CSB Bank IPO Dates, Allotment, Bid Details, Subscription, GMP Price & Size

Last Updated Date: Nov 16, 2022Let’s have a detailed review of the company and analytics of the CSB Bank IPO release date, IPO offer price, subscription, CSB IPO allotment, grey market price and other details like the company’s background, its financial positions, its promoters, and other related things.

- Issue Price of this IPO is Rs. 193 – 195 . Check the Live Share Price here CSB Bank Share Price

- To track the performance of this IPO, click on this link – IPO Performance

| Market Lot | 75 Shares |

| Min. Order Quantity | 75 Shares |

| Listing At | BSE, NSE |

| Price Band | Rs. 193 – 195 |

| Listing Date | Dec 4, 2019 |

| Offer for Sale | 19,778,298 |

CSB Bank IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 7.5/10 |

| Industry Ranking | 7.1/10 |

| Company Background | 7.3/10 |

| Company Reputation | 7.2/10 |

| Competitive Edge | 7.7/10 |

| Financial Statements | 7.1/10 |

| Popularity Index | 7.4/10 |

| Promoters Reputation | 7.7/10 |

| Retail Appetite | 7.1/10 |

| Top Brokers Review | 7.9/10 |

| Overall Ratings | 7.4/10 |

| Star Ratings | ★★★★☆ |

Summary of CSB Bank IPO

The Company one of the oldest private sector banks in India with a history of over 98 years and have a strong base in Kerala along with significant presence in Tamil Nadu, Karnataka, and Maharashtra.

They offer a wide range of products and services to their overall customer base of 1.3 million as on September 30, 2019, with particular focus on SME, Retail, and NRI customers.

The Promoters of this company FIH MAURITIUS INVESTMENTS LTD. The lead manager to the issue is Axis Capital Limited and IIFL Securities Limited and the Registrar to this issue is Link Intime India Private Limited.

From FY 2016-17 to FY 2018-19, as per the Restated Financial Statements

The net interest margin increased from 2.11% in Fiscal 2017 to 2.80% in Fiscal 2019 primarily on account of reduction in their cost of funds and increase in credit to deposit ratio. Further, the net interest margin was 3.43% for the six month period ended September 30, 2019.

Their cost to income ratio increased from 74.49% in Fiscal 2017 to 97.68% in Fiscal 2019. Further, cost to income ratio was 71.54% for the six month period ended September 30, 2019.

Their Tier I capital ratio has been further augmented post capital infusion in second quarter of Fiscal 2020. Further, as per the Basel III Norms, the CRAR, as assessed by their Bank as on September 30, 2019 was 22.77% (including capital conservation buffer).

CSB Bank IPO Date / Launch Date

The opening and the closing date of CSB Bank IPO is Nov 22, 2019 – Nov 26, 2019.

CSB Bank IPO Subscription

| Day / Date | QIB | NII | RII | Total Subscription |

| 1st Day – Nov 22 | 0.00x | 0.10x | 5.60x | 1.90x |

| 2nd Day – Nov 25 | 0.26x | 1.07x | 21.53x | 4.35x |

| 3rd Day – Nov 26 | 62.18x | 164.68x | 44.46x | 86.91x |

| Shares Offered or Net Issue | 6,302,721 | 3,151,360 | 2,100,906 | 11,554,987 |

The shares subscribed by the public will be updated herein.

CSB Bank IPO Allotment Status

Here, you can find the Allotment Status of this IPO.

CSB Bank IPO Listing Date

Find the dates below for basis of allotment, refund, listing and more:

| Basis of Allotment Finalization | 2-Dec-19 |

| Refunds Initiation | 3-Dec-19 |

| Credit of Shares to Demat Account | 3-Dec-19 |

| Share Listing Date | 4-Dec-19 |

CSB Bank IPO Price Band / Cash Pricse

The face value of each share is Rs 10, but the price band of the IPO is Rs. 193 – 195.

CSB Bank IPO Size

Fresh Issue – 1,243,523 Shares, aggregating up to Rs. 24.00 Crores

Issue Size – 21,021,821 Shares, aggregating up to Rs. 409.68 Crores

CSB Bank IPO Share Offering

The company’s equity share offerings for different investors:

- QIB – 6,302,721

- RII – 3,151,360

- NII – 2,100,906

Offer for Sale – 19,778,298 Shares, aggregating up to Rs. 385.68 Crores

CSB Bank – Company Overview

They deliver their products and services through multiple channels, including 412 branches (excluding three service branches and three asset recovery branches) and 290 ATMs spread across 16 states and four union territories as on September 30, 2019, and various alternate channels such as micro ATMs, debit cards, internet banking, mobile banking, point of sale services and UPI.

The believe with the focus on quality of service and nurturing long term relationship with their customers, they have developed a well-recognized and trusted brand in south India, particularly in the states of Kerala and Tamil Nadu.

