Mangalam Global Enterprise Ltd IPO Dates, Bid, Size, Allotment, Subscription, GMP, Price

Last Updated Date: Sep 01, 2023Let’s have a detailed review of the company and analytics of the Mangalam Global Enterprise Limited IPO release date, IPO offer price, subscription, MGEL IPO allotment, grey market price and other details like the company’s background, its financial positions, Mangalam Global IPO promoters, and other related things.

Mangalam Global Enterprise IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 7.5/10 |

| Industry Ranking | 7.1/10 |

| Company Background | 7.3/10 |

| Company Reputation | 7.2/10 |

| Competitive Edge | 7.7/10 |

| Financial Statements | 7.1/10 |

| Popularity Index | 7.4/10 |

| Promoters Reputation | 7.7/10 |

| Retail Appetite | 7.1/10 |

| Top Brokers Review | 7.9/10 |

| Overall Ratings | 7.4/10 |

| Star Ratings | ★★★★☆ |

Summary of Mangalam Global Enterprise Limited IPO

Company was originally incorporated as “Hindprakash Colourchem Private Limited” as a Private Limited Company under the provisions of the Companies Act, 1956 vide Certificate of Incorporation dated September 27, 2010 issued by the Registrar of Companies, Gujarat, Dadra and Nagar Havelli.

They are mainly engaged in the business of manufacturing of Refined Castor Oil First Stage Grade (F.S.G.), Castor De-Oiled Cake and High Protein Castor De-Oiled Cake for the domestic market as well as for exports to international markets.

Company has diversified its business operations into manufacturing of Cotton Bales (Lint Cotton) and Delineate Cotton Seeds. They were engaged in the trading business before starting commercial manufacturing of above mentioned products in the FY 2018-19.

The Promoters of this company are Mangalam Global Enterprise Limited and Communication Limited IPO is VIPIN PRAKASH MANGAL, CHANAKYA PRAKASH MANGAL AND CHANDRAGUPT PRAKASH MANGAL. The lead managers to the issue are PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED and the Registrar to this issue is LINK INTIME INDIA PRIVATE LIMITED.

Open Free* Demat A/C Now! Fill the details below

Mangalam Global Enterprise Ltd IPO Date

The opening and the closing date of the Mangalam Global IPO are Nov 15, 2019 to Nov 20, 2019.

Mangalam Global Enterprise IPO Subscription

Check the IPO NSE live subscription by clicking the link below:

- NSE Bid Details

| Sr. No | Category | No of shares bid for |

|---|---|---|

| 1 | Qualified Institutional Buyers(QIBs) | 0 |

| 1(a) | Foreign Institutional Investors(FIIs) | 0 |

| 1(b) | Domestic Financial Institutions(Banks/ Financial Institutions(FIs)/ Insurance Companies) | 0 |

| 1(c) | Mutual funds | 0 |

| 1(d) | Others | 0 |

| 2 | Non Institutional Investors | 32,78,000 |

| 2(a) | Corporates | 3,12,000 |

| 2(b) | Individuals(Other than RIIs) | 29,66,000 |

| 2(c) | others | 0 |

| 3 | Retail Individual Investors(RIIs) | 2,48,000 |

| 3(a) | Cut Off | 0 |

| 3(b) | Price bids | 2,48,000 |

| Total | 35,26,000 |

| Day / Date | NII | RII | Total Subscription |

| 1st Day – Nov 15 | 1.08x | 0.02x | 0.55x |

| 2nd Day – Nov 18 | 1.63x | 0.12x | 0.87x |

| 3rd Day – Nov 19 | 1.65x | 0.21x | 0.93x |

| 4th Day – Nov 20 | |||

| Shares Offered or Net Issue | 2,009,000 | 2,009,000 | 4,018,000 |

Mangalam Global Enterprise IPO Allotment Status

Here, you can find the Allotment Status of this IPO.

| Finalization of Basis of Allotment with the Designated Stock Exchange | 25-Nov-19 |

| Unblocking of funds from ASBA Accounts | On or before November 26, 2019 |

| Credit of Equity Shares to demat accounts of Allottees | On or before November 27, 2019 |

| Commencement of trading of the Equity Shares on the Stock Exchange | On or before November 28, 2019 |

Mangalam Global Enterprise Limited IPO/ MGEL IPO Price Band or Cash Price

Fresh Issue of 42,30,000 Equity Shares of face value Rs.10 each of Mangalam Global Enterprise Limited for cash at a price of Rs.51 per Equity Shares aggregating Rs.2157.30/- lakhs by the Company

Mangalam Global Enterprise IPO Issue Size

Initial public issue of 42,30,000 equity shares of face value of Rs. 10/- each of the Company for cash at a price of Rs. 51/- per equity share (including a premium of Rs. 41/- per equity share) aggregating upto Rs. 2157.30 lakhs comprises a reservation of upto 2,12,000 Equity Shares aggregating upto Rs. 108.12 lakhs for market maker

Mangalam Global IPO Offering

- Issue of Equity Shares by the Company: 42,30,000 Equity Shares of face value of Rs. 10/- each

- Market Maker Reservation Portion: 2,12,000 Equity Shares

- Net Issue to the Public*: 40,18,000 Equity Shares

Mangalam Global Enterprise Ltd – Company Overview

Incorporated in the year 2010, Company Mangalam Global Enterprise Limited belongs to Ahmedabad based Mangalam group of Companies set up by Mangal Family and led by the vision of Mr. Vipin Prakash Mangal.

