Bollinger Bands – Meaning, How it works, Example, Usage for Traders, Benefits & more

Last Updated Date: Nov 16, 2022Know everything about Bollinger Bands here. It is a well known Intraday Indicator or Technical Analysis Tool used by traders & technical analyst.

Find details like How it works, Understand the tool with an example, how does it helps a trader, why it is a good tool, limitations & more.

About Bollinger Bands Intraday Indicator

John Bollinger’s technical analysis tool helps traders to get a clear insight into ongoing or upcoming trends and get an idea about the overbought and oversold signals.

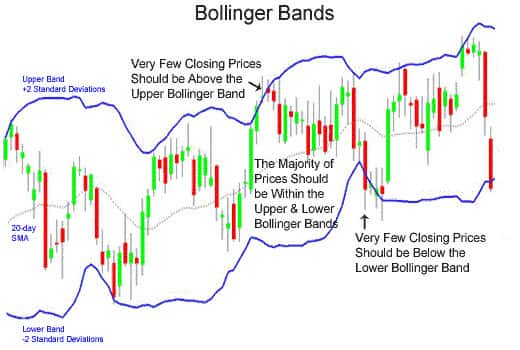

Bollinger band is composed of three conjunctions: the simple moving average, upper Band and lower Band.

Both upper and lower bands are basically defining 2-standard deviations +/- backed by a 20-day simple moving average (middle band).

During an uptrend, traders tend to sell their stocks before the reversal occurs.

During a downtrend, traders tend to purchase stocks with the increase of selling activity among other sellers.

John Bollinger, the founder of Bollinger bands long back ago in 1980, developed an amazing tool (Bollinger bang) for technical analysis of the market. You can also identify the Bollinger band with the name trading band or envelope, as both are the same.

With the help of this ‘versatile tool,’ the trader obtains a clear vision of whether the commodity is overbought or it is oversold.

Undoubtedly, it is quite a famous technical analysis tool developed using moving averages and standard deviations techniques.

Open Demat Account in 10 Min & Start Trading Now!

How Bollinger Bands works?

Bollinger bands work upon three main conjunctions –

Moving Average –it includes 20-period simple moving averages.

Upper Band – it includes 2-standard deviations above the moving average

Lower Band- below the moving average, it includes 2-standard deviations.

Standard deviation is a term defining mathematical formula which is often used to measure volatility. By using this formula, a user gets clear into the stock price variations from its actual value.

Based on the market conditions, this measured price volatility helps Bollinger Bands to adjust themselves accordingly.

In this way, traders obtain the entire data related to price between two bands (Upper and Lower).

Understand Bollinger Bands with an Example

This indicator has its own specific traits that help a trader to grasp essential information about the market.

For instance, a trader observes the possibilities of sharp prices move if the bands appear to tighten in the meantime of a low volatility period.

For instance, a trader observes the possibilities of sharp prices move if the bands appear to tighten in the meantime of a low volatility period.

Moreover, this often indicates a sign of a ‘trending move, but make sure that it isn’t a false move, which is likely to move in the opposite direction.

When you observe a big gap between the bands, it signifies an increase of volatility, and the existing trend is likely to end.

However, there’re high chances of fluctuations in prices within the Bollinger bands. For instance, it can touch one band while moving towards another band. But these swings can also help a trader to assess the profit targets.

In short, the upper band is deemed as the profit target if the price drops below to the lower band and suddenly glides up and crosses the moving average.

Meanwhile, of strong trends, prices tend to increase or hug the Bollinger band for a long time. But you should exercise additional research to determine the additional profits.

For instance, the prices can also cross the bands and suddenly flip back inside the band, creating a negative situation.

How Bollinger Bands helps a Trader?

Here are the various ways a trader can use Bollinger Bands Tool, to make profits in Stock market.

Bollinger Bands and Day Trading Uptrends

Overall, Bollinger bands can help a trader to conclude the rising probabilities of an asset. Even though the asset is potentially losing strength or reversing, Bollinger bands define it comprehensively.

The uptrend is likely to reach the upper band frequently if it’s stronger, and it also points towards the rising figure of the stock.

Similarly, it triggers a trader’s mind to make a buying decision, as they assume it a great opportunity. The prices can flip back and forth, so one should also bear this thing in mind.

For instance, if prices pull back but stay within the middle band and again move forward to the upper band, it discloses lots of strength in the stock.

On the contrary, if the prices move towards the lower band within the uptrend, it clearly defines that the stock is losing strength and creating a warning sign for the trader.

Throughout the spawn of strong uptrends, the technical traders strive to capture maximum profits.

