Ujjivan Small Finance Bank IPO Dates, Bid, Allotment, Subscription, Size, GMP & more

Last Updated Date: Nov 16, 2022Let’s have a detailed review of the company and analytics of the Ujjivan Small Finance Bank IPO release date, USFB IPO offer price, subscription, Ujjivan IPO allotment, grey market price and other details like the company’s background, UFSL financial positions, its promoters, and other related things.

- Issue Price of this IPO is Rs. 36 – 37 . Check the Live Share Price here Ujjivan Small Finance Bank Share Price

- To track the performance of this IPO, click on this link – IPO Performance

| Market Lot | 400 Shares |

| Min. Order Quantity | 400 Shares |

| Listing At | BSE, NSE |

| Price Band | Rs. 36 – 37 |

| Listing Date | Dec 12, 2019 |

| Issue Size (shares) | 208,333,333 |

Ujjivan Small Finance Bank IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 7.5/10 |

| Industry Ranking | 7.1/10 |

| Company Background | 7.3/10 |

| Company Reputation | 7.2/10 |

| Competitive Edge | 7.7/10 |

| Financial Statements | 7.1/10 |

| Popularity Index | 7.4/10 |

| Promoters Reputation | 7.7/10 |

| Retail Appetite | 7.1/10 |

| Top Brokers Review | 7.9/10 |

| Overall Ratings | 7.4/10 |

| Star Ratings | ★★★★☆ |

Summary of Ujjivan Bank IPO

They are a mass market focused SFB in India, catering to unserved and underserved segments and committed to building financial inclusion in the country. UFSL’s erstwhile business was primarily based on the joint liability group-lending model for providing collateral free, small ticket-size loans to economically active poor women.

Ujjivan Small Finance also offers individual loans to Micro and Small Enterprises (“MSEs”) and adopted an integrated approach to lending, which combined a customer touchpoint similar to microfinance, with the technology infrastructure and related back-end support functions similar to that of a retail bank.

The Promoters of this company is Ujjivan Financial Services Limited. The lead manager to the issue are Kotak Mahindra Capital Company Limited, IIFL Securities Limited, JM Financial Limited and the Registrar to this issue is Karvy Fintech Private Limited.

From FY 2016-17 to FY 2018-19, as per the Restated Financial Statements

Also, Net Interest Margins in Fiscal 2018 and 2019 were 10.31% and 10.93%, respectively, and was 10.51% in the three months ended June 30, 2019. Total deposits have increased from Rs. 2,064.05 million as of March 31, 2017 to Rs. 73,794.40 million as of March 31, 2019 and were Rs. 79,567.64 million as of June 30, 2019.

Of their total deposits, share of retail deposits has increased from 3.15% as of March 31, 2017 to 37.07% as of March 31, 2019 and was 43.09% in the three months ended June 30, 2019. Moreover, our CASA to total deposits ratio has improved from 1.57% as of March 31, 2017 to 10.63% as of March 31, 2019 and was 10.39% as of June 30, 2019.

Open Free* Demat A/C Now! Fill the details below

Ujjivan Bank IPO Date

The opening and the closing date of Ujjivan Small Finance Bank IPO is Dec 2 – Dec 4, 2019.

Ujjivan Bank IPO Subscription

| Day / Date | QIB | NII | RII | RPS |

Total Subscription |

| 1st Day – Dec 2 | 0.23x | 0.43x | 8.61x | 0.72x | 1.62x |

| 2nd Day – Dec 3 | 0.85x | 2.46x | 23.85x | 1.87x | 4.86x |

| 3rd Day – Dec 4 | 110.72x | 473.00x | 47.72x | 4.01x | 165.45x |

| Shares Offered | 56,250,000 | 28,125,000 | 18,750,000 | 20,833,333 | 123,958,333 |

The shares subscribed by the public will be updated herein.

Ujjivan Small Finance Bank IPO Allotment Status

Here, you can find the Allotment Status of this IPO. Those who had applied for shares in this IPO can check their allotment status through application number, DPID/ Client ID or PAN card number. Allotment of shares for Ujjivan IPO is in progress.

Ujjivan IPO Listing Date / Other Events

Find the dates below for basis of allotment, refund, listing and more:

| Basis of Allotment Finalization | Dec 9, 2019 |

| Refunds Initiation | Dec 10, 2019 |

| Credit of Shares to Demat Account | Dec 11, 2019 |

| Share Listing Date | Dec 12, 2019 |

| Submission and Revision in Bids | 10.00 a.m. to 5.00 p.m. |

| Submission and Revision in Bids | 10.00 a.m. to 3.00 p.m. |

Ujjivan Small Finance Bank IPO Price Band

The face value of each share is Rs 10, but the price band of the IPO is Rs 36 – Rs 37.