The Corporate Identification Number of Company is U24224GJ2010PLC062434.

Company has marked its presence in both domestic as well as global markets. They supply products in states such as Gujarat, Rajasthan, Delhi, Maharashtra, and West Bengal. In order to capture growing demand for Castor Oil in international market and to create a more responsive and cost-effective supply chain, they started export operations. Company export products to countries such as Thailand, Oman.

Mangalam Global Enterprise Limited Business Model

In this dynamic and extremely competitive business environment, they have developed a diversified business model with offerings ranging from castor oil to cotton products.

Company have been successfully catering to these two different sectors in our business operations.

They are mainly engaged in the business of manufacturing of Refined Castor Oil First Stage Grade (F.S.G.), Castor De-Oiled Cake and High Protein Castor De-Oiled Cake for the domestic market as well as for exports to international markets.

Mangalam Global Enterprise Limited Business Process

Company has diversified business operations into manufacturing of Cotton Bales (Lint Cotton) and Delineate Cotton Seeds. They were engaged in the trading business before starting commercial manufacturing of our above mentioned products in the FY 2018-19.

Company has one cotton processing unit at Harij, Gujarat and two well-equipped Castor processing units at Harij and Palanpur, Gujarat respectively for undertaking manufacturing operations of above mentioned two product segments.

They are also engaged in the trading of Castor Seeds and Raw Cotton.

Business strategies of Mangalam Global Enterprise Limited

- Increase our Global Presence through Exports

- Leveraging our market skills and relationship

- Improving functional efficiency through technology enhancements

- Brand image

Mangalam Global Enterprise Limited – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary of Mangalam Global Enterprise IPO

On the basis of Standalone statement:-

| Amount (in INR & lakhs) | ||||

| June, 2019 | 31-Mar-19 | 31-Mar-18 | 31-Mar-17 | |

| Total Assets | 9,095.55 | 4,714.81 | 934.75 | 698.19 |

| Total Revenue | 14,592.77 | 33,003.73 | 2,689.83 | 268.71 |

| Total Expense | 14,451.14 | 32,701.67 | 2,655.94 | 254.49 |

| Profit After Tax | 105.39 | 216.98 | 25.89 | 9.41 |

| PAT Margin (%) | 0.72% | 0.66% | 0.96% | 3.50% |

| EBITDA |

251.8 | 584.24 | 42.25 | 16.65 |

| EBITDA Margin (%) | 1.73% | 1.77% | 1.57% | 6.20% |

Earnings per Equity Share (in lakhs)

| June 30, 2019 | 31-Mar-19 | 31-Mar-18 | 31-Mar-17 | |

| Basic & Diluted | 0.88 | 2.31 | – | – |

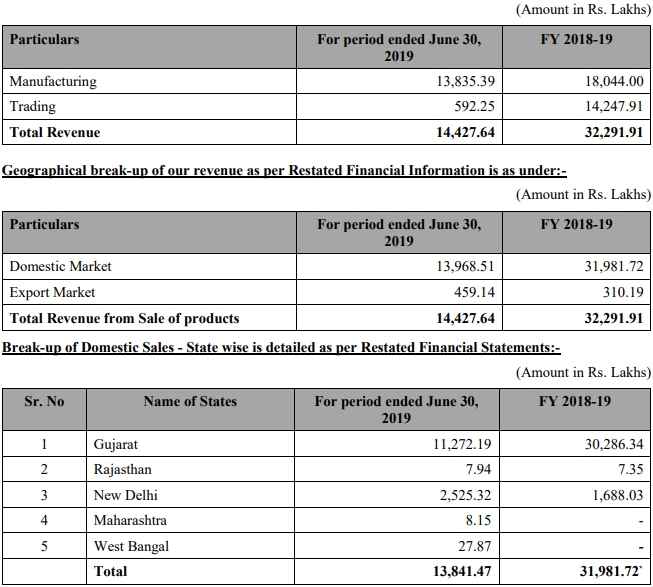

Activity wise break-up of our revenue as per Restated Financial Information is as under:

From the above statements, one could find that Mangalam Global Enterprise Limited may perform well.

Mangalam Global Enterprise Limited IPO – Promoters

The Promoter of this company is:

- Vipin Prakash Mangal,

- Chanakya Prakash Mangal &

- Chandragupt Prakash Mangal

List of Related Parties (Key Managerial Personnel)

- Ashutosh Mehta, CFO

- Rutu Shah

Interest in promotion of the Company

Promoters are interested in Company to the extent that they have promoted Company and to the extent of their shareholding and the dividend receivable, if any and other distributions in respect of the equity shares held by them in company.

