Hindprakash Industries IPO Dates, Bid, Size, Allotment, Subscription, GMP, Listing, Price

Last Updated Date: Aug 31, 2023Let’s have a detailed review of the company and analytics of the Hindprakash Industries IPO release date, IPO offer price, subscription, Hindprakash IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters, and other related things.

Hindprakash Industries IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 7.5/10 |

| Industry Ranking | 7.1/10 |

| Company Background | 7.3/10 |

| Company Reputation | 7.2/10 |

| Competitive Edge | 6.7/10 |

| Financial Statements | 6.1/10 |

| Popularity Index | 7.4/10 |

| Promoters Reputation | 6.7/10 |

| Retail Appetite | 7.1/10 |

| Top Brokers Review | 6.9/10 |

| Overall Ratings | 7.0/10 |

| Star Ratings | ★★★★☆ |

Summary of Hindprakash Industries IPO

Their Company is located at Vatva i.e. in the heart of Gujarat Industrial Development Corporation, an Industrial Estate for manufacturing, blending and formulation of dyes, auxiliaries & intermediaries. The Estate has common effluent treatment plant of which most of the units in the estate are members apart from having their own environmental treatment facilities.

With their wide range of products, they cater to various industries viz. Dyestuff and Dye intermediates, Textiles, Construction Chemicals, Speciality Chemicals etc.

The Promoters of this company are Hindprakash Industries and Communication Limited IPO is MR. SANJAY PRAKASH MANGAL, MR. OM PRAKASH MANGAL AND MR. SANTOSH NARAYAN NAMBIAR. The lead managers to the issue are Hem Securities Limited and the Registrar to this issue is Bigshare Services Private Limited.

Open Free* Demat A/C Now! Fill the details below

Hindprakash IPO Date

The opening and the closing date of the Hindprakash Industries IPO are JANUARY 15, 2020 and JANUARY 17, 2020.

Hindprakash IPO Subscription

| Day / Date | NII | RII | Total Subscription |

| 1st Day – Jan 15 | 0.13x | 0.06x | 0.09x |

| 2nd Day – Jan 16 | 1.54x | 0.35x | 0.94x |

| 3rd Day – Jan 17 | 2.96x | 1.36x | 2.16x |

| Shares Offered or Net Issue | 1,365,000 | 1,365,000 | 2,730,000 |

The shares subscribed by the public will be updated here.

Hindprakash Industries IPO Allotment Status

Here, you can find the Allotment Status of this IPO.

| Basis of Allotment Finalization | NA |

| Refunds Initiation | NA |

| Credit of Shares to Demat Account | NA |

| Share Listing Date | NA |

Hindprakash Industries IPO Price Band or Cash Price

The decided Cash Price for this PO is Rs. 40, including a share premium of Rs. 30 per equity share.

Hindprakash Industries IPO Issue Size

The Public Issue of 28,80,000 Equity shares of face value of Rs. 10/- each at issue price of Rs. 40 per Equity share including share premium of Rs. 30 per Equity share aggregating to Rs. 1152 Lakhs.

Hindprakash Industries IPO Equity Share Offering

The reserved portion of 1,50,000 Equity Shares of face value of Rs. 10 each at an issue price of Rs. 40 each aggregating to Rs. 60 Lakhs subscribed by Market Maker in this issue.

Market Lot Size & Minimum Order Quantity: 3000 equity share

Open Free Demat Account Now!

Hindprakash Industries Limited – Company Overview

Their Company was originally incorporated as a Partnership Firm in 1998 through its Partners, viz., Devendra Sayani and Chetankumar Timbadia and subsequently converted the Partnership Firm into a Public Limited Company and commenced the business from February 18, 2019.

Hindprakash Industries Business Model

Their Company is engaged in the manufacturing and trading of Dyes, Auxiliaries, Intermediates and Chemicals. They started their manufacturing unit in the year 2008 to produce Disperse Dyes, Reactive Dyes and Textile auxiliaries for catering the needs of domestic textile industry.

With their wide range of products, they cater to various industries viz. Dyestuff and Dye intermediates, Textiles, Construction Chemicals, Speciality Chemicals etc.

Hindprakash Industries Business Process

Their Company started its operations with an aim to become a leader & frontrunner in dyes & chemical industry by providing the best and innovative quality products.

