ECL Finance Limited NCD Dates, Size, Allotment, Subscription, DRHP & more

Last Updated Date: Nov 16, 2022Let’s have a detailed review of the company and analytics of the ECL Finance Limited NCD release date, NCD issue size, subscription, ECL Finance NCD allotment and other details like the company’s background, its financial positions, its promoters and other related things.

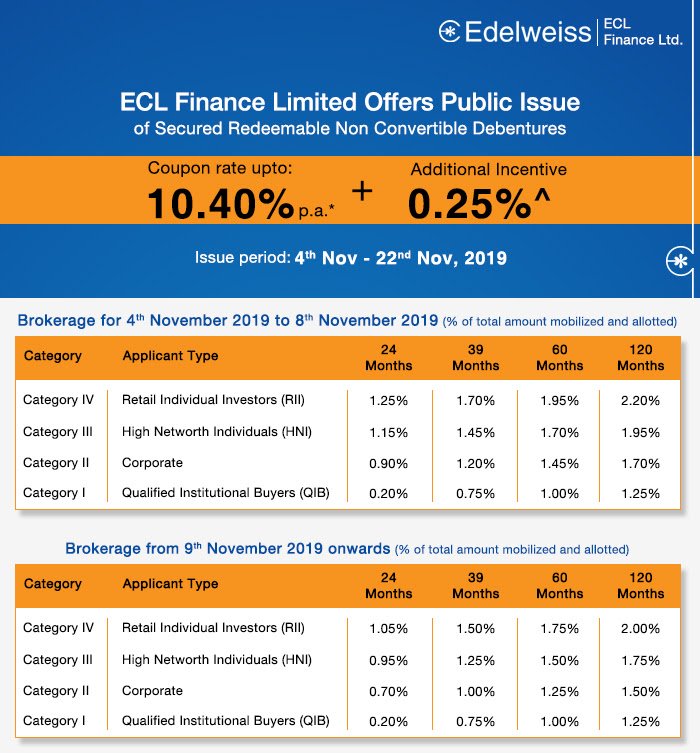

ECL Finance Limited NCD – November 2019 Detail

| Credit Rating | CARE AA Positive by CARE and CRISIL AA Stable by CRISIL Limited |

| Issue Open | Nov 4, 2019 |

| Issue Close | Nov 22, 2019 |

| Base Size | Rs 100 Crores |

| Shelf Size | Rs 400 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Tenor | 24 months/ 39 months/ 60 months/ 120 months |

| Series | Series I to Series IX |

| Payment Frequency | Monthly, Cumulative and Annual |

| Basis of Allotment | First Come First Serve Basis |

ECL Finance Limited NCD – Basis of the Offer Price

| ISSUE STRUCTURE | |

| Security Name | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Coupon payment frequency | Monthly, Cumulative and Annual |

| Coupon type | Fixed & Floating |

| Tenor | 24 months/ 39 months/ 60 months/ 120 months |

| Depository | NSDL and CDSL |

| Disbursement | SEBI Debt Regulations |

| Debenture Trustee | Beacon Trusteeship Limited |

| Tranche II Issue Size | Rs 5,000 million |

| Shelf Limit | Rs 20,000 million |

| Mode of Issue | Public issue |

ECL Finance Limited NCD Dates

The opening and the closing date of ECL Finance Limited NCD is from Nov 4, 2019 to Nov 22, 2019.

ECL Finance Limited NCD Subscription

| Day / Date | QIB Category 1 | NII Category 2 | HNI Category 3 | RII Category 4 | Total Subscription |

| 1st – 10th Day : till Nov 11, 2019 | 0.00x | 0.37x | 2.61x | 3.89x | 2.02x |

| 10th – 20th Day : till | |||||

| 20th – 30th Day : till | |||||

| Shares Offered or Net Issue | 10,00,000 | 10,00,000 | 15,00,000 | 15,00,000 | 50,00,000 |

The shares subscribed by the public will be updated here.

ECL Finance Limited NCD Allotment Status

Here, you can find the Allotment Status of this NCD – https://www.linkintime.co.in/BONDS/AllotmentDetails.html

ECL Finance Limited NCD Share Offering

Public issue of secured redeemable non-convertible debentures of face value of Rs.1,000/- each (The “Debentures” or The “NCDs”), with a base issue size for an amount of Rs. 1,000 million /- with an option to retain over subscription of additional NCDs of face value of Rs.1,000/- each, for an amount upto Rs. 4,000 million /- aggregating to Rs. 5,000 million /- (“Tranche II Issue”) which is within the shelf limit of Rs.20,000 Million.

ECL Finance Limited NCD Allocation Ratio

| NCD Allocation Ratio | |

| Category | NCD’s Allocated |

| QIB – Category 1 | 20% |

| Corporate – Category 2 | 20% |

| HNI – Category 3 | 30% |

| RII – Category 4 | 30% |

ECL Finance Limited NCD Offered

| NCD’s Offered | |

| Category | NCD’s Reserved |

| QIB – Category 1 | 10,00,000 |

| NII – Category 2 | 10,00,000 |

| HNI – Category 3 | 15,00,000 |

| RII – Category 4 | 15,00,000 |

| Total NCD’s | 50,00,000 |

ECL Finance Limited NCD Coupon Rates

| Series | I | II | III | IV | V | VI | VII | VIII | IX |

| Frequency of Payment |

Annual | Cumulative | Annual | Cumulative | Monthly | Annual | Cumulative | Monthly | Annual |

