Forward Contract – Understanding, Examples, Expiry, Settlement & more

Last Updated Date: Nov 17, 2022In this article, you will learn everything about Forward Contracts. We will also dig into Forward Markets & Forward Contracts & how it works.

About Forward Contract & Futures Market

The futures market is central to the domain of the derivatives market. As the name suggests, a derivative is any security, which derives its value from the value of another underlying security.

Such underlying security could be anything, ranging from an equity stock or a currency.

Such underlying security could be anything, ranging from an equity stock or a currency.

In the Indian context, future derivatives seem to have been around from quite a long time. A reference of the same is available in arthashastra’s by Kautilya which date back to the 320 BC.

The arthashastra, which is basically an understanding of economics, explores the state of pricing mechanisms from that era.

It discusses how the standing crops are priced for harvesting at a later date. It is possible that a mechanism such as this one was in use to make advance payments to farmers.

Thus, in effect, it would amount to a true forwards contract in every sense. There is a remarkable similarity between futures contracts and forwards contracts.

Like futures, a forward’s contract is also a form of derivative. For ease of understanding, a forward’s contract can be seen as a conventional form of a futures contract.

Even though the transactional structure of both, forwards and futures is the same, over the years, futures contracts have become more popular and prominent among traders.

Today, forwards contracts are only in use by select industries and banks at most. To gain a complete understanding of futures contracts, it is vital to understand about forwards contracts as well.

Open a Demat Account Now! – Start Trading in Futures

An illustrative guide on Forward Contracts

As can be understood from the depiction of arthshastras above, it is clear what the purpose of forwards contracts implies.

The inception of such forwards contracts perhaps occurred to protect the interests of the farmers who faced uncertainty regarding payments for their produce.

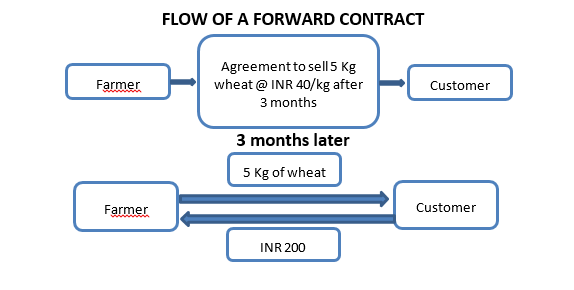

So, as per the design of a forward’s contract, both the parties to the agreement decided to exchange certain goods for cash.

As expected, such an exchange would occur on a specific date in the future for a specific price. This price results from acceptance from both parties to the agreement at the time of concluding such agreement.

Accordingly, the date and time to honor the contract are also decided at the initial stage itself.

Since the agreement takes place between the two parties to the agreement, without intervention from any third party, it goes by the name of ‘Over the counter’ agreement.

An exchange of a forward contract usually only happens through this mechanism since the parties to the agreement negotiate the terms of the contract without the intervention of any third party.

Example on Forward Contract

Let us take an example to comprehend the context of this situation.

Let us assume a person by the name of A, who is a designer of copper utensils and retails them through different channels.

The other party to the agreement is an importer of copper, who sources exclusive and pure copper and sells them to retailers like A. Let us call him B.

Let’s say that on 9th of October, A decides to enter into an agreement with B. He agrees to purchase 15 kg copper from B in a matter of 3 months, which end on 9th of January.

At present, the current market price of copper is INR 1550 for every kg. Thus, they decide to fix the price at the prevailing market rate.

Thus, it announces the agreement between A and B, whereby, A agrees to purchase 15kg of copper from B on the 9th of January at INR 23250 (1550*15).

In return, A expects to obtain 15 kg of copper from B for the price he will pay. This is how a forward’s contract comes into existence.

In all its reality, the agreement has been made on 9th of October and both A and B are under an obligation to honor the agreement after a span of 3 months.

Implications of Forward Contracts

On the part of A, the thinking behind the agreement would stem from his expectation that the price of copper may increase in the next 3 months.

Hence, by entering into a forward’s agreement today, he is hedging his risk to avoid paying more on that day.

This is the motivation behind most forwards contracts. A is the buyer of the forward’s contract in this case.

On the other hand, B may be of the opinion that the price of copper may fall in the coming 3 months.

Hence, he is guided by the motive to enter into a forward’s agreement to make a profit from the fall in the price of copper. In this case, B is the seller of the forward’s contract.

The forward agreement comes into existence due to the difference in opinion between A and B about the movement of copper prices in the foreseeable future.

Know everything about Futures Trading

What happens at the expiry of a Forward’s contract?

Even though A and B have opposing views about the possible prices of copper in the future, there are only 3 outcomes which are likely to occur at the date of expiry of any forward contract.