Keeping quality and precision as the benchmark for any operation, Hindprakash hails to become one of the sought after dyes & chemical manufacturing company offering good products at reasonable price. Quality and Advancement are the mainstay of their Company which has brought them this far in this industry.

Business strategies of Hindprakash Industries

- Focus on high value business

- Grow their market share in existing geographies and expand operations to new geographies

- Improving integration base for speciality chemicals

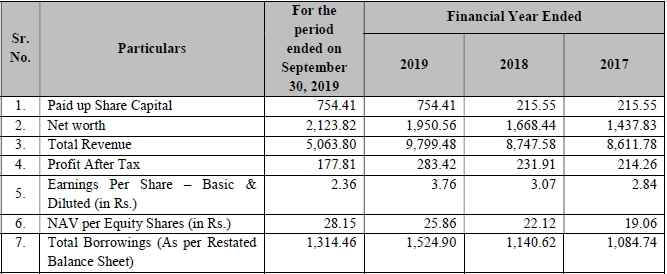

Hindprakash Industries – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary of Hindprakash Industries IPO

On the basis of Standalone statement:-

| Amount (in INR & lakhs) | ||||

| 30-Sept-19 | 31-Mar-19 | 31-Mar-18 | 31-Mar-17 | |

| Total Assets | 4,793.36 | 4813.52 | 3,116.37 | 3,467.16 |

| Total Revenue | 5063.80 | 9799.48 | 8747.57 | 8611.78 |

| Total Expense | 4737.00 | 9,255.27 | 8,258.51 | 8,145.14 |

| Profit After Tax | 177.81 | 283.42 | 231.91 | 214.26 |

Earnings per Equity Share (in lakhs)

| 30-Sept-19 | 31-Mar-19 | 31-Mar-18 | 31-Mar-17 | |

| Basic & Diluted | 2.36 | 283.42 | 231.91 | 214.26 |

From the above statements, one could find that Hindprakash Industries may perform well.

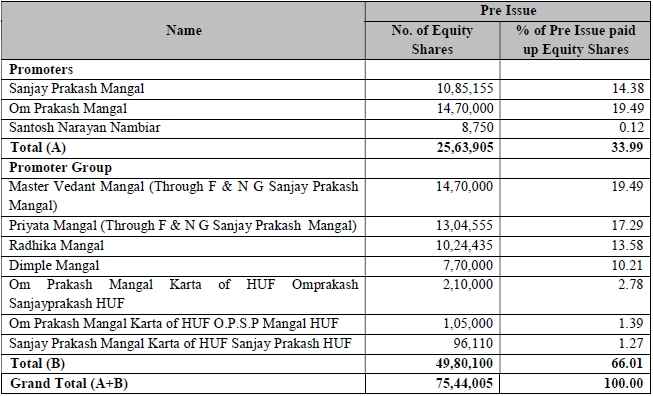

Hindprakash Industries IPO – Promoters

The Promoter of this company is:

- MR. SANJAY PRAKASH MANGAL

- MR. OM PRAKASH MANGAL

- MR. SANTOSH NARAYAN NAMBIAR

List of Related Parties (Key Managerial Personnel)

- Mr. Utsav Himanshu Trivedi

- Mr. Hetal Kishorbhai Shah

Interest in promotion of the Company

Except Mr. Sanjay Prakash Mangal and Mr. Santosh Narayan Nambiar, who are the Promoters of their Company, none of their other Directors have any interest in the promotion of their Company other than in ordinary course of business.

Except as disclosed above, no amount or benefit has been paid or given within the two (2) preceding years or is intended to be paid or given to any of their Directors except the normal remuneration for services rendered as Directors

Property Interest

Except as disclosed in this Draft Prospectus, their Promoters, Directors and Group Company have no interest, whether direct or indirect, in any property acquired by their Company within the preceding three years from the date of this Draft Prospectus or proposed to be acquired by it as on the date of this Draft Prospectus, or in any transaction by their Company for acquisition of land, construction of building or supply of machinery.

