How to determine Share Price of a Company? – Step by Step Process

Last Updated Date: Nov 17, 2022We have catered this write up, merely for the purpose to explain How to determine Share Price of a Company? or Stock Valuation process.

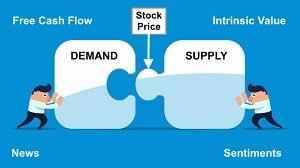

Ideally, the stock market mainly depends on the supply and demand factors, just like any other prevailing market.

When a buyer sells stock in the market, he or she gets money from the seller in the ownership of the stock. The price for which the seller buys the stock is ideally the new market price

How to determine Share Price of a Company? or Stock Valuation

One thing is for sure the higher the price of the stock, higher is the demand in the market. On the flip side, the lower the price of the share more is the supply of the stock.

Ideally, IPO or initial public offering is at a price that is equal to the value of anticipated potential dividend payments.

Ideally, IPO or initial public offering is at a price that is equal to the value of anticipated potential dividend payments.

The price of the share mainly fluctuates due to the change in supply and demand.

A plethora of factors leads to change in the supply and demand factors, which directly have an impact on the share price of the company.

If one is new to the stock market, then the stock prices will indeed seem daunting for them.

As they go up and down, people tend to lose or gain money, but now one must be wondering why are they moving? Who decides these stock prices?

It is next to impossible if one wants to know the exact reason why one stock is selling for a fee.

There are a plethora of factors that influence it, but at the same time, the personal sentiments of the investors who decide to buy or sell. But it is not too challenging to understand the general policies.

When it comes to prices of the stock, there tends to be, some type of uncertainty, and you can learn what to see to get a hint why the stock has its value.

Open Demat Account Now! – Zero Brokerage on Delivery

About Capital Markets

One of the huge parts of understanding the stock prices mechanism is the capital markets.

Firstly, capital markets tend to come up with a primary market by linking different servers of capital with the ones who plan to raise the capital.

In simple terms, a business owner who intends to start or grow their business can make use of the capital markets by connecting with investors.

Ideally, business tends to raise funds either by investing shares or bonds. If a company plans to issues, the bonds they are mainly establishing a deal with the investor, and the company will pay back the loan with interest.

A company that issues stocks chooses to sell a part of ownership in the company, rather than getting repaid similar to a loan, the investor will sell a part of the ownership and mostly after the company grows and value increases.

The stock price of the company increases when the value of the company increases. Even though there are various other factors which you need to consider.

Additionally, capital markets give some support to the secondary market for current owners of stocks and bonds to find out who is planning to buy the stocks.

The secondary markets are most successful as compared to primary markets.

It is mainly because investors find it more confident that they will find someone who will buy the securities or bonds that comes with liquidity.

Lastly, capital markets give way for general people to outsource their investment so they can concentrate on their main career activity.

The capital markets also create some opportunities for organizations to invest on behalf of someone. They do it for some charge. You can get the investing activity through an agent or broker.

What is a Stock Price?

Ideally, the stock price is the current price which the stock is trading on the market currently.

When the shares are issued, every public trade company is given a specific price, which is ideally the assignment of the value.

It mainly highlights the value of the company. The price of the stock mainly goes up and down with regard to different factors like economic changes or industrial changes.

Besides another thing, the change in the price of the stock can also happen due to problems in the company.

P= D1/ r-g

P = current price of the stock

G= growth rate in perpetuity expected for the dividends

R= constant cost of equity capital for a company

D1= value of the potential dividends

For instance, the stock price of ABC company is $100 per share and 5% rate of return and current dividend $2 per share that increases 3% annually.

$2/ (0.05-0.03) = $100

Factors affecting Share Price of a Company

Here are few factors which effect share price of a company –

Law of supply and demand – The price of the stock goes high when the demand is high if a company generates products which do not have a lot of competitors or which are mainly desired.

The prices of the stocks tend to plateau if the demand aligns with the supply. Additionally, the share price of the company drops if the supply is more than demand.

The price of the stock might stay the same or enhance even if the supply is more provided there is some variation.

Management of the charges of production – The changes in the management can also cause an increase or decrease in the share price of the company.

It also depends on how the company is managed and the goods are produced.

Changes in the style of goods production or management mainly lead boost in efficiency, which overall leads to effectiveness.

Basically, it increases the profits and causes the price of the stock to rise. But negative changes tend to give the opposite effect also.

The Company’s name Prominence – You must also keep a note of the main effect of the price of the stock by news or social media.

The events are of two types, including scandal or success. Scandals, whether actual or not, can lead to a drop in the price of the company or simply tend to be negative.

If there is some breakthrough in the market, then one can expect an increase in the price of the stock.

How to determine the Share Price of a Company? – Step by Step Process

The stock market is quite similar to other economic markets as the demand and supply. One can use different quantitative formulas and techniques to predict the price of the company.

It is referred to as dividend discount models (DDMs); they depend on the concept that the current stock price is equal to the sum of all the future dividends.

Firstly, one needs to calculate the initial public offerings when the shares are first put into the market.

The investment companies tend to use a plethora of metrics besides the total number of shares to understand the stock price of the company.

Then the factors that you know already cause the fall or rise in the price of the stock. Largely, the earnings of the company decide the fall or rise in the price of the stock.

The analysts use the financial metrics often to understand the value of the firm, like the history of earnings and the expected profit. The traders will cause the prices to go up or down.

Determine Companies Share Price – Conclusion

The publicly-traded company is given a share price for each stock which it issues. The price of the stock mainly reflects the value of the company.

When it comes to value, the experts say that the public is ready to pay for a part of the company.

Open Demat Account Now! – Zero Brokerage on Delivery

Most Read Articles