Arms Index Indicator or TRIN – Concept, Calculation, Importance, Drawbacks & more

Last Updated Date: Nov 16, 2022You must be curious to learn about Arm Index or TRIN Indicator; this guide is just for you.

Though indexes tell you about the overall well being of the market but they can’t reveal anything more than that.

Technical analysts tend to rely on a plethora of technical data, including financial charts and indicators, to make buying and selling decisions.

The best part about these indicators is that they allow the traders to keep an eye on the different trends in the stock market.

Besides this, traders can also monitor the momentum in the stock market and stock price. One such index is the arms index.

Know about Arms Index Indicator or TRIN

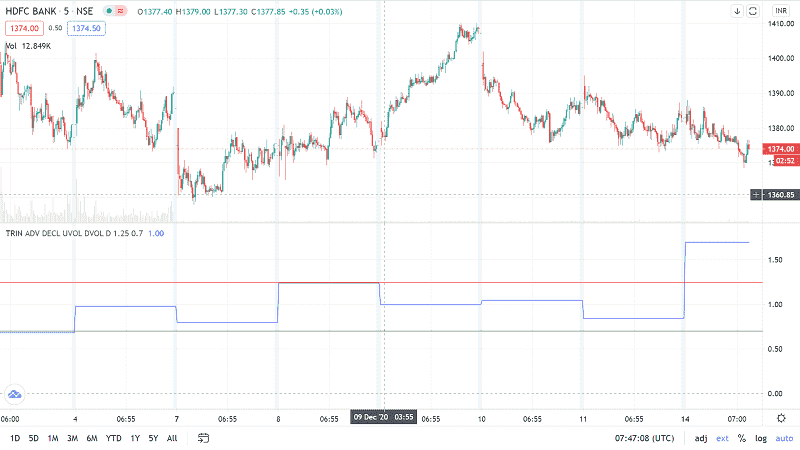

You can also address the Arms index as the Short-Term Trading Index (TRIN). Basically, it is a technical analysis indicator that you can use to compare both the increase and decrease of stocks.

It is a ratio of advancing and declining of stocks to advancing and decline volume. With this indicator, you can quickly gauge the market sentiment.

The indicator was invented back in 1967 by Richard W. Arms, Jr.

Additionally, you can also use the indicator to predict the future price movements prevailing in the market. It is mainly for the intraday basis.

Furthermore, the indicator does this by evaluating oversold and overbought levels that predict when the index will change the trend.

Open Demat Account Now! – Zero Brokerage on Delivery

What does the Arms Index convey to you?

The Arms index helps in providing a tremendous dynamic explanation of the overall movement of the stock exchanges, including the NSE or NIFTY.

It does so by evaluating the movement’s strength and breadth. If the index value is 1.0, then the ratio of the volume is equal to the AD ratio. Additionally, the market is neutral if the value is 1.0.

It is mainly because up volume is equally aligned over the increasing issues while the down volume is equally aligned over decreasing issues.

The majority of the technical analysts claim that the Arms index signals a bullish trend when it is less than 1.0. It is an excellent volume in the average up stock as compared to average down stock.

Furthermore, some of the analysts also claim when the long-term equilibrium is less than 1.0; then it confirms bullish bias to the stock market.

What more Analyst has to say about Arms Index Indicator?

If the reading is more significant than 1.0, it ensures a bearish signal. It is mainly because there is a considerable volume in the average down stock as compared to the average up stock.

If the arms index is farther away from the 1.00, then the contrast volume is also more significant on the buying and selling day.

You can say that the market position is oversold when the value exceeds 3.00. Under this value, the bearish element is too dramatic.

When you see this value, you can say that an uptrend reversal in prices is prevailing.

On the other hand, you can say that the market is overbought, and the bullish element is prevailing when the index value falls below 0.50.

Besides looking at the value of the indicator, traders also tend to see how it prevails in the entire day.

Traders say that if there are any extremes prevailing in the market, then it means the market will change soon.

How can you calculate the Arms Index?

TRIN = Advancing Volume/Declining Volume/Advancing Stocks/Declining Stocks

- Advancing stocks means the number of stocks that are higher on that particular day.

- Declining stocks means the number of stock that is lower on that particular day.

- Advancing volume means the total number of advancing stocks.

- Decline volume means the total number of declining stocks.

You need to know that the Arms index is available under several charting applications. The steps here can help you in calculating the index easily:

- Firstly you need to calculate the ARD ratio by the number of advancing stocks by the number of declining stocks. You can calculate it as preset intervals, including daily or every five minutes or the interval type you choose.

- Then to get the AD volume, you need to divide the total advancing volume by the total declining volume.

- You can then divide the AD volume by Ad ratio.

- Plot all the results on the graph that you record.

- For the next interval, you can repeat the calculation.

- After connecting several data points, you can understand how the TRIN moves.

What does the TRIN Index value tell you?

You can get at least three readings along with this index. Especially, Value 1.0 holds a lot of importance.

This result says that the AD ratio is equal to the AD volume ratio, and here the market is in a neutral position.

When AD is less than 1.0 value, it means AD volume is more than an AD ratio. It strongly indicates a bull market.

Additionally, when the volume is 1.0 above AD, the volume is less than the AD ratio. The index value indicates a bear market.

Importance of Arms Index

Unlike the typical market indexes, the Arms index takes one step ahead by comparing the net advances of volume. Under this situation, the volume plays a crucial role.

When the price movements are high, they are quite vital as compared to those prevailing under low volume.

The best part about this index is that you get a complete picture of what is going on in the market. When you do the assessments correctly, you can get a better idea of the price action.

Basically, the values under this index are bought, sell, or hold signals.

Drawbacks of using the Arms Index

When it comes to using the arms index, traders need to keep in mind some peculiarities. Inaccuracies are most likely to arise as the index is all about volumes.

Though the situation is not typical, if the problem occurs, it makes the indicator highly unreliable.

Conclusion – Arms Index Indicator

Traders are most likely to take into account both the value of the indicator and the changes that happen throughout the day.

Additionally, traders consider extremes in the index’s value to look for signals which indicate some changes in the market.

Thus, the indicator is quite useful if you want to learn about the factor that drives the movements of the market.

Hence, the index allows you to get a better idea of where the index is leading. Above all, the index is pretty easy to understand.

Open Demat Account Now! – Zero Brokerage on Delivery

Most Read Articles