| Minimum Application |

Rs. 10,000/- (10 NCDs) across all Series | ||||||||

| Face Value/ | Rs. 1,000/- | ||||||||

| In Multiples of thereafter (Rs.) |

Rs. 1,000/- (1 NCD) | ||||||||

| Tenor | 24 months |

24 months | 39 months |

39 months | 60 months |

60 months |

60 months | 120 months |

120 months |

| Coupon (% per annum) |

9.90% | NA | 10.20% | NA | 9.95% | 10.40% | NA | 9.95% | 10.40% |

| Effective Yield |

9.89% | 9.90% | 10.22% | 10.20% | 10.41% | 10.39% | 10.40% | 10.41% | 10.39% |

| Mode of Interest Payment |

Through various mode available | ||||||||

| Amount (Rs. / NCD) on Maturity |

Rs. 1,000/- |

Rs. 1,208.11/- |

Rs. 1,000/- |

Rs. 1,371.81/- |

Rs. 1,000/- | Rs. 1,000/- |

Rs. 1,640.90/- |

Rs. 1,000/- |

Rs. 1,000/- |

| Maturity / Redemption Date |

24 months |

24 months | 39 months |

39 months | 60 months |

60 months |

60 months | 120 months |

120 months |

| Put and Call Option |

NA | NA | N/A | NA | NA | *NA | N/A | *NA | NA |

ECL Finance Limited NCD Issue Object

The Company proposes to utilise the funds which are being raised through this Tranche II Issue, after deducting the Tranche II Issue related expenses to the extent payable by the Company (“Net Proceeds”), towards funding the following objects (collectively, referred to herein as the “Objects”):

- For the purpose of onward lending, financing, and for repayment/prepayment of interest and principal of existing borrowings of the Company; and

- General corporate purposes.

ECL Finance Limited – Company Overview

The Company was incorporated in Mumbai, Maharashtra on July 18, 2005 as a public limited company under the provisions of the Companies Act, 1956, as ECL Finance Limited and received the certificate of commencement of business from the Registrar of Companies, Maharashtra at Mumbai on August 04, 2005. The Company is registered as a Non-Banking Financial Company under Section 45-IA of the Reserve Bank of India Act, 1934.

The Company was incorporated in Mumbai, Maharashtra on July 18, 2005 as a public limited company under the provisions of the Companies Act, 1956, as ECL Finance Limited and received the certificate of commencement of business from the Registrar of Companies, Maharashtra at Mumbai on August 04, 2005. The Company is registered as a Non-Banking Financial Company under Section 45-IA of the Reserve Bank of India Act, 1934.

ECL Finance Limited NCD Lead Managers

| Lead Managers |

| AXIS BANK LIMITED Axis House, 8th Floor, C-2, Wadia International Centre, P.B. Marg, Worli, Mumbai – 400 025, Maharashtra, India Tel.: +91 22 6604 3293 Fax: +91 22 2425 3800 Email: ecl.ncd2019@axisbank.com Website: www.axisbank.com Investor Grievance email: investor.grievance@axisbank.com Contact Person: Mr. Vikas Shinde Compliance Officer: Mr. Sharad Sawant SEBI Registration No.: INM000006104 CIN: L65110GJ1993PLC020769 |

| Lead Managers |

| EDELWEISS FINANCIAL SERVICES LIMITED* Edelweiss House, Off CST Road, Kalina, Mumbai 400 098, Maharashtra, India Tel: +91 22 4086 3535 Fax: +91 22 4086 3610 Email: ecl.sncd@edelweissfin.com Website: www.edelweissfin.com Investor Grievance email: customerservice.mb@edelweissfin.com Contact Person: Mr. Lokesh Singhi Compliance Officer: Mr. B. Renganathan SEBI Registration No.: INM0000010650 CIN: L99999MH1995PLC094641 |

ECL Finance Limited NCD Debenture Trustee

| Debenture Trustee |

| BEACON TRUSTEESHIP LIMITED 4 C&D, Siddhivinayak Chambers, Gandhi Nagar, Opp. MIG Cricket Club Bandra (East), Mumbai- 400 051 Tel: +91 22 26558759 Email: compliance@beacontrustee.co.in Investor Grievance e-mail: investorgrievances@beacontrustee.co.in Website: www.beacontrustee.co.in Contact Person: Mr. Vitthal Nawandhar SEBI Registration Number: IND000000569 CIN: U74999MH2015PLC271288 |

ECL Finance Limited NCD Registrar to offer

| Registrar to the Offer |

| LINK INTIME INDIA PRIVATE LIMITED C- 101 1st Floor 247 Park LBS Marg, Vikhroli (West) Mumbai 400083 Maharashtra, India Tel: +91 22 4918 6200 Fax: +91 22 4918 6195 Email: eclapr2019.ncd@linkintime.co.in Investor Grievance mail: eclapr2019.ncd@linkintime.co.in Website: www.linkintime.co.in Contact Person: Ms. Shanti Gopalkrishnan Registration Number: INR000004058 CIN: U67190MH1999PTC118368 |

ECL Finance Limited NCD Ratings

The NCDs proposed to be issued under this Issue have been rated “CARE AA; Positive” for an amount of ` 20,000 million, by CARE Ratings Limited vide their letter dated April 10, 2019 and revalidated as “CARE AA-; Stable” by revalidation letters dated July 31, 2019, September 10, 2019 and October 18, 2019 and “CRISIL AA/Stable” for an amount of ` 20,000 million, by CRISIL Limited vide their letter dated April 18, 2019 and revalidated as “CRISIL AA/Negative” vide its revalidation letters dated July 20, 2019 and August 20, 2019 and further revalidated as “CRISIL AA-/Stable” vide its letter dated October 07, 2019.

The rating of “CARE AA-; Stable” by CARE Ratings Limited and “CRISIL AA-; Stable” by CRISIL Limited indicate that instruments with these ratings are considered to have a high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk.

ECL Finance Limited NCD News

News 1 – Download DRHP Prospectus

Market Guide

Featured Topics