Random Walk Index – Concept, Calculation, Formula, Trading, Drawbacks & more

Last Updated Date: May 11, 2022We are here to satiate your curiosity by providing all the details about the Random Walk Index.

Ideally, some indicators can help you understand the direction in which the price is changing, and always it is not apparent.

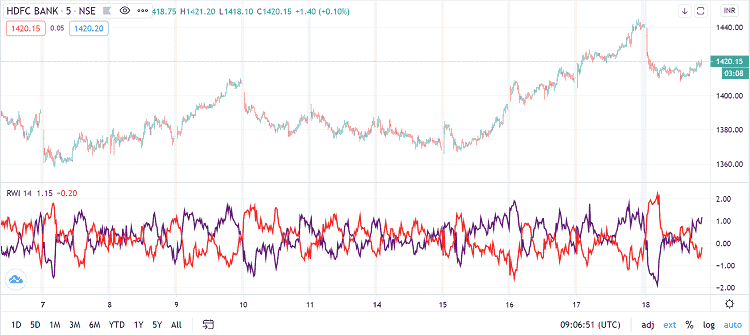

The random walk index is a little different from other indexes as it is quite specific. It tells if the price movement is random or you can expect it to be a part of a big trend.

The majority of us hear the saying quite often that if the trend is your friend, then you must trade with the market and not against it.

By learning about the RWI Indicator, you can easily understand the real direction of a price change and follow it.

About Random Walk Index or RWI Indicator

Ideally, the random walk index is a technical indicator. It basically compares the price of the underlying of the stock to movements in a way to understand if it is in trend statically.

You can use the index to generate some trade signals based on the strength of the underlying security. Michael Poulos created the Random walk index.

The main agenda of creating this index is to understand if the current price of the stock is showcasing a random walk. Or it is just a result of the significant trend moving statistically higher or lower.

In simple terms, Random walk is all about market or security movements that are amid the realm of statistical noise levels. It is not constant with a trend that is definable.

Back in the 1990s, in Technical Analysis of Stocks and Commodities magazine the technical was published. It had a title, Of Trends And Random Walks.”

No doubt, the index was specially developed for the stock market, but today traders can use this for types of assets and time frames.

The RWI Indicator fluctuates significantly with the accidental asset price movement. The overbought or oversold indicator depicts the index value for the short term as 2 to 7 periods.

On the other hand, the overbought or oversold indicator depicts for the long term for the index value having 8 to 64 periods.

When the random walk index is more than 1, you can say financial security is trending. While, when the it is less than 1, you can say a downtrend is prevailing in the market.

The indicator tries to understand if the market is in a strong trend or downtrend. It basically does so by measuring the ranges of the price over N and how it stands out from the expectation.

When you see greater ranges, you can say the trend is strong. A straight line is the shortest distance between two points, and prices further stray away from the straight line.

It indicates that the market is choppy and random. As the random walk indicator is a random trend indicator, you can use it in similar ways to Aroon indicators.

Open Demat Account Now! – Zero Brokerage on Delivery

How can you Calculate Random Walk Index or RWI?

William Feller a mathematician having specialization in probability proved the bounds of randomness. It is also called as displacement distances.

He calculated the random walk index by considering the square foot of the Number of binary events. In simple terms, the binary events refer to the two-sided outcomes featuring equal probability.

The random walk index takes into account some of the mathematical principles when calculating the uptrend or downtrend. It helps in understanding if it is random or meaningful in statistical terms.

The indicator features two lines and needs separate calculations for both. It is mainly because the indicator determines both uptrend and downtrend.

RWI High = ATR×n/ High−(Low×n)

Here:

N = Number of days

ATR= average true range

For example, if you want to calculate the RWI for the last five days. Then you can take the current high and minus current least value from the previous period.

You can do this for each day, going back Number of trading sessions. Hence, your random walk indicator is the highest value for the Number of days.

RWI Low = ATR×n/ High−Low

You can calculate it just like the high random walk index. The only difference here is that you will use high from the last period and low from today.

Hence RWI Indicator is the lowest value for the Number of days.

How to Trade using Random Walk Index?

Typically traders use the random walk index over two or seven periods for short-term trading. For long term trading, traders use eight or sixty-four periods.

The majority of the market players choose to experiment with these periods to understand what works for them for the strategies overall.

You can say that securities are trending higher or lower when readings are above 1.0. When readings go below 1.0, the securities move randomly.

The market indicates a strong downtrend when the RWI low is above one. On the other hand, the market shows a strong uptrend when the random walk index high is above one.

When traders see these figures in low and high markets, they tend to enter a long position.

It means that traders track two random walk indexes like one is for a shorter duration while the other is for a more extended period.

A few traders also use the crossovers of two lines to depict the potential trades. It is most likely to be useful when strong trends tend to show.

But it will undoubtedly lead to losses of trades if the price fails to trend well, as crossovers tend to occur without any trends.

Drawbacks of Random Walk Index or RWI Indicator

It is a lagging indicator because it relies too much on historical data. As it uses past data, there isn’t much predictive about it.

Though the indicator moves from one signal to another quickly, it slips back below one rapidly. You can use the indicator in conjunction with price action.

Random Walk Index or RWI Indicator – Conclusion

The random walk index features two lines RWI High and RWI Low. These lines can measure the uptrend and downtrend strength.

There is an uptrend prevailing in the market when the its high is above the random walk index low and vice versa.

The market indicates a strong non-random trend when either the RWI high or low is above one.

Values below one indicate random as there is no strength to tell any other thing. Hence the index is quite useful and even today traders choose to use it. Hope the guide works for you.

Open Demat Account Now! – Zero Brokerage on Delivery

Most Read Articles