On Balance Volume or OBV – Meaning, How to Calculate, Trading Rules & more

Last Updated Date: Nov 17, 2022Another indicator to learn about is the On-Balance Volume or OBV. The best part is that we cover everything from scratch.

As per the general theory of volume, the theory of on-balance volume was developed by Charles Dow. During the trend, the volume should increase all.

It means that when there is an uptrend, along with the price, the volume should also shoot up, and when there is a downtrend, the volume must be on the rise even when the price is falling down.

The quality of the trend is mainly confirmed with the increase in volume. When more and more research was done for the subject with the duration of time, the theory of balance came into the picture.

What is On Balance Volume or OBV Indicator?

You might be curious to dig down on the topic and learn more about the indicator, but you must be precise with some basics before diving deep, of course.

So, basically, as per the theory, the price and volume are correlated. The on-balance volume technical indicator ideally determines the buying and selling pressure, which is mainly dependent on an aggregate basis.

It integrates the volume on up days while on the down day’s volume is eradicated. Above all, you need to know on balance volume is one of the first indicators that determine positive and negative volume flow.

Joe Granville had developed this indicator. This indicator is generally used by people to affirm the price trend and also understand the correlation between the price and on-balance volume.

Open Demat Account in 10 Min & Start Trading Now!

How to Calculate the On Balance Volume?

You can easily calculate the on-balance volume by adding the volume of the day to an aggregate total when the stock’s price closes up, and when the security’s price closes down, then you can subtract the volume of the day.

If today’s close is more than the previous day’s close, then:

OBV = Previous day’s OBV + Today’s Volume

If today’s close is below yesterday’s close, then:

OBV = Previous day’s OBV – Today’s Volume

If today’s close and yesterday’s close are equal, then:

OBV =Previous day’s OBV

Thus you need to know that the absolute figure of the daily on-balance volume is not the primary focus, but the overall direction of the OBV line plays a significant role.

Above all OBV line is nothing but the running aggregate of pessimistic and optimistic volume.

Trading Rules using OBV Indicator

The On Balance Volume is most likely to follow the price direction during an uptrend, and it will most likely continue making both higher top and bottom.

So charts, including OBV and price chart, will almost look similar. The trend is said to be entirely up provided that both the charts move in the same pattern.

All it means that the volume supports the price increase. While when the trend is a downtrend, then OBV must make both lower top and bottom in a similar pattern as price.

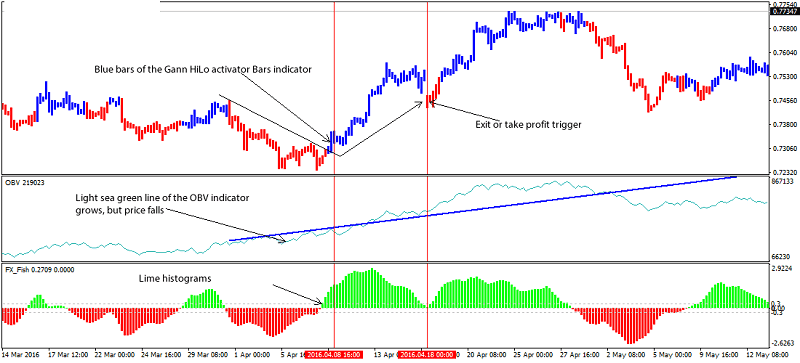

It mainly confirms that the downtrend is highly supported by the volume, and it is intact correctly. There might come a time when both price and OBV will fail entirely to acknowledge each other.

Some of the forms commonly taken during the trading are:

The Uptrend is not Confirmed

Under this situation, the price is most likely to make a new higher top, but the On balance volume won’t be successful in creating a new higher top. It is one of the initial signs of trouble in an uptrend.

Even though the price is increasing and also maintain the higher top but the volume cannot hold it successfully.

All it means that volume fails to support the price. It is known as non- confirmation, and this type of non-confirmation mainly occurs when the uptrend is about to end.

Downtrend Non–Confirmed

Ideally, it is expected that both price and volume will go down in the same pattern during a downtrend.

Often we also see that both price and volume don’t move in tandem. By that, we mean the price might have broken the previous bottom, but the volume fails to do so.

All it shows that price has broken with minimum volume. It is a trouble-making point as the volume doesn’t support the price falling, and it is known as non-confirmation of the downtrend.

Mostly at the end of the bear market, this type of confirmation takes place.

More advanced Breakout

One of the most exciting factors of the on-balance volume is the advanced breakout. There isn’t any major problem as long as price and volume rise together, but at times we see that price will not reach the desired top, but the OBV has already got it.

It is an indicator that the price might also cross the last top. Lastly, it is excellent to know that advanced breakout shows strength, while non- confirmation portrays weakness.

Advanced Breakdown

Both price and on balance volume are most likely to move in the same patterns that are lower top and bottom during a downtrend.

There will be times when we see OBV will break the last bottom, but the price will not succeed in breaking the previous bottom. This is termed a progressive breakdown.

Additionally, an advanced breakdown indicates price might also cripple the bottom. On the part of the price, it is a matter of weakness.

Limitations of On Balance Valume Indicator

One of the most common indicators of OBV is that it is a leading indicator, and all it means that it might produce some predictions, but it doesn’t say much about what has actually happened with the indications it produces.

It is mainly because it is more prone to false signals. You can indeed balance it by using lagging indicators.

All you need to do is integrate a moving average line to the OBV if you want to see OBV breakouts.

By doing so, you can affirm the breakout in the price, provided the OBV indicator creates a concurrent breakout.

Conclusion – On Balance Volume or OBV Indicator

Ideally, OBV is quite a simple indicator that mainly depends on volume and price to determine the selling and buying pressure.

When positive volume is more than negative volume, then the buying pressure can be indicated provided, the OBV line rises.

When negative volume is more than the positive volume, then selling pressure can be indicated to provide the OBV line also falls. To confirm the prevailing trends, the chartists tend to use OBV.

Lastly, you need to know that as with all other indicators, it is essential to use OBV jointly with other elements of technical analysis. OBV isn’t a standalone indicator.

Open Demat Account in 10 Min & Start Trading Now!

Most Read Articles