Financial Intermediary – Concept, Objectives, Workings, Types, Benefits & more

Last Updated Date: Nov 17, 2022After learning so much about finance, it is quite possible you might plan to visit the Financial Intermediary.

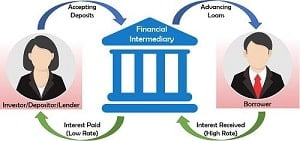

A financial intermediary is an institution or person which basically bridges between two parties of the financial transaction. Here one party is either the lender or borrower.

About Financial Intermediary

To facilitate a financial transaction, intermediary financial acts as a bridge between two parties.

Some of the common institutions that act as financial intermediaries are investment banks, mutual funds, pension funds, and commercial banks.

They aim to reinvest the uninvited capital to productive sectors of various industries. Investors choose to do it mainly through debt and equity.

In simple terms, you can say financial intermediaries transfer funds from individuals or companies having surplus capital to other companies or individuals in need.

Basically, they need the capital to carry out their economic activities. You can call an intermediary as a middleman, and it can either be a firm or an individual.

Open Demat Account Now! – Zero Brokerage on Delivery

Objectives of Financial Intermediaries

The main objective of financial intermediaries is to channel savings to investment. For providing these services, these institutions charge some fees.

These intermediaries are crucial tools for the efficient market system. It is mainly because they help in channelizing the saving into investment.

These intermediaries are crucial tools for the efficient market system. It is mainly because they help in channelizing the saving into investment.

As per the sub crisis, these can also be a cause of worry for many. Above all, there arises a need to regulate the activities of the intermediaries.

Basically, the financial middlemen is the company that acts as a link between two parties that is the borrower and the investor.

The main agenda of the these intermediaries are to meet the financial objectives of both parties.

Hence, these parties are most likely business entities which tend to accept deposits from investors or depositors. They allow low interest on the sum.

These organizations choose to lend the amount to people and firms at a much higher rate of interest to meet their margin.

Some of the significant roles that the financial intermediaries play are the creation of funds and monitoring the payments system.

Financial Intermediary as a Middleman

You can say that the financial intermediary is a middleman. For an average consumer, they offer a plethora of benefits. It includes safety, economies of scale, and liquidity.

However, advances in technology tend to avoid them. Above all, disintermediation isn’t that much of a threat in different areas of finance like banking and insurance.

The intermediary is basically a link between the consumer and the service provider.

In the financial system, they exists for only profit. For the same reason, some kind of regulation is a must.

As per experts, they tend to work in either savings or investment phase of the economy and they mainly serve as a conduit between both the lenders and borrowers.

The intermediaries, like banks, play a massive role in the financial system. It is only possible if the bank finances the majority part of the dollar.

When it comes to corporates, then financial intermediaries are essential for raising the external funds. They are way different from the capital markets.

Under the capital markets, investors contact the corporates directly by creating some marketable securities.

On the other hand, these intermediaries either choose to borrow from consumers or lenders. And then lend to companies who are in need.

Workings of Financial Intermediary

Basically, the non-bank financial intermediary doesn’t choose to accept deposits from the standard public. Instead, these institutions offer leasing, factoring, other financial services, etc.

Almost all intermediaries decide to participate in the securities exchange and use long term loans for both growing and managing funds.

You can see the economic stability, in general terms, reflects through financial intermediary’s activities and growth of financial industries.

These intermediaries choose to move funds from institutions that have excess capital and give to parties who are in need.

For instance, a financial planner gets in touch with a client who buys stocks, bonds, real estate, etc. So, here the bank makes a link between the borrowers and lenders.

All they do is offer capital by borrowing from institutions like the Federal Reserve. On the other hand, insurance companies provide benefits by taking premiums for policies.

Under the pension fund, the financier collects the fund on behalf of the pensioners and then distributes the same among pensioners.

Example of Financial Intermediary

For instance, MRS.B is a housewife who chooses to deposit her money with XYZ bank every month.

On the flip side, there is an entrepreneur MR. A, who wishes to avail a loan for the operations of his business.

So now Mr. A has two options that are to convince the people who plan to invest and are looking for investment opportunities. Or he can avail a loan from the XYZ bank.

You can say that the first option sounds a little challenging as it will take a lot of time to convince people. Hence, the second choice is not only quick but also convenient.

On a large scale, we can say that financial intermediaries offer funding and lending.

Types of Financial Intermediaries

There are various types of Financial Intermediaries, all of them have been mentioned below –

Banks

These are one of the most prominent financial institutions as they offer simple lending and borrowing process. Besides this, they also provide other services.

Credit Unions

You can say that they are cooperative financial units that facilitate lending and borrowing of the funds to offer financial assistance.

Non-Financial Banking Companies

The company offers loans to companies at a significant amount of interest.

Stock Exchanges

These stock exchanges are most likely to facilitate security trading. They charge fees for all the activities which form the part of their profit there.

Mutual Fund Companies

These companies tend to merge the amount from a plethora of investors. All the investors here have similar objectives and risk-taking appetite.

Then the company invests the fund collectively in various stocks.

Financial Advisors

These brokers tend to collect funds from different investors to invest in bonds, stocks, etc. They also offer expert opinion to the investors.

Insurance Companies

These companies tend to offer insurance policies to both companies and funds. The main aim is to secure the insured of death, accidents, and risks.

Benefits of Financial Intermediaries

Here are some of the advantages of Financial Intermediaries –

Minimum Risk – With financial intermediaries, there is a minimum risk of default, fraud, etc.

Convivence – With these intermediaries, the exchange is relatively easy for both parties.

Greater Liquidity – Thanks to them, you don’t need to stress as an investor as they are reliable.

Disadvantages of Financial Intermediaries

Here are few drawbacks of Financial Intermediaries –

Minimum returns on investment – The main aim of any investment is profit. Thus, with these intermediaries, people can’t earn a lot of profit.

High interest on loans – The financial middlemen tend to charge interest on the loan.

Fake opportunities – At times, they tend to offer counterfeit opportunities guaranteeing higher returns featuring hidden risk.

These not only yield the returns but turns out to be a failure for the investor.

Financial Intermediary – Conclusion

Hence financial intermediaries are a link between both investors and lenders. They not only help the efficient markets but also minimize the cost of running a business.

No doubt, intermediaries don’t accept public deposits but at the same time offer leasing. They provide several benefits, including pooling of risk, minimizing the cost, etc.

Open Demat Account Now! – Zero Brokerage on Delivery

Most Read Articles