Covariance – Concept, Impact on Portfolio, Usage, Formula, Drawback & more

Last Updated Date: Nov 16, 2022Covariance gives the analysts an idea about the directional relationship taking place between returns on two different assets.

A positive covariance states that the asset returns are moving together. On the other hand, a negative covariance states that the asset returns are moving inversely.

The calculation of Covariance is done through an analysis. It is done through a correlation multiplication by each variable’s standard deviation between the two variables.

Understanding Covariance in Portfolio Management

Covariance helps the trader to form an opinion about the mean value of two moving variables. These variables go ahead in a parallel position.

Similarly, if stock X’s return is moving higher. Alongside, stock B’s return is also moving higher; there will be a positive covariance.

Even though both Stock X’s return and Stock Y’s return are declining at once, there will be a positive covariance.

Covariance is taken into account to help for the diversification of security holdings. Though most traders often skip this critical point, yet it has a notable impact on the portfolio.

On the big picture, Covariance provides traders with statistical details about the two assets moving in the same direction.

Hence, it becomes essential to point out this most critical thing during the building of a portfolio.

For instance- while creating a portfolio, a trader strives to keep the risk and volatility minimal while expecting a positive return. For this analysis, keep an eye on the historical data of the price.

It helps them to get an idea about the assets, such as which asset can be a better option for being a part of the portfolio and which one is not.

Covariance comes to light amid this. If the included assets create a negative covariance (getting down similarly), the portfolio’s volatility is likely to decline.

However, analysts mainly put the historical data into exercise for the calculation of Covariance of assets classes.

Get expert help for PMS Investment – Fill up the form Now!

How Covariance impacts a Portfolio?

Covariance has a significant impact on the overall portfolio position. For instance, it can trim down the volatility for a portfolio thoroughly.

On the other hand, it can also encourage the diversification of assets in a portfolio. If you want to reduce the overall risk within a portfolio, you can add negative Covariance there.

Though, initially, it’s possible that the assets may drop at a fast pace. But as you add more assets, it may drop off at a slow speed.

But make sure, Covariance comes at some limitations. Covariance can provide the analysts’ data on the direction of the assets.

It implies that you can’t get an idea of the strength between two asset prices. Hence, you can take the help of the correlation coefficient by determining it between the assets.

It’s the best way to get an overview of the strength.

How to use of Covariance? – Modern Portfolio Theory

MPT brings the special traits of using Covariance to light. It discusses the importance of using Covariance for a portfolio.

As part of the Modern theory, most investors are risk-averse investors; still, they want to enjoy high returns. That’s why Covariance provides them with an attractive way.

On the base of it, they make a decision and come out from their risk-averse mindset to some extent.

They can invest in risky assets while staying within a safe position. Hence, they can enjoy more profits.

Here, the analysts create a combination of assets and align them in such a way so the amount of risk and rate of return on a particular asset could be frequently examined.

It helps them to put the right diversification strategy into action. Similarly, the risk is equally divided, and the return is efficiently obtained.

Covariance Formula

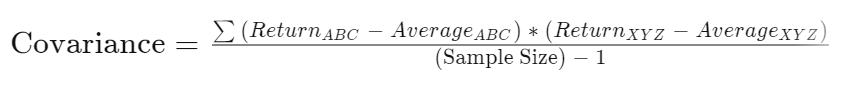

For the calculation of Covariance in Portfolio Management, traders use a formula that clears their doubt.

In the first step of the formula, traders get insight into the average daily return that each individual can get from an asset.

Similarly, the trader then analyzes the difference between the obtained returns from assets on a daily basis by eliminating the average daily return from it.

The obtained number is later multiplied with the received data from both. The outcome is divided by the trading period’s numbers and eliminating ‘1’ from it in the final step.

However, in the maximum cases, traders bring Covariance into action to make a robust diversification.

That’s why it’s quite effective for you if you want to obtain more out of your expectations from your portfolio.

In the end, we’ll glance at the major drawbacks that might create a hitch for you on using Covariance.

Covariance Drawbacks

There’re a few downsides to using Covariance, and hardly a few people talk about it. As said, the Covariance can only give the trader an idea on assets’ relation moving together.

In most cases, you need to assess the strength of the assets. Since Covariance doesn’t offer it to you, so it turns out to be a major fault of it.

Another big downside of using Covariance lies in its sensitive calculation. If you want to estimate higher volatility returns, you may find issues here.

Also, daily price moves come with lots of twists and turns, which can impact the Covariance as well.

Mostly traders often bump into these issues. You can detect an error in your calculation. In most cases, the end result goes fully beyond your expectation.

Hence, you should use it carefully with a decent knowledge of the basics.

Covariance – Conclusion

Suppose you’re also looking for a way that can make your diversification strategy more helpful. Beyond a doubt, you should start paying attention to covariance usage.

It will help you a lot while creating a portfolio and picking out an asset. It’ll provide you with a balanced position in which you’ll view all risk and return in a steady form.

Even though you’re a risk-averse investor, the method forces you to take action. You spend money on a risky asset with no less fear of losing money.

The overall Covariance method can help you out to lessen the risk chances. Still, it has a few faults, so don’t forget to take them into account.

Get expert help for PMS Investment – Fill up the form Now!

Most Read Articles