Alternative Investment Fund or AIF – Concept, Types, Investor Class, Taxation Rules, Pros, Cons & more

Last Updated Date: Aug 30, 2023Investment arena was prior grouped or rather bounded to the conventional avenues. Subsequently, non-conventional investment avenues were originated, AIF or Alternative Investment Fund included.

Establishment of AIF goes back to May 21, 2012, where it belongs to Regulation 2(1)(b) (Alternative Investment Funds) Regulation 2012, with no bounds to any regulatory body’s jurisdiction.

The accepted rate of AIF has been on a rise since then.

About AIF or Alternative Investment Fund

The reckoned definition states AIF in context with a form of company or a trust or a LLP or a corporate body, which is objectified towards High Networth Individuals.

Alternative Investment Funds are privately pooled investment vehicles, involved in the process of collecting high investment amounts for investment in real estate, private equity and hedge funds.

All Indians, NRIs, PIOs and OCIs, are eligible Parties for investment, given, a set of criteria is met. Such vehicles are unlike the rather traditional forms of investment, i.e. stocks, debt securities, to name a few.

AIFs have their specified set of inves3tment policy, which obliges to funds collection from India and foreign included, centred to investors profit.

Invest in AIF Now! – Fill up the form

Types of Alternative Investment Fund or AIF

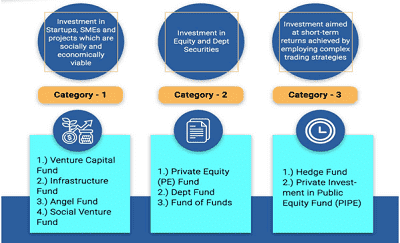

SEBI, the regulating body, has categorized three different groups of AIFs. This opens three different doors of investment for the investors to choose from.

Distinctive investments make up the three categories individually and the minimum investment limit is still above what is required for any conventional asset class.

Here is how the classification has been done.

Category I AIF

- Venture Capital Funds

- Angel Funds

- SME Funds

- Social Venture Capital Funds

- Infrastructure Funds

Category II AIF

- Private equity (PE) Funds

- Real Estate Funds

- Funds for Distressed Assets

- Debt Funds

- Funds of Funds

Category III AIF

- Hedge Funds

- Private Investment in Public Equity Funds (PIPE)

Find the list of Best AIF in India here.

Category I AIFs

These funds are referred to the class of vehicles that are highly desired, both socially and economically.

The level of exceeded aspiration is subject to their investment behavior where they target startups or early-stage ventures or SMEs or social ventures or infrastructure or other sectors.

Here are the subcategories:

Venture Capital Funds

This group of funds comprise of StartUps, which are extremely driven by an innovative and high growth potential base.

Targets are basically the StartUps, which find is hard to create wealth through the capital market channel, but need the same to get through the establishment or expansion process.

Business profiles, assets’ size, and phase of product development are among the factors taken into consideration for investment by VCFs.

Investment is then made by VCFs in such ventures, to fulfil the needs of HNIs inclined towards High risk – high return investments.

Angel Funds

Individuals denoted as Angel Investors have interest into Angel Funds, who have a strong hold of investment and have vast business management experience.

This further, adds to Angel fund’s motive where fund managers pool in money from Angel Investors, for investment in budding Startups or for development.

SME Funds

AMCs pool in these funds for investment in micro, small and medium enterprises, both listed and unlisted.

SME Funds fulfil the equity financing needs of SMEs. Returns are generated from growth in the enterprise or though listing in major stock exchanges.

Social Venture Capital Funds

The class of businesses funded via this particular Social Venture Capital Funds are the one who have an objective of creating a social impact on the society.

The limelight themes or segments of these impact funds are education, affordable healthcare, agriculture, and clean energy.

Other than the common funding, Impact funds also contribute technical and operational support. There are also further arenas in which helps is provided.

Infrastructure Funds

The investment arena for this fund is subject to companies with infrastructure projects are their business category.

All such infrastructure projects may include railways, roads, water, municipal solid waste, and renewable energy.

Furthermore, Our Government also reaches out to these funds and offers incentives and concessions for investment in infrastructure funds.

Category II AIFs

There is no provision of incentives and concessions by GOI in this categorized fund and consists of funds that are not described under category I and III.

The line of investment is related to various equity securities and debt securities.

Private equity (PE) Funds

Private Equity Funds is the hub for companies which are unlisted and have hurdle raising capital via equity and debt sources.

In PE funds, capital sourced from investors is invested in such companies, also gaining a part ownership in the organization.

Debt Funds

This fund is commonly for investment in listed, as well as unlisted companies.

Such funds target companies which possess high growth possibility and also have good corporate practices but lack in the domain of capital pooling.

Funds of Funds

Funds of Funds is generally denotes a mixture of several Alternate Investment Funds. The idea here is to invest in other AIFs, rather than creating a portfolio of their own.

The major drawback or the point of extreme consideration is that Fund of Funds under AIFs cannot issue units of fund publicly.

Category III AIFs

Funds which fall under this category have the idea of short term returns.

So, this private investment vehicles deploy in a vast number of complex and diverse trading strategies to ensure the short term maximization goal is reached.

As Similar to the tier II category, there is no provision of incentives and concessions by GOI.

Hedge Funds

Noteworthy things first, these funds are expensive, if a comparison measure is established.

The capitals are fetched from institutional investors and also accredited investors. Capitals are pooled from both local and overseas markets, so as to aim at high returns.