Ujjivan Bank IPO Size & Offering

Issue Size: 208,333,333 Equity Shares of Rs. 10 (Face Value), aggregating up to Rs. 750 Crores.

Price Discount: Rs. 2/- per equity share for Ujjivan Financial Services Limited (“UFSL”) shareholders bidding in the Shareholder Reservation Portion

Ujjivan Financial Services Limited – Company Overview

Ujjivan Financial Services Limited as a wholly-owned subsidiary. UFSL, subsequent to obtaining RBI Final Approval on November 11, 2016 to establish and carry on business as an SFB, transferred its business undertaking comprising of its lending and financing business to our Bank, which commenced its operations from February 1, 2017.

They were included in the second schedule to the Reserve Bank of India Act, 1934 as a scheduled bank on July 3, 2017. In the short span of time that company has been operational as an SFB, they are among the leading SFBs in India in terms of deposits, advances, branch count and geographical spread, as of March 31, 2019.

Among the leading SFBs in India, Company’s Bank had the most diversified portfolio, spread across 24 states and union territories as of March 31, 2019. Company intend to develop and offer a comprehensive suite of asset and liability products and services that will help attract new customers and deepen the relationship with existing customer base.Their focus customers are primarily young middle class customers across India.

UFSL Products & Services

Their portfolio of products and services includes various asset and liability products and services. The asset products comprise: (i) loans to our micro banking customers that include group loans and individual loans, (ii) agriculture and allied loans, (iii) MSE loans, (iv) affordable housing loans, (v) financial institutions group loans, (vi) personal loans, and (vii) vehicle loans. On the liability side, we offer savings accounts, current accounts and a variety of deposit accounts. In addition, we also provide non-credit offerings comprising ATM-cum-debit cards, Aadhaar enrolment services, distribute third party insurance products and point of sales (“POS”) terminals.

Business strategies of Ujjivan Financial Services Limited

- Diversify product offerings to enable multiple customer relationships

- Continue to focus on technology and data analytics to grow operations

- Strengthen liability franchise and focus on increasing our retail base

- Expand our distribution network to increase customer penetration

- Focus on developing responsible banking behavior for unserved and underserved segments

- Diversify revenue streams

Ujjivan Financial Services Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary of UFSL IPO

On the basis of Standalone statement:-

| Amount (in INR & Millions) | ||||

| September 30, 2019 | March 31, 2019 | March 31, 2018 |

July 4, 2016 to March 31, 2017 | |

| Total Assets | 1,61,078.96 | 1,37,422.15 | 94,728.73 | 84,359.05 |

| Total Revenue | 14,348.57 | 20,375.75 | 15,793.55 | 2,238.74 |

| Total Expense | 12,477.47 | 18,383.57 | 15,724.92 | 2,238.39 |

| Profit After Tax | 3,054.73 | 2,043.91 | 68.89 | 0.35 |

Earnings per Equity Share (in Millions)

| September 30, 2019 | March 31, 2019 | March 31, 2018 |

July 4, 2016 to March 31, 2017 | |

| Basic & Diluted | 1.21 | 1.20 | 0.05 | 0.00 |

From the above statements, one could find that Ujjivan Small Finance Bank may perform well.

Ujjivan Small Finance Bank IPO – Promoters

The Promoter of this company is:

- Ujjivan Financial Services Limited

Ujjivan Bank IPO – Promoter Holding

UFSL is the sole Promoter of our Bank. As of the date of this Red Herring Prospectus, the Promoter holds an aggregate of 1,440,036,800 Equity Shares (which includes six Equity Shares held by nominees on behalf of UFSL), aggregating to 94.40% of the pre-Issue issued, subscribed and paid-up Equity Share capital of the Bank, and 200,000,000 Preference Shares aggregating to 100% of the issued and paid-up Preference Share capital of the Bank.

- Pre Issue Share Holding is 94.40%

List of Related Parties (Key Managerial Personnel)

- Rajat Singh, Business Head – Micro Banking and Rural Banking

- Alok Chawla, Head – Audit

- Jaya Janardanan, Chief Operating Officer

- Chanchal Kumar

- Sanjeev Barnwal

- Sanjay Kao

- Upma Goel

- Sanjay Kao

- Jaya Janardanan

- Alok Chawla

- Chanchal Kumar

Interest in Intellectual Rights of the Company

As on the date of filing of the Draft Red Herring Prospectus, the Company does not own any intellectual property rights.