The Price of Copper can Increase

On 9th October, the price of copper was INR 1550 per kg. It is possible that on 9th January, the same price for a kg of copper may be INR 1700. It is clear that A’s expectation has come true while B’s did not.

So, since the forward’s contract was made at INR 23250, A is liable to purchase 15 kg copper from B at a price of INR 23250.

This agreement stands valid even though the price of copper has increased and the value of the contract is INR 25500 now.

For A, honoring this agreement brings a benefit of INR 2250, which he would otherwise have to pay if he has not entered into such agreement.

For B, this agreement spells a loss of INR 2250 since he will have to sell copper to A at a price lower than its current value.

The Price of Copper can Decrease

Taking cues from the above explanation, let us say that the price of copper on 9th January is INR 1300.

Even when the price of copper has come down, A is under an obligation to purchase the same from B at INR 23250, which was the original value of the contract, even though it’s present value stands at no more than INR 19500.

From a financial perspective, A suffers a loss of INR 3750. This is because he has to honor the agreement and purchase 15 kg copper from B at INR 1550 per kg, even though its present price is less.

B makes a profit by the same quantum on this transaction. This happens since he can buy copper from the open market at a lesser price and sell it to A at a profit.

The Price of Copper remains the Same

It is possible that on the day of expiry, the price of copper remains unchanged.

Under these circumstances, neither A nor B will benefit by any measure through this forwards contract or bear any loss.

Settling a Forward Contract

Continuing the example from above, consider that any of the 3 outcomes occurs and A and B decide to honor the agreement.

They can settle the agreement in any one of the following ways.

Physical settlement

A physical settlement will occur if B actually purchases the 15 kg copper from the open market at INR 1700. Later he delivers it to A for INR 1550 per kg.

In return, A will pay the complete amount of INR 1550 per kg to B. He will then obtain delivery of the 15 kg copper. This mechanism is a physical settlement.

Cash Settlement

In this system, neither party actually delivers or receives the security for which the agreement has been made.

The parties to the contract simply decide to exchange the difference of cash between the transaction and settle the contract.

So, let us say that A and B decide to settle the agreement in this way. Then, in scenario one above, the difference of INR 2250 which results from an increase in the price of copper, will go out from B’s pocket.

A will receive this differential amount of gain on the transaction. Or, let’s say that the price of copper decreases.

Then, in this case, the differential price of INR 3750 will be given by A to B, which is the fall in the price of copper on the date of expiry of the contract.

Thus, these are the two ways in which the settlement of a forward contract will take place.

Risks involved in a Forwards Contract

The design and execution of a forward’s contract are quite simple and understandable. But it does not mean that there is no risk associated with it.

Apart from the changes in price, there are many other risks which can occur along with a forward contract. Let us get to know about each one of them.

Liquidity risk

To elucidate on the above example, the operation of the forward’s contract is easy to understand. What is hard is to guarantee that parties will be able to find each other.

This means that in the real world, it is not necessary that every A will be able to find a B to enter into a contract with.

Usually, A will have to approach an institution. They will then help him find someone to match the contract but they will do this at a fee.

Counter Party Risk

As long as the price of the underlying security, which is copper in this case, falls down or goes up, a counter party risk will always exist. In either of these cases, one party stands to gain while the other does not.

The expectation of the parties on the date of expiry remains that the other party will honor their end of the agreement. However, what will happen if they fail to do so? There will be no gain to the party in that case.

Regulatory risk

It is no surprise that a forward’s contract comes without the intervention of any third party. Hence, only the two parties involved in the contract know about the agreement.

This means that there is nothing binding them to the contract.

In this scenario, it is highly likely for either of the parties to adopt the unlawful approach. They might end up making default on their end of the bargain.

The regulatory risk arises from the fact that there is no outside administration to oversee that the contract is fulfilled.

Rigidity

It is quite possible that during the period of 3 months between entering the forward’s agreement and its expiry, either A or B may feel that they are on the wrong side of the contract.

This can happen due to a change in perception about the market conditions and ongoing market sentiment.

However, due to the rigidity of the forward’s contract, they may be unable to exit from the contract. They will have to honor the original terms of the contract until its very end.

Due to the limitations of a forward contract, the concept of futures contract came into existence.

To Conclude Forward Contract

The essential features of a futures contract arise from the specific details of a forward’s contract.

Trading of forward contract does not happen on an exchange. These are basic over the counter agreements which take place without the intervention of a third party.

The terms of a forward’s contract can vary between one party to another. Each forwards contract has a buyer and seller of the contract.

There are only two ways to settle a forward contract, which is either a physical settlement or cash settlement.

Essentially, both forward and futures contracts are the same. However, a futures contract eliminates the risks which come with a forward’s contract.

Open a Demat Account Now! – Start Trading in Futures

Most Read Articles