Modern Portfolio Theory – Concept, Diversification, Strategies, Benefits & more

Last Updated Date: Nov 18, 2022Come along to talk over this critical topic of Modern Portfolio Theory, to outperform in the financial market.

The trading sector often becomes tricky to predict. In most instances, you pull out all the stops to achieve your goal in the financial market; still, your efforts are never paid off.

It happens due to the lack of the right strategy and well-planned execution. Hence, there are a few vital things that you must consider before moving ahead.

A well-managed portfolio is the foundation of any investment port. However, probably most of you are still following the old standard portfolio system.

That’s why mostly the time, you fail to survive and ultimately find it hard to make both ends meet. A traditional type of portfolio lacks a quantitative approach.

They can’t balance portfolio, that creates trouble to handle multiple assets. Similarly, a trader finds it hard to reduce the risk on the portfolio.

But Modern Portfolio Theory (MPT) has brought a new fad of creating a portfolio and taking wise moves through it.

What is Modern Portfolio Theory or MPT?

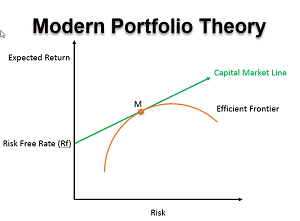

Modern Portfolio Theory is an outcome of Nobel Laureate Harry Markowitz’s efforts to know the financial market.

At present, it’s one of the most popular investing models that help traders a lot to reduce market risk. Though, the theory is also helpful to boost the returns alongside.

At present, it’s one of the most popular investing models that help traders a lot to reduce market risk. Though, the theory is also helpful to boost the returns alongside.

MPT allows the trader to make a vision and set a degree of risk that can likely impact your entire portfolio.

However, the theory encourages risk-averse investors to build a portfolio and start investing.

According to the theory, risk-averse investors sometimes find it safe to move ahead by taking a glimpse of the expected return at a given risk.

If a trader obtains quantifiable details over the risk, he can initiate investment.

An investor can also diversify his portfolio to reduce the risk by following the theory and using the quantitative method.

Get expert help for PMS Investment – Fill up the form Now!

Diversification as per Modern Portfolio Theory

Modern Portfolio Theory also says that it isn’t critical that an investor solely focuses on the risk and returns.

It may vary from time to time and asset to asset. Hence, it becomes vital for an investor to divide in many instead of putting entire eggs in one basket.

For instance, one should split his/her investment and purchase multiple stocks instead of putting entire money on a single asset.

Most of you might also name it ‘Diversification.’ It’s helpful, and MPT also gives it chief importance.

According to MPT, diversification is one of the fast and effective ways to reduce the portfolio’s risk level.

Also, Modern Portfolio believes that each stock in a portfolio has its underlying standard deviation that can be called a “risk.”

That’s why, by diversifying the stocks rather than focusing on an individual stock, the risk becomes easy to reduce.

Let’s understand it in-depth through an example. Suppose a stock continues to providing you returns despite a highly volatile market.

But your other return provides you return periodically, and often it fails to survive. However, you can’t rely solely on the first stock because it’s unpredictable when the market will take a giant u-turn.

The second option is also not reliable. In such situations, you can add both assets to your portfolio. If any of your assets fail to survive, another asset will always be there to pay off.

In this way, you’ll be reducing the overall risk in a portfolio.

Investing Strategies of Modern Portfolio Theory

Modern Portfolio Theory guides traders not to set a goal that is solely focusing on extracting higher returns at the condition of the highest risk.

You can’t overlook the equal chances of risk associated with it. A trader should focus more on investment that helps them to stay in a balanced position.

The highest returns are acceptable, but not at the condition of putting the entire portfolio at risk. Below are the two main strategies that may help you to achieve your goal.

Strategic Asset Allocation

If you seek an effective portfolio that keeps maximizing wealth for you, you should first follow a strategic approach.

For instance, the best strategic approach you can follow is to purchase and hold a group of assets but at a condition that they shouldn’t be correlated positively.

They shouldn’t be moving up and down simultaneously on the occurrence of the same market condition.

Also, you should periodically rebalance the portfolio that will help you out in avoiding overweight.

Two-Fund Theorem

As per this strategy, you avoid an entirely complex portfolio. However, this strategy helps traders who don’t have ample capital to invest in multiple assets.

MPT also guides you only to add two mutual funds in your portfolio and avoid choosing individual stocks.

For instance, you can select 50% mid-cap, small-cap, and large-cap stock and 50% shorter term, intermediate-term, medium-term, and government bonds.

Benefits of Modern Portfolio Theory

Here are the list of major advantages of MPT –

- Reduce risk investing

- Best for an average investor

- No timing of the market

Drawbacks of MPT

Here are all possible disadvantages of Modern Portfolio Theory –

- Standardized assumptions

- Doesn’t follow whole modern data

Why is Modern Portfolio Theory Important?

If you don’t have enough capital to meet advisors and experts’ expenses, you should probably start following Modern Portfolio Theory.

Though, most points outlined in the MPT theory are fundamental. You can still assume it a core pillar of building a strong portfolio and earn ample from it.

MPT guides you skillfully about the basics, chiefly if you prefer managing your portfolio on your own.

Modern Portfolio Theory or MTP – Conclusion

However, if you hire a manager, hardly a few of them will provide you a satisfactory reply. It is also possible that you miss most of the critical points.

They never provide you a full history of the market, and you can’t compare various modules. You’ll be wholly dependent on them. That’s why, in most instances, you may fail to derive essential data.

But, we can’t overlook the few shortcomings of using Modern Portfolio Theory as well. You’ll have to study most of the things additionally on your own.

Get expert help for PMS Investment – Fill up the form Now!

Most Read Articles