UFSL IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Issue of Equity Shares | Up to [●] Equity Shares, aggregating up to Rs. 7,500 million |

| Of which: | |

| Reserved for Market Makers | Upto [●] Equity Shares of Rs. 10 each for cash at a price of M [●] per share aggregating Rs.7,50 Million |

| Net Issue to the Public | Up to [●] Equity Shares, aggregating up to Rs. 6,750 million |

| Of which: | |

| Retail Investors Portion | Not more than [●] Equity Shares |

| Non-Retail Investors Portion | Not more than [●] Equity Shares |

| Equity Shares outstanding prior to the Issue | 1,525,520,467 Equity Shares |

| Equity Shares outstanding after the Issue | [●] Equity Shares |

Ujjivan Small Finance Bank IPO Issue Object

Bank proposes to utilize the Net Proceeds from the Issue towards augmenting our Bank’s Tier – 1 capital base to meet our Bank’s future capital requirements. Further, the proceeds from the Issue will also be used towards meeting the expenses in relation to the Issue.

The Bank expects to receive the benefits of listing the Equity Shares on the Stock Exchanges.

Ujjivan Small Finance Bank IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors. Bank allotted 14,055,097 Equity Shares under the USFB ESPS 2019 to certain eligible employees of our Bank and UFSL on November 11, 2019.

Qualitative factors are:

- Deep understanding of mass market serving unserved and underserved segments

- Customer centric organization with multiple delivery channels

- Pan-India presence

- Technology driven operating model with advanced digital platform

- Robust risk management framework

- Strong track record of financial performance

- Professional management, experienced leadership with focus on employee welfare

The relevant quantitative factors are:

On the basis of standalone statement:-

| Basic & Diluted EPS | RONW | NAV (Rs.) | |

| 31 Mar-19 | 1.20 | 9.49% | 12.64 |

| 31 Mar-18 | 0.05 | 0.42% | – |

| 31 Mar -17 | 0.00 | 0.00% | – |

- Price to Earnings (P/E) ratio in relation to Issue Price of Rs. [ ]:

| Particulars | P/E ratio |

| Highest | 60.85 |

| Average | 29.64 |

| Lowest | 15.70 |

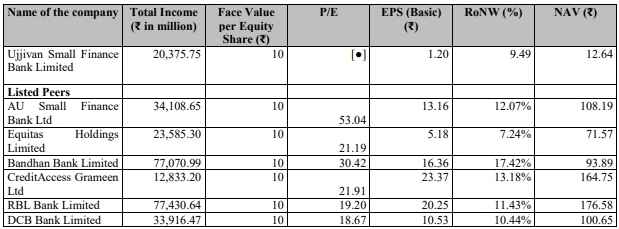

UFSL IPO – Competitive Peers

Below are the listed entities which are focused exclusively on the segment in which they operate.

Ujjivan Small Finance Bank IPO Lead Managers

| Lead Managers |

| Kotak Mahindra Capital Company Limited

IIFL Securities Limited JM Financial Limited |

Ujjivan Small Finance Bank IPO Registrar to offer

| Registrar to the Offer |

| Karvy Fintech Private Limited* Karvy Selenium, Tower B, Plot No. 31-32 Gachibowli Financial District Nanakramguda Hyderabad 500 032 Tel: +91 40 6716 2222 E-mail: einward.ris@karvy.com Investor grievance e-mail: USFB.ipo@karvy.com Website: www.karisma.karvy.com Contact Person: Murali Krishna SEBI Registration No.: INR000000221 |

Ujjivan Bank IPO Other Details:

- Statutory Auditor – MSKA & Associates, Chartered Accountants,

- Peer Review Auditor – MSKA & Associates, Chartered Accountants,

- Bankers to the Issue – HDFC Bank Limited

Ujjivan Small Finance Bank IPO Grey Market Premium

The Ujjivan Small Finance Bank IPO Grey Market Premium price is Rs 16-17, the Kostak rate is Rs 400-450 and the Subject to Sauda is Rs. 4500.

Open Free* Demat A/C Now! Fill the details below

Ujjivan Small Finance Bank IPO News

News 1 – Download DRHP Prospectus

News 2 – Download RHP Prospectus

Market Guide

Featured Topics