These vehicles are aggressively managed, as in; they strongly build their portfolio, often deploying the leverage service in a higher proportion.

Private Investment in Public Equity Funds (PIPE)

This pool of investment is privately sourced public equity investment. The precise definition or explanation of PIPE is – purchase of publicly traded company stocks, but at a discounted price.

Here a stake as per the share ownership is granted to the investors, and the companies use the capital as per their need.

This fund is a hub for medium and small-sized businesses to fund their businesses easily, since there is no lengthy process of administration or paperwork involved, as compared with secondary issue.

Alternative Investment Fund or AIF suitable class of investors

AIF is a perfect match to the needs of the HNIs. Purposefully, eligible participants are Resident Indian Individuals, Non-Resident Indians (NRIs) and also Foreign Nationals.

Such funds draft the necessity of a cap on investment and the investors have to abide by it. The minimum size of investment allowed is INR 1 Crore.

There is a certain relaxation for the directors, employees and fund managers of AIF, where the allowed minimum size for them is INR 25 lakhs.

Another term, as stated in the norms of the funds is – Category I and II funds are generally close-ended, with a minimum tenure of 3 years.

On the contrary, the Category III funds are either open-ended or close-ended.

Who can invest in AIF or Alternative Investment Fund

Eligibility for this category fund is pre determined, and investors deemed eligible can invest in AIF.

As per the nationality, Resident Indian Individuals, Non-Resident Indians (NRIs) and also Foreign Nationals are permitted to invest in AIFs.

Next, the investors must possess the required threshold of investment amount. The marked threshold goes as following:

- Minimum investment – INR 1 crore

- Angel Investors – INR 25 lakhs

- Directors, employees and fund managers of AIF – INR 25 lakhs

Rules of Taxation in consideration with AIF

There are certain applicable rules for AIF taxation, and it differs on the basis of each category.

As for the Category I and Category II funds, they are pass-through vehicles. There is no obligation of tax on earning payment, for these funds.

However, there is a tax slab on the investors, as deemed payable by the investors.

When capital gains on stocks are made, the investors are obligated to pay 10% or 15%, the final rate of which depends on holding period.

The next taxation rule is applicable on the Category III AIFs, the category which has the highest income tax slab.

Tax slab in monetary terms is 42.7%, and the deductions are first made, following which the returns are provided to the investors.

AIF or Alternative Investment Fund Sponsors

If you come across the term sponsor in AIFs or Alternative Investment Fund, it refers to the person responsible for the formation of AIF.

The reference is made in context with a promoter in case of a company, and that of designated partner in case of Limited Liability Partnership.

Certain rules and regulations have been set up, which secure the interest of sponsor or manager, in accordance with investors.

This does not mean that fee waived for the sponsor or the manager. Manager or Sponsor has to make a certain amount of contribution.

In accordance with Category I and II funds, the respective individuals will lay down a capital not less than 2.5% of the corpus or INR 5 Crore, whichever is lesser.

In accordance with Category III funds, the deemed threshold of contribution is 5% of the Corpus or INR 10 Cr, the least amount of both.

Finally, as per the Angel Investors, the set threshold is 2.5% of Corpus or INR 50 lakh, the least amount of both.

Corpus – Corpus means, the invested amount that contributed by the investors, for a particular AIF. This contribution can be in the form of written contract, or any document to the likes of it.

Pros of AIFs or Alternative Investment Fund

Investment choices are certainly tough and the focus in always on options which possess high return potential.

While investors solely have to battle out the decision making process of investment in conventional or non conventional avenues, we wish to contribute to the process of decision making.

Here are a list of Pros you might mark as the reasons why you can pursue AIF investment.

- In a short span of time, this category investment has grown into the limelight, and continues to be popular among investors. This speaks about the positive portion of the investment avenue.

- Going off the general avenues generally expand your portfolio towards the pathways that are excessively profitable. Mutual Funds, stocks and bonds are not the asset classes of AIF, where you can get diversification and potential high returns as an investor.

- High Net-worth individual’s domain is of high risk, and the high risk prospects of AIF leads to high returns as well. These returns are often above par at what traditional investments may fetch.

- There have been discussions in the Union Budget, where Government aims at measures to improve and strengthen investments into AIFs. The categories of investors given priority are Angel Investors and venture capital funds. This shows how our economy may overlook traditional forms of investment and go beyond up to non conventional assets.

Cons of AIFs or Alternative Investment Fund

Weighing the cons is equally essential for the process of decision making, and to come to an unbiased conclusion.

Here are the certain cons you must consider and know in advance.

- Investment in AIFs is generally complex and possesses a high degree of risk.

- The investment slab in the minimum is INR 1 crore, though it varies for the Angel investors and the manager and employees of AIF.

- Investors must fulfil the criteria of investment slab and are the ones eligible for investment. No amount below the minimum investment threshold is permitted.

Conclusion – Alternative Investment Fund or AIF

There are special terms and conditions that investors need to comply with, if they want to invest in Alternate Investment Funds.

HNIs are the special target for AIFs, who choose to travel the route less traveled, i.e. non conventional investment avenues.

The high probability of earning excessive returns from high risk investment makes such funds desirable for HNIs.

They have an idea of investment, and AIFs purely satisfy every need, and is the reason why Alternative Investment Funds have been earning a lot of significance.

Invest in AIF Now – Fill up the form Now!

Most Read Articles