CSB Bank – Business Overview

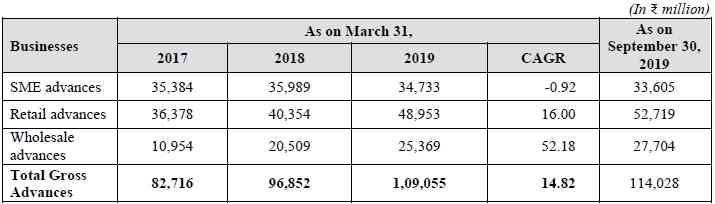

They have four principal business areas, namely, (a) SME banking, (b) retail banking, (c) wholesale banking, and (d) treasury operations.

SME Banking:

SME business offers comparatively higher yields, cross-selling and associated business opportunities, and higher degree of secured and collateralized loans. As on March 31, 2019 and September 30, 2019, 99.26% and 96.11% of their SME loan portfolio was secured by tangible collateral, respectively. Lending to SMEs also helps them to meet their priority sector lending targets.

They believe that SMEs are more often confronted with challenges such as availability of adequate and timely financial resources than large corporates. They focus on meeting the funding and banking requirements of these SME customers. As a percentage of their total advances, loans to SME customers accounted for 43%, 37%, 32% and 29.47% as on March 31, 2017, March 31, 2018, March 31, 2019 and September 30, 2019, respectively.

Retail Banking:

Under their retail banking business, they offer a wide range of loan and deposit products to their retail and NRI customers. Their retail lending products include gold loans, vehicle loans including two wheeler loans, loans against properties, personal loans, housing loans, agricultural loans, and education loans.

Their deposit products include current accounts, savings accounts, fixed deposits, recurring deposits, and corporate salary accounts. Their retail loans (including gold loans) constituted approximately 44%, 42%, and 45% and 46.23% of their total advances as on March 31, 2017, March 31, 2018, March 31, 2019, and September 30, 2019, respectively.

Their Gold loans advances (including agriculture gold loans) have increased from Rs. 20,263 million as on March 31, 2017 to Rs. 33,331 million as on March 31, 2019 growing at CAGR of 28.3%.

Wholesale Banking:

Under their wholesale banking business, they cater to large and mid-size corporates and other business entities (with credit requirement of Rs. 250 million and above). As a percentage of their total gross advances, wholesale banking advances accounted for 13%, 21%, 23% and 24.30% as on March 31, 2017, March 31, 2018, March 31, 2019, and September 30, 2019, respectively.

Treasury Operations:

Their treasury operations primarily consist of statutory reserves management, asset liability management, liquidity management, investment and trading of securities, and money market and foreign exchange activities.

They also distribute life insurance products of Edelweiss Tokio Life Insurance Company Limited, HDFC Life Insurance Company, and ICICI Prudential Life Insurance Company Limited, and others.

Their income from bancassurance was Rs. 51 million, Rs. 69 million, and Rs. 96 million for Fiscals 2017, 2018, and 2019, respectively and has grown at a CAGR of 37% during the last three Fiscals. Further, their income from bancassurance was Rs. 46.5 million as on September 30, 2019.

Business strategies of CSB Bank

- Accelerate transformation as new age private bank

- To expand product portfolios and turnkey composite works

- Grow asset business with focus on SME, agricultural and retail customers by leveraging capital position.

- Continue to leverage strong deposits franchise.

- Grow and diversify distribution infrastructure in key geographical locations.

- Maximizing non-interest income by widening products and services for corporate as well as retail customers.

CSB Bank – Financial Statements

A quick look into the past financial performance of the company to understand its performance of business and evaluate the growth prospectus:

Financial Summary of CSB Bank IPO

On the basis of Standalone statement:-

| Amount (in INR & Millions) | ||||

| Sept-19 | 31-Mar-19 | 31-Mar-18 | 31-Mar-17 | |

| Total Assets | 1,73,232.58 | 1,64,534.60 | 1,53,346.62 | 1,57,700.26 |

| Total Revenue | 8,167.14 | 14,834.33 | 14,222.26 | 16,174.96 |

| Total Expense | 7,131.39 | 14,700.75 | 13,478.99 | 14,657.83 |

| Profit After Tax | 442.72 | (656.89) | (1,270.88) | (579.91) |

Earnings per Equity Share (in Millions)

| Sept-19 | 31-Mar-19 | 31-Mar-18 | 31-Mar-17 | |

| Basic & Diluted | 3.86^ | (7.90) | (15.70) | (7.66) |

*** CSB Bank IPO may not be that profitable to the Investors.

CSB Bank IPO – Promoters

The Promoter of this company is:

- FIH MAURITIUS INVESTMENTS LTD

Promoter Holdings – CSB Bank IPO:

- Pre Issue Share Holding is around 50.09%

- Post Issue Share Holding is NA

List of Related Parties (Key Managerial Personnel)

- Ms. Veluthattil Maheswari, CFO

- Mr. Sijo Varghese, CSCO

- Mr. Vincy Louis Pallissery, CCO

- Mr. P. V. Antony, Head IPO

- Mr. Arvind Sharma, CRO

Interest in promotion of the Company

The Key Managerial Personnel of the Company have interest in the Company to the extent of the remuneration or benefits to which they are entitled to as per their terms of appointment and reimbursement of expenses incurred by them during the ordinary course of business and to the extent of Equity Shares held by them in the Company, if any and dividends payable thereon, if any.

