Systematic Risk – Understand Concept, Example, Types of Risks & more

Last Updated Date: Nov 17, 2022Know everything about Systematic Risk here.

Risk is one of the most unwelcome and unavoidable parts of trading. But we can’t overlook that it’s one of the most valuable segments of the trading sector.

A person who knows the tactics of managing risk effectively can enjoy amazing results for a long time.

However, your excellence in risk management comes from your comprehensive understanding of the types of risks, how they affect the trading instruments, industry, or market, such that you can make a better investment decision.

On the grounds of your risk management strategy, you can develop an investment plan accordingly.

However, total risk comprises two risk variations, systematic risk and unsystematic risk, and in this article, we’ll thoroughly discuss Systematic Risk.

About Systematic Risk

Systematic risk often referred to as Market Risk, is often related to the entire market or a portion of the market.

An investor encounters systematic risk due to economic, sociological, or political changes affecting the market.

However, the risk is often uncontrollable; thus, the investors or firms have to go through significant losses in most instances.

That’s why the risk is also deemed as volatility risk or non-diversifiable risk.

On the contrary, some events or announcements can also affect the whole financial market; that’s why these risks come down into the list of ‘systematic risk’ that the investors are likely to face.

In short, any risk that occurs due to microeconomic factors can be called systematic risk. We encounter all these unforeseen events in our daily lives.

That’s why investors fail to eliminate their impact despite many strategy availabilities.

Open Demat Account in 10 Min & Start Trading Now!

Example of Systematic Risk

Interest rate changes and inflammation affect the whole market. That’s why the only solution to get rid of these risks is to avoid investing, especially on those assets that are more close to systematic risk.

If we take few other examples, systematic risk is influenced by- changes to laws, interest rate hikes, tax reforms, political instability, currency value, foreign policy, natural disaster, economic recessions, bankrupts, etc.

Know everything about Risk Management here

Types of Systematic Risk

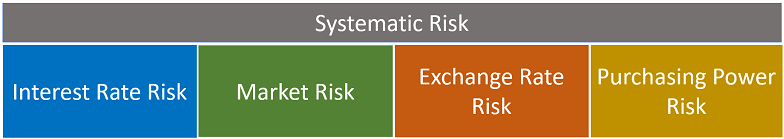

Systematic risk comprises of numerous risks, but here we’ll talk about the most significant risk types, such as the interest rate risk, market risk, exchange rate risk, and purchasing power risk:

Interest Rate Risk

The reason behind the arrival of ‘Interest rate risk’ is the change in the interest rate in the market.

These risks affect the fixed income securities in the stock market due to the bond prices that are ‘inversely subjected’ to the market’s ‘interest rate.’

However, the interest rate risk also consists of two components: Reinvestment Risk and Price Risk, which move in opposite directions.

For instance,- price risk is influenced by the changes in the security’s price, which is likely to come due to interest rate changes in the market.

On the other hand, Reinvestment risk is connected with reinvesting dividend/interest income.

Such that, if the price risk slops downward (indicating negative), the reinvestment slop will be pointing upward (indicating positive direction).

Market Risk

The herd mentality of the investors becomes the leading cause behind Market Risk. For example- when investors start following the direction of the market.

Subsequently, the market risk is defined as the tendency of security and prices that are likely to move together.

Therefore, if the market indicates a downfall, then even a good performing company will encounter problems, and ultimately, the price of its shares will fall.

However, most systematic risk belongs to market risk; that’s why systematic risk is often identified as the market risk.

Exchange Rate Risk

Modern-day companies are working at a global level; hence they daily have to interact with foreign currencies.

Since each country’s currency rate varies and fluctuates over time, that’s why uncertainty associated with their value becomes a matter of concern.

MNCs, Export companies, or all those companies that rely on foreign materials, products, or currency, thus encounter exchange rate risk.

Purchasing Power Risk

If the inflation is on a hike in the market, the purchasing power risk is likely to incline. Due to inflation, the price level increases, reducing the demands of most of the products.

The primary reason is that only fewer buyers are available to purchase expensive goods or services.

Thus with the rise of inflation, investors’ income doesn’t increase; besides, they only have lower income.

Conclusion – Systematic Risk

So this was all about systematic risk. However, most of the risk is associated with some dominant subjects that affect the entire market.

Thus, despite the diversification of their investment portfolio, investors fail to derive the desired results.

Still, if you understand the risk before time, you can create a plan of whether the risk will impact the particular industry or the whole market and step back.

Don’t hesitate to take help from the risk management tools because, in this way, you’ll be creating an effective strategy supporting your buying or selling decision.

Open Demat Account in 10 Min & Start Trading Now!

Most Read Articles