Capital Structure – Concept, Basics, Importance, Factors, Optimal & more

Last Updated Date: Nov 16, 2022The majority of the corporate officers and professional investors talk about the capital structure of the company.

Capital structure is quite essential as it can impact the returns of a company. The returns are mainly for its stakeholders. It also decides if the company will survive in a depression or recession.

If you are planning to learn about the it, then you are on the right place. We will cover almost all the aspects of capital structure here.

Here, we will discuss about its concept, definitions, importance, factors & more.

What do you mean by Capital Structure?

By the term capital structure, we mean that it is a mix of preference share capital, debentures, equity share capital, and retained earnings.

All these together form capital, which a firm needs to raise to run the business smoothly.

All these together form capital, which a firm needs to raise to run the business smoothly.

In simple terms, you can say that capital is a mix of debt and equity which a company uses for its overall development and growth, debt includes bonds or loans.

On the other hand, equity has retained earnings, common stock, or preferred stock. You can also consider short term debt as a part of the capital structure.

Well, it is also the ratio of various kinds of securities that a company raises under long term finance. It mainly includes two types of decisions.

Firstly, we need to decide the security type to be issued, that are, equity or debt. Then, we must lookout for a relative ratio of securities through the capital gearing process.

Post that, high and low geared companies are determined. High geared companies feature small equity capitalization.

On the other hand, the low geared companies feature huge equity dominance. Based on what kind of growth the company is looking forward to, capital structure is specific.

The basic meaning of the term capital structure is that it refers to the percentage of capital in any business.

Experts say that it is a concept where companies employ debt and equity funds mainly for their operations.

Typically a firm expresses its financial structure as a ratio of debt-to-capital. You can use this to fund the operations, acquisitions, and other investments.

At times there are some tradeoffs also prevailing where the company needs to decide if it wants to use debt or equity.

Managers also have a choice to use the combination of both to finance the operations of the company.

Open Demat Account Now! – Zero Brokerage on Delivery

Definitions of Capital Structure

As per Gerstenberg – The capital structure of a company refers to the make-up of its capitalization, and it includes all long-term capital resources viz., loans, reserves, shares, and bonds.

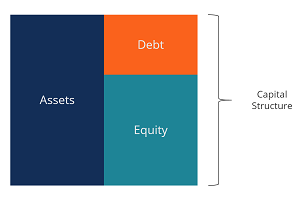

As per John J. Hampton – The capital structure is the combination of debt and equity securities that comprise a firm’s financing of its assets.

Capital Structure, Finance Structure & Asset Structure – Are they related?

First of all, when it comes to learning about the capital structure, you must not confuse it with finance and asset structure.

The finance structure is all about the long term, short term debts, and the shareholders capital. It takes up the complete left side of the balance sheet.

On the other hand, It is all about long term debt and the shareholders’ fund. You can say that capital structure is a branch of finance structure.

Additionally, a few experts also include short term debt in their structure. So in such a situation, there isn’t a significant difference between capital and financial structure.

As there is no significant difference between capital and financial structure, you can say the capital structure is a part of the economic structure.

Under the total capital of the company, the capital includes a mix of long-term debt and equity.

On the flip side, the financial structure includes owners’ equity and all liabilities, including long and short term.

Financial structure excludes short term liabilities, and financial structure features both long and short term liabilities.

By the term asset structure, we mean that it a mix of total assets that a firm uses. It makes up the asset side of the balance sheet in simple terms.

You can say it is an application of funds in various types of asset classes that are both fixed and current.

Assets structure = Fixed Assets + Current Assets.

Basics of Capital Structure

Under the balance sheet, you can find both debt and equity. You can also find the company assets under the balance sheet as they purchase the same with debt and equity.

Additionally, capital structure is a fusion of short term debt, long-term debt, preferred stock, and common stock.

When it comes to analyzing the capital structure of the company, you need to consider the proportion of short term and long term debt.