Property Interest

Directors have not entered into any contract, agreement or arrangements in which the Directors are interested directly or indirectly and no payments have been made to them in respect of these contracts, agreements or arrangements or are proposed to be made to them.

Interest in Intellectual Rights of the Company

As on the date of filing of the Draft Red Herring Prospectus, the Company does not own any intellectual property rights.

CSB Bank IPO Offer Details or Issue Details

| Particulars | No. Of Equity Shares |

| Equity Shares Offered | Issue Size – 21,021,821 Shares, aggregating up to Rs. 409.68 Crores |

| Of which: | Fresh Issue – 1,243,523 Shares, aggregating up to Rs. 24.00 Crores

|

| Reserved for Market Makers | Upto [●] Equity Shares, for cash at a price of M [●] per share aggregating M [●] Millions |

| Net Issue to the Public | Upto [●] Equity Shares, for cash at a price of M [●] per share aggregating M [●] Millions |

| Of which: | |

| Retail Investors Portion | Upto [●] Equity Shares, be available for allocation for Investors of up to M 2.00 Millions |

| Non-Retail Investors Portion | Upto [●] Equity Share, will be available for allocation for Investors of up to M 2.00 Millions |

| Equity Shares outstanding prior to the Issue | 172,225,058 Equity Shares |

| Equity Shares outstanding after the Issue | Upto [●] Equity Shares |

CSB Bank IPO Issue Object

The objects of the Offer are to augment the Bank’s Tier-I capital base to meet the Bank’s future capital requirements which are expected to arise out of growth in the Bank’s assets.

Primarily their Bank’s loans/advances and investment portfolio and to ensure compliance with Basel III and other RBI guidelines. Further, the proceeds from the Offer will be used towards meeting the expenses of the Offer.

CSB Bank IPO – Basis of the Offer Price

The issue price is determined by the company in consultation with the Lead manager on the basis of the following qualitative and quantitative factors.

Qualitative factors are:

- Strong channel network and trusted brand in South India;

- strong capital base;

- well established SME business;

- retail offering driven by strong gold loan portfolio;

- stable and granular deposit base;

- professional and experienced management with strong and independent Board; and

- streamlined risk management controls, policies and procedures.

The relevant quantitative factors are:

On the basis of standalone statement:-

| Basic & Diluted EPS | RONW | NAV (Rs.) | |

| Mar-19 | (7.90) | -4.48% | 85.12 |

| Mar-18 | (15.70) | -8.11% | 90.95 |

| 31-Mar-17 | (7.66) | -3.30% | 102.12 |

| Mar-16 | – | 10.07 % | – |

- Price to Earnings (P/E) ratio in relation to Issue Price of Rs. [ ]:

| Particulars | P/E ratio |

| Highest | 27.1 |

| Average | 12.1 |

| Lowest | 18.8 |

CSB Bank IPO – Competitive Peers

Below are listed entities which are focused exclusively on the segment in which they operate.

| Name of the Bank | Face Value (Rs) | Total Income (Rs million) | Basic EPS | P/E | P/BV | RONW (%) | NAV (Rs) |

| CSB Bank Limited | 10 | 14,834.33 | -7.9 | [●] | [●] | -6.70% | 73.54 |

| DCB bank | 10 | 33,917 | 10.5 | 19.4 | 2.2 | 0 | 92.7 |

| Federal bank | 2 | 1,29,707 | 6.7 | 14.5 | 1.4 | 9.80% | 68 |

| South Indian bank | 1 | 76,027 | 1.4 | 12.1 | 0.6 | 4.90% | 28.2 |

| City Union | 1 | 42,816 | 9.6 | 21.3 | 3.1 | 14.10% | 65.9 |

| Karur Vysya Bank | 2 | 67,786 | 2.6 | 27.1 | 0.9 | 3.30% | 80.4 |

CSB Bank IPO Lead Managers

| Lead Managers |

| Axis Capital Limited

IIFL Securities Limited |

CSB Bank IPO Registrar to offer

| Registrar to the Offer |

| Link Intime India Private Limited C-101, 1st Floor, 247 Park L.B.S Marg, Vikhroli (West) Mumbai 400 083 Telephone no.: +91 22 4918 6200 E-mail: csb.ipo@linkintime.co.in Investor Grievance e-mail: csb.ipo@linkintime.co.in Website: www.linkintime.co.in Contact Person: Mr. Shanti Gopalkrishnan SEBI Registration No.: INR000004058 |

CSB Bank IPO Other Details:

- Statutory Auditor – M/s. Deepak Ramesh Jain & Co., Chartered Accountants

- Peer Review Auditor – M/s. Deepak Ramesh Jain & Co., Chartered Accountants

- Bankers to the Company – State Bank of India

CSB Bank IPO Grey Market Premium

The CSB Bank IPO Grey Market Premium price is Rs 65-70, the Kostak rate is Rs 180-200 and the Subject to Sauda is Rs 3500.

Open Free* Demat A/C Now! Fill the details below

CSB Bank IPO News

News 1 – Download DRHP Prospectus

News 2 – Download RHP Prospectus

Market Guide

Featured Topics