Owing to the fact, the probabilities of reversal stay higher for all time. In most instances, the stock stays in a constant position and fails to reach higher.

Hence, in this situation, traders observe a sense of incurring losses; thus, to avoid it, they instantly start selling assets before the reverse trend occurs.

That’s why technical traders pay special attention to the uptrend and constantly monitor its behavior to disclose the varying situations of weakness and strength of the stock.

Bollinger Bands and Day Trading Downtrends

Traders also use Bollinger Bands to get the idea of the assets in downtrends. For instance, it helps them to determine the falling state of the assets, especially when it’s reversing from the upside trend.

In simple words- during a strong downtrend, the prices are likely to stay constant alongside the lower band. It raises the possibility of selling activities.

On the other hand, the prices are likely to be losing momentum if the prices fail to move along or touch the lower band.

In such situations, traders also observe the signs of ‘downtrend strength,’ especially when the price pullbacks (going higher) or stays below the middle band. However, it can also indicate the reversing of the trend if the prices break above the upper band.

However, during the downtrends phase, traders avoid trading, but they find it the best buying opportunity.

The duration of a downtrend can also vary, e.g., it can happen for a few minutes, hours, days, weeks, months, and sometimes years.

That’s why investors should have a decent familiarity with downtrends and must be aware of its early signs to avoid losses.

Without thinking twice, traders should completely avoid investing in long traders if the downtrend phase is steady at the lower bands.

Why Bollinger Band Indicator is good?

Bollinger bands, over time, have become the most used technique among traders. It provides them an in-depth overview of the trend.

If the prices glide up to the upper band, the chances of an overbought increase in the market. On the contrary, if the prices glide down to the lower band, the chances of ‘oversold’ tend to increase in the market.

In the below chart, it has been shown how the stock prices daily movements go back and move along with supper and lower band.

The bands widen because the market is volatile, and the bands contract because the market is in less volatile periods.

The Squeeze

In the Bollinger Bands, the squeeze refers to the phase when bands become too close, contracting the middle band (moving average).

The squeeze signal is also deemed a low volatility period and an indication that points towards the increased volatility near the future, ultimately, raising the trading opportunities for traders.

On the other hand, if the bands move wider, this phase indicates a decrease in volatility, and traders will increasingly start exiting from the trade.

Overall, these bands never depict the futuristic changes in the trading environment; the entire process revolves around guessing works.

Breakouts

90% of price actions are settled between upper bands and lower bands. Traders assume that breakout between both these bands is a significant moment of trading.

But you should be aware of this common mistake because breakout should never be noticed as a trading signal.

As said above, the price moving along or exceeding the band isn’t a clear indication to come across a buy or sell decision; it can reverse as well.

That’s why you shouldn’t take speedy actions during breakouts, as they provide no ‘indication’ regarding future price movement or direction of the line.

Limitations of Bollinger Bands

Ultimately, we become familiar with the Bollinger Bands’ helpfulness in technical analysis for traders. But, we can’t overlook the limitations associated with the use of this Bollinger Bands Tool.

The first limitation is that it doesn’t predict the outcome and only reacts to ongoing trading matters.

Whenever the price moves up or goes down, the Bollinger band reacts, especially in ‘uptrend’ and ‘downtrends.’ That’s why it’s also similar to the other technical indicators; the prices stay unpredictable.

However, this is due to the Bollinger band dependency over Simple Moving average, which also counts the average price of the stocks at varying price bars and does not predict the upcoming behavior of it.

On their own, traders predict the price and create a vision about the upcoming trend through deep market analysis. The tool solely doesn’t allow the trader to predict the prices.

If we talk about another limitation, so it lies down in the standard-setting associated with Bollinger Bands. It’ll fail to work for traders. That’s why traders should strive hard to look for settings since it’ll help them while trading.

Traders will be able to set guidelines for a particular stock, which initiates a well-planned investment.

But this also has a little shortcoming; if the selected band’s setting fails to deliver the desired outcome, the trader will then have to think about using a different tool or completely change the settings.

That’s why a trader must be well-familiar with the market and parameters at which he/she perhaps requires to alter the settings.

Conclusion – Bollinger Bands

Bollinger Bands is one of most commonly used Intraday Tool used by traders to make money in share market.

We have gone through in detail about how it works, examples, benefits, how it is helpful for traders, limitations & more.

We hope that this article have been fruitful for your understanding & it can help you in trading. You can now open a demat account & start trading.

Open Demat Account in 10 Min & Start Trading Now!

Most Read Articles