Hindprakash Industries IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Issue of Equity Shares by their Company | 28,80,000 Equity Shares of face value of Rs. 10/- each for cash at a price of Rs. 40 per share aggregating to Rs. 1152 Lakhs |

| Of which: | |

| Market Maker Reservation Portion | 1,50,000 Equity Shares of face value of Rs. 10/- each for cash at a price of Rs. 40 per share aggregating to Rs. 60 Lakhs. |

| Net Issue to the Public | 27,30,000 Equity Shares of face value of Rs. 10/- each for cash at a price of Rs. 40 per share aggregating to Rs. 1092 Lakhs. |

| Of which: | |

| (A) Retail Portion | 13,65,000 Equity Shares, for cash at a price of Rs. 40 per share, shall be available for allocation for allotment to Retail Individual Investors of up to Rs. 2.00 Lakhs |

| (B) Non – Institutional Portion | 13,65,000 Equity Shares, for cash at a price of Rs. 40 per share, shall be available for allocation for Investors other than Retail Individual Investors. |

| Pre-and Post-Issue Equity Shares | |

| Equity Shares outstanding prior to the Issue | 75,44,110 Equity Shares of face value of Rs. 10 each |

| Equity Shares outstanding after the Issue | Upto 1,04,24,110 Equity Shares of face value of Rs. 10 each |

Hindprakash Industries IPO Issue Object

These are the IPO Issue Objects of the company

- To Meet Working Capital Requirements

- General Corporate Purpose; and

- To Meet the Issue Expenses.

Hindprakash Industries IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Focus on Quality & Innovation

- Experienced Promoters and Management

- Technical Assistance to Customers

- Locational Advantage

- Established Relationship with Clients

The relevant quantitative factors are:

On the basis of standalone statement:-

| Basic & Diluted EPS | RONW | NAV (Rs.) | |

| 31-Mar-17 | 2.84 | 14.90% | – |

| 31-Mar-18 | 3.07 | 13.90% | – |

| 31-Mar-19 | 3.76 | 14.53% | 25.86 |

- Price to Earnings (P/E) ratio in relation to Issue Price Rs. [●] per Equity Share of Rs. 10 each fully paid up

| Particulars | P/E ratio |

| Highest | 19.47 |

| Average | 6.53 |

| Lowest | 13.00 |

- Competitive Peers:

| Companies | EPS | PE Ratio | RONW (%) | NAV (Per Share) | Face Value |

| Hindprakash Industries Limited | 3.76 | [●] | 14.53 | 25.86 | 10.00 |

| Camex Ltd | 3.68 | 6.53 | 12.04 | 30.55 | 10.00 |

| Mahickra Chemicals Limited | 2.82 | 19.47 | 13.55 | 20.83 | 10.00 |

| Shree Pushkar Chemicals & Fertilisers Limited | 13.32 | 7.38 | 14.36 | 92.57 | 10.00 |

Hindprakash Industries IPO Lead Managers

| Lead Managers |

| HEM SECURITIES LIMITED 904, A Wing, 9th Floor, Naman Midtown, Senapati Bapat Marg, Elphinstone Road, Mumbai-400013, India. Tel :+91 22 4906 0000 Email: ib@hemsecurities.com Investor Grievance Email: redressal@hemsecurities.com Website: www.hemsecurities.com Contact Person: Anil Bhargava SEBI registration number: INM000010981 |

Hindprakash Industries IPO Registrar to offer

| Registrar to the Offer |

| BIGSHARE SERVICES PRIVATE LIMITED 1st Floor, Bharat Tin Works Building, Opp. Vasant Oasis Makwana Road, Marol, Andheri (East), Mumbai – 400059, Maharashtra India. Tel No: +91-22-6263 8200 Email: ipo@bigshareonline.com Investor Grievance Email: investor@bigshareonline.com Website: www.bigshareonline.com Contact Person: Swapnil Kate SEBI Registration Number: INR000001385 |

Hindprakash Industries IPO Other Details:

- Statutory Auditor – KEDIA & KEDIA ASSOCIATES, CHARTERED ACCOUNTANTS

- Peer Review Auditor – Kedia & Kedia Associates

Hindprakash Industries IPO Grey Market Premium

The Hindprakash Industries IPO Grey Market Premium price is Rs X, the Kostak rate is Rs X and the Subject to Sauda is X.

Open Free* Demat A/C Now! Fill the details below

Market Guide

Featured Topics