Property Interest

Promoters do not have any interest in any property acquired by Company in the three years preceding the date of this Draft Prospectus.

Interest in Intellectual Rights of the Company

As on the date of filing of the Draft Red Herring Prospectus, the Company does not own any intellectual property rights.

Mangalam Global Enterprise IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Issue of Equity Shares by our Company | Up to 42,30,000 Equity Shares of face value of Rs.10 each fully paid-up for cash at price of Rs. 51/- per Equity Share aggregating to Rs. 2,157.30 Lakhs |

| Of which: | |

| Market Maker Reservation Portion | Up to 2,12,000 Equity Shares of face value of Rs. 10 each fully paid-up for cash at price of Rs. 51/- per Equity Share aggregating to Rs.108.12 Lakhs |

Net Issue to the Public |

40,18,000 Equity Shares of face value of Rs. 10/- each |

| Of which: | |

| (A) Retail Portion | 20,10,000 Equity Shares, aggregating Rs. 1025.10 lakhs will be available for allocation for allotment to Investors of up to Rs. 2.00 lakhs |

| (B) Non – Institutional Portion | 20,08,000 Equity Shares, aggregating Rs. 1024.08 lakhs will be available for allocation to investors above Rs. 2.00 lakhs |

| Pre-and Post-Issue Equity Shares | |

| Equity Shares outstanding prior to the Issue | 1,18,27,410 Equity Shares of face value of Rs. 10/- each |

| Equity Shares outstanding after the Issue | 1,60,57,410 Equity Shares of face value of Rs. 10/- each |

Mangalam Global Enterprise IPO Issue Object

These are the IPO Issue Objects of the company

- Funding the working capital requirements of our Company;

- General corporate purposes.

Mangalam Global Enterprise Ltd IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Experienced Management Team;

- Quality Control & Quality Assurance;

- Diversified business model & customer base; and

- Scalable Business Model.

The relevant quantitative factors are:

(On the basis of standalone statement)

| Basic & Diluted EPS | RONW | NAV (Rs.) | |

| 31-Mar-17 | N.A. | – | – |

| 31-Mar-18 | N.A. | – | – |

| 31-Mar-19 | 2.31 | 6.62% | 29.52 |

| June 30, 2019 |

0.88 | 2.89% | 30.41 |

- Price to Earnings (P/E) ratio in relation to Issue Price Rs. [●] per Equity Share of Rs. 10 each fully paid up

| Particulars | P/E ratio |

| Highest | 36.18 |

| Average | 22.39 |

| Lowest | 8.59 |

Mangalam Global Competitive Peers

| Companies | EPS | PE Ratio | RONW (%) | NAV (Per Share) | Face Value |

| Mangalam Global Enterprise Limited | 2.31 | 22.08 | 6.62 | 29.52 | 10.00 |

| Gokul Agro Resources Limited |

0.39 | 36.18 | 2.44 | 15.89 | 2.00 |

| Jayant Agro Organics Limited |

15.83 | 8.59 | 15.00 | 105.56 | 5.00 |

Mangalam Global IPO Lead Managers

| Lead Managers |

| PANTOMATH CAPITAL ADVISORS PRIVATE LIMITED 406-408, Keshava Premises, Behind Family Court, Bandra Kurla Complex, Bandra East, Mumbai – 400 051, Maharashtra, India Tel: +91-22 6194 6700 Fax: +91-22 2659 8690 Website:www.pantomathgroup.com Email: ipo@pantomathgroup.com Investor Grievance Id: ipo@pantomathgroup.com Contact Person: Unmesh Zagade SEBI Registration No:INM000012110 |

Mangalam Global IPO Registrar to offer

| Registrar to the Offer |

| LINK INTIME INDIA PRIVATE LIMITED C-101, 1st Floor, 247 Park, L.B.S. Marg, Vikhroli (West), Mumbai – 400 083, Maharashtra , India Tel: +91 22 4918 6200 Fax: +91 22 4918 6195 Website: www.linkintime.co.in Email: mangalam.ipo@linkintime.co.in Investor Grievance Id: mangalam.ipo@linkintime.co.in Contact Person: Shanti Gopalkrishnan SEBI Registration Number: INR000004058 |

Mangalam Global Enterprise Limited IPO Other Details:

- Statutory Auditor – MM/s. Keyur Shah & Co, Chartered Accountants

- Peer Review Auditor -MM/s. Keyur Shah & Co, Chartered Accountants

- Bankers to the Company – HDFC BANK LIMITED

Mangalam Global Enterprise Limited IPO Grey Market Premium

The Mangalam Global Enterprise Limited IPO Grey Market Premium price is Rs X, the Kostak rate is Rs X and the Subject to Sauda is X.

Open Free* Demat A/C Now! Fill the details below

Market Guide

Featured Topics