You need to understand that analysts are talking about capital structure when they tell you about debt to equity ratio. The ratio can tell you about the risk of the company.

You can say a company is mostly financed by debt if it has a more aggressive capital structure.

Additionally, they are quite risky for investors also. But the risk is also the primary source of the growth of the company.

Ideally, debt is one of the ways in which companies can raise money. Thanks to its tax advantages that companies are most likely to benefit from the debt.

On the other hand, unlike equity, debt allows a firm to retain its ownership. When low interest prevails in the market, debt is not only abundant, but you can easily access it.

When a company raises funds through equity, even outsiders can get partial ownership of the firm. As compared to debt, equity is more expensive. I

t is especially true if the interest rates are low. But you don’t need to pay equity back, unlike debt. In case of declined earnings, it is beneficial to the company.

Equity represents the owner’s claim on the company’s earnings.

Importance of Capital Structure in a Company

Here are few things which tells you why capital structure is important –

Enhance the value of the firm

An excellent capital structure of a firm which increases the prices of shares and securities, helps in enhancing the value of the firm.

Utilization of available Funds

A sound capital structure allows the company to a business enterprise to make the most of the funds.

When the capital structure makes sure, it decides the financial requirements of the company.

You need to raise funds in such mixtures from different sources to make the most of the funds of the company.

An excellent structure gives cover to the firm from over capitalization and under capitalization.

Maximization of Returns

If you have a sound capital structure, it allows the management to enhance the profits of a firm in the form of a great return to the equity shareholders.

It means it improves the earnings per share. You can say it does by the mechanism of trading on equity.

In simple terms, it is all about increasing the proportion of debt capital in the capital structure.

It is the cheapest source of capital. If the rate of return on capital is more than the fixed rate of interest that you pay to debt holders, the company trades on equity.

Minimization of Cost of Capital

Suppose you have sound capital in your business enterprise then which maximizes the wealth of shareholders minimizes the cost of capital.

You can do it by implementing long term debt capital in the capital structure.

The cost of debt capital is less than the cost of equity or preference share capital, as you can get a deduction on interest on the debt.

Solvency or Liquidity Position

A good capital structure doesn’t allow a business company to raise an excessive amount of debt.

It is mainly because of low earning as it disturbs the solvency, and you need to compulsory pay the interest to the debt.

Flexibility

The best part about having a sound capital structure is that you can get some space for expansion or reduce debt capital.

It is mainly because it allows you to change as per the changing market conditions.

Undisturbed Controlling

With an adequate capital structure, the shareholders don’t get any freedom to dilute the business.

Reduces Financial Risk

For instance, if the debt enhances the capital structure of the company, then it is most likely possible that financial risk will also increase.

The best part about sound financial structure is that it protects the business from all types of financial risks. It all does through a combination of debt and equity.

Equity Capital – Equity capital is all about funds that shareholders own. Shareholders are owners of the company. The types of equity capital are:

- Contributed Capital – It is the original fund that was invested in the business. The fund is an exchange for shares.

- Retained Earnings – These are profits that a company keeps from the previous year. They mainly use these earnings to make the balance sheet healthy or for expansion.

The majority of people think that equity capital is one of the most expensive capital types.

It is mainly because people can utilize its cost as a return, which the firm must earn to make the investment attractive.

For example, a mining company needs a significant number of returns to attract investors to buy the stock.

Debt Capital – In the capital structure of the company, you can say debt capital is all about borrowed money. The cost mainly depends upon the balance sheet of the company.

If your company features a triple AAA, then you can borrow at low rates as compared to a speculative company with lots of ton. There are various types of debt capitals:

- Long term bonds– You can say these are the safest types of bonds. It is mainly because the company has years to come with the principal.

- Short term commercial papers- Mostly, giants use this paper to meet the daily requirements of the working capital.

Best or Optimal Capital Structure

You can say that a firm has an optimal capital structure when you see its debt and equity proportion. It mainly results in the lowest weighted average cost of capital for the company.

