate enough income to pay all those expenses associated with loans or debt amounts, the company is likely to fall into a financial crisis.

That’s why, if the company is holding loan-generated obligations in a high amount, an investor is likely to face higher risk by trusting that company.

However, additional risk can also bring a firm into massive financial trouble, making a firm fully vulnerable to credit risks or financial risks. These risks are likely to come-

- When the interest rate is exceeding in the market, it can increase expenses on the company and lead to low-income generation.

- Less equity financing

- Imbalances in the management, as the company is unable to maintain a balance between expenses and income.

Moreover, if the business is expanded to foreign countries, the risk related to foreign currency exchange also comes down in financial troubles.

For instance, a decrease in foreign currency value can trigger sudden losses in the company.

Operational Risk

Operational risks are associated with natural disasters, and every organization always stays prepared to bear such losses. These risks can stem from-

- Error by employees

- Hardware issues (in the machine, computer) or technical problems

- Business operations on the old system that requires advanced processes

That’s why businesses set up some techniques and upgrade their management to avoid these small but impactful risks.

If a company is working with advanced technology and highly qualified staff, there’s little probability that the company will encounter operational risks.

Still, if it faces, the company should be ready to incur the cost relating to such errors. These risks can be identified as a combination of

- Cost of correcting the technical or human-made errors

- The loss that a company is ready to bear

Early identification of the risk can help a firm to avoid futuristic losses. Meanwhile, if you’re an investor, then you can get an idea about the company’s swiftness in resolving human or technical errors.

If a company takes speedy actions to resolve a customer’s query, it implies that it is ready to deal with operational risk.

Strategic risk

Strategic risk involves when the company fails to achieve the limit of selling its goods or services.

However, it can happen if the company wasn’t ready with a solid plan and now finding it hard to evolve in the industry.

On the other hand, if the company is entering into a partnership and planning to add a firm to its business, it already has a low market reputation.

The customers will resist purchasing the products; thus, it’s likely to impact its growth.

Legal Risks

Legal Risks can be dangerous for a company, because in most instances, they can put the entire company under massive liabilities, creating stressful situations among the investors as well.

This type of risk can include the actions of a customer against the company. However, competing firms and suppliers can also put you into such troubles based on the business and the strategies you follow.

In most instances, government actions or changes in the lawsuit also evolve as a legal risk for a company.

That’s why most companies often stay well-prepared in their policies, conditions, and have complete documentation.

Simultaneously, few firms in the industry, despite all efforts, fail to remain in the market for long. In the end, they have to bear losses.

Know everything about Risk Management here

Examples of Unsystematic Risk

As said, ‘unsystematic risk is uncertain;’ thus, it can significantly impact a company’s investment or the overall industry.

For instance,- the market competitors sometimes trigger these types of risk, resulting in the scenario that a company observes a downfall in its share value.

On the other hand, legal procedures, natural disasters, or strikes by the company employees can be called unsystematic risk.

That’s why investors can choose diversification strategies in such situations to avoid potential losses.

However, investors who do not follow the diversification strategies are likely to lose their real money.

For instance, if other investors are putting their money in different industries, few investors invest their money at a single place, e.g., the Reliance industry.

Similarly, if other sectors are playing poorly in the market, and ‘one industry’ is enjoying a boost in its return, it can provide profitable results to the investors.

Those investors who were solely focusing on the Reliance industry perhaps face considerable losses in unfortunate situations.

Since they haven’t diversified their investments before time, they’ll be only losing money irrespective of earnings.

Conclusion – Unsystematic Risk

In most instances, both systematic and unsystematic risks become easy to mitigate with the proper execution of risk management strategies.

For example, asset allocation, valuation of timing, and diversification can help investors avoid the losses associated with such types of risks.

However, these strategies aren’t only helpful in mitigating these risks, but owing to these strategies, investors can also increase portfolio returns and optimize their investment portfolio.

Smart investors understand how to reap the benefits of these emerging probabilities or risks. Still, in rare events, despite strategic moves, investors incur losses.

Open Demat Account in 10 Min & Start Trading Now!

Most Read Articles