Technically people don’t use this definition regularly. It is because experts give a strategic view of the ideal capital structure.

A firm can either issue more of debt or equity to optimize the financial structure.

You can use the new capital to invest in new assets, or you can use it to repurchase debt or equity. It is currently outstanding, and you can say it is a type of recapitalization.

Dynamics of Debt and Equity

Ideally, you can say debt investors choose to take the minimum risk as they have the first claim on the company’s assets when bankruptcy comes up.

It is for the same that they also take up a low rate of return. When it issues debt in comparison to equity, the firm has a minimum cost of capital.

Equity investors are most likely to take the most risk it is because they receive the residual amount after repaying the investors. Investors expect higher returns in exchange for the chance.

Factors that determine the Capital Structure of a Company

Here are few important points which helps in determining whether the capital structure of a company is good or bad –

Risk of Cash Insolvency

Due to a failure to pay fixed interest liabilities, the risk of cash insolvency comes up.

Ideally, when the proportion of debt is higher, then it compels the company to pay more interest. It doesn’t consider if the fund is available or not.

If the company fails to repay the amount on time, then it is quite possible that the company needs to liquidate.

When you remove the fund suddenly, then it is quite possible that it causes cash insolvency. Hence you can say risk factor plays a crucial role in deciding the capital structure of a firm.

You can avoid it if the firm issues more equity funds.

Risk in a Variation of Earnings

You can say that risk of variation in the expected revenues is high when the amount of debt is more.

The stakeholders can earn more returns on the capital structure if the return is more than the interest rate.

On the flip side, the stakeholders can’t make any returns if the rate of interest is more than investment.

Cost of Capital

First of all, you need to know that cost of capital is all raising funds from various fund sources.

You need to pay the price when it comes to using the capital. As a business, you must earn enough revenue to meets its capital cost.

When it comes to designing the financial structure of the company, the finance manager must take into account the cost of all funds.

Control

Under capital structure decisions, you need to consider retaining the control of the business.

You can choose debt capital to equity capital if you don’t like to give away the control. It is because this option doesn’t have any voting rights as such.

Trading on Equity

You can say you are trading on equity when you use fixed interest-bearing securities besides the owner’s equity. Under this arrangement, the company aims to enhance the return on equity shares.

It is mainly based on fixed interest-bearing securities, including preference shares and others.

You can increase the return on equity shares by using borrowed capital if the current capital structure is all about equity shares.

It is mainly because the interest payable on debentures is deductible under income tax laws. Post that, the tax cost of debenture becomes relatively low.

If you earn something extra, then the same is added up to equity shareholders.

Government Policies

Government policies and rules and regulations of SEBI are most likely to influence the capital structure of the company.

The financial pattern of the company changes entirely if there are changes in any of these policies.

Additionally, both the fiscal and monetary policies of the government affect the decisions under the capital structure.

Size of the Company

The size of the company mainly influences the availability of the funds. It is challenging for small companies to raise funds.

Small companies mostly depend upon retained earnings and equity shares. On the flip side, large companies choose to issue various types of securities.

The large companies pay minimum interest because investors believe that large companies are not that risky.

Needs of the Investors

When it comes to choosing the capital structure of the company, you need to consider the financial conditions of the investor.

You also need to consider the psychology of various types of investors. If you are a cautious investor, then it is quite possible you will want your capital to grow with equity shares.

Flexibility

The capital structure of the company must be flexible so you can change it as and when required. Ideally, flexibility gives some space for growth. There is no significant risk in the profile.

Capital Structure – Conclusion

The majority of investors today choose to use debt and equity ratios to finance their assets. Ideally, capital structure is the way a company funds its overall operations.

This is most likely to vary from industry to industry. You can use this guide to learn more about financial structure.

Open Demat Account Now! – Zero Brokerage on Delivery

Most Read Articles